Picture this: you’ve just acquired the perfect parcel of land for your next project. Weeks later, a notice arrives. A previously unknown heir, a forgotten construction lien, or a messy boundary dispute suddenly surfaces, threatening to derail your timeline and budget. It sounds like a nightmare, but for land developers and real estate professionals, it’s a very real risk.

This is exactly where title insurance on land becomes a critical component of your acquisition strategy. It’s your single best defense against these hidden, historical risks that can jeopardize a project before a single shovel breaks ground. Unlike other insurance that covers future events, title insurance looks backward, protecting your investment from issues that happened long before you took ownership. It ensures your right to the property is clean and secure from the moment you close.

Why Title Insurance Is Your Project's Best Defense

Acquiring a simple asset is one thing. Acquiring land is a different ballgame entirely. A property’s history is a long, complex narrative told through decades of public records. That narrative is often messy, full of hidden "title defects" like unresolved boundary disputes, fraudulent signatures on old deeds, or surprise easements that give others rights to use your land.

These are the landmines that title insurance is designed to defuse. It’s a unique kind of shield. While your other policies protect against future events—a fire, a storm, a theft—title insurance is all about safeguarding your investment from the ghosts of the property's past.

Understanding the Two Types of Policies

It's critical for any investor or developer to know that not all title policies are the same. In nearly every land transaction, two separate policies are issued, and they each protect a different party.

- Owner's Title Insurance: This policy is for you, the buyer. It’s designed to protect your ownership rights and your financial stake—your equity—if a covered title issue emerges. You pay a one-time premium at closing, and that policy protects you for as long as you or your company own the land.

- Lender's Title Insurance: If you're financing the acquisition, your lender will require this policy. It protects their investment in the property, ensuring their loan is secure against any title defects. Crucially, it offers zero protection for you or your equity.

Think of it this way: a lender's policy protects the loan, but an owner's policy protects your asset, your investment, and your ownership. Without an owner's policy, your company could face massive legal bills or even lose the land—all while still being on the hook for the mortgage.

A One-Time Investment for Lasting Security

Acquiring land is one of the most significant capital expenditures you'll make. An owner's policy is a single premium you pay at closing, and for that one-time cost, you get a powerful, long-term defense for your asset.

If a valid claim ever arises, your title insurance company steps in. They'll cover the legal fees to defend your title in court. If the defense isn't successful, they'll compensate you for your financial loss, up to the policy's value.

That upfront investment buys incredible peace of mind and de-risks the entire project. It transforms a potentially risky purchase into a secure asset, allowing you to build, develop, or hold your property without worrying that a problem from 50 years ago will emerge to threaten your ROI. While advanced platforms like TitleTrackr are revolutionizing the speed and accuracy of the title search process, the insurance policy itself remains the ultimate backstop for any landowner.

The Title Search: A Property's Historical Investigation

Before a title insurance policy can be issued, a title professional must conduct a meticulous investigation into the property’s past known as a title search. This isn't a simple database query; it’s a deep dive into public records to verify that the seller has the undisputed legal right to transfer the property to you.

This process means sifting through decades—sometimes even centuries—of documents. Title professionals, often called abstractors, piece together the property's complete ownership story to establish a clear "chain of title." This is an unbroken timeline of ownership, from the current owner back to the original land grant. To truly appreciate the expertise involved, you can learn more about the role of title abstractors in modern real estate.

Uncovering the Property's Past

The entire purpose of the title search is to identify "defects"—any potential issues that could threaten your ownership rights. It's analogous to due diligence on a corporate acquisition, but instead of checking financial statements, you’re auditing the property’s legal history.

Here's what title professionals are typically examining:

- Deeds and Mortgages: These documents show every time the property was sold or used as collateral.

- Wills and Probate Records: If a previous owner passed away, these records confirm the legal transfer of the land to their heirs.

- Court Judgments and Liens: This is where you find unpaid contractor bills (mechanic's liens), old lawsuits, or tax liens attached to the property.

- Easements and Covenants: These are legal rights given to others to use part of your land, like a utility company needing access to infrastructure.

