You wouldn't buy a used car without its history report, right? You’d want to know about hidden accidents, outstanding loans, or if the seller even has the right to sell it. A title commitment is the official vehicle history report, but for a piece of real estate—and for title professionals, it’s the foundational document that dictates the entire closing process.

It is the title insurance company’s formal promise: a blueprint that maps out every known fact, requirement, and potential issue tied to a property's ownership before the deal can close. Mastering this document is a non-negotiable skill for ensuring secure, efficient, and profitable real estate transactions.

The Blueprint for a Successful Real Estate Closing

Before anyone signs at the closing table, every party involved—the buyer, seller, and lender—needs a crystal-clear roadmap. The title commitment is that roadmap. It provides a detailed snapshot of the property's title status, transforming a potential legal jungle into a manageable checklist. For title companies and real estate law firms, this single document is the cornerstone of every successful closing.

The commitment's function is twofold: it reveals and it resolves.

First, it illuminates potential problems. We're talking about unresolved mechanics' liens, ownership claims from previously unknown heirs, or hidden easements that restrict property use. Second, it explicitly outlines the steps required to clear these issues before the transaction is finalized. It’s a proactive strategy to prevent significant legal and financial headaches down the line.

So, what is a title commitment in technical terms? It’s a binding document from a title insurer outlining the specific conditions that must be met for them to issue the final title policy after closing. This isn't just a preliminary report; it's a firm promise, contingent upon satisfying all listed requirements.

By bringing potential ownership disputes or financial encumbrances to the surface upfront, the commitment provides title professionals with a clear action plan to ensure a clean transfer of ownership.

Managing the moving parts of a commitment—requirements, deadlines, documentation—demands precision and efficiency. Without this foundational document, every real estate transaction would be a gamble. It provides the structure and confidence necessary to move forward and close the deal securely.

Decoding the Three Schedules of a Title Commitment

At first glance, a title commitment can appear intimidating. However, it’s logically organized into sections called "schedules." Think of it as a pre-flight checklist for a real estate transaction; each part methodically confirms the critical details needed for a smooth journey to closing. Understanding these schedules is fundamental to navigating the process effectively.

This three-part structure is the bedrock of the industry, a system that has evolved since the first American title company was founded in 1876. Over the decades, organizations like the American Land Title Association (ALTA) have standardized this format, turning it into the reliable, mission-critical tool used today.

