An appraisal report is more than just a concluding number; it's a meticulously crafted narrative justifying the value of a property, business, or asset. For professionals in real estate, energy, and land development, understanding the structure and nuances of these documents is critical for success. A robust report provides a defensible opinion of value, forming the bedrock of transactions, financing, and strategic decisions. Conversely, a poorly executed one, often built on inefficient data gathering, can introduce risk, derail projects, and lead to significant financial consequences.

This article moves beyond theory to provide a practical breakdown of six diverse appraisal report example types. We will deconstruct everything from a standardized residential URAR (Form 1004) to a complex commercial narrative and a detailed business valuation. Each example is analyzed to highlight key strategic elements, common pitfalls, and the specific data points that drive the final valuation.

Our goal is to demystify these essential documents, providing actionable insights you can apply directly to your work. By examining these samples, you'll gain a clearer understanding of how to interpret reports effectively and recognize the critical role that accurate, fast data extraction plays. This is precisely where modern platforms like TitleTrackr streamline workflows, ensuring every valuation is built on a solid foundation of verified information, faster.

1. Residential Real Estate Appraisal Report (URAR Form 1004)

The Uniform Residential Appraisal Report (URAR), or Fannie Mae Form 1004, is the cornerstone of residential property valuation in the United States. Developed and standardized by government-sponsored enterprises Fannie Mae and Freddie Mac, this comprehensive document provides lenders with a consistent and reliable estimate of a property's market value. It's the most common appraisal report example you'll encounter for single-family homes, guiding critical decisions in the mortgage lending process.

The URAR form methodically structures the appraisal process, requiring the appraiser to analyze the subject property, its neighborhood, and the local market conditions. The core of the report is the sales comparison approach, where the appraiser selects recent, nearby, and similar property sales (comparables or "comps") to derive a value for the subject property. This standardized format ensures all key data points, from property characteristics to market trends, are captured and presented uniformly.

Strategic Breakdown of the URAR Form

The URAR's strength lies in its meticulous, section-by-section analysis. For professionals like landmen and developers, understanding its structure is key to evaluating residential assets quickly and accurately.

- Subject and Contract Information: This section verifies basic details like the borrower, owner, and property address. It also includes contract details for purchase transactions, which helps the appraiser understand the context of the valuation.

- Site and Improvements: Here, the appraiser details the property's physical attributes, including lot size, zoning, utilities, and the home's features (e.g., square footage, room count, age, condition). Accurate data is crucial, as this forms the basis for all comparisons.

- Sales Comparison Analysis: This is the most critical section. The appraiser presents a grid comparing the subject property to at least three comparable sales. Adjustments are made to the comps' sale prices to account for differences in features, location, or condition relative to the subject property.

Key Insight: The logic behind the adjustments is where an appraiser's expertise shines. A well-supported URAR will have clear, market-based justifications for every adjustment, whether for an extra bathroom, a superior location, or a recent renovation. Manually gathering this data is a bottleneck; automation is the solution.

Actionable Takeaways for Land Professionals

While focused on lending, the URAR provides invaluable data for anyone involved in real estate. The challenge is speed and accuracy.

- Verify Data Meticulously: Ensure all data, especially gross living area (GLA) and lot size, is accurate. Discrepancies between the appraisal and public records can signal issues. Tools that use AI to aggregate and verify property data, like TitleTrackr, can slash this verification time from hours to minutes.

- Scrutinize Comparable Selection: The quality of the appraisal hinges on the quality of the comps. They should be recent (ideally within 6 months) and geographically close. Question comps that are older, distant, or not truly similar.

- Analyze the Neighborhood Section: The appraiser's commentary on neighborhood boundaries, market conditions (e.g., stable, increasing), and property value trends provides a snapshot of the micro-market, which is essential for development and acquisition strategies.

2. Employee Performance Appraisal Report

An Employee Performance Appraisal Report is a formal document used by managers and HR professionals to evaluate an employee's job performance over a specific period. While it may seem different from a property appraisal, the core principle is the same: providing a structured, evidence-based assessment of value. This type of appraisal report example is crucial for talent management, guiding decisions on compensation, promotions, and development, much like a URAR guides mortgage lending.

Modern performance appraisals, influenced by thinkers like Peter Drucker and frameworks like Google's OKRs (Objectives and Key Results), have moved beyond simple ratings. They now emphasize continuous feedback, goal alignment, and forward-looking development. This structured approach provides a clear record of an employee's contributions, strengths, and areas for growth, ensuring that assessments are fair, consistent, and tied to business objectives.

