When a mortgage is paid off, it’s a major milestone. But the final payment isn't the finish line. There's a critical final step for title professionals and lenders: ensuring a mortgage release is properly filed.

This document is the official, legal confirmation that a loan has been paid in full. More importantly, it removes the lender’s claim—or lien—from the property's title. Without it, a paid-off loan can become a major obstacle in a future transaction, creating a title nightmare that stalls closings and frustrates clients.

The Final Handshake of Your Mortgage Journey

Think of a mortgage as a long-term contract secured by a property. The mortgage release is what makes the end of that contract official in the public record. If this document is never filed, the lender's lien technically remains, creating a "cloud" on the title that can derail a future sale or refinance.

This isn't just a simple receipt. A mortgage release is a formal legal instrument. Once it’s filed with the county recorder or land registry office, the homeowner holds a clear title, free of that specific mortgage lien. For a deeper dive, you can find more insights about the release of a mortgage on ProTitleUSA’s blog.

To break it down, here are the core components you’ll find in a typical mortgage release.

Key Elements of a Mortgage Release at a Glance

This table outlines the essential information and parties involved in a standard mortgage release document.

| Element | Description | Primary Party Responsible |

|---|---|---|

| Borrower Information | Full legal names of the individuals who took out the loan. | Lender/Closing Agent |

| Lender Information | Full legal name of the lending institution that issued the mortgage. | Lender |

| Property Details | Legal description of the property, including address and parcel number. | Lender/Closing Agent |

| Original Mortgage Data | The date the mortgage was signed and its recording information (book/page). | Lender |

| Statement of Release | Formal language confirming the loan has been paid in full and the lien is released. | Lender |

| Notarization | An official seal and signature from a notary public to verify authenticity. | Lender/Notary |

Understanding these parts helps you see why this document is so much more than a simple confirmation of payment.

Why This Document Is Non-Negotiable

A clean title, backed by a recorded mortgage release, is absolutely essential for any future property transaction. It’s what gives a homeowner the power to:

- Sell their home without surprise delays caused by an old, unreleased lien.

- Refinance their property with a new lender, who will always require a clear title.

- Secure a home equity line of credit (HELOC).

- Pass the property to their heirs without saddling them with a legal mess.

Ultimately, this simple piece of paper is the key to true, unencumbered homeownership. It prevents a small oversight today from turning into a major financial and legal problem for homeowners and title professionals tomorrow.

How the Mortgage Release Process Really Works

From the final mortgage payment to a clean title, the release process follows a very specific and legally critical path. It all starts the moment a homeowner sends in that last payment. That single action sets a legal stopwatch in motion, obligating the lender to start the process of releasing their lien on the property.

Next, the lender drafts a document known as a mortgage release (or sometimes a "satisfaction of mortgage"). This isn't just a simple receipt; it's a detailed legal instrument where every piece of information must be perfect. Even a tiny mistake here can snowball into major title defects that surface years later.

Key Information in a Release Document

For the document to be legally sound, it has to nail several key details:

- Borrower and Lender Names: The full, legal names of everyone involved.

- Property Description: The official legal description of the property—not just the street address you'd plug into Google Maps.

- Original Mortgage Details: Reference information, like the book and page number, that points directly back to the original mortgage filing.

Once this document is prepared and notarized, it’s sent to the county recorder’s office to be officially filed in the public record. This is the step that truly matters. An unrecorded release is basically invisible to anyone performing a future title search. State laws are pretty strict about this, often giving lenders a window of 30 to 90 days to get it done.

