Think of a land title search as a deep-dive background check on a piece of property. It's the essential process of digging through historical records to confirm who legally owns a property and, just as importantly, to uncover any hidden claims or problems that could derail a real estate deal.

At its core, a title search ensures the seller has the legal right to sell, and the buyer is getting a clean slate, free from someone else's debts or disputes. It’s the absolute foundation of any secure property purchase.

What a Land Title Search Actually Is

Before you’d ever buy a used car, you’d pull its vehicle history report to check for accidents or liens, right? A land title search is exactly that, but for real estate—where the stakes are infinitely higher. It's a meticulous investigation into a property's paper trail to confirm the seller is the genuine owner and to identify any skeletons in the closet that could threaten your investment.

This process is a non-negotiable step in any sound real estate transaction. Skipping it is like flying blind, leaving a buyer wide open to massive financial and legal risks that might not surface until years down the road.

Protecting Your Investment from Hidden Dangers

The main goal here is to drag any "clouds" or defects on the title into the light before you sign on the dotted line. These "clouds" are just unresolved issues or claims that could challenge your ownership rights later. A thorough search is your most critical risk-management tool.

By combing through public records, a title professional can uncover a whole host of potential nightmares, including:

- Outstanding Mortgages: A previous owner's mortgage that was never fully paid off can remain attached to the property, even after it's sold.

- Unpaid Property Taxes: If a prior owner skipped out on their taxes, the government can place a lien on the property—a debt that would become your responsibility.

- Liens from Creditors: Contractors who were never paid for a new roof, for example, can place a legal claim (a lien) against a property for those unpaid bills.

- Ownership Disputes: You'd be surprised how often an unknown heir, an ex-spouse, or a forgotten co-owner pops up with a legitimate claim to the property.

A clean title is the bedrock of property ownership. A title search is the meticulous process of ensuring that bedrock is solid, free of cracks and hidden faults that could compromise the entire structure of your investment.

The Broader Role in Real Estate Transactions

The sheer importance of land title searches is clear when you look at the industry built around them. In the U.S. alone, the Title and Settlement Services market hit $15.4 billion in 2024, a number that speaks volumes about its central role in every property transaction. If you want to dig deeper, you can discover more insights about the title and settlement industry's market size.

This industry does a lot more than just run searches. It also handles escrow, coordinates the closing, and prepares all the legal paperwork needed to transfer ownership securely.

Ultimately, getting a handle on this process is the first step toward protecting yourself from future financial headaches and legal battles. It’s what guarantees the property you're buying is truly yours, free and clear.

What the Traditional Search Process Really Looks Like

Ever seen a detective in an old movie piecing together a mystery that spans decades? That’s pretty close to what a traditional title examiner or abstractor does for a living. Their investigation doesn’t involve crime scenes, but it does lead them deep into county courthouses and public record offices—and sometimes into dusty, forgotten storage rooms that look like they haven't been touched in a century.

The old-school way of doing a land title search is a manual, often grueling, journey back in time. It demands an incredible amount of patience, a hawk-eye for detail, and a high tolerance for archaic record-keeping systems that can change completely from one county to the next.

The Hunt for an Unbroken Chain

The core mission is to build a chain of title. You can think of this as the property's official biography—a perfectly unbroken, chronological list of every single owner, starting with the current seller and stretching all the way back through history. Each "link" in that chain is a recorded document, usually a deed, that legally passed the property from one person to the next.

To put this chain together, examiners have to physically track down and read every historical document. They're often pulling massive, leather-bound deed books off shelves, squinting at microfilm readers, or—if they’re lucky—navigating clunky, primitive digital archives. A single gap or broken link is a huge red flag. It could mean a past transfer was fraudulent or just wasn't recorded properly.

A property transaction is only as strong as its chain of title. The traditional search is a painstaking, link-by-link construction of this history, and just one weak link can bring the whole structure of ownership crashing down.

