For industry professionals, the primary methods to find liens on a property are conducting manual searches of public records, engaging a traditional title company, or leveraging an AI-powered platform for instant, comprehensive results.

At its core, a property lien is a legal claim against a property for an unpaid debt. Uncovering these encumbrances is a critical component of due diligence in any real estate transaction, protecting investments and ensuring a clear chain of title.

Why a Lien Search Is a Non-Negotiable Step in Due Diligence

Imagine this: your firm is days from closing a high-value commercial deal. Suddenly, a mechanic's lien for a substantial amount surfaces, filed by an unpaid contractor. This scenario isn't just a hypothetical risk; it's a common operational bottleneck that can derail transactions, tie up capital, and trigger costly delays.

This isn't just about procedural compliance. It's about mitigating risk and protecting your—and your client's—investment from latent liabilities.

A thorough lien search is the foundation of a secure real estate transaction. Proceeding without one is an unacceptable business risk. You have no visibility into the financial claims attached to the asset—claims that transfer to the new owner upon closing. These hidden encumbrances introduce significant financial exposure and potential legal entanglements.

The Financial Impact of Undiscovered Liens

Never assume a property is unencumbered. Analysis of public records indicates that approximately 20-30% of residential properties may have some form of lien at any given time. Forgoing a detailed search is a significant gamble with your capital and reputation.

Beyond the direct risk of inheriting debt, properties with known title issues often face transactional delays and may see their market value discounted by 5-10% due to the increased complexity. For broader context, you can review global property market trends on globalpropertyguide.com.

Understanding the different types of liens is fundamental to identifying potential red flags during due diligence. This reference table outlines the most common classifications.

Common Types of Property Liens and Their Triggers

| Lien Type | Common Trigger | Typical Holder |

|---|---|---|

| Mortgage Lien | A loan was taken out to purchase the property. | The bank or mortgage lender. |

| Tax Lien | Unpaid property, state, or federal taxes. | A government agency (IRS, state, or county). |

| Mechanic's Lien | A contractor wasn't paid for labor or materials. | The unpaid contractor or supplier. |

| Judgment Lien | A court ruling where one party owes another money. | The winning party in a lawsuit (the creditor). |

Each of these liens represents a financial obligation that is legally attached to the real estate itself.

A meticulous lien search is the only way to ensure you're getting a clear title. It's the ultimate safeguard for your investment against unexpected financial burdens.

The Traditional Method: Manual County Record Searches

Before the widespread adoption of digital solutions, the only viable method for lien discovery was a direct visit to the county courthouse or recorder’s office. This manual approach is still functional, but it is resource-intensive and fraught with inefficiencies.

This "boots-on-the-ground" process begins with identifying the correct government office—typically the County Recorder, Clerk of Court, or Register of Deeds. While a property address is a starting point, the parcel number (APN) is the key identifier for efficient record retrieval.

What to Expect at the Recorder's Office

Expect a blend of legacy systems, from physical ledgers to outdated computer terminals. The process is far from streamlined, requiring users to manually sift through deeds, mortgages, and lien filings.

- Fee Structures: Be prepared for ancillary costs. Counties typically charge per-page fees for copies, which can accumulate quickly on properties with extensive histories.

- Time Commitment: This is not a quick task. A comprehensive manual search can consume hours, if not a full business day, depending on the complexity of the property's title history.

- Complex Jargon: Proficiency in legal terminology is essential. Users must understand terms like "grantor," "grantee," and "encumbrance" to interpret documents correctly.

A manual search involves physically tracing the chain of title and identifying any recorded claims that could cloud ownership. It is a painstaking but foundational element of title examination.

While thorough, the manual approach is a masterclass in inefficiency, operational bottlenecks, and the potential for human error. It requires significant patience and a meticulous eye for detail.

Understanding this traditional workflow is crucial. It highlights the precise pain points that modern technological solutions were designed to eliminate, delivering equivalent or superior results in a fraction of the time.

Preliminary Research: Using Online Public Records

The digitization of public records has provided a valuable preliminary research tool. Most counties now offer online access to their property records, enabling a quick, initial assessment to find liens on a property without leaving your desk.

These online portals are typically managed by the county recorder or clerk's office. The most effective search inputs are the property’s parcel number or the full name of the current owner. The process involves navigating digital archives of deeds, mortgages, and other filings to identify potential encumbrances—a digital-first version of the traditional courthouse search.

Navigating County Websites Effectively

To locate these resources, search for "[County Name] property records" or "[County Name] register of deeds". Many of these government websites have not been updated in years, so usability can vary.

To maximize search effectiveness:

- Be precise. Using the parcel number is the most direct method to isolate the correct property records.

- Think like a detective. Search the owner's full name, but also try variations with initials or any known aliases to ensure comprehensive coverage.

