Ever tried to buy a used car, only to find out later that the bank still has a loan on it? That’s a nightmare scenario. A clear title for a piece of property is your best defense against something similar happening with your real estate or energy asset. It’s the official proof that you are the one and only owner, with no hidden claims or old debts waiting to ambush you.

So, What Exactly Is a Clear Title?

At its heart, a clear title means you have absolute, unquestioned legal ownership. It certifies that the property is totally free from liens, disputes, or other legal baggage—what we call "encumbrances"—that could put your investment at risk.

Think of it as the solid ground every secure property transaction is built on. Without it, you could be dragged into legal fights over debts that aren't even yours, or discover a previous owner's heir suddenly has a claim. This is why verifying a title's status is the critical first step in protecting your assets.

A clear title is your legal shield. It confirms that no other person or entity—be it a lender, a contractor, a government agency, or an heir—has a legitimate claim against your property.

This verification process is all about making sure there are no skeletons in the closet. It gives you the confidence that once the deal is done, your ownership is solid.

The Foundation of Secure Ownership

A clear title is more than just a piece of paper; it’s the bedrock of any sound property investment. It confirms several critical things:

- Undisputed Ownership: It proves you are the sole legal owner. No one else can legally claim it.

- Freedom from Liens: The property is clear of financial claims, like unpaid contractor bills or lingering tax debts.

- No Boundary Disputes: It helps confirm the property lines are correctly recorded and not being fought over by a neighbor.

- Protection Against Fraud: A deep title search can uncover forgeries or improperly filed documents from decades ago.

To help you see the difference, here’s a quick comparison of what you want (a clear title) versus what you definitely want to avoid (a clouded title).

Clear Title vs. Clouded Title

| Attribute | Clear Title (Secure Ownership) | Clouded Title (Ownership at Risk) |

|---|---|---|

| Ownership Status | Ownership is undisputed and absolute. | Ownership is questionable due to unresolved issues. |

| Financial Claims | Free of liens, back taxes, and other debts. | May have active liens from contractors, lenders, or tax authorities. |

| Legal Disputes | No active lawsuits or boundary disputes. | May be subject to ongoing legal challenges or inheritance claims. |

| Transferability | Easy to sell, finance, or transfer. | Difficult or impossible to sell until the "cloud" is removed. |

| Risk Level | Low risk for buyers and lenders. | High risk for all parties involved. |

As you can see, a clouded title introduces a world of uncertainty and potential legal headaches. Securing a clear title is the only way to ensure your ownership is safe and your investment is protected.

Traditionally, verifying all this meant an expert had to manually dig through piles of dusty courthouse records, a process that was slow and left room for human error. But technology is changing the game. The global AI market is projected to hit around $757.58 billion by 2025, and that growth is fueling new tools that are bringing incredible accuracy and speed to industries like title verification. You can learn more about this incredible growth and its impact.

Why a Clear Title Is Not Negotiable

Think of a clear title as your legal shield. It’s far more than just a piece of paper you get at closing; it’s the bedrock of your ownership. For a homebuyer, it’s the difference between a peaceful new beginning and years of legal headaches. For an energy company, it’s the solid ground needed before breaking ground on a multi-million dollar project.

Without it, you’re leaving yourself wide open to massive risks that can completely unravel your investment. The fallout from a clouded title is no joke—it can stop you from selling or refinancing and could even lead to you losing the very property you thought was yours.

When a Dream Home Becomes a Nightmare

Let me paint a picture for you. A family finds their perfect home, signs the papers, and moves in, thinking they've achieved the American dream. But six months down the road, they get a notice taped to their door. It’s a foreclosure warning from a contractor they’ve never even heard of.

Here’s what happened: the previous owner never paid for a kitchen remodel from two years ago. That contractor, rightfully owed money, placed a mechanic's lien on the property. It’s a legal claim that was somehow missed during the original title search. Now, this family is stuck in a legal fight over someone else's debt, facing the very real possibility of losing their home.

A clouded title can turn your most valuable asset into your biggest liability. Unseen claims from the past, such as old liens or ownership disputes, can surface without warning and jeopardize your financial security.

This nightmare scenario is precisely why you have to define clear title as a non-negotiable part of your due diligence. It’s not about checking a box. It’s about protecting your future.