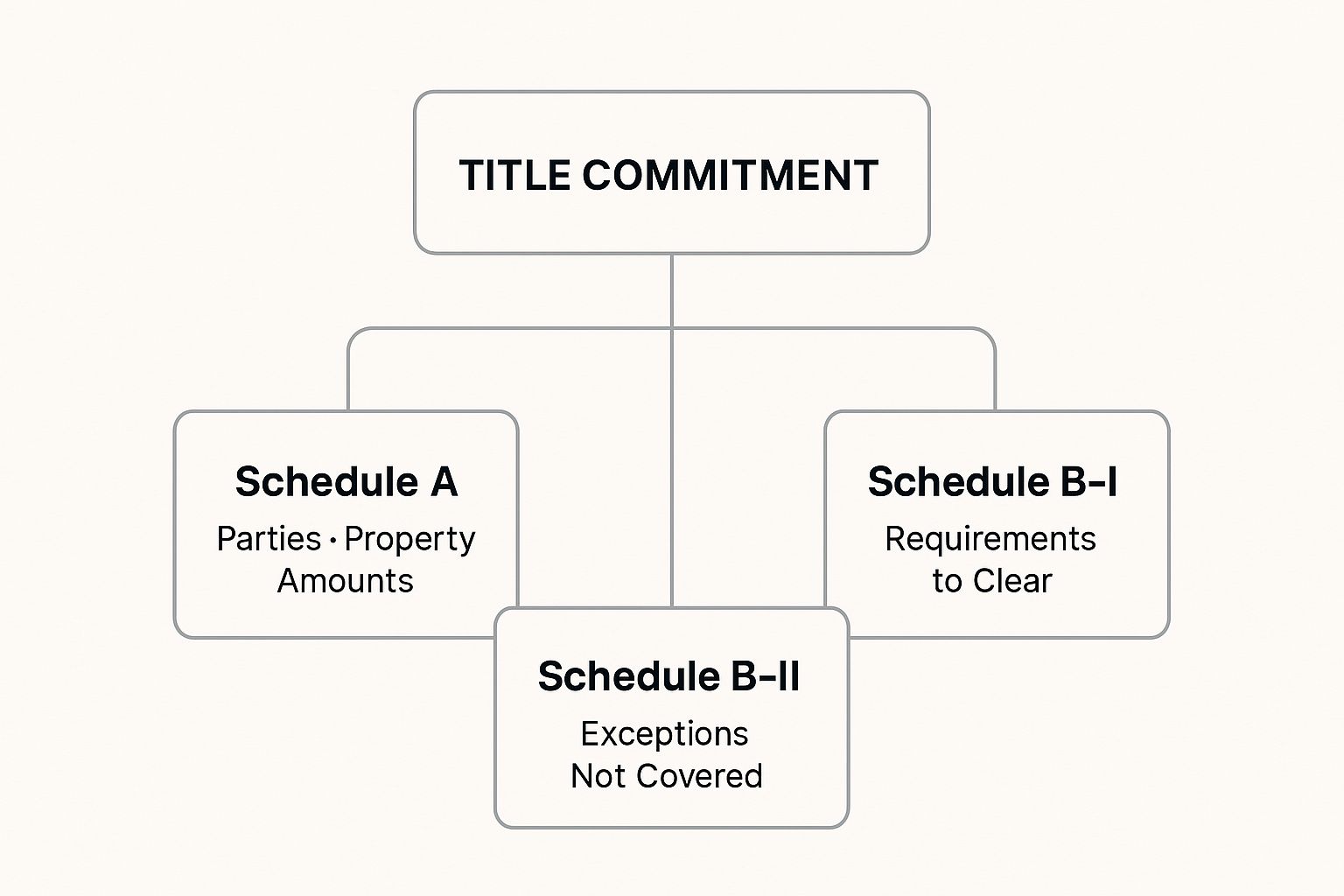

This diagram breaks down the three fundamental schedules that form the backbone of every title commitment.

As you can see, the commitment is broken down into confirming the basics (Schedule A), laying out the required actions (Schedule B-I), and detailing what isn't covered (Schedule B-II).

The Core Components Explained

Each schedule serves a specific purpose, guiding you from the transaction’s basic facts to the nitty-gritty conditions required for closing. Let's break them down from an industry perspective.

-

Schedule A: This is the "who, what, and how much" of the deal. It establishes the effective date of the commitment, the proposed policy amounts, the names of the parties being insured (the buyer and lender), and the full legal description of the property. Any error here can derail the entire closing, making accuracy non-negotiable.

-

Schedule B-I: This is the "action plan" or curative worklist. It itemizes every requirement that must be satisfied before the title insurer will issue the final policy. This is where you’ll find items like paying off existing mortgages, settling outstanding taxes, or obtaining necessary legal documents.

This schedule is where the real work happens for title professionals. It’s the task list that title officers and abstractors must execute flawlessly to clear the path for closing. The efficiency with which you manage these tasks directly impacts your closing timeline and client satisfaction.

- Schedule B-II: This section lists the exceptions—the specific items the final title insurance policy will not cover. You'll typically see standard items here like public utility easements, local zoning ordinances, and any existing subdivision covenants, conditions, and restrictions (CC&Rs).

To make it even clearer, here’s a quick-reference table that boils down the purpose and key information found in each schedule of a standard title commitment.