Chasing Down Encumbrances and Restrictions

While they're building the ownership timeline, the examiner is also on the hunt for anything that could limit or challenge the new owner's rights. We call these encumbrances, and they come in all shapes and sizes. This part of the search means digging through entirely different sets of records, not just deeds.

- Mortgages and Liens: Examiners have to scour mortgage records for any outstanding loans. They also check court judgments for financial claims, like a mechanic's lien from an unpaid contractor or a lien for back taxes.

- Easements and Covenants: These are non-financial limits. An easement might give a utility company the right to access part of the land, while a covenant could put strict rules on what you can build.

- Other Legal Actions: The search also dives into probate court records to look for claims from heirs, divorce decrees that split property, and even old bankruptcy filings.

The Real-World Problems with Manual Searches

This detective work is absolutely riddled with obstacles that create serious risks and delays. Relying on physical paper and human interpretation means there are countless ways for things to go wrong. These aren't just hypotheticals; they derail real estate closings every single day.

For instance, a deed from 1920 might be written in cursive that’s nearly impossible to read today. A county clerk in 1975 could have misspelled a name, causing a key document to be indexed incorrectly and basically hidden from sight. In other cases, records are just plain lost, damaged by a long-ago flood, or completely missing from the archives.

This environment is a breeding ground for human error. An overworked examiner might misread a legal description or simply miss a critical document buried in a mountain of paperwork. Any one of these small mistakes can lead to a major title defect being overlooked, causing devastating legal and financial headaches for a buyer years down the road. The manual grind is exactly why experienced title abstractors and searchers are such skilled pros, but it also shines a bright light on the system's built-in flaws.

And then there's the time. A complex search can easily take days, sometimes even weeks, to finish. This creates a massive bottleneck in the closing timeline. It's a slow, laborious process that just doesn't mesh with the speed of the modern market—and it’s exactly why the industry has been crying out for a technological shift.

Uncovering Common Property Title Defects

The real value of a land title search is finding problems before they become your problems. Think of it as your field guide to the most common "clouds" or defects that can completely stop a property deal in its tracks. Once you understand these potential red flags, you'll see why a thorough, accurate search isn't just a formality—it's critical.

Let's cut through the dense legal jargon and look at real-world scenarios that pop up all the time during a title examination. These issues can be anything from a simple clerical mistake to a full-blown ownership war, but every single one has the power to derail a closing.