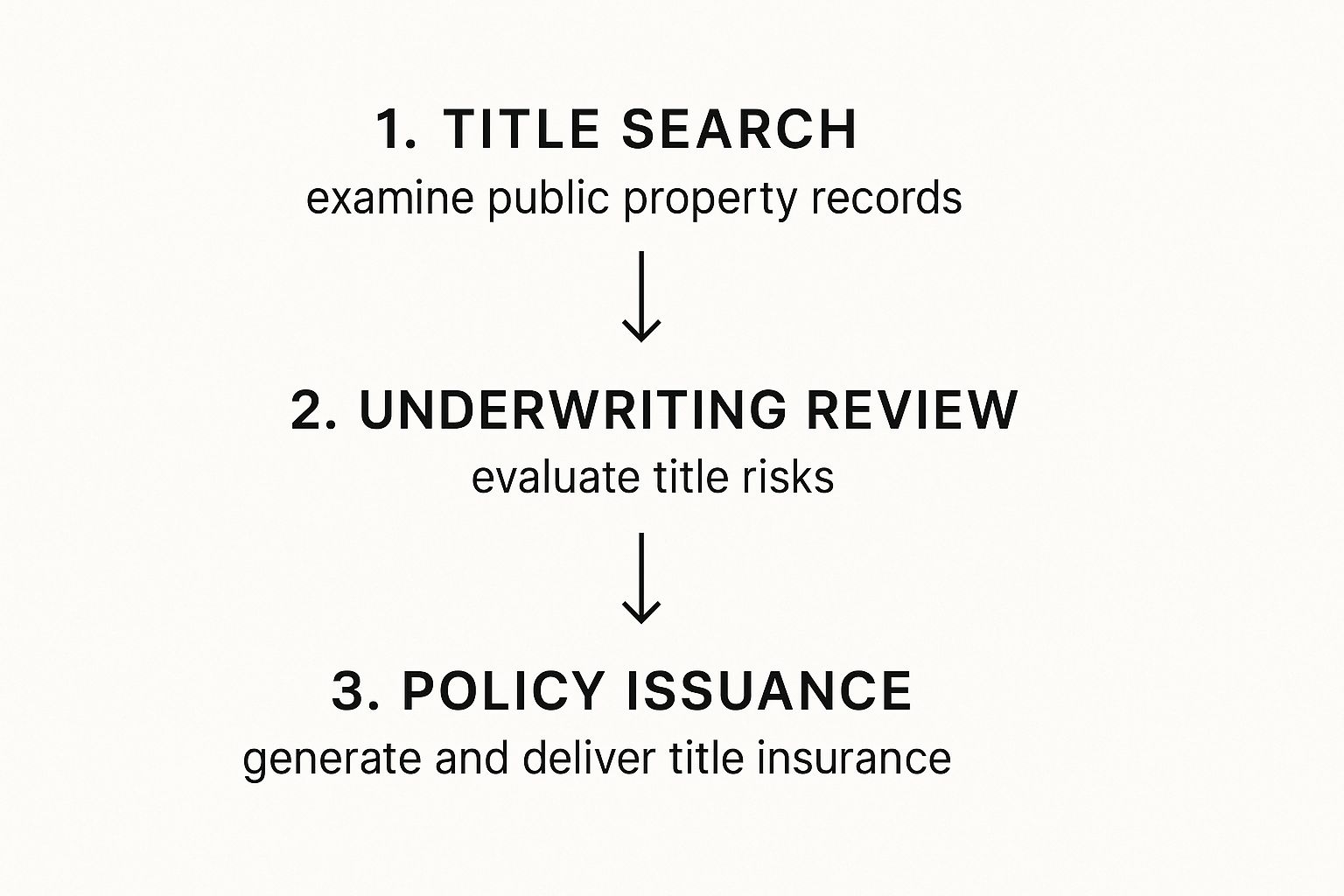

This infographic breaks down the typical workflow, from the initial research to the final policy.

As you can see, the title search is the bedrock of the entire process. The quality of the final policy depends entirely on the thoroughness and accuracy of this initial investigation.

The Importance of a Meticulous Process

A single broken link in the chain of title—perhaps a forged signature on a deed from 1950 or an overlooked heir—can create massive legal and financial liabilities for a new owner. The goal is to discover these skeletons in the closet before you close the transaction.

By identifying potential defects early, the title company can work with the seller to cure them. That could mean paying off an old lien, correcting a public record, or obtaining a legal release from a potential claimant.

This careful, often manual, work is what makes title insurance so valuable. The global market for title insurance reflects this, growing from an estimated $67.0 billion in 2025 to a projected $124.4 billion by 2030. The demand from the industry for secure, fraud-free transactions is only getting stronger. Ultimately, this historical deep dive is the foundation of your protection, allowing an underwriter to issue a policy that truly safeguards your investment.

Common Title Defects Hiding on Vacant Land

A parcel of vacant land might look like a blank canvas, but its history can be far more complex than a property with an established structure. Raw land often carries a legacy of hidden issues just waiting to surface. These problems, known as title defects, can completely derail a project and its financial viability.

Understanding these potential traps is the first step to appreciating why title insurance on land isn't just a line item in a budget—it's a fundamental risk management tool. Without it, your company is personally liable for risks created by people you’ve never met, sometimes generations ago.

