When you're buying a property, a title agency is the unsung hero working behind the scenes. Think of them as part investigator, part insurance broker, and part project manager for the single biggest purchase of your life. Their job is to make absolutely sure the property you’re buying is legally yours, with no hidden strings attached.

The Guardian of Your Property Transaction

When you purchase a home, you're not just buying the physical structure; you're buying the title—the legal rights of ownership. The title agency's main mission is to confirm that the seller actually has the undisputed right to sell you those rights.

Without this deep dive into a property's past, you could accidentally inherit someone else's problems, like unpaid contractor liens, old mortgage claims, or legal squabbles from previous owners. It's a critical step that prevents a dream home from turning into a legal nightmare.

To give you a clearer picture, here's a quick breakdown of their main duties.

Core Responsibilities of a Title Agency at a Glance

| Responsibility | Description |

|---|---|

| Title Search | A comprehensive review of public records to uncover the property's ownership history and identify any potential issues, like liens, easements, or unresolved claims. |

| Title Curative Work | If problems are found during the search, the agency works to resolve them. This could involve clearing old mortgages, settling lien claims, or correcting errors in public records. |

| Escrow Services | The agency acts as a neutral third party, holding all funds, documents, and instructions from the buyer, seller, and lender until every condition of the sale has been met. |

| Closing Coordination | They prepare all the necessary legal documents, coordinate with all parties involved, and manage the final signing meeting where the property officially changes hands. |

| Title Insurance | After verifying a clear title, the agency issues title insurance policies to protect both the new owner and the lender against any future claims that might arise from past events. |

In short, the agency meticulously investigates the property's history, fixes any issues they find, and orchestrates the closing process so that everyone walks away with what they're owed. This all leads up to issuing title insurance—a vital policy that defends you and your lender from future ownership challenges.

Protecting Your Biggest Investment

This protective role is the bedrock of secure real estate ownership. The whole point is to provide peace of mind that your title is clean.

Just how important is this? The title insurance industry generated roughly $3.9 billion in premiums in just the first quarter of the year, marking an 18% increase from the year before. Those numbers aren't just statistics; they represent millions of property deals made safer and more reliable. You can dig into more of this data on the American Land Title Association's website.