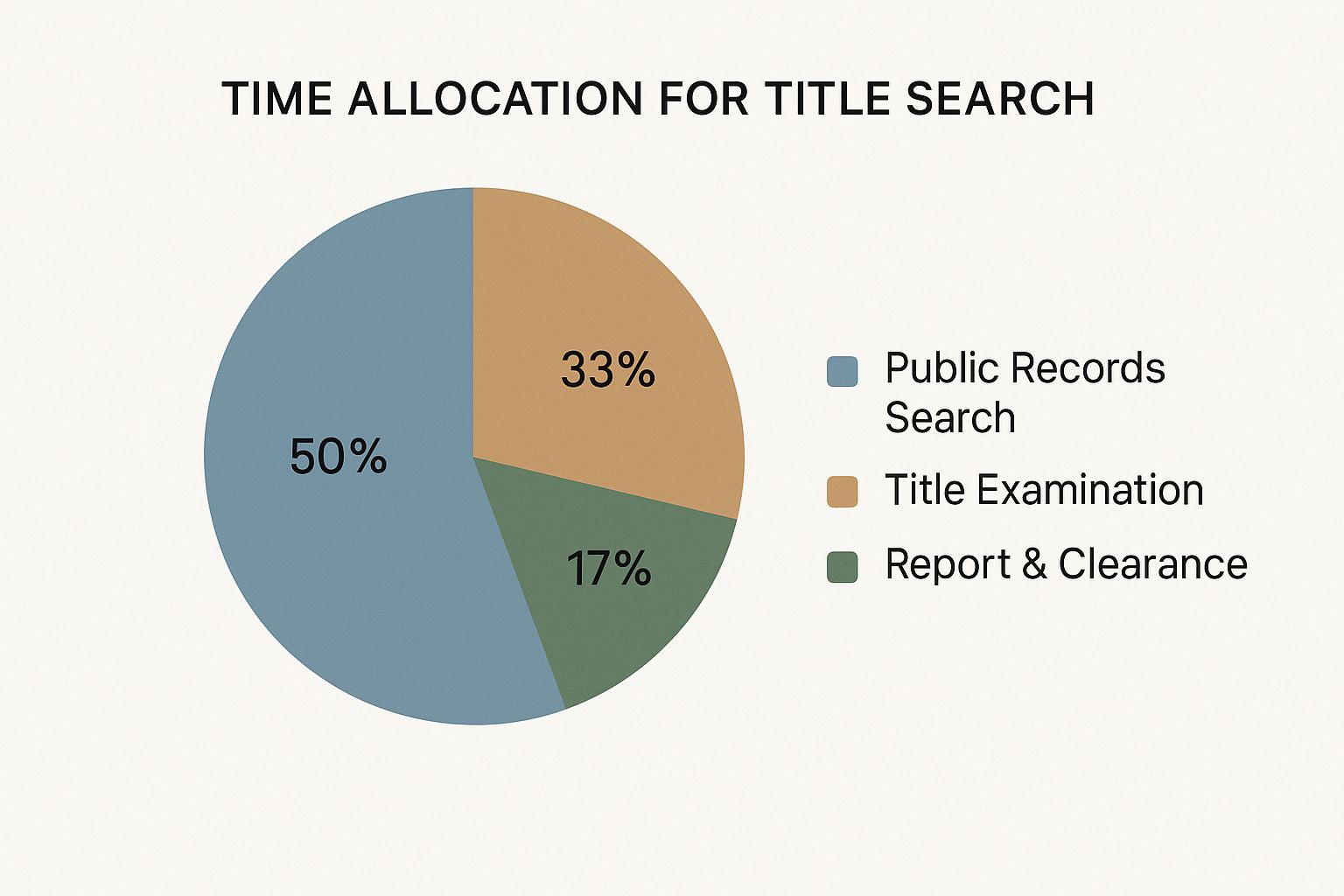

This infographic shows just how much time is spent on different parts of a traditional search. It really highlights where examiners focus their efforts to uncover these defects.

As you can see, a massive 50% of the entire process is spent just digging through public records. That alone shows you how much manual work goes into finding potential problems in the first place.

Financial Burdens and Surprise Liens

One of the most frequent discoveries is an unexpected financial claim tied to the property. These are called liens, and they function like a debt that travels with the land itself, not the person who owned it. If they aren't resolved, that debt can easily become the new owner's headache.

A classic example is a mechanic’s lien. Say the previous owner hired a contractor for a kitchen remodel but never paid the final invoice. That contractor can legally file a lien against the property, and it will stick there until the bill is settled.

Other financial surprises include:

- Unpaid Property Taxes: When property taxes aren't paid, the local government gets first dibs. They place a high-priority lien on the property that absolutely must be cleared before the title can change hands.

- Unpaid Mortgages: You'd be surprised how often an old mortgage was paid off, but the official release was never recorded. It just sits there, clouding the title. Other times, a second mortgage or a home equity line of credit was simply forgotten about.

- Judgment Liens: If a prior owner lost a lawsuit and had a money judgment entered against them, that court judgment can be attached to their real estate as a lien.

Errors and Gaps in Public Records

Not all title problems are about money. Plenty of them are born from simple human error that happened years or even decades ago. These kinds of clerical slip-ups can create massive confusion and often require legal action to fix.

For instance, a deed recorded back in 1985 might have a typo in the legal description, misstating the property’s boundaries. That one tiny mistake could spark a major boundary dispute with a neighbor down the road.

A clean title relies on a perfect paper trail. Even the smallest clerical error—a misspelled name, an incorrect date, or a transposed number—can create a significant legal ambiguity that must be resolved before a property can be securely transferred.

