When you sign a contract to buy a house, what do you actually own? You don't have the deed yet, but you definitely have something. That "something" is what we call equitable title.

Think of it this way: you've bought a non-refundable ticket to a concert. You don't own the arena, but you have an undeniable right to your specific seat on that specific night. Equitable title works much the same way—it’s your beneficial interest in the property, giving you the right to enjoy, use, and ultimately take legal ownership when the deal closes. This concept is fundamental for title professionals who need to see the complete ownership picture to prevent costly closing delays.

Understanding Your Stake in a Property

In real estate, ownership isn't a simple on-or-off switch. During a transaction, it’s actually split into two different parts: legal title and equitable title. The seller holds onto the legal title, which is the official, on-paper ownership proven by the deed. But the moment that purchase agreement is signed, the buyer gains equitable title.

This is a huge turning point in any deal. It means the buyer now has a genuine, legally recognized stake in the property. It's far more than a handshake agreement; it’s a powerful right that protects the buyer's claim to future ownership while all the final details are hammered out, and it's a critical piece of information for any accurate title search.

Why This Distinction Matters

That in-between period—from contract signing to closing day—is a critical phase where rights and responsibilities are clearly divided. Understanding the role of equitable title makes it clear who holds what power.

- For the Buyer: Equitable title grants them the right to possess and use the property (as specified in the contract, of course).

- For the Seller: Holding legal title means they remain the official owner and have the authority to sign the final deed at closing.

- For the Transaction: Most importantly, equitable title locks the property down. It prevents the seller from turning around and selling the place to someone else while your contract is active.

This separation of duties is the bedrock of modern property sales. In fact, roughly 85-90% of residential property sales in the U.S. rely on this transitional period where a buyer holds equitable title while the seller retains legal title. This phase, usually lasting between 30 and 60 days, shows just how essential it is to recognize these two distinct ownership interests. For a deeper dive, you can explore the legal principles and common law origins of equitable title to see how the concept has evolved.

At its core, equitable title is the bridge. It connects the promise made in a purchase agreement to the finality of a recorded deed, making sure both sides are protected on the journey from contract to closing. Recognizing this interest is the first step in conducting a thorough and accurate title search.

Equitable Title vs Legal Title Explained

If you've ever felt like legal jargon in real estate was designed to be confusing, you're not alone. Two terms that often trip people up are equitable title and legal title. While they might sound like two sides of the same coin, they represent completely different sets of rights that come into play at different stages of a property sale.

Getting this distinction wrong can cause major headaches, cloud a title, and even put a deal at risk. So, let’s clear it up.

Think of legal title as the heavyweight champion of ownership. It’s the official, undisputed, on-paper ownership. The name on the recorded deed? That’s the legal title holder. They have the authority to sell the property, lease it, or take out a mortgage against it. It's the final word.

Equitable title, on the other hand, is more of a promise. It’s the beneficial interest a buyer gets the second they sign a purchase agreement. It’s not full ownership yet, but it’s a powerful, legally recognized right to eventually receive that legal title, as long as they hold up their end of the bargain.