The risks are just too high to ignore, whether you're buying a house for your family or securing land for a massive energy development. Making sure the title is clean is the only way to lock down your ownership and sleep well at night.

Common Problems That Cloud a Property Title

You’ve found the perfect property, but what if its past holds a few secrets? Title defects are like hidden traps in the property's history, just waiting to catch an unsuspecting new owner by surprise. These issues, often called "clouds" on a title, can range from simple clerical mistakes to complex legal fights that put your entire investment on the line.

Figuring out what these common problems are is the first step toward protecting yourself. If these clouds aren't cleared up before you close, you could be facing major financial losses and legal headaches for years to come.

Hidden Liens and Unpaid Debts

One of the most common surprises we see is an undiscovered lien. Think of a lien as a legal "IOU" attached to the property itself. If a previous owner didn't pay their property taxes, skipped out on paying a contractor for a new roof, or defaulted on a loan, that creditor can slap a lien on the property to collect their money.

Here's the kicker: those liens don't just vanish when the property changes hands. If they aren’t found and settled before closing, that debt can become your problem. All of a sudden, you could be responsible for thousands of dollars in someone else's unpaid bills.

A title defect isn’t just an inconvenience; it's a direct challenge to your ownership rights. From clerical errors in public records to undisclosed heirs, each issue represents a potential threat to your investment.

Other financial claims, like old utility bills or unpaid HOA dues, can also pop up. While they might seem small at first, they can snowball into serious financial and legal messes if ignored.

Easements and Boundary Disputes

Not every title issue is about money. Sometimes, it’s about who has the right to use the land. An easement gives another party the legal right to use a specific part of your property for a specific reason. For instance, a utility company might have an easement to access power lines, or your neighbor could have a legal right-of-way to use your driveway.

Easements aren't always a deal-breaker, but you absolutely need to know they exist. An unknown easement could derail your plans to build a fence, a pool, or an addition right where you wanted it.

Boundary disputes are another classic headache. What happens if a survey from 50 years ago was off, and your neighbor’s fence is actually 10 feet on your side of the property line? This creates a direct conflict over who owns what, often leading to expensive new surveys, legal bills, and tense conversations with the folks next door.

Spotting these red flags is exactly why a thorough title search is so important—it’s the only way to be sure you're getting the clear title you're paying for.

To give you a clearer picture, here’s a breakdown of some of the most common title defects and the risks they carry.

Common Title Defects and Their Impact

| Title Defect | Description | Potential Impact |

|---|---|---|

| Mechanic's Liens | A claim filed by a contractor or supplier for unpaid work or materials on the property. | The new owner could be forced to pay the outstanding debt to prevent foreclosure. |

| Tax Liens | A claim placed on the property by a government agency for unpaid property taxes. | The property could be seized and sold by the government to satisfy the tax debt. |

| Unknown Easements | A third party has the right to use a portion of the land, which was not disclosed. | Restricts the owner's use of their property (e.g., can't build in a certain area). |

| Boundary Disputes | Disagreements between neighbors over the exact location of the property lines. | Can lead to costly legal battles, loss of land, and the need for new surveys. |

| Undisclosed Heirs | A previously unknown heir of a former owner comes forward to claim ownership of the property. | The new owner's title could be invalidated, leading to a complete loss of the property. |

| Forgeries & Fraud | A past deed or document in the title's history was forged or signed under false pretenses. | The entire chain of title could be illegitimate, voiding the current owner's rights. |

| Clerical Errors | Mistakes in public records, such as typos in names or incorrect legal descriptions. | Can create confusion over ownership and requires legal action to correct the public record. |

As you can see, these aren't minor technicalities. Each one represents a real threat that can complicate or even nullify your ownership, which is why identifying and resolving them before closing is absolutely non-negotiable.

How Professionals Verify a Clear Title

Knowing the risks of a clouded title is one thing; knowing how to prevent them is a whole different ballgame. Professionals in the real estate and energy sectors don't just cross their fingers and hope for the best. They follow a meticulous process to make sure a title is clean, turning a potential minefield of a transaction into a secure investment.

The bedrock of this whole process is the comprehensive title search. You can think of it like a full-blown historical investigation into the property. Experts, often called title abstractors, roll up their sleeves and dig through decades of public records. They pore over every deed, mortgage, court judgment, and tax record tied to that specific piece of land.