Boundary Lines and Survey Errors

One of the most common challenges with undeveloped land is defining its precise physical boundaries. Old property descriptions often used landmarks that no longer exist, like "the large oak tree" or "the stone wall." A century-old survey might be wildly inaccurate by today's standards, creating a recipe for major disputes.

Imagine you acquire ten acres for development. Months later, an adjacent landowner produces an older survey demonstrating their property line extends 50 feet further than you thought—right through your planned entryway. This is more than a simple disagreement; it's a direct threat to your ownership and right to develop the land as planned.

A title search uncovers these historical surveys and legal descriptions. If conflicting records are found, they can be resolved before you close the deal, saving you from a costly and time-consuming legal battle.

Forgotten Easements and Access Rights

Just because land is vacant doesn't mean other parties don't have the right to use it. An easement is a legal right for another person or entity to use a specific part of your property for a specific purpose. These are incredibly common on raw land.

For example, a utility company might have a decades-old easement to run infrastructure directly across your parcel. Or a "landlocked" neighbor might hold a legal right-of-way across your property to access a public road. Discovering this after closing can completely disrupt your site plans and development strategy.

These "forgotten" rights can severely diminish your property's value and utility. Common easements found on vacant land include:

- Utility Easements: For power, water, sewer, and communication lines.

- Access Easements: Granting neighbors or the public a path across your land.

- Conservation Easements: Restricting development to protect natural resources.

Hidden Mineral, Water, or Timber Rights

Here’s a critical issue for developers: what’s under or on your land might not actually belong to you. In many regions, it's common for a previous owner to have sold off—or retained—the rights to minerals, water, or timber on the property. This is known as a severed rights issue.

This means a third party could have the legal right to enter your property to drill for oil, mine for gravel, or harvest timber. They would be within their rights to do so, leaving you with little recourse and a major disruption to your project. Title insurance is designed to identify these severed rights during the title search, so you know exactly what bundle of rights you are acquiring.

Unresolved Claims from Heirs and Past Owners

Finally, the chain of ownership for rural or undeveloped land can be a convoluted mess. Properties are sometimes passed down through families for generations without proper legal documentation or probate filings. This leaves the door open for an unknown heir to suddenly appear and stake a claim to the land you thought was yours.

Furthermore, issues like fraudulent transfers, forged signatures on old deeds, or simple clerical errors from decades past can create serious breaks in the ownership chain. Without a clean, undisputed title, your claim to the property is vulnerable. These are precisely the historical risks a title search is designed to uncover—and what an owner's title policy is built to protect you against.

How a Policy Protects Your Financial Investment

We've covered the hidden risks that can lurk in a property's history. Now, let's focus on the solution. An owner’s title insurance policy isn't just another closing document; it’s an active defense for your financial stake in that land.

Think of it as having a legal and financial guardian standing watch over your property rights for as long as your company owns it. This protection works in two critical ways, shielding your project from the devastating costs that can arise from a title defect. It is your first and last line of defense, ensuring a problem from the past doesn’t bankrupt your future plans.

Your Legal Shield in Court

First and foremost, your owner's policy is a legal shield. If a third party files a claim against your property—whether it’s a surprise heir, a neighbor disputing a boundary, or a creditor with an old lien—you aren't left to fight it alone. The title insurance company steps in to defend your ownership.

This is a massive benefit. Real estate litigation is notoriously expensive and complex, capable of dragging on for years and accumulating six-figure legal fees. With an owner's policy, the insurer assumes the responsibility and cost of mounting that legal defense. They hire the attorneys and manage the court proceedings, saving your company from a potentially ruinous financial drain.

Your Financial Safety Net

The second function of your policy is to act as a financial safety net. Sometimes, even with a strong legal defense, a claim against your property might succeed. A court could rule that an old easement is valid, shrinking your usable land, or worse, determine a past transfer was fraudulent, voiding your ownership completely.

In these catastrophic scenarios, the title insurance company compensates you for your financial loss, up to the full value of the policy. This means if your claim to the property is legally defeated or diminished, you won't lose your entire investment. The policy ensures you are made financially whole.

This dual-layered protection—covering both legal defense costs and financial loss—is what makes title insurance on land such a vital one-time investment. It secures your ownership rights and your financial future with a single premium paid at closing.

The growing complexity of real estate deals has made this protection more critical than ever. The global title insurance market is projected to climb from $4.15 billion in 2025 to $5.69 billion by 2034, fueled by more property sales and a greater need for secure ownership. You can read more about what’s driving this growth on HousingWire. Land developers, in particular, need robust systems to manage the complexities of land acquisition and title due diligence. You can explore these challenges and solutions on our developer's page. Ultimately, this single purchase provides priceless security for decades.