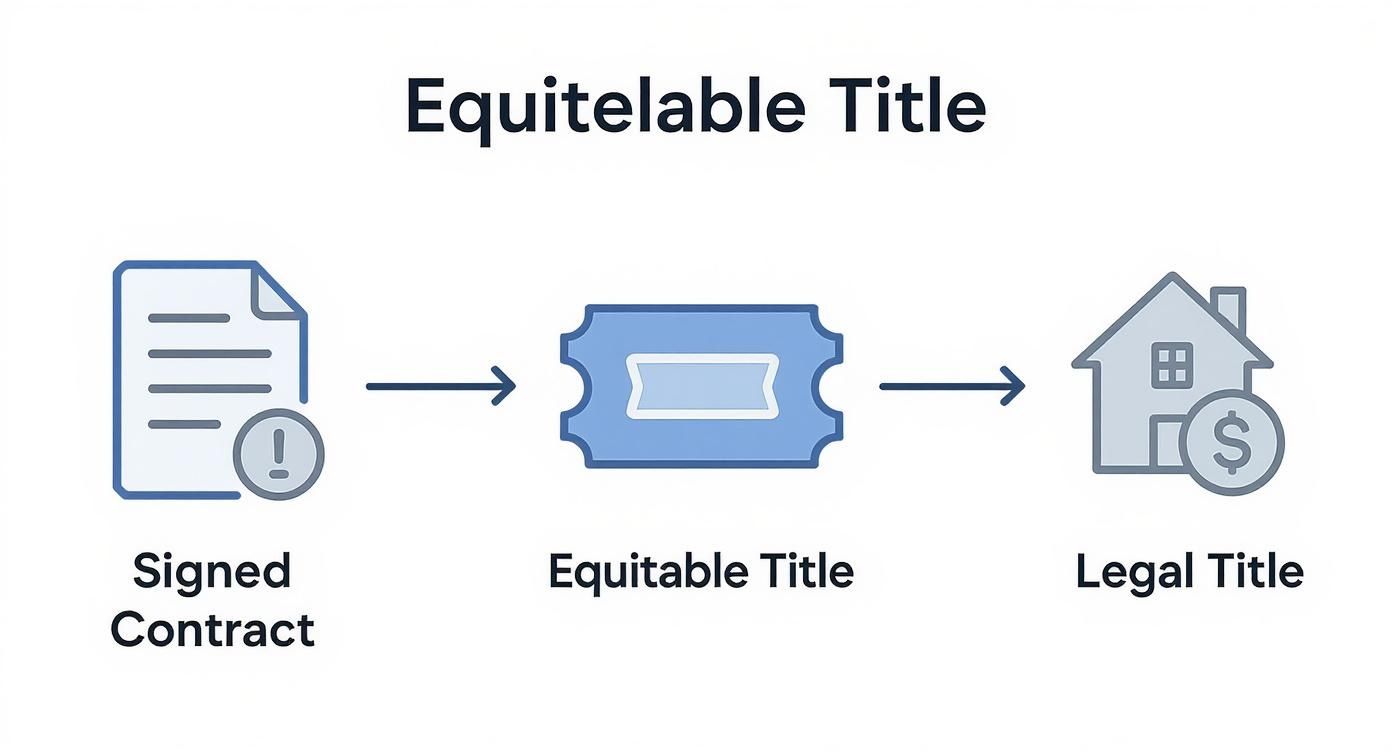

This infographic breaks down that journey from a simple handshake to holding the keys.

As you can see, that signed contract is the starting gun. It's what creates the equitable title, which serves as a bridge until the legal title is finally handed over at the closing table.

Equitable Title vs Legal Title At a Glance

To really get a feel for how these two concepts work in the real world, it helps to put them side-by-side. Each one gives its holder a specific set of powers and duties during that critical period between contract and closing.

This table cuts through the noise and gives you a direct comparison.

| Attribute | Equitable Title (The Buyer's Interest) | Legal Title (The Seller's Ownership) |

|---|---|---|

| Proof of Interest | A legally binding purchase agreement or land contract. | The official, recorded deed filed with the county. |

| Primary Right | The right to obtain full ownership upon closing. | The right to sell and formally transfer the property. |

| Holder's Role | The buyer, who has a beneficial stake in the property. | The seller, who is the official owner of record until closing. |

| Risk of Loss | Often bears the risk of property damage during escrow. | May retain risk depending on the contract and state laws. |

| Power to Transfer | Cannot transfer ownership to another party. | Can sign the deed to officially transfer ownership. |

Seeing them laid out like this makes the division of responsibilities much clearer. The buyer has the right to get the property, while the seller has the power to give it.

Practical Implications in a Transaction

So, why does any of this matter to industry professionals? Because the separation between these titles has very real consequences.

Let's say a freak hailstorm damages the roof of a house one week before closing. Who's on the hook for repairs? In many states, a legal concept called "equitable conversion" puts the risk of loss squarely on the buyer—the equitable title holder. Why? Because their interest is tied to the property's future, and they are the ones who will ultimately benefit from it.

On the flip side, the seller—the legal title holder—is the only one who can actually sign the deed to make the transfer official. Even with a signed contract and money in escrow, the buyer can't just decide to sell the property to someone else. They don’t have the legal authority yet.

This deliberate separation ensures that property transfers happen in a structured, predictable way. For professionals in the title industry, keeping these interests straight is non-negotiable. It’s exactly why tools like TitleTrackr are so valuable, empowering abstractors and landmen to trace these distinct interests with a high degree of precision, ensuring no claim is ever missed.

The core takeaway is this: equitable title gives a buyer the right to get the property, while legal title gives a seller the power to give the property. Recognizing both is essential for a clean and defensible title search.

How a Buyer Gains Equitable Title

Equitable title isn't something that just magically appears. It's born at a very specific, legally crucial moment in a real estate deal: the instant a purchase agreement becomes fully executed. The second both buyer and seller have signed on the dotted line, a massive shift in property rights happens.

That single document—often called a purchase and sale agreement—is the trigger. It effectively transfers the beneficial interest in the property to the buyer. While the seller still physically holds the deed (the legal title), the buyer now has a powerful, enforceable claim to future ownership. This is the birth of their equitable title.

The Contract as the Catalyst

Of course, not just any scrap of paper will do. For a contract to grant equitable title, it has to be legally sound and enforceable. Without a few key ingredients, the document is worthless, and no equitable interest is created.

For any title professional, knowing how to spot these elements is non-negotiable. It’s how you pinpoint the exact moment a valid claim came into being.