Understanding the Schedules in a Title Commitment

| Schedule | Core Purpose | Key Information Included |

|---|---|---|

| Schedule A | To establish the basic facts of the transaction. | Effective Date, Policy Amounts, Proposed Insured, Legal Property Description. |

| Schedule B-I | To list all requirements that must be met before closing. | Payoffs for existing mortgages, tax liens, judgments, and other necessary curative actions. |

| Schedule B-II | To detail what is NOT covered by the title policy. | Standard utility easements, CC&Rs, mineral rights, and other pre-existing restrictions. |

By breaking the commitment down into these three parts, you can systematically tackle any issues and ensure every party involved knows exactly what to expect. It’s all about creating a clear and transparent path to the closing table.

Why a Title Commitment Is Your Best Defense

A title commitment is not just procedural paperwork. In any real estate deal, it is the single most critical risk management tool available. Think of it as an advanced diagnostic scan for a property's legal health—one that protects buyers, lenders, and your business from financial disasters that could surface years down the road.

While a property inspection identifies physical defects like a leaky roof, the title commitment uncovers invisible threats that jeopardize legal ownership itself.

Uncovering the Hidden Defects in a Title

This document is your frontline defense against a host of hidden legal issues that can cloud a title. By digging deep into public records, the commitment brings these problems to light before closing, providing a crucial window to resolve them.

What kind of problems can be uncovered? The list is extensive:

- Undisclosed Heirs: Claims from relatives of a past owner you never knew existed.

- Forged Documents: Fraudulent deeds or other paperwork lurking in the property's history.

- Lingering Construction Liens: Unpaid bills from contractors who performed work on the property.

- Clerical Errors: Simple typos or mistakes in public records that could call ownership into question.

By flagging these issues upfront, the commitment transforms a high-stakes gamble into a secure transaction. It lays out a clear path to resolve any problems, ensuring the new owner receives a clean, marketable title free from prior encumbrances.

This proactive step is crucial for preventing future litigation. In major markets like California and Texas, for instance, title commitments find defects like outstanding liens or legal claims in about 25-30% of transactions. Addressing these issues pre-closing slashes the risk for all parties and reduces potential title claims by an estimated 50%. You can learn more about how commitments reduce risk on RobbieEnglish.com.

Without this vital line of defense, a buyer would be purchasing a property blind, vulnerable to claims that could surface years later. The commitment ensures that what you see is what you get, providing the confidence to close the deal without future liability.

A Practical Guide to Reviewing the Title Commitment

Receiving the title commitment is a major milestone, but the real work is just beginning. A careful, detail-oriented review is what separates a smooth closing from a costly disaster. This is the final quality control check before the transfer of ownership.

Your first stop must always be Schedule A. This is the foundation of the entire transaction, and you need to confirm every detail with precision. Are the buyer, seller, and lender names spelled correctly and consistent with all legal documents? Most importantly, is the legal description of the property 100% accurate? Verify it word-for-word against the purchase agreement and survey.

Scrutinizing Requirements and Exceptions

Once you’ve confirmed Schedule A, it’s time to analyze the B schedules. This is where the action items live. Schedule B-I is your pre-closing worklist, outlining everything that must be handled before the final policy can be issued. This list often includes paying off old mortgages, settling tax liens, or obtaining specific court orders.

Here’s a practical workflow for this stage:

- Assign Responsibility: Clearly define who is responsible for each curative item. Is it the buyer, the seller, or the lender? Eliminate all ambiguity.

- Set Deadlines: Every task needs a firm deadline to keep the closing on schedule. This is non-negotiable for maintaining transaction velocity.

- Gather Documentation: Immediately begin collecting the necessary paperwork—like payoff statements and lien releases—as soon as the requirements are identified.

Finally, turn your expert attention to Schedule B-II. This section lists all the exceptions that the title policy will not cover. It is critical to review these with the buyer so they understand any existing easements, covenants, or restrictions that will affect their ownership rights.