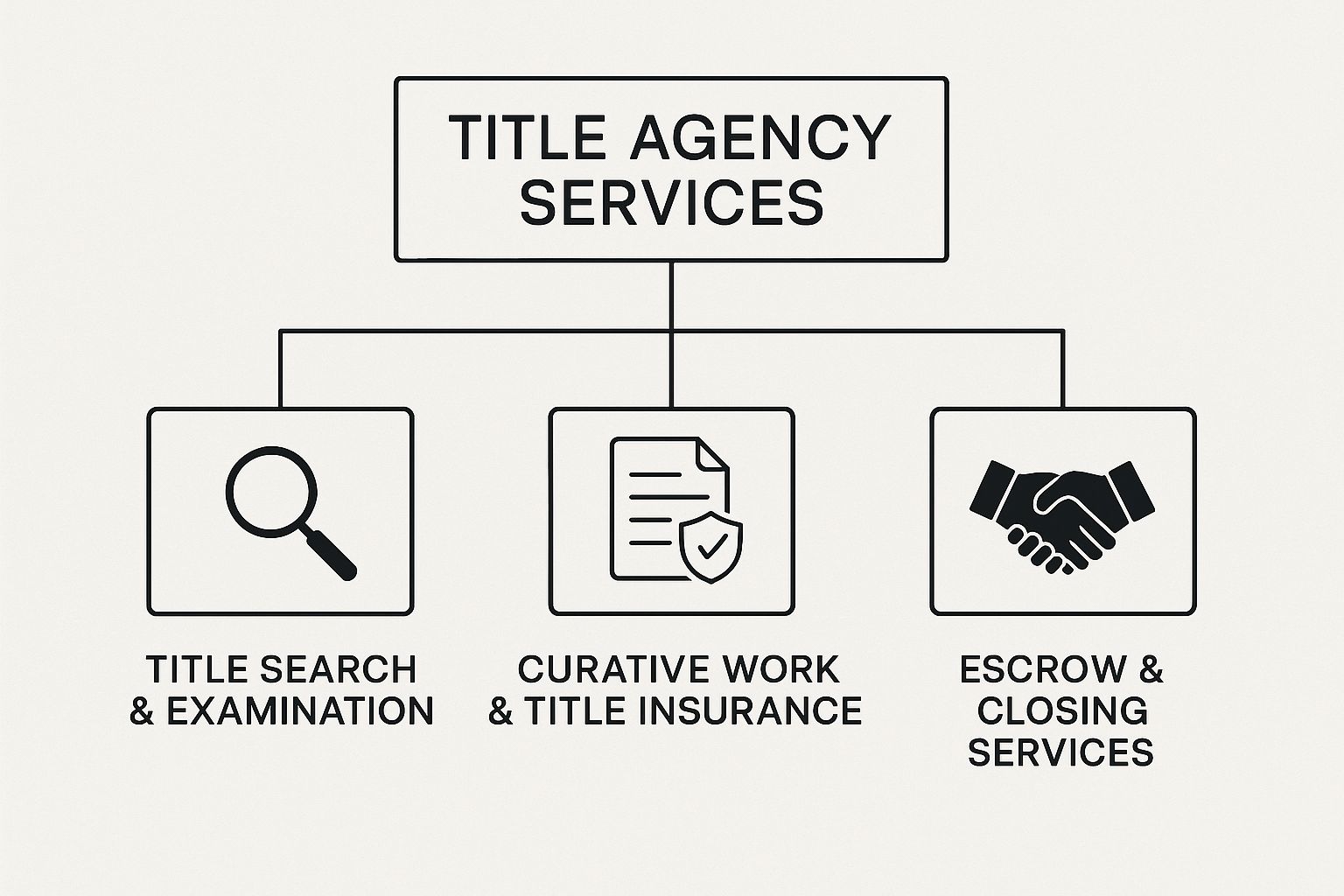

When you’re buying a property, a lot happens behind the scenes to make sure the deal goes through smoothly. At the center of it all is the title agency. Their job can be broken down into three core pillars, each one building on the last to ensure you get a clean, legally sound title.

Think of it as a complete lifecycle for verifying and securing ownership. It starts with digging into the past, then cleaning up any messes, and finally, making sure the closing is buttoned up and official.

Let's break down what each of these pillars really means for your transaction.

Title Search and Examination

The first pillar is the title search and examination. This is the detective work. Title professionals dive deep into public records—deeds, mortgages, tax records, court judgments, you name it—to piece together the complete ownership history of the property.

Their goal is to uncover any "title defects," which are just hidden problems that could come back to haunt you later. We're talking about things like old, unpaid mortgages, liens from a contractor who never got paid, or even a messy boundary dispute with a neighbor. The whole point is to find these landmines before you step on them. This heavy lifting is often handled by specialists, and you can learn more about what these expert title abstractors do in our detailed guide.

Curative Work and Title Insurance

Finding a problem is one thing, but fixing it is another. That brings us to the second pillar: curative work and title insurance. If the title search turns up an old lien or an error in a past deed, the agency doesn't just throw up its hands. They get to work fixing it. This "curative" process involves tracking down old parties, getting legal documents signed, and making sure the public record is corrected.

Once the title is clean, the agency issues title insurance.

An owner's title insurance policy is your ultimate safety net. You pay a one-time premium at closing, and it protects your property rights against any surprises from the past for as long as you or your family own the home.

If a hidden heir or an old claim pops up years later, this insurance policy is what defends your ownership in court and covers any financial loss. It’s all about peace of mind.

