In the world of real estate, some legal terms sound far more complicated than they are. Lis pendens is one of them. For title agents, attorneys, and investors, understanding this term isn't just academic—it's critical for protecting transactions and managing risk. A lis pendens is essentially a legal "heads up" that can bring a property deal to a grinding halt.

Think of it as a giant, flashing warning sign posted on a property's public record. It alerts anyone looking—from potential buyers to title companies—that there's an active lawsuit that could directly impact who owns the property. For professionals, spotting one early is the key to preventing wasted time and resources.

Understanding Lis Pendens: A Quick Guide

Let’s paint a picture. A promising deal is moving through your pipeline. The contract is signed, the client is ready, and the initial title search seems clear. But then, a lis pendens is filed. That single document instantly signals the property is caught in a legal battle, and your deal is now on shaky ground.

The term lis pendens literally means “suit pending” in Latin. It’s a formal notice filed in the county records to let the world know a lawsuit involving that specific piece of real estate has started. The notice ensures that any future buyer knows about the litigation before they sign on the dotted line, because the outcome could cloud the title and even change ownership.

What It Means for a Transaction

So, does a lis pendens legally stop the owner from selling? No, not technically. But in the real world, it makes a sale practically impossible.

Here’s why: the notice effectively chains the lawsuit to the property itself. Whoever buys the property also inherits the lawsuit. If the person who filed the lis pendens wins their case, the new owner could lose their claim to the property.

This creates a domino effect of problems for any deal:

- No Title Insurance: Title insurance companies are in the business of managing risk. They will almost certainly refuse to issue a policy for a property with an active lis pendens.

- No Lender Financing: A mortgage lender won’t approve a loan without title insurance. It’s a non-negotiable part of their process.

- Scared-Off Buyers: Even a cash buyer with no need for a loan will almost always walk away. Why would they voluntarily buy into a costly, time-consuming legal fight?

In short, a lis pendens hits the brakes on a property's marketability. It effectively freezes the asset, stopping a sale or refinance until the underlying lawsuit is resolved and the notice is formally removed from the record.

To help break it down even further, it’s useful to see what a lis pendens is and what it isn't.

Lis Pendens at a Glance: Key Takeaways

| Concept | What It Is | What It Is Not |

|---|---|---|

| Legal Status | A public notice of a pending lawsuit involving the property. | A lien or a judgment against the property. |

| Purpose | To warn potential buyers and lenders of a legal dispute. | A final decision or ruling from a court. |

| Effect | Puts a cloud on the title, making it difficult to sell or finance. | A legal prohibition against selling the property. |

| Resolution | Removed when the lawsuit is settled, dismissed, or a judgment is issued. | A permanent mark on the property's record. |

At the end of the day, a lis pendens serves its purpose by protecting the rights of the person suing while giving fair warning to everyone else.

Navigating these kinds of complexities requires a solid grasp of real estate law and a keen eye for detail. For more insights on similar topics that can impact a property's title, feel free to explore other articles on our real estate insights blog.

How a Lis Pendens Can Derail Your Real Estate Deal

A lis pendens notice isn't just a piece of legal paperwork. It’s a deal-killer, plain and simple. When one of these gets filed, it instantly creates a major problem known as a "cloud on title."

Think of a property's title as its clean bill of health. A cloud on title is like getting a lab result back stamped with "inconclusive, further testing required." It’s a massive red flag that screams of unresolved legal issues tied to the property's ownership, making everyone pump the brakes.

The Title Insurance Roadblock

The first and biggest domino to fall is title insurance. Title companies are in the business of managing risk, and an active lis pendens is a risk they absolutely will not take. They exist to guarantee a clear title to the new owner and their lender, so they won't issue a policy on a property with a pending lawsuit attached.

No title insurance, no deal. It's that straightforward.

Lenders won't even consider financing a property without title insurance to protect their investment. Even a cash buyer, who doesn't need a mortgage, would have to be incredibly reckless to move forward. They’d be willingly walking into a legal battle and risking their entire investment.

This puts everyone involved in an impossible position:

- The Seller: Their property is effectively frozen. They can't sell it, can't refinance it, and are stuck in legal quicksand until the lawsuit is over.

- The Buyer: All their plans come to a screeching halt. They've likely already spent time and money on inspections and loan applications, only to see their new home slip through their fingers.

- The Real Estate Agent: The agent is stuck in the middle, watching a commission disappear and dealing with a transaction that just went up in smoke.

The Chilling Effect on Marketability

The mere presence of a lis pendens chills the market for a property. It’s designed to protect a claimant's potential interest, but in practice, it frightens away nearly all potential buyers and lenders. While it isn't technically a lien, it clouds the title so severely that the owner can't sell or refinance until the legal fight is resolved. You can find a deeper dive into this issue in a great article from The Florida Bar Journal.

