A property title issue is an industry term for a defect or claim that could challenge the ownership of a property. These critical risks can arise from simple clerical errors in public records, unresolved liens, or complex challenges like an undisclosed heir.

For real estate professionals, these problems can jeopardize an entire transaction, leading to costly legal battles and significant delays. The only way to secure an asset and protect a client's investment is with a thorough, accurate title search that confirms ownership is free and clear.

Why a Clear Title Is Non-Negotiable in Real Estate

Imagine a client is weeks away from closing on a major commercial acquisition. Suddenly, the deal is stalled by a claim from a long-lost relative of a previous owner. The client's capital is tied up, and the entire project timeline is at risk. This is precisely why a clear property title isn't just a formality—it's the definitive proof of ownership that underpins every secure transaction.

A title search is a deep-dive background check on a property's history. It scrutinizes the entire chain of ownership, uncovering every past owner, debt, and dispute attached to it. Skipping or rushing this step means operating blind, exposing your transaction and your clients to legacy issues that could surface years down the road.

The Foundation of Any Secure Deal

A clean title is the absolute bedrock of any real estate transaction. It guarantees that the seller has the undisputed right to transfer ownership. This confidence is essential for lenders, investors, and buyers. The fallout from title defects can be severe, ranging from high legal fees to, in the worst-case scenario, the complete loss of the property.

And these property title issues are far more common than many professionals realize. They are a significant global problem, causing major delays and financial losses across the industry.

The World Bank estimates that around 30% of the world's land isn't formally registered, which creates a massive amount of uncertainty. Even in a market as established as the United States, title defects from record errors, liens, or forgeries impact an estimated 5% of all property transactions every single year.

It’s Time for a Modern Solution

Given the high stakes, clinging to outdated, manual search methods is a significant business risk. The sheer volume and complexity of property records demand a modern, reliable solution that provides complete certainty. Without an accurate and efficient process, you expose your firm and your clients to unnecessary liability.

This is where a new approach becomes essential. For industry pros looking to secure their transactions, advanced tools are no longer a luxury—they're a necessity. See for yourself how TitleTrackr is modernizing the title search process to deliver the clarity and security every deal needs. A clear title is non-negotiable, and having the right tools to verify it is the ultimate safeguard.

Uncovering the Most Common Title Defects

A property title is the official record of a property’s ownership history. But often, that history contains hidden risks—problems that can bring a real estate transaction to a halt and create significant financial pain. These "defects" are frequently buried in decades of public records, waiting to catch even seasoned professionals off guard.

Think of it this way: a "clean" title is a straightforward, unbroken chain of ownership. A defect creates a "cloud" on that title, making it unclear who has the legal right to sell the property. Understanding these common clouds is the first step to mitigating risk.

Surprise Claims from Undisclosed Heirs

One of the trickiest property title issues to resolve is the sudden appearance of an undisclosed heir. This isn’t just a dramatic plot point; it happens when a previous owner dies without a clear will, or when a family member was unknown or overlooked during probate.

Imagine a seller is marketing a family property, believing they are the sole heir. The deal proceeds smoothly until a title search reveals a half-sibling from a previous marriage who is legally entitled to a share of the estate. The entire transaction is now on hold. The seller must now locate and negotiate with a relative they may have never met.

These situations can escalate into complex legal disputes, stalling a sale for months or even years. Until every heir’s claim is settled, the seller cannot legally transfer a clear title, putting the entire deal in jeopardy.

"When a homeowner dies, the legal title to their property does not automatically transfer to surviving family members. Even if relatives continue living in the home or maintaining the property, the name on the deed remains that of the deceased owner until legally updated."

Lingering Liens and Encumbrances

A lien is a legal claim against a property for an unpaid debt. These claims, known as encumbrances, attach to the title and follow the property from one owner to the next until the debt is paid. It is a common shock for sellers to discover old liens they believed were resolved—or never knew existed.

Several types of liens can cloud a title:

- Mechanic's Liens: A contractor who was not paid for a new roof or a kitchen remodel can file one. That unpaid bill becomes a legal claim against the house itself.

- Tax Liens: The government can place a lien on a property for unpaid property taxes, income taxes, or other debts. These are especially serious and take priority for repayment.