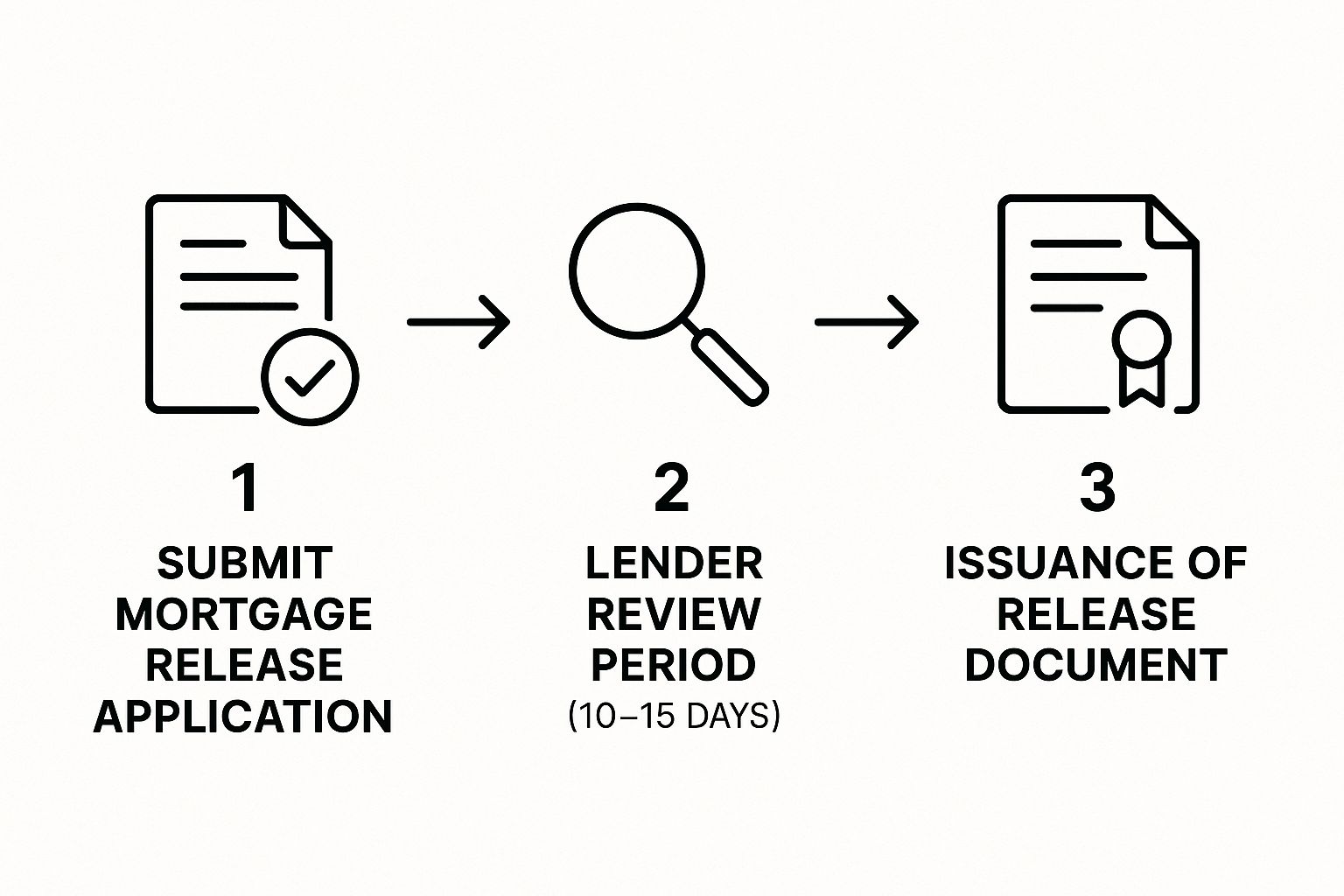

This infographic gives you a good visual of the flow from the homeowner's perspective.

As you can see, the process has multiple stages where things can get delayed or go wrong, especially during the lender's internal review and document prep.

A hiccup anywhere in this chain of events can create a “cloud” on the property’s title. This cloud can stop a future sale or refinance dead in its tracks, forcing title professionals into a time-consuming scavenger hunt to fix a problem that should have been handled correctly years ago. Accuracy and speed aren't just best practices here; they're essential for keeping the chain of title clean.

When a Missing Release Creates a Title Nightmare

It often starts with a simple clerical mistake—a document that never got filed. But that one oversight can spiral into a full-blown crisis for everyone involved in a property transaction. When a mortgage release isn’t recorded, it leaves an old lien on the property's title like a ghost, just waiting to derail a sale at the worst possible moment.

Picture this: A homeowner is ready to sell. They paid off their mortgage 10 years ago and haven’t given it a second thought. But during the buyer’s title search, an old lien from that paid-off loan pops up, still active in the public record.

Just like that, the deal slams to a halt. You can't close a sale with a clouded title. What comes next is a frustrating and expensive ordeal for the seller, the buyer, and the title professionals caught in the middle. This is exactly the kind of hidden landmine that TitleTrackr was built to find and defuse before it blows up a closing.

The Detective Work Begins

For the title professional, this discovery kicks off a frantic hunt for a ghost. They are now tasked with tracking down a lender that might have merged, been acquired, or simply gone out of business years ago. This isn't just a quick phone call; it's a deep dive into decades of corporate history.

The chase usually involves:

- Tracing Bank Mergers: Unraveling a tangled web of acquisitions to pinpoint which institution is now responsible for the original lender's paperwork.

- Securing Corrective Documents: Once the right entity is found, the professional has to request—and wait for—a brand new, corrective release document.

- Fighting the Clock: This whole process can drag on for weeks, sometimes months, putting closing deadlines in jeopardy and giving the buyer every reason to walk away.

This frustrating, manual chase is more than just an inconvenience. It introduces significant financial risk and operational drag, turning a routine closing into a high-stress emergency. The costs in time, labor, and lost opportunities add up quickly.

Keeping an eye on when and how often mortgage releases are filed is critical for the health of the entire real estate market. Timely releases ensure clean property titles, which underpins everything from home sales to secondary mortgage market transactions. You can explore more on the importance of mortgage release data from The Warren Group. Without a proactive system to track these documents, title professionals are stuck cleaning up yesterday's messes instead of closing today's deals.

A Title Abstractor's Guide to Verifying Releases

For any title professional, verifying a mortgage release isn’t just another item on a checklist. It's a high-stakes responsibility where one small oversight can bring a closing to a screeching halt. Getting it right demands a systematic approach to confirm that a lien has been fully and properly wiped from the public record.