Ultimately, a lis pendens acts as a complete transaction-killer. It freezes the property's value and mobility, leaving all parties with significant financial and professional risks until the underlying legal conflict is fully resolved.

Common Lawsuits That Trigger a Lis Pendens Filing

A lis pendens notice never just appears out of thin air. It's always the direct result of a lawsuit aimed squarely at a specific piece of property. For any real estate professional looking to get ahead of risk, understanding these common triggers is absolutely essential.

Think of it this way: the person filing the lis pendens is essentially planting a flag in the public record. They're telling the world, "Hey, my claim to this property is being decided in court, and any new owner is buying it subject to that outcome." Their goal is to prevent the property from being sold or refinanced right out from under them while the wheels of justice are turning.

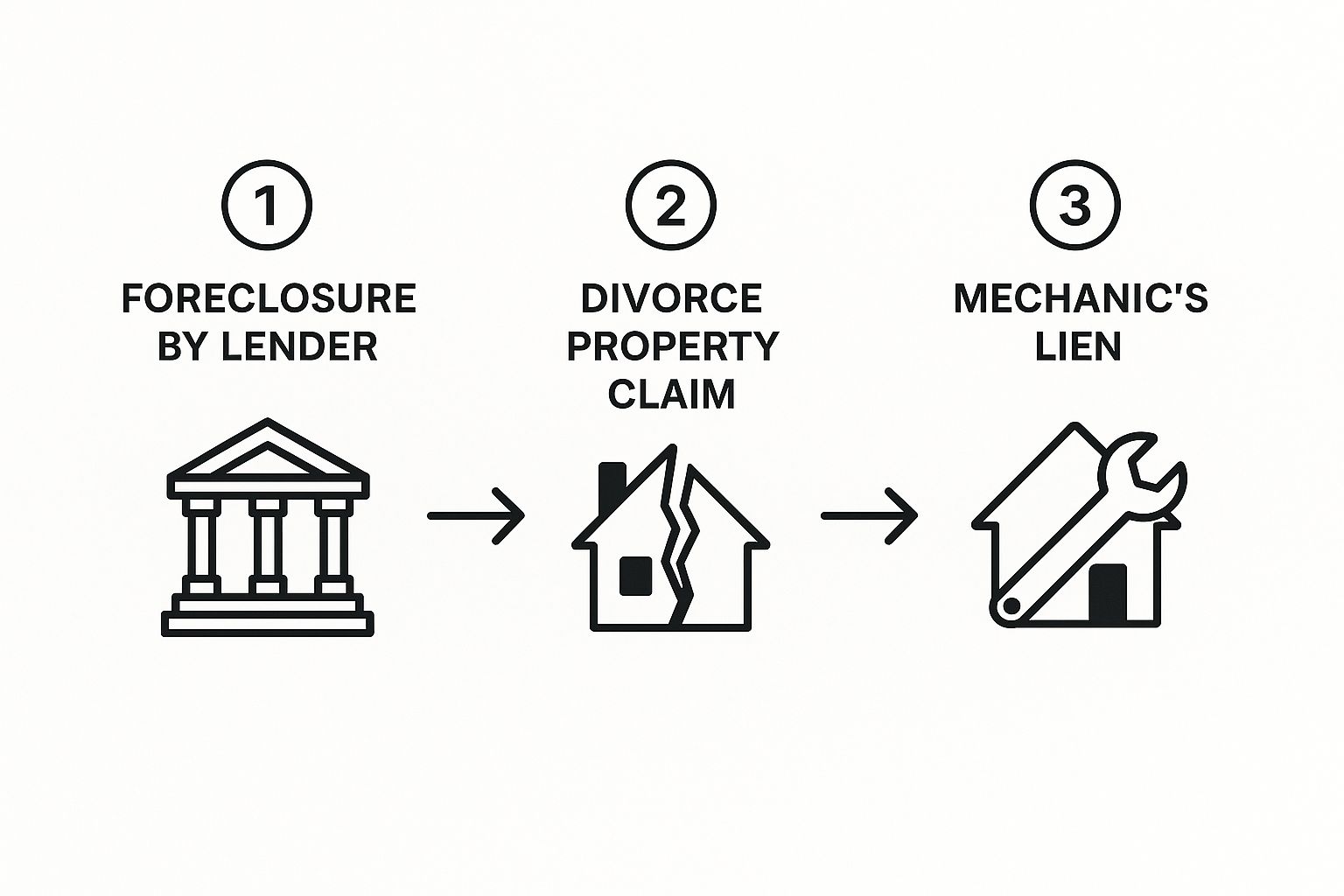

This simple flowchart shows a few of the most frequent paths that end with a lis pendens being filed.

As you can see, everything from a lender foreclosure to a messy contractor dispute can converge on this one powerful legal tool to stake a claim against real estate.

