When you buy a piece of real estate, you get a deed. Simple enough, right? But buried in that document is one of the most important—and often overlooked—details: the vesting deed.

This isn't just about who owns the property. It's about how they own it. For title professionals, abstractors, and real estate attorneys, getting this detail right isn't just a best practice—it's the foundation of a clean and defensible title. That single distinction can have massive consequences down the road.

Your Property's Ownership Blueprint

Think of the vesting clause as the blueprint for ownership. While the main deed hands over the keys to the kingdom, the vesting language sets the rules of the realm. It’s the part that defines the legal rights and limitations of the owner, answering the big questions about what they can and can't do with their asset.

This is where the rubber meets the road. This one clause dictates what happens if the owner wants to sell the property, if they get sued, or when they pass away. Getting this part right is a critical decision, directly impacting:

- Inheritance: How smoothly (or not) the property transfers to heirs, and whether probate is required.

- Tax Consequences: The potential tax hits for the owner and their family.

- Asset Protection: How well the property is shielded from creditors and liens.

Vesting is all about the legal structure of ownership. Is there a sole owner? Are they buying with a spouse or a business partner? Each scenario demands a different approach. Common forms like joint tenancy or tenants in common carry completely different outcomes.

For example, a joint tenancy often includes a "right of survivorship," meaning if one owner passes away, their share automatically goes to the surviving owner—no probate court necessary. You can dive deeper into these vesting legalities with experts like Barnes Walker.

Ultimately, the vesting choice isn't just fine print; it's the legal bedrock of a valuable asset. For industry professionals, verifying its accuracy is non-negotiable. Overlooking it is a risk you don't want to take.

Breaking Down the Key Parts of Your Vesting Deed

Legal documents can feel like they're written in another language, but a vesting deed is actually pretty straightforward once you know what to look for. Think of it as a property's biography—each part tells a crucial piece of the ownership story that title professionals must verify.

First, you have the main characters. The Grantor is the person or entity selling or transferring the property. On the other side, you have the Grantee—the new owner who is receiving the title. These two names immediately establish the "who" of the entire transaction.

The Property's Unique Fingerprint

Next up is the Legal Description. This isn't the street address you'd type into your GPS. It’s a much more precise, formal description of the property's exact boundaries, often using things like township, range, and section numbers pulled from an official plat map.

A property's legal description is its unique identifier in the public record. An error here can create significant title issues, a problem known as a "title defect," which can complicate future sales or refinancing efforts and create liability.

The All-Important Vesting Clause

Finally, we get to the most critical piece of the puzzle: the Vesting Clause. This is the specific language that spells out how the Grantee is taking ownership. It’s the difference between simple ownership and a carefully defined legal arrangement with serious, long-term consequences.

Here are a few common examples you might see:

- "John Doe, a single man, as his sole and separate property." This one is clean and simple. It establishes clear, individual ownership with no co-owners involved.

- "Jane Smith and John Smith, as joint tenants with right of survivorship." This structure is common for married couples. It means if one owner passes away, the other automatically inherits the entire property without it having to go through probate court.

- "XYZ Corp., a Delaware corporation." This shows that a business entity, not a person, holds the title.

Making sure every one of these details is spot-on is a huge part of what property researchers do. If you're in the industry, it's worth understanding the tools professional title abstractors use to dig into these records and verify everything is correct. Ensuring accuracy here isn’t just good practice; it's essential for mitigating risk.

Common Ways to Structure Property Ownership

Okay, so we've talked about what a vesting deed is, but the real magic is in how you use it. Choosing your vesting option isn't just checking a box—it's deciding how an owner can control, protect, and one day pass on their property. Each structure offers a different path, and the right one depends entirely on the owner's specific situation and goals.

The most straightforward path is Sole Ownership. It's exactly what it sounds like: one person or a single entity, like a corporation, holds the title all by themselves. This is the go-to for single buyers or businesses because it offers total control. They can sell it, lease it, or take out a mortgage without asking for anyone's permission. Simple and clean.