Strategic Breakdown of the Performance Appraisal

A strong performance appraisal report is built on a foundation of clear metrics and specific examples. For team leaders and managers in any industry, understanding its components is key to building a high-performing team.

- Objectives and Key Results (OKRs): This section outlines the specific, measurable goals the employee was expected to achieve. It compares the targeted results against actual accomplishments, providing a quantitative basis for the evaluation.

- Competency Assessment: Here, the manager evaluates the employee against core competencies relevant to their role and the company's values. This could include skills like communication, teamwork, problem-solving, and leadership.

- Strengths and Areas for Development: This part provides qualitative feedback. It highlights where the employee excels and identifies specific areas for improvement, supported by concrete examples of behavior and performance. A development plan with actionable steps is often included.

Key Insight: The most effective performance reports are a two-way dialogue, not a top-down judgment. Systems like Adobe's 'Check-In' have replaced traditional annual reviews with ongoing conversations, making the process more collaborative and development-focused.

Actionable Takeaways for Land Professionals

The principles of effective performance appraisal can be directly applied to managing land teams, from title abstractors to development project managers.

- Document Performance Continuously: Avoid last-minute evaluations. Keep a running log of achievements, challenges, and key contributions for each team member throughout the year. This ensures the final report is balanced and evidence-based.

- Use Specific Metrics and Examples: Instead of vague statements like "good work," use specific data. For a landman, this could be "successfully negotiated 15 leases ahead of the Q3 deadline" or for an abstractor, "maintained a 99.5% accuracy rate on title reports."

- Connect Individual Goals to Team Projects: Ensure each team member's goals are directly aligned with broader project milestones, like securing a right-of-way or completing due diligence for an acquisition. This provides clear context for their performance and boosts motivation. Platforms that centralize project data, like TitleTrackr, can help track individual contributions toward these collective goals, providing a clear line of sight on team productivity.

3. Commercial Real Estate Appraisal Report (Narrative Format)

A Commercial Real Estate Appraisal Report is a comprehensive, in-depth document that establishes the market value of income-producing properties like office buildings, retail centers, or industrial facilities. Unlike standardized residential forms, these are typically extensive narrative reports. This format provides a detailed analysis that is critical for high-stakes investment decisions, such as a shopping center acquisition or the refinancing of a large multifamily apartment complex.

The core of this appraisal report example is its focus on the property's economic potential. Appraisers, often those with an MAI designation from the Appraisal Institute, conduct a thorough investigation into market dynamics, zoning, and highest and best use. The valuation heavily relies on the income approach, which analyzes rental income, operating expenses, and capitalization rates to determine what a rational investor would pay for the asset's cash flow.

Strategic Breakdown of the Narrative Report

The narrative format allows for a much deeper dive than a simple form, which is essential for complex commercial assets. For developers and investors, understanding its components is vital for due diligence and strategic planning.

- Market and Neighborhood Analysis: This section goes far beyond basic trends. It includes a detailed economic overview, demographic analysis, and a look at supply and demand dynamics, including vacancy and absorption rates for the specific property type.

- Highest and Best Use Analysis: This is a crucial component that determines the most profitable, legally permissible, and physically possible use of the property. This analysis underpins the entire valuation.