To give you a clearer picture, here are some of the most common situations where a lis pendens pops up.

Common Reasons for a Lis Pendens Filing

| Lawsuit Type | Typical Plaintiff | Goal of Filing |

|---|---|---|

| Mortgage Foreclosure | A bank or mortgage lender | To reclaim the property from a defaulting borrower and prevent its sale. |

| Divorce Proceeding | One of the spouses | To stop the other spouse from selling or refinancing a shared property. |

| Breach of Contract | A prospective buyer | To force a seller to complete a sale (specific performance). |

| Inheritance Dispute | An heir or beneficiary | To freeze the property until the court decides who rightfully inherits it. |

| Mechanic's Lien Foreclosure | A contractor or supplier | To force the sale of the property to satisfy an unpaid construction bill. |

Each of these scenarios creates a cloud on the title, making the lis pendens a critical red flag for anyone involved in a transaction.

Foreclosure Proceedings

By far, one of the most common triggers for a lis pendens is a mortgage foreclosure. When a homeowner stops making their loan payments, the lender has to take legal action to get the property back. Filing a lis pendens is one of the first steps they take to officially notify the public they are suing to foreclose.

This filing is a massive signal of borrower distress. While a credit report might hint at late payments, a lis pendens confirms that active litigation is underway against both the borrower and the property itself. This protects the lender by making sure no one else can sneak in and buy the property with a clear title while the foreclosure is ongoing. You can read more about its role in the mortgage world on National Mortgage Professional's website.

A lis pendens filed during foreclosure is a clear warning that the property's ownership is in jeopardy. It stops other transactions in their tracks until the lender's claim is fully resolved.

Disputes Over Ownership and Contracts

Beyond foreclosure, all sorts of ownership and contract squabbles can lead to a lis pendens. These situations often involve messy personal or business disagreements that spill over into real estate claims.

Here are a few classic examples:

- Divorce Proceedings: When a marriage ends, the shared home is usually the biggest asset on the table. If the couple can’t agree on how to split it, one spouse might file a lis pendens to block the other from selling or refinancing it behind their back.

- Breach of Contract: Picture this: a buyer and seller have a signed purchase agreement, but the seller suddenly gets cold feet and backs out. The buyer can sue for "specific performance" to force the sale to go through, and they’ll file a lis pendens to stop the seller from finding a different buyer in the meantime.

- Inheritance Disputes: When family members fight over who gets a property left in a will, things can get complicated. A lis pendens can be used to freeze the asset, keeping it from being sold or transferred until the probate court settles the dispute.

Mechanic's Liens and Contractor Claims

Another frequent trigger involves disputes over construction or renovation work. If a contractor, roofer, or materials supplier works on a property but doesn't get paid for their labor or goods, they can place a mechanic's lien on it.

But a lien is just a claim; to actually collect on it, the contractor has to file a lawsuit to foreclose. As part of that lawsuit, they'll file a lis pendens. This move puts potential buyers and lenders on high alert that there's a debt attached to the property that has to be paid off before the title can be cleared.

The Lifespan of a Lis Pendens: From Filing to Finish

A lis pendens notice isn't a permanent mark on a property's record, but it casts a long and intimidating shadow while it's active. For any real estate professional caught in the middle of a transaction involving one, understanding its lifecycle—from the moment it’s filed to its eventual removal—is non-negotiable.

This entire process is governed by strict legal rules, and for good reason. They're designed to protect both the person filing the claim and the property owner from misuse.

Getting a Lis Pendens on the Record

First things first: you can't just file a lis pendens because someone owes you money. For a lis pendens to be valid, it has to be directly linked to a lawsuit where the title or ownership of that specific property is the core issue.

The process kicks off when a plaintiff files that lawsuit. To protect their potential stake while the gears of justice turn, their attorney will then take a few critical follow-up steps.

- Drafting the Notice: A formal lis pendens document is drawn up. It has to clearly identify the property and cite the specific lawsuit that's pending.

- Recording the Notice: This document is then taken to the county recorder's office where the property sits and is officially filed, making it part of the public record.

- Serving the Notice: In most places, you can't just file it and walk away. The filer must also formally serve a copy to the property owner and any other parties involved in the lawsuit.

That public recording is the key. It's what officially creates the "cloud on title," waving a giant red flag to anyone who runs a title search.

How a Lis Pendens Goes Away

Just as there’s a formal way to put a lis pendens on, there are clear paths to get it off. The notice stays put for as long as the lawsuit is active and only disappears once the legal fight is over. Ensuring these clouds are properly cleared from the record is a huge part of the job for diligent pros, including the crucial work done by title abstractors to maintain accurate property histories.

Usually, it ends in one of three ways:

- Settlement: The simplest path. The parties strike a deal, the plaintiff agrees to drop the lawsuit, and the lis pendens is withdrawn.