Options for Co-Ownership

Things get a little more interesting when multiple people buy property together. This is where vesting becomes absolutely critical.

A popular choice for co-owners is Joint Tenancy, which comes with a powerful feature called the "right of survivorship." If one owner passes away, their share automatically transfers to the surviving owner(s). The best part? This happens outside of the court system, letting them bypass the often slow and expensive probate process.

Then there's Tenants in Common. This setup is all about flexibility. It allows co-owners to hold separate, distinct shares of the property that don't have to be equal. Think of two business partners who own a building together, with one holding a 60% stake and the other 40%. Crucially, there's no right of survivorship here. Each owner is free to sell their piece or leave it to their heirs in a will.

This is a massive distinction for anyone thinking about estate planning. Joint Tenancy creates a seamless, automatic transition between co-owners. Tenants in Common, on the other hand, gives each owner total control over their individual slice of the pie.

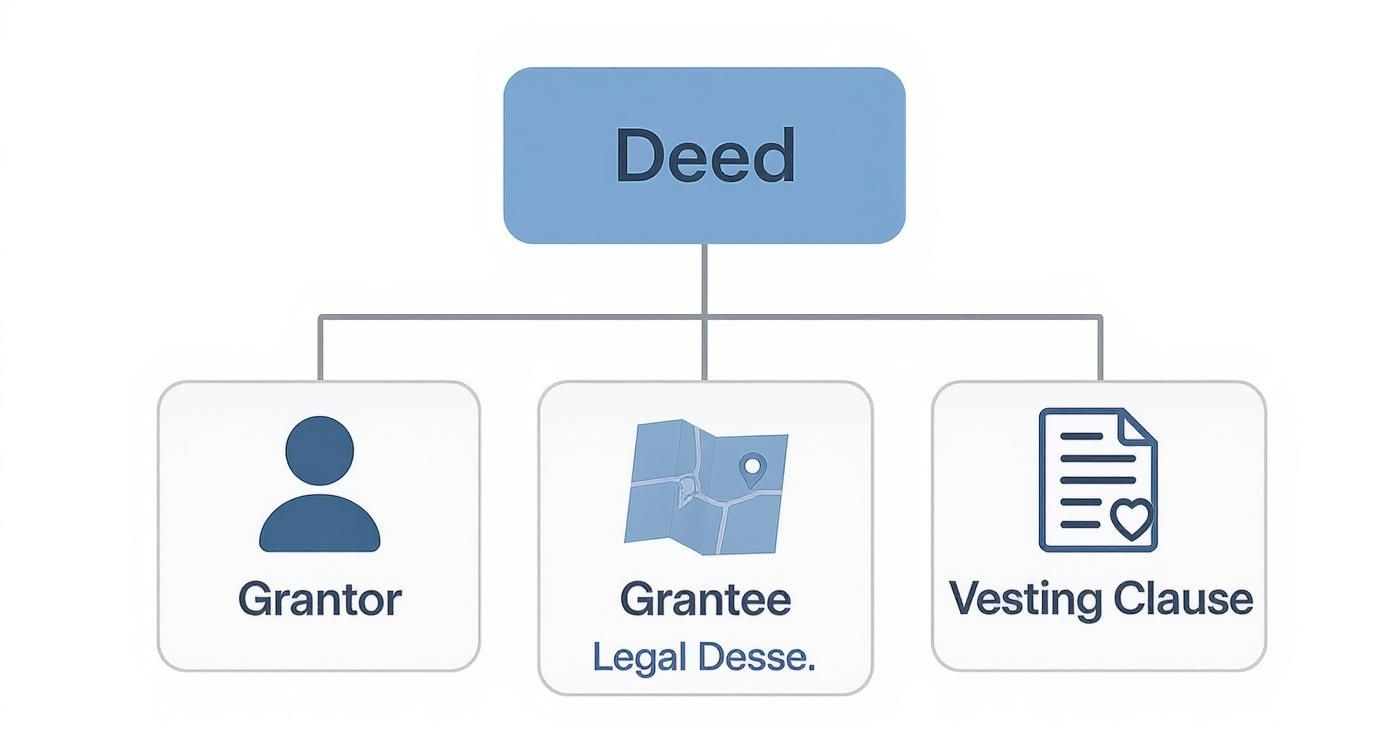

This infographic really helps visualize where the vesting clause fits into the bigger picture of a deed.