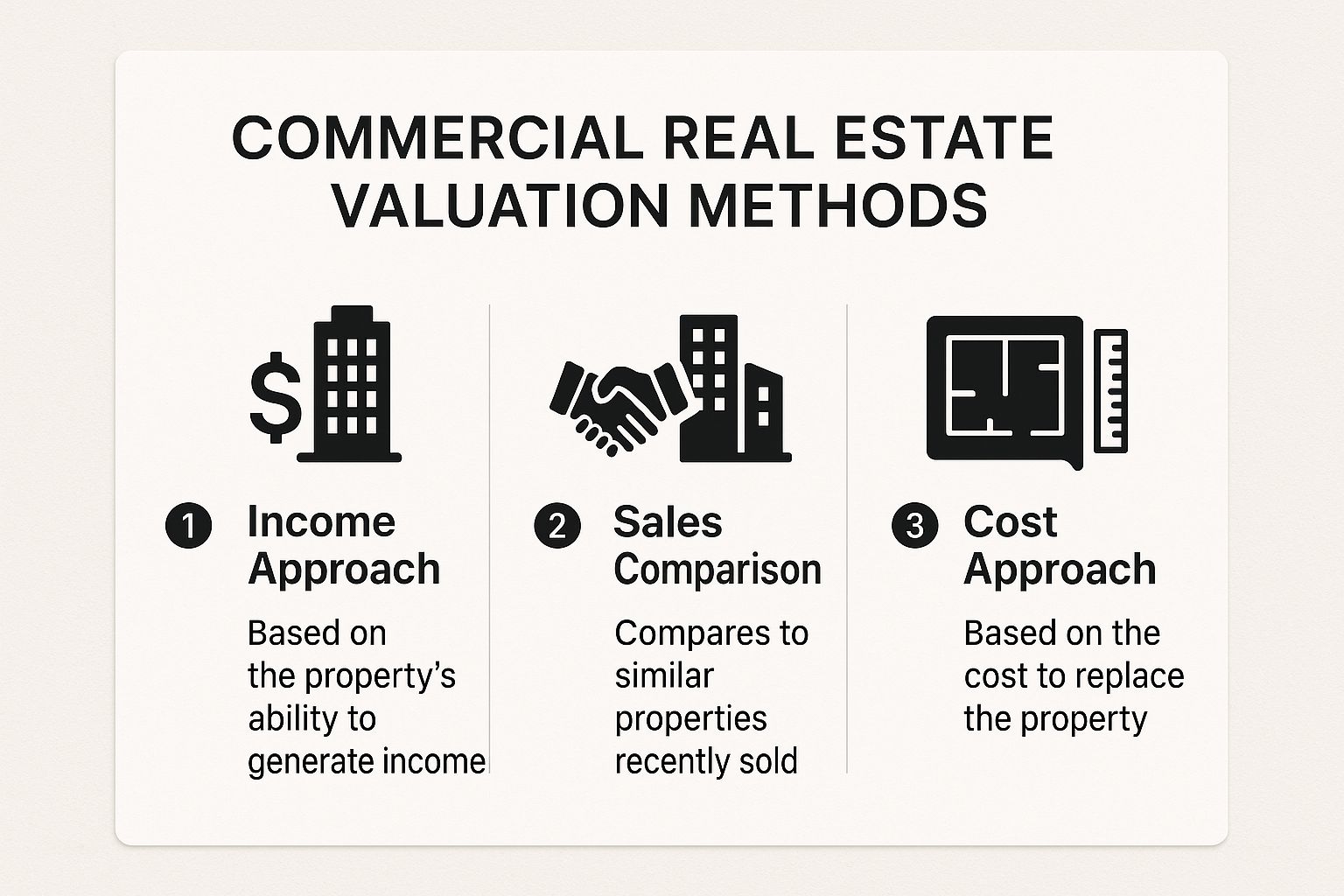

- Valuation Approaches: The report meticulously details three approaches to value: the Income Approach, Sales Comparison Approach, and Cost Approach. The appraiser then reconciles these different values into a final conclusion.

Key Insight: The reconciliation of value is where the appraiser’s expertise is most evident. In most commercial appraisals, the Income Approach is given the most weight, as investors primarily buy these properties for their ability to generate income. A well-argued reconciliation explains why one approach is more relevant than others for that specific asset.

The infographic below summarizes the three core valuation methods used in commercial real estate appraisals.

This visual highlights how each method provides a different perspective on value, which the appraiser must synthesize to arrive at a credible conclusion.

Actionable Takeaways for Land Professionals

The detailed nature of a commercial narrative report offers a wealth of strategic information for land and energy professionals.

- Validate Income and Expense Data: The Income Approach is only as good as its inputs. Cross-reference the appraiser's pro-forma with actual operating statements, rent rolls, and lease agreements. Any discrepancies can significantly impact the valuation. This is where manual data extraction becomes a major pain point.

- Analyze Lease Abstracts: Dig into the lease terms. Pay close attention to expiration dates, renewal options, and expense reimbursement structures (e.g., NNN, Gross). This analysis reveals the stability and future potential of the income stream.

- Review the Highest and Best Use Conclusion: For developers, this section is a roadmap. It can reveal untapped potential, such as the feasibility of redevelopment or adding density, providing a basis for acquisition and entitlement strategies. Efficiently gathering the necessary zoning, plat, and deed data for this analysis can be streamlined with platforms like TitleTrackr, which automate the extraction of key information.