- Judgment Liens: If a previous owner lost a lawsuit and failed to pay the judgment, the court can attach a lien to their property to secure the debt.

Let's say a buyer is ready to close, but the title search flags a $15,000 mechanic's lien from a roofer who performed work five years ago. The previous owner never settled the final invoice, and now that debt threatens to become the new owner's liability. The transaction cannot proceed until that lien is paid off.

Boundary Disputes and Encroachments

Property lines should be clear, but they often aren't. Old surveys, vague legal descriptions, or even a fence built in the wrong location can ignite disputes with neighbors. An encroachment occurs when a neighbor's fence, shed, or driveway extends onto your property.

Picture this: a homebuyer loves their new backyard, especially the large oak tree providing shade. Months later, the neighbor presents a new survey proving the tree—and the surrounding fence—is actually three feet on their side of the property line. What seemed minor is now a potential legal battle that may require moving the fence.

These kinds of property title issues are often hiding in plain sight. They are typically discovered only after a careful review of surveys and historical plot maps, proving the need to understand both the paperwork and the physical layout of the land.

The Growing Threat of Title Fraud

Beyond simple errors and old debts, modern criminal activity presents a serious risk. Title fraud, including forged deeds and seller impersonation, is a nightmare scenario that is becoming more prevalent. Scammers use sophisticated tactics to create fake documents, impersonate the owner, and then sell or mortgage a property they have no right to.

This is a major problem for vacant properties, vacation homes, or properties owned by seniors. A criminal might forge a deed to transfer the title into their name, then quickly sell it to an unsuspecting buyer. By the time the real owner discovers the fraud, the buyer has lost their investment and has no legal claim to the property. As scammers become more sophisticated, our methods for verifying ownership must evolve.

To help put these risks into perspective, here’s a quick rundown of the most common issues.

Common Property Title Issues and Their Impact

This table summarizes the frequent title defects we see, their origins, and the serious impact they can have on a transaction.

| Title Issue Type | Common Cause | Potential Impact |

|---|---|---|

| Undisclosed Heirs | Improperly probated wills, unknown family members, or errors in estate planning. | Transaction delays, legal disputes with rightful heirs, potential loss of ownership percentage. |

| Liens and Encumbrances | Unpaid contractor bills, delinquent taxes, or unresolved court judgments from prior owners. | Inability to sell or refinance, financial liability for old debts, risk of foreclosure. |

| Boundary Disputes | Outdated or inaccurate surveys, fences or structures built over property lines. | Costly legal battles with neighbors, loss of property use, need for a new survey. |

| Title Fraud | Forged deeds, seller impersonation, or falsified mortgage satisfaction documents. | Complete loss of property and investment, expensive litigation, voided transactions. |

These common defects highlight just how many hidden landmines can exist in any real estate deal. Attempting to identify these red flags by manually digging through mountains of records is a slow, tedious process where it is all too easy to miss a critical detail.

This is exactly why we built TitleTrackr. Our platform is engineered to hunt down these specific issues with exceptional speed and accuracy, giving your team the clarity needed to close with confidence. Request a demo of TitleTrackr and see how our AI-powered analysis can safeguard your transactions from these hidden threats.

The True Cost of Overlooking Title Problems

Identifying a potential property title issue is one thing; understanding the catastrophic financial and legal fallout is another. Overlooking a cloud on the title isn't a minor oversight—it's like noticing a crack in a dam and walking away. The potential for a total collapse of the deal is very real and can be devastating.

The true cost extends far beyond the purchase price, spiraling into a cascade of unexpected expenses that can completely derail an investment.

When a hidden defect surfaces late in the game, the financial bleeding starts immediately. Seemingly simple fixes, like filing a quiet title action to clear a claim or tracking down an heir for a signature, become expensive fast. Legal fees alone can easily climb into the tens of thousands of dollars, consuming capital allocated for the project itself.

And that's before accounting for the staggering cost of delays. Every month a deal is stalled is another month of carrying costs, missed opportunities, and mounting pressure from stakeholders.

A Deal Derailed: A Cautionary Tale

Consider a sharp real estate investor, Sarah, who identified a prime commercial property for redevelopment. She was on a tight schedule to secure financing and begin construction. The initial title search—conducted manually—came back clean, so the deal moved forward.