As you can see, it’s a core component that works with the grantor, grantee, and legal description to create a rock-solid legal foundation for ownership.

Specialized Vesting for Married Couples

In certain states, married couples have access to a special type of ownership called Tenancy by the Entirety. It’s a lot like joint tenancy but with an extra shield of creditor protection. Under this arrangement, the property isn't owned by the individuals but by the "marital unit" itself. This can be a huge advantage, as it often protects the home from the individual debts of just one spouse.

While it's only available in a handful of states, it's a historically important tool for protecting family homes. And considering that around 61% of U.S. homes were owned by married couples in 2021, the vesting method chosen can have a dramatic impact on everything from liability to what happens when an owner passes away. You can find more great insights into how property ownership structures work on Landopia.com.

Comparing Property Vesting Options at a Glance

To make these differences crystal clear, I've put together a quick comparison table. It breaks down the most common vesting types so you can see how they stack up side-by-side.

| Vesting Type | Ownership Structure | Right of Survivorship | Probate Required |

|---|---|---|---|

| Sole Ownership | Single individual or entity | No (passes to heirs) | Yes |

| Joint Tenancy | Equal shares between co-owners | Yes (automatic transfer) | No |

| Tenants in Common | Can be unequal, distinct shares | No (transferable via will) | Yes |

| Tenancy by Entirety | Spouses as a single legal entity | Yes (automatic transfer) | No |

Seeing it laid out like this really highlights the trade-offs. The key is understanding how each one affects survivorship and whether an estate will have to go through probate—two factors that can save loved ones a lot of time and money down the road.

How Your Vesting Choice Plays Out in Real Life

Let's move beyond the legal definitions and talk about what this stuff actually means for property owners. The specific wording in a vesting deed isn't just a formality for lawyers; it has massive financial and emotional consequences that can ripple outward for years.

These decisions can either protect the people involved or create a complicated mess. The scenarios below show just how different the outcomes can be, all hinging on a few critical words on a piece of paper.

Scenario One: The Business Partners

Imagine two business partners buying an office building together. They make the smart move to hold the title as Tenants in Common. When one partner unexpectedly passes away, this vesting choice works exactly as planned.

Their 50% share of the property doesn't get tangled up in business limbo. Instead, it passes directly to their children through their will, securing the family’s financial future just like they wanted.

Scenario Two: The Married Couple

A married couple buys their dream home and chooses Joint Tenancy with right of survivorship. It seems like a small detail at the time. Years later, when the husband passes, the wife automatically inherits the entire property—no court intervention, no frustrating delays.

That simple decision saved her from the stress and expense of a months-long probate process during an already gut-wrenching time.

A vesting deed with survivorship rights acts as a direct instruction for property transfer upon death, bypassing the often complex and public probate system. This ensures assets are transferred quickly and privately to the surviving owner.

Scenario Three: The Unmarried Couple

Now, let's flip the script. An unmarried couple buys a condo but overlooks the vesting details, failing to specify any form of survivorship. When one partner dies suddenly without a will, the state's default rules kick in, treating them as Tenants in Common.

The result is a heartbreaking legal battle. The surviving partner is forced to fight the deceased's estranged family over ownership of the home they shared. It’s an absolute nightmare that could have been easily avoided.

These examples make it clear: the right vesting clause is a powerful shield. The wrong one—or no clear one at all—can create unintended chaos. Getting these details right from day one is the only way to truly safeguard a property for the future.