Modernizing the Title Search with Technology

The traditional title search, the critical step in securing title insurance on land, has historically been the bottleneck in real estate transactions. For decades, it required a physical trip to the county courthouse to manually comb through dusty deed books, tax ledgers, and court dockets. This painstaking work is slow, costly, and prone to human error.

In an industry where speed is a competitive advantage, this analog method creates significant delays. A process that should take days can easily stretch into weeks, holding up closings and frustrating all stakeholders. While the principles of a thorough title search remain, the tools for executing it are finally entering the 21st century.

The Shift from Manual to Automated Workflows

Technology is fundamentally transforming this outdated process. The initial leap was the digitization of public records, but that only shifted the problem from paper to screen; professionals still had to manually interpret complex documents. The real revolution is happening now, with platforms that don't just display data but actively analyze it.

Today's advanced solutions use AI and automation to accomplish in minutes what once took days. They can scan thousands of documents, flag potential issues like liens or easements, and assemble a clear chain of title automatically. This dramatically shortens the time between a signed contract and a clear-to-close.

This is precisely where platforms like TitleTrackr are making an impact. Instead of providing a simple search bar for public records, solutions like TitleTrackr centralize data and use AI to streamline the entire examination. By automating the laborious task of extracting key information and flagging risks, it empowers title professionals to focus on high-value analysis and problem-solving.

This shift delivers two game-changing benefits:

- Speed: Automation radically shortens the title search timeline, helping your team close deals faster and gain a competitive edge.

- Accuracy: AI algorithms are trained to spot inconsistencies and risks that a human eye might overlook, leading to more reliable and comprehensive title reports.

Introducing Intelligent Title Examination

The future of the title search is intelligent automation. The newest platforms are engineered not just to find documents, but to understand them. They can differentiate between a warranty deed and a quitclaim deed, interpret complex legal descriptions, and connect related records across disparate databases without manual intervention.

For land developers, energy companies, and institutional investors, this is a game-changer. When you're evaluating large tracts of land for acquisition, getting fast, accurate title reports is absolutely critical. A delay of a few weeks can mean losing out on a major opportunity.

This is the power of a modern title workflow. By leveraging technology to handle the heavy lifting of data collection and initial analysis, companies can make smarter, faster decisions.

If you're ready to see how this technology can make your land acquisition process quicker and more accurate, request a demo of TitleTrackr. You'll see the future of title research in action—and how, while the need for secure ownership is timeless, the path to getting there is now more efficient than ever.

Frequently Asked Questions

Even for seasoned professionals, land acquisition can stir up complex questions. Title insurance, in particular, can have its nuances. Let's clarify some of the most common inquiries from an industry perspective.

Do I Really Need Owner's Title Insurance for Vacant Land?

Yes, absolutely. It might seem counterintuitive, but raw land often carries a more convoluted and less-documented history than a developed property. Issues like old survey errors, forgotten easements, or unresolved claims from a previous owner's heirs are far more common.

An owner's policy is your only true defense against these historical liabilities. Without it, your entire investment is exposed to risks created decades before you entered the picture.

Isn't the Lender's Policy Enough?

No. This is a critical distinction that can expose buyers to significant risk. A lender's policy provides zero protection to you, the owner. Its sole purpose is to protect the financial institution that financed the purchase.

If a title claim arises, their policy ensures they recover their investment. However, your down payment, your equity, and your ownership rights are completely unprotected. Only an owner's policy safeguards your financial stake in the property.

How Long Does an Owner's Policy Last?

This is one of the policy's greatest strengths. An owner's title insurance policy protects you and your heirs or corporate successors for as long as you own the land. You pay a single, one-time premium at closing, and the coverage remains in force indefinitely, securing your asset for generations with no recurring costs.

The policy's perpetual nature is its core value. A one-time payment establishes a permanent legal and financial defense against title problems that could surface years, or even decades, in the future.

Can a Title Defect Be Found After Closing?

Unfortunately, yes. Even the most diligent title search cannot uncover every potential issue. Certain problems, such as fraud, forged signatures, or unrecorded documents, are impossible to detect in the public record.

For example, a previously unknown heir could emerge years later with a valid legal claim to your land. This is the very reason title insurance exists—to protect you from the hidden, undiscoverable risks that can materialize long after the transaction has closed.

For a deeper dive, you can always explore our comprehensive FAQ page at http://titletrackr.com/faq to get answers to even more specific questions. Clarifying these details demonstrates why securing your title is a non-negotiable step in any professional land acquisition.

Bringing the title examination process into the modern era is the key to spotting these issues faster. TitleTrackr uses advanced AI to automate document analysis, helping professionals generate precise reports in a fraction of the time. To see how you can reduce risk and accelerate your land acquisitions, request a demo of TitleTrackr today.