Escrow and Closing Services

The final pillar is escrow and closing services. At this stage, the title agency acts as a neutral third party, or an escrow agent. They're like the trusted referee in the middle of the transaction, holding all the important documents and money—the down payment, the lender's funds—in a secure account.

They make sure all the i's are dotted and t's are crossed before any money changes hands. They prepare the final settlement statements that spell out every single cost for both the buyer and seller. Finally, they run the closing meeting where everyone signs on the dotted line, funds are paid out, and the keys are officially yours. This makes sure the final handoff is controlled, transparent, and by the book.

Walking Through a Real Estate Closing

To really get a feel for what a title agency does, let’s go behind the scenes of a typical real estate deal. Imagine a signed purchase agreement for a family home lands on a closing agent’s desk. This is where the real work begins, and the clock is officially ticking.

First things first, the agent opens a new file and orders a title search. This kicks off a deep dive into county records, where an abstractor meticulously pulls every document tied to the property’s past. The whole point is to build a clear chain of title—a complete, historical timeline of ownership.

Once the search comes back, a title examiner takes over. They pore over every document, hunting for red flags. It’s not uncommon to find an old, unpaid mortgage, a lien from a contractor, or a messy heirship issue from a generation ago. Any one of these "defects" has to be resolved before anyone can move forward.

Coordinating All the Moving Parts

While all this is happening, the closing agent acts as the central hub of communication. They are constantly on the phone or emailing with the buyer, seller, real estate agents, and lender, keeping everyone in the loop and chasing down necessary documents. It’s a delicate balancing act of managing personalities, expectations, and tight deadlines.

The agent also prepares the most critical documents, like the settlement statement, which breaks down every single fee and credit for everyone involved. Accuracy here is everything; one small mistake can bring the whole transaction to a screeching halt. Considering that studies show title problems pop up in over a third of residential deals, this coordination is absolutely essential.

The closing meeting is the grand finale, the culmination of weeks of diligent, behind-the-scenes work. It’s a high-stakes event where everyone gathers to sign the final paperwork, transfer ownership, and finally, hand over the keys.

But even after the signatures are dry, the title agency’s job isn't quite done. They still have to record the new deed with the county, make sure all funds are disbursed to the right people, and issue the final title insurance policies. Only then is the deal truly closed, a process that highlights the immense pressure to get every single detail right.

The Daily Grind: Modern Challenges Facing Title Agencies

While the core mission of a title agency hasn't changed, the world they operate in has. Today's title professionals are up against a tough mix of operational, financial, and security hurdles that make an already demanding job even harder. These aren't just abstract problems—they're the day-to-day realities that eat into efficiency and squeeze profits.

One of the biggest culprits is the sheer volume of manual work. Teams spend countless hours digging through mountains of paperwork, painstakingly keying in data, and cross-referencing documents. It’s slow, tedious, and, worst of all, opens the door to human error. A single misplaced decimal or missed document can delay or even derail a closing.

On top of that, the regulatory landscape is a constantly moving target. Compliance rules can shift with little notice, forcing agencies to overhaul workflows and retrain staff just to avoid steep penalties. It's a huge administrative weight that pulls focus from what really matters: closing deals.

Navigating Economic and Security Threats

The industry is also feeling the heat from a volatile economy. Fluctuating markets, inflation, and general financial uncertainty directly impact real estate volumes. For many title companies, this has meant rising operational costs and shrinking profit margins. You can learn more about how agencies are tackling these financial challenges at ClosingLock.com.

Beyond the economic squeeze, security is a massive concern. The threat of wire fraud is very real, with criminals using increasingly sophisticated tactics to trick employees and clients into sending money to the wrong accounts. A single lapse can be financially catastrophic and cause irreparable damage to an agency’s reputation.

In this high-stakes environment, finding new efficiencies isn't just about getting ahead—it's a survival strategy. Agencies have to find smarter ways to work, cut down on manual overhead, and lock down their transactions to stay competitive.