The whole process kicks off with a deep dive into county land records. The goal is to hunt down the recorded release document and then meticulously cross-reference every detail against the original mortgage. This means matching borrower names, the property’s legal description, and the original loan’s recording information—think book and page number.

Common Red Flags to Watch For

Even when you find a release, the job's not done. You have to scrutinize it for accuracy because seemingly minor mistakes can invalidate the entire document, creating a massive cloud on the title. Abstractors learn to keep a sharp eye out for several common red flags that scream "problem ahead."

- Incorrect Legal Descriptions: A simple typo in a parcel number or a mistake in the metes and bounds description could mean the release is legally worthless.

- Missing or Flawed Notarization: An absent notary seal or an expired commission date? That can be enough to invalidate the whole document.

- Mismatched Names or Dates: If the names on the mortgage and the release don't line up perfectly, you've got a problem that needs solving.

One of the biggest, most persistent headaches is trying to track down a mortgage release from a lender that doesn't even exist anymore. Bank mergers and acquisitions have created a tangled mess of corporate succession that can take weeks of pure detective work to unravel. It's not uncommon for an abstractor to trace a loan’s ownership through several defunct banks just to get the right signature on a corrective document.

These manual verification methods are not only brutally time-consuming, but they’re also completely reactive. Every unreleased lien discovered at the eleventh hour forces abstractors into a frantic, high-pressure scramble—a process just begging for a better way.

This is exactly why having a proactive strategy is so critical. By modernizing how they track and verify releases, firms can slash their risk and get back to focusing on closing deals. For more advice on updating these workflows, check out our guide for abstractors and title pros. The daily grind of manual verification just highlights how badly a more efficient system is needed to protect every transaction.

How to Automate Lien Release Tracking with TitleTrackr

Let’s be honest. Chasing down old mortgage paperwork is a reactive, time-sucking chore. What if you could get ahead of title problems before they even start? This is where modern tech completely changes the game, turning the slow, manual grind of lien verification into a proactive, efficient part of your workflow.

Instead of a title search unearthing a decade-old problem right before closing, an automated system puts you back in control. It allows title pros to monitor entire portfolios, get instant alerts on unreleased liens, and start curative work long before a deal is on the line. This is a fundamental shift from reactive clean-up to proactive management.

The Power of a Proactive Workflow

A platform like TitleTrackr is designed to bring all this critical information into one place. It works in the background, continuously monitoring public records and giving you a clear dashboard view of your entire portfolio's health. More importantly, it flags potential issues the moment they appear.

Here’s a look at how the TitleTrackr platform organizes and presents this crucial lien data.

This centralized view lets your team identify and address unreleased liens systematically, rather than scrambling when a transaction is at risk.

By connecting the dots between paid-off mortgages and their corresponding release documents, TitleTrackr closes the loop that so often leads to title clouds. This reduces risk, saves countless hours of detective work, and helps you close deals faster and more reliably.

Stop letting old liens dictate your closing schedule. See for yourself how automation can protect your transactions by exploring our platform. You can get started today with a free trial of TitleTrackr. It’s time to move from chasing problems to preventing them.

Common Questions About Mortgage Releases

Even when everything goes right, the final steps of paying off a mortgage can stir up a lot of questions. For title professionals, anticipating these questions is key to guiding clients and ensuring a smooth, confident closing process.

Let's walk through some of the most common questions that pop up after that final mortgage payment clears. Understanding these details demystifies the path to a clean title and shows why this last piece of paperwork is so critical for long-term ownership.

How Long Does a Lender Have to Issue a Release?

This is a big one. State laws give lenders a specific window to issue and record a mortgage release, and it's usually somewhere between 30 and 90 days after they've received the final payment.

This isn't just a friendly guideline—many states hit lenders with financial penalties if they miss the deadline. If a homeowner hasn't received confirmation within that 90-day window, it's time to follow up. A proactive approach can keep a simple delay from snowballing into a major title headache years down the road.

Release vs. Satisfaction of Mortgage

You'll hear "mortgage release" and "satisfaction of mortgage" used interchangeably, and for good reason—they do the exact same job. Both are official, recorded documents that confirm the loan is paid in full and formally release the lender’s lien from the property.

The term you see often just depends on local custom or state law. Whether it’s called a release, a satisfaction, or something else, the legal effect is identical: it clears the lien off the title.

What If My Lender Was Acquired?

This happens all the time. If the original lender merged with another bank or was acquired, the new institution is legally on the hook for issuing the mortgage release. This can get tricky, especially when a title search digs up an old lien from a bank that no longer exists.

When this happens, an abstractor has to play detective, tracing the chain of assignments through public records to figure out who currently owns the servicing rights. For more on tough situations like this, check out our frequently asked questions page. This kind of investigative work is exactly why automated tracking systems are so valuable—they manage these institutional changes and save a ton of time and effort.

Ready to stop chasing down old liens and start preventing title problems before they begin? TitleTrackr gives you the tools to monitor your entire portfolio proactively, so you can close deals faster and with greater confidence.