4. Business Valuation Appraisal Report

A Business Valuation Appraisal Report determines the economic worth of an entire business enterprise. Unlike real estate appraisals that focus on a single physical asset, this report provides a comprehensive opinion on a company's value for critical events like mergers, partner buyouts, estate planning, or litigation. It’s a vital appraisal report example for understanding the worth of an operating entity, not just its tangible property.

The process involves a deep analysis of financial statements, market position, industry trends, and intangible assets like brand reputation and goodwill. Appraisers use established methodologies, including the asset-based, market, and income approaches, to arrive at a defensible conclusion of value. This complex analysis provides stakeholders with the critical financial intelligence needed for high-stakes business decisions.

Strategic Breakdown of a Business Valuation Report

The strength of a business valuation lies in its rigorous, multi-faceted approach to determining value. For professionals involved in corporate transactions or asset management, understanding its components is essential for due diligence.

- Financial Statement Analysis: This section goes beyond surface-level numbers. The appraiser makes "normalizing adjustments" to historical financials to remove non-recurring or discretionary items, revealing the company's true earning capacity. This includes adjusting for things like above-market owner salaries or one-time legal expenses.

- Valuation Approaches: The core of the report details the application of valuation methods. The appraiser will typically consider a Discounted Cash Flow (DCF) analysis (income approach), a Guideline Public Company or Transaction Method (market approach), and an Adjusted Net Asset Method (asset-based approach) before reconciling them into a final value conclusion.

- Risk Assessment and Industry Outlook: This crucial section analyzes both internal risks (e.g., customer concentration, management depth) and external factors (e.g., economic conditions, competitive landscape). This qualitative analysis provides context for the quantitative valuation models.

Key Insight: The selected "standard of value" (e.g., Fair Market Value, Fair Value, Investment Value) dramatically influences the outcome. Fair Market Value, the most common standard, assumes a hypothetical, knowledgeable buyer and seller, while Investment Value may reflect synergies unique to a specific buyer.

Actionable Takeaways for Professionals

While specialized, the principles of business valuation offer powerful insights for anyone assessing commercial assets or opportunities.

- Gather Comprehensive Financials: Before engaging a valuator, assemble at least three to five years of complete financial statements and tax returns. Clean, organized data expedites the process and improves accuracy. This discipline is also best practice when managing asset portfolios.

- Understand the Normalizing Adjustments: Pay close attention to the adjustments made to the income statement. These reveal the appraiser's assumptions about the business's sustainable profitability and are often key points of negotiation in a transaction.

- Verify Appraiser Credentials: The report's defensibility hinges on the appraiser's qualifications. Look for credentials like ASA (Accredited Senior Appraiser), CVA (Certified Valuation Analyst), or ABV (Accredited in Business Valuation). This ensures the methodology meets professional standards.

5. Machinery and Equipment Appraisal Report

A Machinery and Equipment (M&E) Appraisal Report assesses the value of tangible business assets, from industrial manufacturing lines to specialized medical devices. Unlike real estate, where value is tied to land and structures, M&E appraisals focus on personal property crucial for business operations. These reports are essential for securing asset-based loans, determining insurance coverage, managing mergers and acquisitions, and ensuring accurate financial reporting. This type of appraisal report example is critical for businesses whose value is heavily concentrated in their operational assets.

The M&E appraisal process involves a detailed inspection of each asset, considering its age, condition, maintenance history, and technological relevance. Appraisers research market data for comparable equipment sales and apply specific valuation premises, such as Fair Market Value, Orderly Liquidation Value, or Replacement Cost, depending on the report's purpose. The final document provides a substantiated value that lenders, insurers, and business owners can rely on.

Strategic Breakdown of the M&E Report

The value of an M&E report comes from its granular, asset-by-asset analysis. For professionals involved in asset-heavy industries, understanding its components is key to leveraging these valuations effectively.

- Valuation Premise and Scope: This section clearly defines the purpose of the appraisal (e.g., for a loan, insurance) and the type of value being determined. This context is vital, as an asset's "fair market value" can differ significantly from its "forced liquidation value."

- Asset Inventory and Description: The core of the report is a detailed list of all machinery and equipment. Each item is described with specifics like manufacturer, model, serial number, age, and condition. This precise documentation forms the foundation of the valuation.