Weeks later, just as final papers were being drafted, the title company discovered a major problem: an unreleased lien from a business loan taken out by a previous owner over a decade ago.

The lender immediately froze the financing. Sarah's team scrambled, losing weeks and spending thousands in legal fees to track down the original lender, which had since been acquired by a larger bank. The paper trail was a mess, and the bank had no immediate record of the loan being satisfied.

That delay cost Sarah dearly. Her construction schedule was disrupted. Material costs rose while she waited. Her investors grew anxious. After three agonizing months and over $25,000 in legal and administrative fees, she finally obtained the lien release. But by then, market conditions had shifted, and her project's profitability was permanently damaged.

The Ultimate Risk: Losing Everything

Sarah's story is a painful example, but it's not the worst-case scenario. The ultimate risk of a serious property title issue is the complete loss of the asset. If a prior claim to ownership is proven valid—such as a forged deed or a rightful heir—a court can void the purchase entirely. The buyer could lose the property and every dollar invested.

This isn't just a theoretical risk; it's a real drag on the market. Statistically, property title issues continue to impact real estate market fluidity and investment across major global markets.

Issues like unrecorded ownership interests, surprise encumbrances, and simple clerical errors delay roughly 5% of U.S. property transactions each year, impacting more than one million homes. In 2023 alone, title claims related to boundary disputes, liens, and fraudulent mortgages led to billions of dollars in lost equity or payouts by title insurers. You can dive deeper into how these problems affect the commercial real estate outlook at Deloitte.com.

Proactive Verification Is Non-Negotiable

The lesson is clear: proactive, deep, and accurate title verification is not an optional step. It is the single most critical form of risk management in any real estate deal. Relying on slow, manual searches prone to human error is a gamble that modern professionals cannot afford to take. The potential for financial ruin is simply too high.

The only way to protect an investment and keep a transaction on track is to identify every potential issue before closing. This is precisely why TitleTrackr was developed. Our platform is engineered to catch the exact problems that derailed deals like Sarah's, delivering comprehensive results with unparalleled speed and precision.

Don't wait for a hidden defect to turn a promising investment into a financial nightmare. Request a demo of TitleTrackr today and see how our advanced technology provides the certainty you need to close with confidence.

Comparing Traditional vs. Modern Title Searches

When uncovering property title issues, the clock is always ticking. The search method you use can mean the difference between a smooth closing and a logistical nightmare. For decades, the industry relied on a slow, manual process of reviewing courthouse records and dense legal documents. That traditional approach, while once standard, is now a major bottleneck in a high-velocity market, leaving deals vulnerable to delays and costly human errors.

A traditional title search is an incredibly hands-on, painstaking process. It requires a title professional, typically an abstractor, to physically visit a county courthouse and sift through deeds, mortgages, tax records, and court judgments. They are manually piecing together a property's history, document by document, to find any gaps in the ownership chain or lingering claims.

It is an inherently slow methodology. A thorough search can take days, or even weeks, especially if records are poorly organized, incomplete, or spread across different offices. This total reliance on manual review also creates significant room for human error—a single overlooked document or a misinterpreted legal description can cause a defect to be missed, putting the entire transaction at risk.

The Old Way: Manual and Rife with Error

Imagine a traditional title search as trying to assemble a 1,000-piece puzzle without a reference image. An abstractor sorts through stacks of documents, each one a puzzle piece, attempting to fit them together in perfect chronological order. If just one piece is missing—like a lien that was never officially released or a deed filed incorrectly—it can compromise the entire picture.

This manual process isn't just slow; it's a high-stakes endeavor where a minor oversight can have massive financial consequences. For real estate professionals on a tight deadline, this uncertainty is a significant source of stress and a major business risk. You are left waiting, hoping the search comes back clean and that nothing critical was missed. For professionals looking to grow in this field, understanding the role and responsibilities of title searchers and abstractors offers great insight into how much the industry has evolved.