- Offer and Acceptance: There has to be a clear, unambiguous offer from the buyer and an equally clear acceptance from the seller.

- Competent Parties: Both sides must be of legal age and sound mind, fully capable of entering into a binding agreement.

- Legal Purpose: The whole point of the contract—transferring the property—has to be legal.

- Consideration: Something of value, usually an earnest money deposit, must be put on the table to show everyone is serious.

- Valid Signatures: The agreement needs to be signed by every party with an interest in the property.

Once these boxes are checked, the contract cements the buyer’s equitable position. It gives them the right to drag the seller to court and force the sale to go through, a process known as specific performance.

The executed purchase agreement is more than a roadmap to closing; it is the very instrument that creates the buyer's equitable stake. Pinpointing this document and verifying its validity is a cornerstone of any comprehensive title search, confirming the origin of the buyer's claim.

Other Scenarios That Create Equitable Title

While a standard purchase agreement is the most common path to equitable title, it's not the only one. Landmen and title searchers often run into other arrangements that create the same split in rights. Recognizing these is vital for building a clean chain of title.

Take a land contract, for example (sometimes called a contract for deed). Here, a buyer makes installment payments directly to the seller over a set period. The whole time, the seller keeps the legal title as a form of security. But from day one, the buyer gets equitable title, giving them the right to use, enjoy, and improve the property as if they already owned it.

You see a similar setup in certain trust agreements. A trustee holds the legal title to manage the assets, but the beneficiaries hold equitable title, allowing them to enjoy all the benefits. In both situations, the core document—whether it’s the land contract or the trust instrument—is the key to figuring out exactly when that equitable interest began.

Equitable Title in Real-World Scenarios

While the classic home sale is where you'll see equitable title pop up most often, its principles reach into far more complex corners of real estate. For any title searcher or landman, spotting these situations is key to delivering an accurate and insurable title report. You need to understand how equitable interests can define ownership rights, even when there isn't a simple purchase agreement in sight.

Two of the biggest areas where this comes into play are mortgages and estate planning. In both, the split between legal and equitable title is what makes the whole system tick. It determines who's in control, who's on the hook for what, and who ultimately gets to benefit from the property. Let's dig into how this works in the real world.

Mortgages: Title Theory vs. Lien Theory States

When someone takes out a loan for a property, the lender needs a way to protect their investment. States have landed on one of two legal frameworks to handle this, and both are built on the concept of equitable title.

- Title Theory States: In these states, the lender literally holds the legal title to the property as collateral. The borrower, on the other hand, holds equitable title. This gives them the right to live in the home, use it, and enjoy it—as long as they keep up with their mortgage payments. Once the loan is paid off, the lender hands over the legal title.

- Lien Theory States: Things work a bit differently here. The borrower gets to hold both legal and equitable title right from the start. Instead of holding the deed, the lender places a lien on the property. That lien gives the lender the right to foreclose if the borrower defaults, but it doesn't give them ownership from day one.

This isn't just a technicality; it has huge practical implications. In fact, these principles are at the heart of approximately 92% of residential mortgage transactions across the country. In lien theory states like New York, which account for about 30% of the U.S. mortgage market, borrowers hold onto legal title while lenders simply have a lien. But in title theory states, making up the other 70% of the market, lenders hold legal title while borrowers have equitable title, which creates a totally different risk dynamic. To get a better handle on how these theories shape lending, you can explore more insights on equitable title in finance.

Estate Planning and Trusts

Equitable title is also a pillar of estate planning, especially when properties are put into a trust. This legal setup allows someone to manage assets for others, and it only works because of that clean split between legal and equitable ownership.

Here’s how a typical trust breaks down: a trustee is named to hold legal title to the property. This gives them the power to manage it—paying taxes, arranging for maintenance, and making other administrative calls. But they don't get to personally profit from the asset.

The real benefit flows to the beneficiaries, who hold equitable title. Their equitable interest gives them the right to any income the property generates, to use it as laid out in the trust, and to eventually inherit it based on the trust's instructions.

This structure is what allows for complex asset management and smooth wealth transfers. For title professionals, it's absolutely crucial to read trust documents with a fine-toothed comb. You have to identify both the legal title holder (the trustee) and every single party with an equitable interest (the beneficiaries). Tracing these separate rights is a non-negotiable part of confirming a clean chain of title.

When you're dealing with complex title issues like these, having the right information makes all the difference. Our team shares insights on this all the time, which you can find when you check out our guide on the TitleTrackr blog.

Why Overlooking Equitable Title Is a Costly Mistake

For any landman or title searcher in the trenches, understanding equitable title isn't just an academic exercise—it's where theory crashes right into your bottom line. Ignoring or completely missing an equitable claim is one of the fastest ways to derail a deal, invite a nasty legal fight, and put your clients at serious financial risk. A quick, surface-level search that only looks at recorded deeds just doesn't cut it anymore.