- Valuation Methodology and Analysis: Here, the appraiser explains the approach used, whether it’s a market approach (comparing to similar sales), a cost approach (calculating replacement cost less depreciation), or an income approach (based on revenue generated by the asset).

Key Insight: The appraiser's treatment of obsolescence, both functional and economic, is a critical factor. A well-supported M&E report will clearly justify deductions for outdated technology or shifts in market demand that impact the equipment's value, providing a realistic picture of its worth.

Actionable Takeaways for Land Professionals

While not directly tied to land, M&E appraisals are invaluable for developers and landmen working with industrial, agricultural, or energy-related properties where operational assets are part of a transaction.

- Verify Asset Lists Against Records: Ensure the appraiser's inventory matches the company's internal asset register and any UCC filings. Discrepancies can complicate financing and acquisitions. Centralizing these disparate documents in a platform like TitleTrackr exposes inconsistencies before they become major issues, saving you time and reducing risk.

- Specify the Correct Valuation Premise: Before ordering the report, be clear about its intended use. An appraisal for insurance replacement cost will yield a different value than one for orderly liquidation in a potential acquisition, so define the need upfront.

- Analyze Market and Industry Trends: The appraiser's commentary on industry-specific conditions is crucial. For example, a downturn in the automotive sector could devalue specialized manufacturing equipment, impacting the collateral value for a land and facility loan.

6. Jewelry and Personal Property Appraisal Report

Beyond real estate, the valuation of high-value personal assets like jewelry, fine art, and antiques requires a specialized appraisal report. A Jewelry and Personal Property Appraisal provides a documented, expert opinion on an item's value, authenticity, and specific characteristics. This type of appraisal report example is crucial not just for personal use like insurance coverage, but also in complex legal and financial situations such as estate settlement, equitable distribution in a divorce, or for substantiating charitable donations for tax purposes.

These reports are meticulously detailed, moving beyond a simple price tag to include qualitative and quantitative data. For a diamond ring, this would involve the "4 Cs" (carat, cut, color, clarity), while an antique furniture appraisal would document provenance, condition, and maker's marks. The valuation is based on the specific purpose of the appraisal-retail replacement value for insurance is often different from the fair market value used for estate taxes. This precision ensures the asset's worth is accurately captured for its intended legal or financial context.

Strategic Breakdown of a Personal Property Appraisal

The report's value lies in its granular detail and the certified expertise behind it. For professionals managing estates or high-net-worth clients, understanding its components is key to protecting asset value.

- Detailed Description and Provenance: This section exhaustively describes the item. It uses standardized terminology, such as those from the Gemological Institute of America (GIA), and documents the item's history or provenance, which can significantly impact value.

- Condition and Quality Analysis: The appraiser provides an expert assessment of the item's physical condition, noting any damage, repairs, or unique features. High-quality photographs are included as visual evidence, which is indispensable for insurance claims or legal verification.

- Valuation Methodology and Market Analysis: Here, the appraiser explains the "how" and "why" of the valuation. They state the type of value being determined (e.g., replacement cost, fair market value) and justify it based on research of comparable sales data, auction records, and current market trends for similar items.

Key Insight: The purpose of the appraisal dictates the value. An appraisal for insurance will reflect the full retail cost to replace an item, while an appraisal for estate liquidation will reflect what a willing buyer would likely pay in the current market. This distinction is critical for accurate financial planning and legal compliance.

Actionable Takeaways for Land Professionals

While seemingly outside the scope of land management, personal property is often tied to estates and mineral rights, making this knowledge valuable.

- Verify Appraiser Credentials: Always ensure the appraiser holds certifications from reputable organizations like the American Society of Appraisers (ASA) or the International Society of Appraisers (ISA). This is non-negotiable for reports used in legal or tax proceedings.

- Specify the Appraisal's Purpose: Clearly communicate the intended use of the appraisal (e.g., estate tax, insurance) to the appraiser. This ensures the valuation methodology aligns with legal and financial requirements, preventing costly errors.

- Digitize and Secure Reports: Personal property appraisals are vital documents, especially in estate settlements that may involve complex land and mineral rights divisions. Storing these reports in a secure, centralized digital repository like TitleTrackr ensures that all asset documentation is easily accessible and protected, streamlining the management of the entire estate.