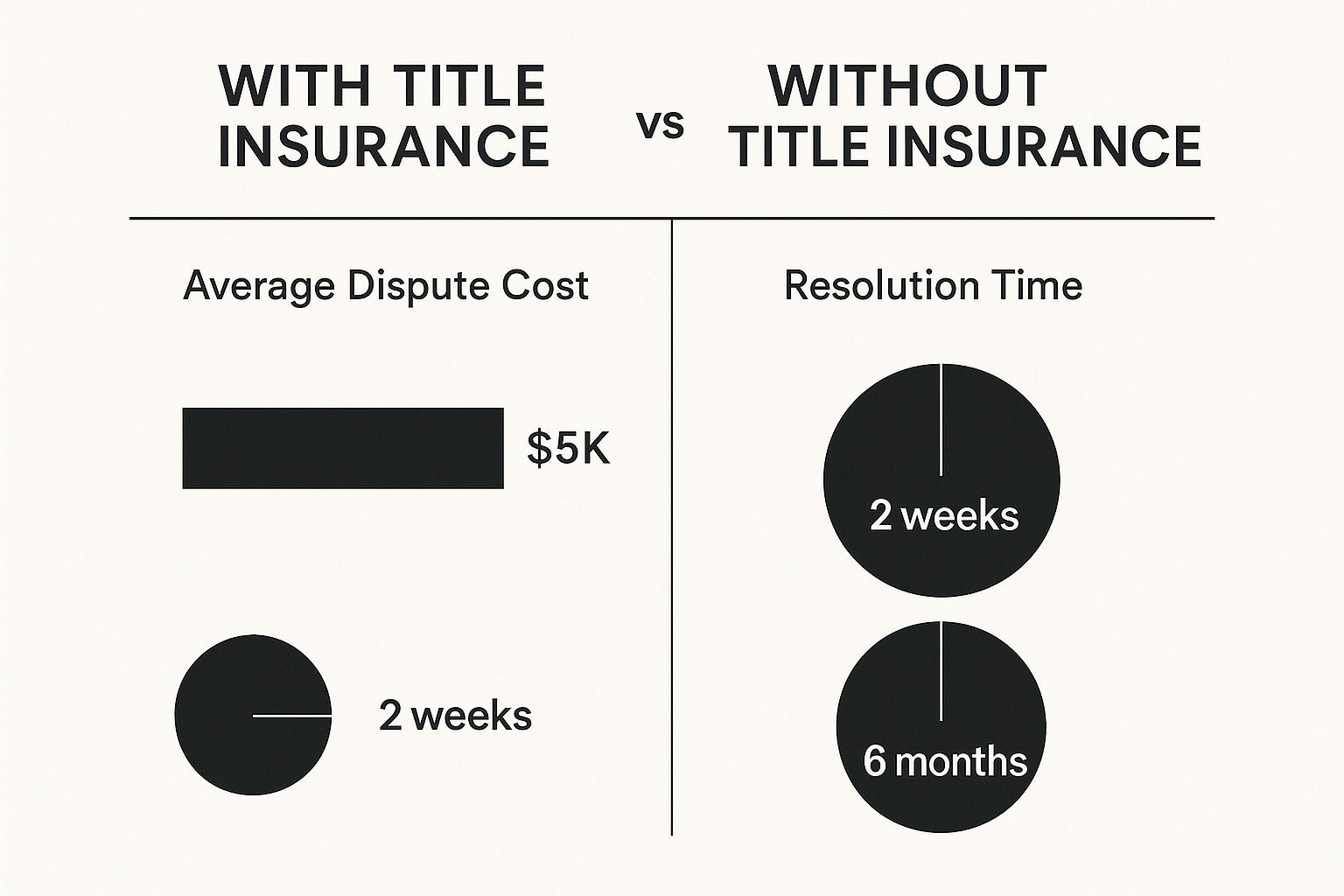

The infographic below highlights the difference in cost and time when title issues arise, underscoring why a robust search is critical from the outset.

As you can see, having the right protections in place makes a world of difference, slashing both the financial impact and the time lost. It’s a powerful reminder of why a meticulous title search is simply non-negotiable.

The Modern Solution: Automation and Accuracy

This is where technology fundamentally changes the game. A modern solution like TitleTrackr eliminates the manual grind by using AI-powered automation to deliver faster, more accurate results. Instead of depending entirely on an individual physically chasing down records, our platform analyzes comprehensive digital data sources in a fraction of the time.