Picture this: you're running title on a property and find a perfectly clean chain of legal title. Looks great, right? But what if, buried somewhere in a mess of other records, there's a decade-old, unrecorded land contract? That forgotten piece of paper represents a valid equitable interest that still clouds the title today. If you don't find it, your client could be buying a property with a hidden ownership dispute just waiting to explode.

The Real-World Consequences of a Partial Search

When an equitable claim slips through the cracks, the fallout can be brutal. These hidden interests create huge roadblocks that are expensive and time-consuming to clear up, and in the end, it’s your professional reputation on the line.

These aren't just what-if scenarios; they create very real problems:

- Deals Come to a Grinding Halt: Finding an equitable claim late in the game can stop a transaction dead in its tracks. Trying to resolve it might require legal action, causing massive delays or even forcing the buyer to walk away entirely.

- Expensive Legal Battles: If a deal closes with an undiscovered equitable interest, the new owner could suddenly find themselves slapped with a quiet title action from the person holding that interest. That kind of legal fight to sort out ownership can drag on for years and rack up tens of thousands of dollars in legal fees.

- Title Insurance Nightmares: A title insurance policy might not cover defects that a more thorough search should have uncovered. This leaves your client holding the bag financially and can easily lead to a professional negligence claim against you.

A truly comprehensive title search has to validate both legal and equitable interests. Just confirming the name on the deed isn't nearly enough; you have to dig deeper to make sure no one else has a legitimate beneficial claim to that property.

Modern Tools for Uncovering Hidden Claims

The real challenge here is that equitable claims often hide in documents that live outside of standard property records—think contracts, trusts, or even divorce decrees. Trying to manually sift through that mountain of paperwork is painfully inefficient and wide open to human error. This is exactly where modern analytical tools become so essential for a complete search.

A solution like TitleTrackr provides the kind of deep-dive analysis needed to navigate these complexities. It uses AI to scan and make sense of a much wider array of documents, flagging potential equitable interests that traditional methods often miss. This gives you the power to protect your clients, prevent costly mistakes, and perform searches with a much higher degree of certainty.

Ready to see how you can uncover every claim and deliver a truly clear title? Request a demo with TitleTrackr and learn how to fortify your title search process.

Common Questions About Equitable Title

Once you get the hang of these concepts, the real-world questions start popping up. Let's break down a few of the most common ones that professionals run into when dealing with the nuances of equitable title.

Think of this as the practical side of the coin. The distinction between who owns the property versus who has the right to own it isn't just a legal theory—it has a direct impact on contracts, inheritance, and everything in between. Getting this right is how you avoid nasty surprises down the road.

Can Equitable Title Be Transferred?

This is a great question. Generally, you can't just hand over your equitable title to someone else like you would a car key. It’s tied directly to you and your specific purchase contract.

However, there's a process called assignment. This is where a buyer transfers their rights and obligations under the contract to a new person. But it's not a free-for-all; this move is almost always subject to the terms of the original agreement and often requires the seller's explicit approval.

What Happens if a Buyer Defaults?

If a buyer drops the ball—say, they can't get their financing approved or they stop making payments—their equitable title is in serious jeopardy. The purchase agreement always spells out what happens in a default.

Typically, the contract gets terminated. The seller, who held the legal title the whole time, often gets to keep the earnest money as compensation. At that point, the buyer’s claim to the property is completely wiped out, and the seller is free to find a new buyer.

The key takeaway is that equitable title is conditional. It only exists as long as the buyer is moving forward in good faith to close the deal. The moment they break that promise, their beneficial interest vanishes.

Does Equitable Title Apply Outside of Sales?

Absolutely. In fact, the idea of splitting legal and equitable ownership is the very foundation of trust and estate law.

Trusts are a perfect example. Estimates show that 60-70% of all estate trusts in the U.S. operate on this model. A trustee holds the legal title—handling the paperwork and management duties—while the beneficiaries hold the equitable title, allowing them to actually enjoy the property's benefits. This structure ensures beneficiaries receive around 100% of the economic advantages, like rental income or appreciation, while a trustee manages the legal side. You can dive deeper into how trusts separate ownership on GrossmanLaw.net.

This dual-title framework is essential anytime assets are being managed for someone else. For more nitty-gritty scenarios and answers, feel free to check out our complete TitleTrackr Frequently Asked Questions page.

A secure title search means uncovering every single claim, whether it's on paper or hiding in the gray area of equitable interest. TitleTrackr uses advanced AI to comb through documents with an expert eye, helping you spot and resolve these hidden interests before they turn into major headaches.

Ready to see how a smarter search can protect your clients and your business? Request a demo of TitleTrackr today.