Appraisal Report Types Comparison

| Report Type | 🔄 Implementation Complexity | 💡 Resource Requirements | 📊 Expected Outcomes | ⭐ Key Advantages | 💡 Ideal Use Cases |

|---|---|---|---|---|---|

| Residential Real Estate Appraisal Report (URAR Form 1004) | Medium – standardized 6-page form, requires licensed appraiser | Licensed residential appraiser, property & neighborhood data | Accurate market value for residential properties | Universally accepted, standardized, comprehensive | Mortgage lending, refinancing, FHA/VA loans |

| Employee Performance Appraisal Report | Medium – structured but may require extensive manager input | Manager and employee time, performance data, feedback | Documented evaluation, improved communication | Supports HR decisions, aligns goals, motivates | Employee reviews, compensation, promotions |

| Commercial Real Estate Appraisal Report (Narrative Format) | High – detailed, 50-150 pages, multiple valuation methods | Certified General Appraiser, extensive market & financial data | Sophisticated value analysis for income properties | Multiple approaches, addresses investment returns | Large commercial financing, investment decisions |

| Business Valuation Appraisal Report | High – complex financial and industry analysis, 4-8 weeks | Credentialed valuator, extensive financial documentation | Defensible company value for transactions and reporting | Facilitates negotiations, complies with standards | M&A, tax reporting, buyouts, estate planning |

| Machinery and Equipment Appraisal Report | Medium-High – detailed inspections, multiple valuation types | Specialized appraiser, on-site inspections, market research | Accurate asset values for reporting and collateral | Supports insurance, financing, tax, and planning | Industrial equipment loans, insurance, estate planning |

| Jewelry and Personal Property Appraisal Report | Medium – requires specialty expertise and detailed descriptions | Certified gemologist or appraiser, high-quality photos | Verified value and authenticity of valuables | Insurance documentation, authentication, estate use | Insurance, estate divisions, charitable donations |

Streamline Your Data, Sharpen Your Valuations

Throughout our exploration of diverse appraisal report examples, from residential real estate to complex business valuations, a unifying principle becomes clear: a superior appraisal is built on a foundation of meticulously gathered, accurate data. The strength of your valuation, whether it's for a single-family home using the URAR Form 1004 or a multi-asset commercial property, is directly tied to the quality and efficiency of your research and data extraction.

Each appraisal report example we analyzed showcases the critical need to synthesize information from various sources. These sources can include deeds, plat maps, financial statements, leases, and comprehensive title records. The manual process of sifting through these documents is not just time-consuming; it's a significant bottleneck where errors can compromise the integrity of the entire valuation.

Core Takeaways from Every Appraisal Type

Across the spectrum of appraisal reports, from tangible assets like machinery to intangible business goodwill, several key themes persist. Mastering these is essential for producing defensible and credible reports.

- Data Integrity is Paramount: The final value is only as reliable as the inputs. Inaccurate data on comparable sales, lease terms, or asset conditions can lead to flawed conclusions and significant financial consequences.

- Methodology Justification is Non-Negotiable: Clearly articulating why you chose a specific valuation approach (Cost, Sales Comparison, or Income) and providing the supporting data is what separates an amateur report from a professional one.

- Context Drives Valuation: A property's value is not determined in a vacuum. Understanding market trends, zoning laws, economic conditions, and the property's highest and best use is crucial for a comprehensive analysis.

Transforming Your Appraisal Workflow

The challenge for modern professionals, including landmen, developers, and title abstractors, is not a lack of information but the overwhelming volume of it. The manual effort required to extract key data points from dense legal and financial documents is the primary obstacle to speed and accuracy. This is where technology offers a transformative solution.

The future of valuation lies in leveraging automation to handle the repetitive, data-intensive tasks, freeing up your expertise for high-level analysis and strategic judgment. Imagine reducing your document review time from hours to mere minutes. This shift allows you to focus on the nuances of the analysis, strengthen your justifications, and ultimately deliver a more robust and reliable appraisal report example for your clients.

Embracing this evolution isn't just about efficiency; it's a strategic move to enhance the quality of your work, mitigate risk, and gain a competitive edge in a demanding industry. By automating data extraction, you ensure consistency, reduce human error, and build a more scalable and profitable workflow.

The common thread in every powerful appraisal report example is flawless data extraction. TitleTrackr uses AI to automate this process, pulling critical information from deeds, leases, and title documents in seconds, not hours. Ready to eliminate manual data entry and focus on high-value analysis? Request a demo of TitleTrackr today and revolutionize your valuation workflow.