A meticulous review process isn't just about checking boxes. It's about proactive problem-solving, risk mitigation, and clear communication to pave the way for a smooth, successful closing.

How to Streamline Your Title Commitment Workflow

If you're still juggling title commitments with spreadsheets and endless email chains, you're exposing your business to unnecessary risk. Manual tracking is a recipe for missed deadlines, costly errors, and jeopardized client relationships. In today's fast-paced market, outdated processes can't keep up—they create operational drag and compliance vulnerabilities.

Moving beyond manual tracking is a strategic imperative for accuracy and control. An effective workflow demands a single, centralized system that automates requirement tracking, monitors deadlines, and serves as the single source of truth for the entire team. This transition lifts a significant administrative burden, empowering your team to focus on what they do best: resolving complex title issues instead of managing paperwork.

From Manual Chaos to Automated Clarity

A purpose-built platform revolutionizes how you manage the title commitment lifecycle. Stop chasing down status updates or digging through email threads for critical documents. With all information organized and instantly accessible, you can be confident that nothing falls through the cracks, leading to a smoother, more predictable closing process.

This dashboard from TitleTrackr provides a perfect example of at-a-glance visibility, allowing you to monitor your entire pipeline in one clean, simple view.

By leveraging automated reminders and centralized communication, the risk of human error plummets while ensuring compliance at every step.

Adopting a modern workflow tool isn't just an upgrade—it's a fundamental change that minimizes risk, boosts productivity, and delivers a superior client experience. It's about working smarter, not harder, to achieve flawless closings.

By automating routine, time-consuming tasks, title operations can reduce administrative overhead by up to 90%. This frees up your expert team to tackle the complex challenges that require their skills. Discover how you can transform your operations. To get started, request a demo of TitleTrackr and find a better way to manage your title commitments.

Common Questions About Title Commitments

Even for seasoned professionals, specific questions often arise when a title commitment is issued. Clarifying these details is key to managing client expectations and ensuring a smooth transaction. Let's address some of the most common points of discussion.

One of the first questions is, "How long is this commitment valid?" A title commitment has a shelf life, typically around six months, though this can vary by state and underwriter. If the closing is delayed beyond this period, an updated commitment is necessary to ensure no new liens or encumbrances have been recorded against the title.

Clarifying Key Distinctions

It's also crucial to distinguish the commitment from the final policy. The title commitment is the blueprint; the title policy is the finished, insured structure. The commitment is the insurer's promise before closing, outlining the conditions to be met. The final title policy is the official insurance contract issued after closing, providing financial protection against past title defects.

Another practical question is, "Who pays?" This is often determined by local custom and can be a point of negotiation. In some regions, the seller pays for the owner's policy, while in others, it's the buyer's responsibility. The lender's policy is almost always paid by the buyer/borrower. The cost of generating the commitment is typically bundled into the total premium for the final title insurance policies. For more detailed answers, you can explore our FAQ page.

Handling Discovered Issues

So, what happens when an issue—often called a "cloud on title"—is discovered? This is precisely why the commitment exists. The title company will flag the problem as a requirement in Schedule B-I, meaning it must be resolved before closing can proceed.

These issues can range from an unreleased mortgage and court judgments to unpaid contractor liens. It then becomes the responsibility of the designated party (usually the seller) to work with the title company to clear these items. This curative process is the core function of the commitment—to find and fix problems before the property changes hands, guaranteeing a clean and clear transfer of ownership.

A firm grasp of these common scenarios demystifies the process and helps manage expectations for all parties. With a solid understanding of these key points, you can navigate the transaction to closing with greater confidence and efficiency.

Managing the requirements, deadlines, and communications for multiple title commitments at once is a high-stakes challenge. TitleTrackr provides a central, automated hub to ensure nothing ever falls through the cracks, reducing risk and accelerating your closings. See how you can transform your workflow by requesting a demo of TitleTrackr today.