TitleTrackr's AI doesn't just scan documents; it understands them. It extracts critical data, identifies potential red flags, and assembles a clear, actionable report that pinpoints any potential property title issues with precision. This transforms the title examination process from a weeks-long waiting game into a streamlined, efficient workflow.

To see the difference clearly, let’s compare the two approaches.

Comparing Title Search Methodologies

The gap between the traditional and modern methods is massive. One is stuck in the past, while the other is built for the speed and demands of modern real estate.

| Feature | Traditional Title Search | TitleTrackr's Automated Search |

|---|---|---|

| Speed | Days to weeks, heavily dependent on record accessibility. | Hours, sometimes minutes, for a comprehensive report. |

| Accuracy | Prone to human error, missed documents, and misinterpretation. | High, with AI algorithms cross-referencing multiple data points. |

| Cost | High labor costs due to intensive manual work. | Lower operational costs and predictable, scalable pricing. |

| Efficiency | Inefficient and resource-heavy, limiting transaction volume. | Highly efficient, allowing teams to handle more volume with less effort. |

The takeaway is clear: automation is not just about speed; it's about being smarter, more reliable, and more strategic.

This new approach isn’t about replacing human expertise—it’s about amplifying it. Our system handles the heavy lifting of data collection and initial analysis, freeing skilled professionals to focus their energy on resolving complex issues and providing high-value strategic advice to their clients. It dramatically reduces the risk of missed defects and delivers a level of clarity that manual methods simply cannot match.

The benefits are immediate and powerful:

- Drastically Reduced Turnaround Times: Get complete title reports in hours, not weeks.

- Increased Accuracy: AI-driven analysis minimizes the risk of human error and overlooked details.

- Actionable Insights: Reports are clear and easy to understand, pinpointing specific issues that need attention.

- Greater Efficiency: Handle more transactions with the same team, boosting productivity and profitability.

The contrast couldn't be starker. While the traditional method exposes you to delays and errors, a modern approach provides the speed, accuracy, and confidence needed to compete and win. Stop letting outdated processes dictate your timeline and put your deals at risk.

How to Resolve and Prevent Title Issues

Discovering a property title issue can feel like hitting a brick wall, but it is rarely an insurmountable obstacle. Whether you are resolving an existing defect or preventing future ones, a clear strategy is essential. Success comes down to tackling problems head-on with the right tools and a proactive mindset.

Fixing a title defect involves taking decisive action to clear the cloud from the property's history. Prevention, however, is about early detection—identifying potential trouble when it's small and manageable, long before it can jeopardize a closing.

A Playbook for Resolving Existing Title Problems

When a title search uncovers a defect, you need a clear action plan. While every situation is unique, most solutions involve a combination of legal action, direct negotiation, and strategic protection.

The appropriate path depends on the specific issue, but here are some of the most effective strategies used in the industry:

- Pursuing a Quiet Title Action: This is a formal lawsuit filed to obtain a court's final judgment on who holds true ownership of the property, extinguishing other claims. It is often the best route for complex issues like a broken chain of title or claims from unknown heirs. The court's ruling effectively "quiets" all other challenges to the title permanently.

- Negotiating a Lien Release: If a lien from a creditor, contractor, or tax authority is obstructing the transaction, the most direct solution is often to negotiate its release. This typically involves settling the outstanding debt. Once paid, the creditor files a formal release, clearing that specific encumbrance.

- Securing a Comprehensive Title Insurance Policy: Title insurance serves as a critical financial safeguard. It protects both the buyer and lender from losses caused by defects that existed before the property was purchased but were not discovered in the initial search. If a hidden issue emerges after closing, the policy covers legal defense fees and financial damages up to the policy limit.

Proactive Prevention Is the Best Strategy

Knowing how to solve title problems is valuable, but avoiding them in the first place is far more effective. The single most powerful way to protect a real estate transaction is with rigorous, proactive due diligence. Uncovering potential property title issues at the very beginning of a deal is the key to a smooth closing.