Making the Right Vesting Decision for Your Property

Knowing what the different types of vesting are is one thing, but putting that knowledge into practice is where the real work begins. Choosing how to hold title to a property isn't just a box to check—it's a decision that weaves together personal relationships, financial goals, and legacy plans.

Every situation is unique, and the choice made will have ripple effects for years to come. That's why it’s so important to think through all the angles before signing on the dotted line. It's always recommended to have a conversation with a real estate attorney to make sure the choice lines up with state laws and actually does what the owner wants it to do.

Key Factors in Your Decision

So, how do you figure out the best path forward? Start by asking a few straightforward questions about the owner's circumstances:

- Who are they buying with? Are they single, married, or partnering up with someone who isn't their spouse, like a friend or business associate? The answer immediately points toward certain options and away from others.

- What happens when they're gone? Do they want their ownership stake to automatically transfer to a co-owner, no questions asked? Or do they need the freedom to pass their share to someone specific in a will?

- How does money play into it? Are they worried about creditors coming after the property? Or are they looking for a structure that shields the property from one owner's individual debts?

Making the right vesting choice is only half the battle. The other half is ensuring that choice is accurately recorded, monitored, and protected against errors or fraud for the entire time the property is owned.

Once a decision is made, the next priority is to make sure it sticks. A simple filing mistake or a failure to update the title down the road can completely unravel even the most thoughtful vesting strategy. This is where modern tools can give your operation a much-needed advantage.

A platform like TitleTrackr acts as a safeguard, ensuring vesting is recorded correctly and then continuously monitored for any unauthorized changes. You're not just closing a file; you're securing an asset. Protecting its legal standing is key to protecting its future value and your business from liability.

For more insights into managing property records and legal documentation, feel free to explore our other articles on the TitleTrackr blog.

Common Questions About Vesting Deeds

Even after you get the hang of the options, a few specific questions always seem to pop up when you're dealing with real estate titles. Let's tackle some of the most common ones to help clear things up and make sure you’re on the right track.

Can I Change the Vesting on My Deed After Buying a Property?

Yes, absolutely. An owner can change the vesting on their property title anytime after the initial purchase. This is a common move, usually handled by drafting and recording a brand new deed.

Life changes are often the trigger. Think about major events like getting married, going through a divorce, or setting up a family trust. For example, someone who bought a house as a "Sole Owner" might later file a new deed to hold the property as "Joint Tenants" with their new spouse. Just remember, this is a formal legal process with potential tax implications, so it's always smart to consult a real estate attorney first.

What Happens If a Deed Does Not Specify Vesting?

This is a great question. If a deed involves multiple owners but doesn't explicitly state the vesting, the state's default rules kick in. For unmarried co-owners, that default is almost always "Tenants in Common."

What does that mean? It means the law assumes each owner holds an equal, separate share of the property that can be passed on through their will.

Leaning on your state's default vesting is a gamble. It might not match what the owners actually want to happen with the property, especially when it comes to inheritance. Defining the vesting choice in the deed is the only sure way to guarantee legal clarity and head off disputes down the road.

Does a Vesting Deed Substitute for a Will?

While a vesting deed can control how a specific piece of real estate is transferred after death, it is absolutely not a substitute for a will. The two are designed to work together.

For instance, choosing a vesting with a "Right of Survivorship"—like you find in a Joint Tenancy—lets that particular property bypass the lengthy probate process and go straight to the surviving owner. But that's all it does. An owner still needs a comprehensive will to:

- Distribute all their other assets (think bank accounts, stocks, and personal belongings).

- Name legal guardians for minor children.

- Outline all other final wishes.

Think of them as two key pieces of a complete estate plan. If you have more questions like these, our comprehensive FAQ page is a great resource for additional insights.

Managing these critical details with precision is why professionals rely on modern tools. Manual processes are slow and prone to error, creating unnecessary risk. TitleTrackr provides the clarity and control needed to ensure your property's legal standing is always protected. See how our AI-powered platform can bring speed and accuracy to your title workflows by requesting a demo today.