Another common headache is a gap in the chain of title. This happens when a transfer of ownership was never properly recorded, creating a break in the historical record. Maybe a property was passed down to an heir, but the deed was never officially filed with the county. This leaves the true ownership completely up in the air.

Ownership Claims and Hidden Heirs

Some of the most tangled title defects involve unexpected ownership claims from other people. These situations get messy fast, often dragging in family disputes or rights you never knew existed.

Imagine a seller inherited a house from a relative. A good title search might uncover a will that names another heir who also has a legal claim to a piece of the property. This "forgotten" heir could show up years later and challenge the new owner’s rights.

It's a similar story with divorce. An ex-spouse who was awarded an interest in the property might still be on the title. Without their signature, the property cannot be legally sold. These are perfect examples of how a land title search protects you from inheriting someone else’s unresolved personal drama.

Title defects come in all shapes and sizes, and we've put together a quick-reference table to show some of the most common issues, their impact, and how they typically get fixed.

Common Title Defects and Their Resolutions

| Title Defect | Potential Impact | Common Resolution Method |

|---|---|---|

| Unpaid Property Taxes | Government can foreclose on the property. Prevents a clean title transfer. | Payment of back taxes and any associated penalties before or at closing. |

| Mechanic's Lien | Unpaid contractors have a claim on the property, which can lead to foreclosure. | Settle the outstanding debt with the contractor to obtain a lien release. |

| Errors in Public Records | Creates ambiguity over property boundaries or ownership, potentially leading to lawsuits. | Filing a corrective deed or, in more complex cases, a "quiet title" action in court. |

| Undisclosed Heirs | A previously unknown heir could claim ownership rights to the property. | Locating the heir and having them sign off on the sale, or resolving the claim legally. |

| Gaps in Chain of Title | The historical record of ownership is broken, making it unclear who the true owner is. | Requires extensive research to locate the missing deed or legal action to establish clear ownership. |

Each of these potential snags reinforces the same core message: a meticulous process that leaves no stone unturned is the only way to ensure a clean and marketable title at closing.

How Technology Is Transforming Title Searches

For a long time, the title industry felt stuck in the past. The process for conducting a land title search relied on physical paperwork, endless filing cabinets, and painstaking detective work by skilled examiners. The move to digital records was a good first step, but it didn't fundamentally change the work.

The real revolution is happening right now, powered by intelligent automation and artificial intelligence (AI). This isn't just about making things faster; it’s a complete overhaul of how we approach property due diligence. Modern platforms can now do in minutes what used to take examiners days—or even weeks.

From Manual Labor to Intelligent Automation

Think about the traditional method: one person, digging through one county's records at a time. It’s a slow, linear slog. Today’s technology flips that entire model on its head. Instead of a human sifting through dusty deed books, sophisticated algorithms can scan millions of documents across countless public and private databases all at once.

This is far more than a simple speed boost. Automation is designed to flag discrepancies, spot potential title defects, and piece together the chain of title with a level of precision that even the most experienced human would struggle to match.

- Manual Process: Inherently prone to human error, limited by an individual's reading speed, and siloed to one dataset at a time.

- Automated Process: Operates with machine precision, chews through massive amounts of data in seconds, and cross-references everything to find hidden connections.

This evolution is changing the game. By 2025, the use of big data analytics, blockchain, and machine learning is expected to completely reshape the industry. Algorithms can now scan enormous property databases almost instantly, which dramatically cuts down on manual mistakes and turnaround times. You can learn more about the key technology trends for the title industry on skylinetitlesupport.com.

The Power of AI in Modern Land Title Searches

AI takes automation a step further. It isn’t just about doing the same old job faster; it’s about doing a smarter, more insightful analysis than was ever possible before. AI-powered platforms can actually interpret complex legal language, recognize patterns in a property's history, and identify subtle risks that might have otherwise gone unnoticed.

Technology is transforming the title search from a historical investigation into a predictive risk analysis. It provides a level of certainty and foresight that was previously unattainable, turning due diligence from a reactive process into a proactive strategy.