- Dismissal: A judge throws the case out. This often happens if the claim lacks legal merit or evidence, and it kills the lis pendens along with it.

- Final Judgment: The court case plays out to the very end. Once a final verdict is handed down, the ownership question is settled, and the notice can finally be removed.

What If It’s a Frivolous Claim?

So, what happens if someone files a lis pendens improperly, maybe just to throw a wrench in a sale or pressure a property owner? The owner isn't helpless. They have a powerful tool at their disposal: filing a motion to expunge the lis pendens.

Expungement is a legal move to have a wrongfully filed lis pendens forcibly scrubbed from the property record. If a judge agrees the lawsuit doesn't actually involve the property's title or the claim is junk, they will order it struck.

This is a property owner's best defense against a frivolous claim designed to hold a transaction hostage. A successful expungement clears that cloud on title, giving the owner the freedom to sell or refinance their property once again.

Protect Your Deals with Proactive Monitoring

Finding a lis pendens during a standard title search is a classic case of “too little, too late.” By the time it pops up in a report, your deal is already on life support. You’ve already poured significant time and money into a transaction that's now hanging by a thread. This old-school, reactive method forces you to play defense when you should be on offense.

There’s a much smarter way to operate. Instead of waiting for a title search to drop a transaction-killing surprise on your desk, proactive monitoring flips the script entirely.

The Problem with Reactive Discovery

Think about the typical real estate workflow. A contract gets signed, then the title search kicks off. This sequence creates a dangerous blind spot where a lis pendens can be filed without anyone knowing until it’s far too late.

The fallout is always messy:

- Wasted Resources: All those hours spent on due diligence, client calls, and loan processing? Gone.

- Pipeline Disruption: One derailed deal can throw your entire pipeline into chaos, wrecking forecasts and revenue projections.

- Reputational Damage: Nothing sours a client relationship faster than a failed closing. It’s a tough hit to your professional standing in a cutthroat market.

This reactive model treats a lis pendens filing like a random bolt of lightning instead of what it is: a predictable risk you can absolutely manage with the right strategy.

TitleTrackr: The Proactive Advantage

This is exactly where TitleTrackr steps in to give industry professionals a crucial edge. It’s your early warning system, completely changing how you manage risk. Instead of waiting for bad news from a title report, TitleTrackr gives you real-time alerts the moment a new filing hits.

This isn't just another piece of software; it's a fundamental shift in strategy. Proactive monitoring gives title agents, attorneys, and investors the power to act swiftly—often before a deal even gets off the ground.

Imagine knowing about a new lis pendens the second it's recorded. This kind of intelligence lets you get way ahead of title issues before they become full-blown crises. You can alert your clients immediately, adjust your strategy, and shield your pipeline from unexpected shocks. It’s about protecting your business by preventing wasted effort and cementing your reputation for closing deals smoothly.

Don't let a surprise filing kill your next closing. See how proactive intelligence works for yourself by exploring TitleTrackr's free trial and start securing your deals against unforeseen title clouds today.

A Few Common Questions About Lis Pendens

Even once you get the hang of what a lis pendens is, some practical questions always seem to come up when you see one in the wild. Let's tackle the most common ones that real estate pros and property owners run into.

Can You Sell a House with a Lis Pendens?

Legally, you can, but practically, it’s a non-starter. A lis pendens casts a massive shadow over the property’s title—what we call a “cloud on title”—making it impossible for a buyer to get title insurance.

And without title insurance, no lender will touch the deal. Even if you find an all-cash buyer willing to take the plunge, they'd be inheriting the lawsuit. If the plaintiff wins, that buyer could lose the entire property. The bottom line is the property is effectively frozen until that lis pendens is cleared.

While a lis pendens doesn't make a sale illegal, it makes it financially and logistically impossible for any sane buyer or lender. The risk is just way too high to move forward.

Is a Lis Pendens the Same as a Lien?

Nope, they're two completely different animals. A lien is a direct claim against a property for a debt. Think of a mortgage or a tax lien—it represents a specific dollar amount owed.

A lis pendens, on the other hand, isn't a claim for money. It’s just a public heads-up that a lawsuit is underway that could impact who owns the property down the road. It’s more of a warning sign about a potential future problem, not a bill for a current debt.

How Long Does a Lis Pendens Last?

A lis pendens sticks to a property’s title for as long as the lawsuit it’s tied to is active. That could mean a few months or, in messy legal battles, it could drag on for years.

Its entire existence is linked to that court case. Some states even require the notice to be renewed periodically if the lawsuit is still going. The lis pendens only disappears from the public record after the lawsuit is completely resolved—whether through a settlement, a dismissal, or a final court judgment.

Don't let surprise filings blow up your deals. With TitleTrackr, you can keep an eye on properties and get instant alerts on new title issues before they become full-blown crises. Request your demo today and see how our platform can protect your pipeline.