Think of it this way: finding a defect a week before closing is like performing emergency surgery. It is stressful, expensive, and the outcome is uncertain. Discovering the same issue a month earlier is like spotting a minor problem during a routine check-up—it is infinitely easier and cheaper to resolve.

The most critical takeaway is that the cost and complexity of resolving a title issue increase exponentially the closer you get to the closing date. Early detection gives you time, leverage, and a clear path to resolution without derailing the entire transaction.

This proactive approach transforms the title examination from a reactive, check-the-box exercise into a powerful risk management tool.

Make Early Detection Your Standard Workflow

How do you integrate early detection into your standard operating procedure? The solution is to move beyond the slow, manual search methods that create delays and introduce unnecessary risk. Today’s real estate professionals need tools that deliver speed, accuracy, and actionable insights from day one.

This is exactly where TitleTrackr integrates into your workflow. Our platform was built to be the ultimate preventative tool, automating the deep-dive analysis needed to identify red flags almost instantly. Instead of waiting weeks for a manual search to uncover a problem, you can identify it—and begin solving it—right away.

By incorporating a tool like TitleTrackr into your process, you shift from hoping for a clear title to ensuring one. You empower your team to handle transactions with confidence, protect your clients' interests, and secure your investments against the risks hiding in public records.

Don't wait for a title defect to put your deal on life support. Take control from the start. Request a demo of TitleTrackr and see how our advanced AI can become your most valuable asset for stopping property title issues before they ever become problems.

Your Top Questions About Property Titles, Answered

Even for seasoned professionals, the nuances of property titles can be complex. We understand. This section serves as a quick-reference guide to the most common questions that arise for real estate professionals and investors.

Mastering these fundamentals is key to approaching any transaction with clarity and confidence.

What’s the Difference Between a Property Title and a Deed?

This is a frequent point of confusion, but the distinction is straightforward. Think of the relationship between your ownership of a car and the physical pink slip.

A property title is not a physical document. It is the legal concept representing a bundle of ownership rights—the right to use, possess, and transfer the property. In contrast, a deed is the physical legal document that is signed and recorded to officially transfer those ownership rights from one party to another.

In short, the title is the right to own it; the deed is the proof of a transfer.

How Does Title Insurance Actually Protect Me?

Title insurance is unique. Unlike other insurance policies that protect against future events, a title policy shields you and your lender from past issues. It is a financial safeguard against title defects that existed before you acquired the property but were not identified during the initial title search.

For example, if a forged signature on a decades-old document or an unknown heir with a valid claim emerges after closing, your policy is designed to cover your legal defense costs and any financial losses incurred, up to the full value of the policy.

Can I Just Do My own Title Search?

Technically, public records are accessible to anyone. However, for any serious transaction, attempting to conduct your own title search is like performing your own dental work—strongly not recommended.

A professional title search involves much more than looking up a few records. Professionals (and specialized platforms) are trained to interpret complex legal language, meticulously trace the chain of title through generations of documents, and identify subtle red flags that are easily missed by an untrained eye. A single undiscovered issue could jeopardize the entire investment.

For a deeper dive into common queries, you can explore our full list of frequently asked questions on our website.

What Is a “Cloud on Title” and How Do I Get Rid of It?

A “cloud on title” is any claim, lien, or unresolved issue that creates uncertainty about who holds true ownership of a property. It makes the ownership questionable and can stop a sale in its tracks.

Common issues that create a cloud include:

- A mortgage that was paid off but never officially recorded as released.

- A claim from an ex-spouse or a previously unknown heir.

- A boundary dispute with an adjacent property owner.

Removing a cloud typically occurs in one of two ways. The simpler path is obtaining a quitclaim deed from the party making the claim, which is a formal document where they release their interest in the property. If that is not feasible, the other option is a quiet title action—a lawsuit that asks a court to make a final ruling and legally clear the title of any and all competing claims.

Navigating the complexities of property titles demands precision, speed, and absolute certainty. The only reliable way to protect your investments is to identify potential issues before they have a chance to derail a transaction.

TitleTrackr uses advanced AI to deliver the comprehensive, accurate, and fast title reports you need to close every deal with complete confidence.

Stop letting outdated, manual processes create unnecessary risk. Request a demo of TitleTrackr today and see how a modern solution can safeguard your deals.