- Use the filters. Most portals allow filtering by document type. Focus on categories like "liens," "judgments," or "mortgages" to isolate relevant records.

A word of caution: while these online records offer a valuable first look, they can be dangerously incomplete. Relying on them as the definitive source for a major investment is a huge risk. Data lags or gaps in digitization can create a false sense of security.

For instance, a mechanic's lien filed yesterday may not appear in the online database for several weeks. This critical information gap is precisely where a professional title search or an AI-powered platform like TitleTrackr becomes essential. These solutions cross-reference numerous data sources in real-time to mitigate the risks posed by outdated or incomplete single-source databases.

Engaging Professionals for a Guaranteed Clear Title

While online public records are useful for preliminary checks, they are insufficient for the demands of a professional real estate transaction due to their inherent limitations. This is why engaging experts like title companies and abstractors remains the industry standard for definitively uncovering liens and securing a clear title.

These specialists conduct a forensic examination of the property’s history. A professional title report provides a comprehensive overview, including the full chain of title, which traces ownership transfers over decades. It uncovers all recorded encumbrances, from mortgages and tax liens to obscure easements and historical court judgments.

The Value of Professional Expertise

Hiring a professional is an exercise in risk management. You are leveraging their deep expertise in navigating complex legal documents and their rigorous attention to detail.

Title professionals are trained to identify anomalies and red flags that a layperson would overlook. Their work product is the basis for issuing title insurance, which protects both the owner and lender from financial loss arising from future title defect claims.

Technology is rapidly increasing the efficiency of this sector. By 2025, it’s estimated that 80% of all lien searches in the U.S. will be conducted electronically, a significant increase from 50% in 2015. This evolution enables professionals to deliver results faster, a critical advantage when lien-related issues cause nearly 15% of all real estate transaction delays. You can find more insights on how technology impacts the real estate market on knightfrank.com.

The primary benefit of a professional search is certainty. Knowing an expert has meticulously vetted the property's history provides the confidence to proceed with a transaction, free from the concern of post-closing surprises.

A professional title search typically costs several hundred dollars and can take multiple business days to complete—a nominal investment for the assurance of a clean and marketable title. For professionals in the field, understanding the key responsibilities of a title abstractor further clarifies the immense value they provide.

The Modern Approach: AI-Powered Lien Discovery

While professional services offer certainty, their turnaround times can introduce friction into fast-paced transactions. The modern alternative is AI, which provides comprehensive, professional-grade detail in minutes, not days. This technology empowers investors and real estate professionals to find liens on a property with unprecedented speed and accuracy.

AI-driven platforms like TitleTrackr fundamentally transform the title search process. Instead of a linear, manual workflow, these systems aggregate and analyze data from thousands of public and private sources simultaneously. This multi-source approach generates a far more complete and timely picture of a property's financial standing than any single county database can provide.

Gaining a Competitive Edge with AI

Imagine initiating a complex, multi-state lien search and receiving a detailed, actionable report in minutes. That is the strategic advantage AI delivers. The technology extends beyond simple data aggregation; it performs sophisticated analysis. It flags inconsistencies, identifies potential fraud, and highlights gaps in the chain of title that the human eye can miss during manual review.

This capability provides the confidence needed to act decisively on time-sensitive opportunities.