These challenges all point to a clear need for modern tools that can automate the grunt work, secure communications, and bring some much-needed clarity to complex workflows.

How Technology Is Reshaping the Title Industry

Anyone who has worked in a title agency knows the grind. The days are packed with manual tasks, paper-heavy processes create bottlenecks, and security risks seem to be growing by the minute. In response, forward-thinking agencies are turning to technology to break free from the old way of doing things.

They're adopting modern software to automate the repetitive work that bogs teams down, secure their communications, and dramatically improve accuracy. This isn't just about making life easier; it's a strategic move to stay competitive. In fact, the entire title insurance sector is gearing up for a recovery driven by this very technological shift. Experts are already seeing insurers get smarter with their operations, using data analytics and predictive modeling to get a better handle on risk assessment, property records analysis, and even fraud detection. You can get a deeper look at these key title industry trends on Skyline Title Support.

The Rise of Unified Platforms

Leading this charge are unified platforms like TitleTrackr. Instead of juggling a dozen different tools, a single, integrated system helps manage every stage of a complex workflow—from the initial title search all the way to final closing coordination—in one place.

For a title agency, this is a game-changer. It means having real-time visibility into every single file. Gone are the days of chasing down status updates or digging through siloed email chains and document folders. Now, teams can see progress instantly, spot potential issues before they become problems, and collaborate far more effectively.

Here’s a quick glimpse of how a modern platform organizes and presents critical title information at a glance.

A centralized dashboard like this one eliminates all the guesswork. This clarity allows agencies to streamline their operations, slash error rates, and ultimately deliver a much better experience for their clients. We cover how these tools work in more detail across a variety of topics on our official TitleTrackr blog.

The core benefits are clear and compelling. Technology empowers agencies with fewer errors, faster turn times, and a higher standard of client service, positioning them as essential partners in any real estate transaction. By embracing these tools, agencies are not just surviving; they're building a foundation for future growth.

Got Questions About Title Agencies? You're Not Alone.

Getting a handle on what a title agency does is the first real step toward a smooth and secure closing. But even with a basic understanding, a few common questions always seem to pop up, especially if you're a first-time homebuyer or seller just trying to navigate the whole process. Let's clear up a few of the most frequent ones.

Who Actually Picks the Title Agency?

This can get a little fuzzy depending on local customs, but generally, the buyer has the right to choose the title agency. In reality, though, it's very common for real estate agents or lenders to suggest a few trusted partners they've worked with for years.

No matter who makes the final call, the most important thing to remember is the title agency’s core mission: they are a neutral third party. Their job is to protect everyone's interests in the deal—the buyer, the seller, and the lender.

Is Title Insurance a Bill I Have to Pay Every Year?

Nope. This is a common point of confusion, but the answer is a simple yes—title insurance is a one-time fee paid at closing. It’s not a recurring expense like your homeowner's insurance.

That single payment actually gets you two separate policies:

- Owner's Policy: This is your shield. It protects your rights to the property for as long as you or your heirs own it.

- Lender's Policy: This one protects the bank's investment in your property. If you have a mortgage, your lender will almost certainly require it.

What If a Title Problem Shows Up After Closing?

This is the exact reason owner's title insurance exists. Let's say a previously unknown issue—like a missed lien from a contractor, a forgery on an old deed, or a surprise heir—comes out of the woodwork after you've already popped the champagne.

If it's a covered risk, you simply file a claim. Your title insurance underwriter then steps in to handle the legal costs of defending your title and covers any financial losses you might suffer, right up to the full value of your policy. For a deeper look at these questions and more, check out our complete title industry FAQ page.

Ready to see how modern technology can wipe out the bottlenecks and manual mistakes that slow down your title work? TitleTrackr gives you the tools to manage searches, documents, and closings with serious precision and speed. Request a demo today at https://titletrackr.com and discover a smarter way to work.