Their mission? To build a complete, unbroken chain of ownership and sniff out any hidden claims or defects that could come back to bite you later. These skilled title abstractors are the detectives who piece together this incredibly complex puzzle.

The Role of Title Insurance

Once the deep dive is done, all the findings are pulled together into what's known as a title abstract or report. This is where title insurance steps in, and it’s a bit different from other types of insurance. It doesn't protect you from things that might happen in the future; instead, title insurance protects you from past, undiscovered issues.

What if that exhaustive search somehow missed a hidden lien from a contractor years ago? Or an old forgery on a deed? Or a long-lost heir who suddenly appears with a claim? That's when your title insurance policy becomes your financial shield.

Title insurance is more than a policy—it’s your legal defense team. It covers the costs of defending your ownership in court and compensates you for financial loss if a claim against your title proves valid.

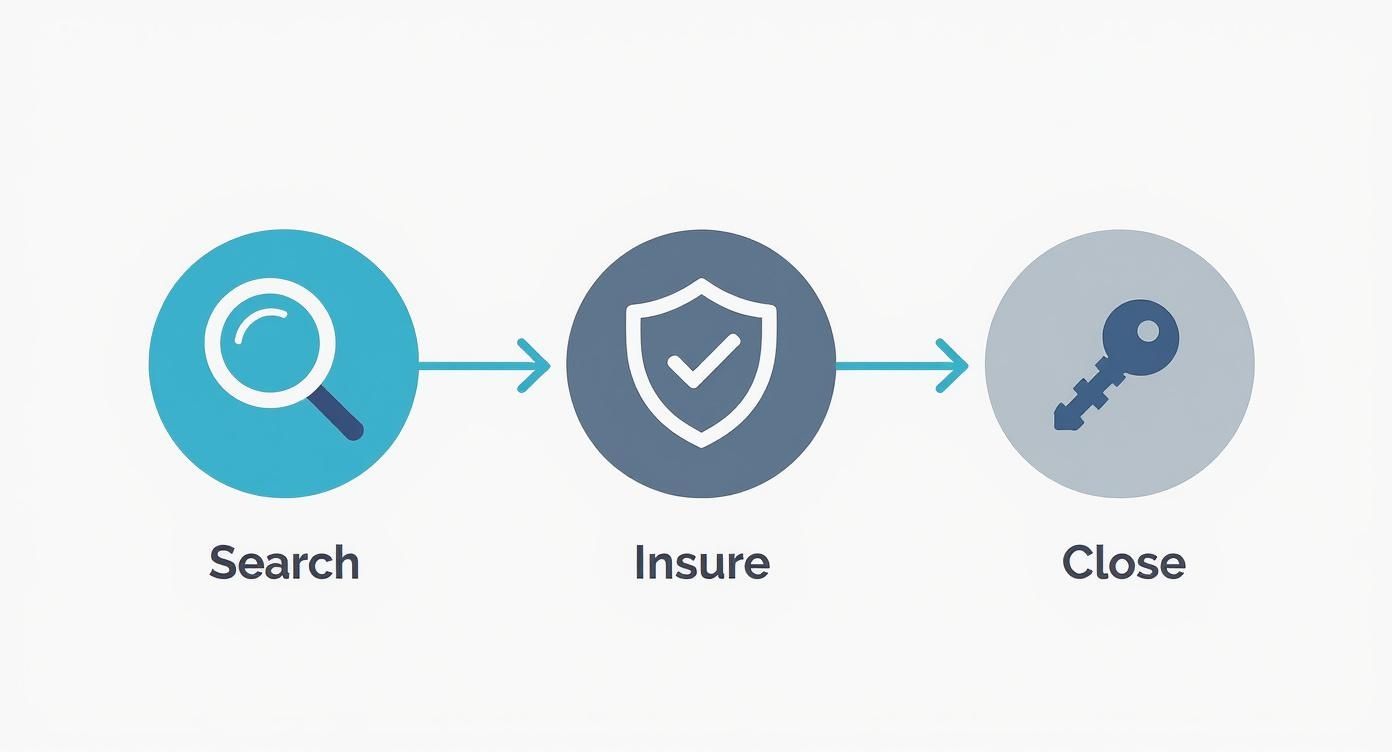

This entire verification process really boils down to a few key steps that professionals follow before any deal closes.