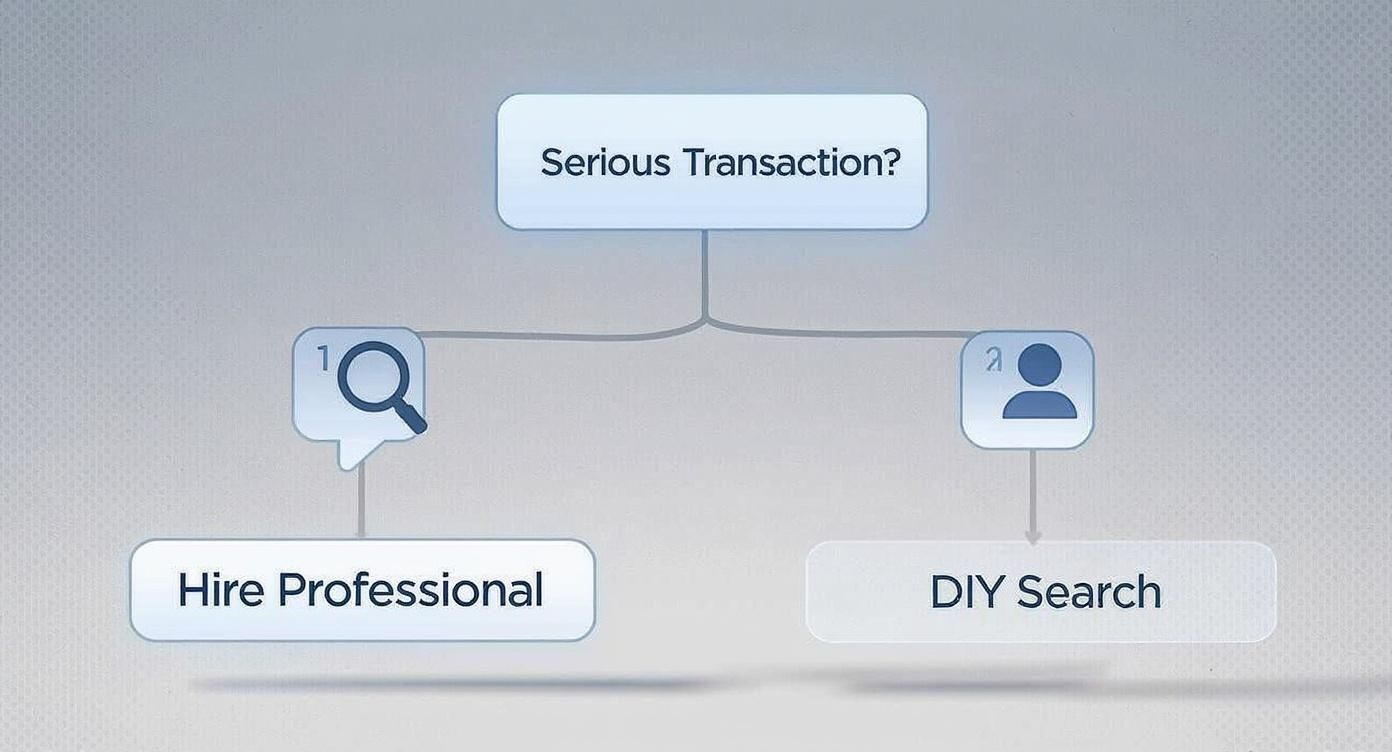

This decision tree illustrates when a preliminary DIY search is sufficient versus when professional tools are necessary to mitigate risk in a high-stakes transaction.

As shown, for high-stakes investments where capital is on the line, leveraging professional-grade tools is the most prudent approach to risk management.

How AI Delivers Better Results

For any real estate professional focused on scaling their operations, AI is the clear path forward. It automates the most time-consuming, low-value aspects of due diligence, freeing up your team to focus on high-value activities like analysis and deal-making.

Platforms like TitleTrackr provide a definitive competitive advantage by combining the velocity of automation with the depth of advanced data analytics. By removing manual effort, AI minimizes the risk of human error and uncovers hidden liabilities that traditional searches may overlook.

The result is a faster, more reliable, and ultimately more profitable workflow.

Adopting this modern approach isn’t just about efficiency. It's about fundamentally reducing transactional risk and making smarter, data-driven decisions on every deal.

See the technology in action for yourself. Explore a free trial of TitleTrackr to experience the difference it can make in your workflow.

Got Questions About Finding Property Liens?

Even for seasoned professionals, complex questions can arise during title examination. Having clear answers is essential for maintaining momentum and advising clients effectively. Here are answers to some of the most common inquiries.

Voluntary vs. Involuntary Liens

What is the distinction between voluntary and involuntary liens?

A voluntary lien is one created by a contractual agreement, such as a mortgage. The property owner willingly pledges the asset as collateral to secure a loan.

An involuntary lien, conversely, is imposed by a legal process without the owner's consent, typically due to an unpaid debt. Common examples include tax liens for delinquent property taxes and mechanic's liens filed by unpaid contractors.

Can a Lien Really Stop a Property Sale?

Yes, an unresolved lien can—and frequently does—halt a property sale.

Most real estate purchase agreements require the seller to deliver a "clear title." This condition mandates that all existing liens must be satisfied before legal ownership can be transferred. The discovery of an unexpected lien will stop a closing until the debt is resolved. In most scenarios, proceeds from the sale are used to pay the lienholder at the closing table.

An undiscovered lien is one of the biggest deal-killers in real estate. It can halt a transaction indefinitely, tying up capital and creating significant delays until it is properly resolved.

Are Those Free Online Searches Accurate?

How reliable are the free, online public record databases?

While a county's website can be a useful starting point for preliminary research, data accuracy and timeliness can be inconsistent. Information may be correct but is rarely real-time. A lien filed yesterday might not appear in an online portal for weeks, creating a critical information gap.

For any professional transaction, relying solely on these free resources constitutes a significant and unnecessary risk. For a deeper analysis of common issues with public records, please visit our comprehensive FAQ page.

Ready to eliminate guesswork and access instant, accurate title data? TitleTrackr uses AI to execute comprehensive lien searches in seconds, empowering you with the confidence to act decisively. Request a demo with TitleTrackr and see how our platform can revolutionize your workflow.