This simple but essential workflow is the backbone of secure property transactions, protecting huge investments every single day.

Ultimately, these professional steps—the exhaustive search and the protective insurance policy—are non-negotiable investments in security. They give everyone involved the confidence to move forward and close the deal, knowing that ownership rights are solid and protected.

Modernizing Title Verification with Technology

The days of title abstractors spending weeks buried in dusty courthouse records are numbered. Technology is bringing a massive shift to the world of title verification, replacing slow, manual labor with the speed and precision of automation. This evolution is critical for ensuring you receive a clear title without the soul-crushing delays of the past.

Artificial intelligence and automated systems are now at the forefront, catching subtle defects that a human eye might easily miss after hours of staring at deeds and liens. These tools can analyze decades of records in minutes—not days—flagging discrepancies and potential risks with incredible accuracy. This is where TitleTrackr is leading the charge.

A Smarter Path to a Clear Title

Our platform uses advanced algorithms to scan, interpret, and make sense of complex property data. We didn't just digitize the old, slow methods. Instead, we built a system from the ground up that actively identifies potential clouds on a title, from simple clerical errors to impossibly tangled conveyance chains in energy land records.

TitleTrackr delivers clear, actionable reports in a fraction of the time it takes traditionally. The benefits are real and immediate for everyone involved in a transaction.

- Minimizes Human Error: Automation slashes the risk of oversight that can creep in during manual searches.

- Accelerates Closing Times: Faster verification means deals can close significantly quicker, saving everyone time and money.

- Boosts Overall Confidence: With a more thorough analysis, all parties can move forward with confidence that the title is truly clear.

By applying intelligent automation to the verification process, we make property and asset ownership more secure than ever before. It's about turning a mountain of data into absolute certainty.

This technological leap isn't just about moving faster; it's about providing a deeper, more robust layer of security for your most valuable investments. You can explore more insights on how technology is shaping the industry by visiting our blog on title and land management topics.

Ready to see how our platform can safeguard your investments and bring new speed to your projects? Request a demo of TitleTrackr and see how we make defining a clear title faster and more reliable.

Frequently Asked Questions About Clear Titles

Diving into the world of property titles can feel like learning a new language, but a few key concepts are all you need to protect your investment. Let's tackle some of the most common questions people have when they hear the term clear title.

Getting a handle on these details is the surest way to a smooth, secure closing.

What Is the Difference Between a Title and a Deed?

It's a great question, and the distinction is simple but important.

Think of it this way: a title is the concept of your ownership. It’s your legal right to own, use, and sell a property. A deed, on the other hand, is the physical legal document that gets signed to officially transfer that ownership right from the seller to you.

The deed is the paper that makes it official; the title is the ownership itself.

Is Title Insurance a One-Time Purchase?

Yes, it is. Unlike homeowner's insurance that you pay every year, an owner's title insurance policy is a single, one-time premium paid at closing.

That single payment protects you (and your heirs) against claims for as long as you own the property. It’s a powerful, long-term shield for your investment, defending you against ghosts from the property’s past that might have been lurking long before you came along.

An owner’s title insurance policy is a one-time cost that provides lasting peace of mind. It shields you from past, undiscovered title defects that could surface years after you've closed on the property.

Once you see it as a permanent safeguard, the one-time cost makes perfect sense. For a deeper dive into common questions, you can explore our comprehensive FAQ page for more answers.

Can a Title Defect Be Fixed Before Closing?

Absolutely. Finding a title defect doesn't automatically kill the deal. The process of fixing the problem is called "curing the title," and it's a routine step in countless transactions.

For example, an unpaid contractor's lien can be paid off by the seller before closing. A simple clerical error in public records can be legally corrected. The key is to find these clouds early with a thorough title search so they can be cleared up before you take ownership.

Who Is Responsible for Providing a Clear Title?

In almost every real estate deal, the seller is legally on the hook to deliver a clear and marketable title to the buyer. It's their job to resolve any known liens, judgments, or other claims against the property before the sale is finalized.

The whole point of the title search and insurance process is to confirm they’ve met that obligation, giving you the confidence that you're getting the property free and clear.

Stop chasing down documents and start getting clear, actionable insights in seconds. TitleTrackr uses AI to automate the painstaking work of title verification, giving your team the speed and accuracy needed to close deals with confidence. Request a demo today.