For instance, an AI system can analyze a property's entire transaction history and flag a series of quick, back-to-back sales—a classic indicator of potential title flipping or fraud. It can also spot tiny inconsistencies in legal descriptions across decades of deeds, which is a common source of messy boundary disputes. This deeper level of analysis builds a much stronger foundation for a secure transaction.

A New Standard for Speed and Certainty

The difference between the old way and the new way is night and day. A manual search might easily take a week to complete, but an automated system can often spit out a preliminary report in under an hour. This incredible acceleration doesn't sacrifice quality—in fact, it enhances it.

By removing the potential for human fatigue and simple oversight, automated systems deliver a far more consistent and reliable product. They ensure every single search is performed with the same rigorous standard, no matter how complex the property might be. This isn't just an improvement; it's a new benchmark for accuracy and client service in the real estate world.

Gaining a Competitive Edge with TitleTrackr

Let's be honest, just bolting on the latest tech isn't a real strategy. The right platform, however, delivers a genuine competitive advantage, turning your firm's due diligence from a cost center into a serious business driver. This is where the line between simple automation and true intelligence gets drawn.

Too many firms are stuck in the "before" picture. Their traditional land title searches are a constant source of bottlenecks. Workflows crawl, operational costs are sky-high from all the manual labor, and the risk of a simple human error hangs over every closing. In that environment, you can't grow. You end up turning down business because your team is already buried.

TitleTrackr was built to create the "after" picture. Our platform goes way beyond just automating old habits. It delivers intelligent, actionable insights that completely change how your team operates. It’s not about doing the same work faster—it’s about empowering your experts to work smarter.

From Manual Grind to Intelligent Workflow

TitleTrackr’s AI engine gets right to the heart of the pain points in a traditional search. Instead of an examiner spending days manually stitching together a chain of title, our system builds it automatically with incredible speed and precision.

It instantly digs through decades of records, flagging complex liens, judgments, and other nasty surprises that a human eye could easily skim over. The result is a clean, comprehensive report delivered in a fraction of the time. This isn't just a small efficiency boost; it’s a complete overhaul of your workflow.

Think about the shift:

- Before TitleTrackr: An examiner spends 80% of their day on tedious data collection and only 20% on high-value analysis and clearance.

- After TitleTrackr: That ratio gets flipped on its head. The AI does the heavy lifting, freeing up 80% of an examiner's time to solve complex title issues, talk to clients, and close more deals.

More Than Just Speed, It's About Capacity

This newfound efficiency hits your bottom line directly. By slashing the time spent on each search, firms using TitleTrackr can massively increase their transaction capacity without adding to their payroll. You can finally say "yes" to more clients and grow your business, knowing your team can handle the volume.

And it doesn't stop there. Our platform beefs up your risk mitigation. The AI’s ability to cross-reference huge datasets provides a much deeper level of scrutiny, uncovering subtle red flags that manual searches often miss.

When you turn due diligence from a time-sucking bottleneck into a swift, intelligent process, you don't just fix your internal operations. You deliver a far better experience for your clients and build a reputation for speed and rock-solid reliability.

The Tangible Business Impact

The story we hear from firms that adopt TitleTrackr is one of total transformation. They see a real, measurable drop in operational costs as billable hours spent on manual research disappear. Even better, they unlock their team's true potential, letting them shift from clerical work to strategic problem-solving.

This is how you get a leg up in today's market. You give your team tools that not only make them faster but make their jobs more rewarding. For anyone curious about the technical side, we provide detailed information for integrating our powerful AI into your own systems. You can explore the possibilities with the TitleTrackr developer resources.

Ultimately, this is about turning due diligence from a necessary evil into your firm’s greatest asset. See for yourself how TitleTrackr can help you manage risk more effectively, serve clients better, and drive your business forward.

The Future of Due Diligence is Here

The path of a land title search tells you everything you need to know about the future of real estate. We’ve gone from digging through dusty courthouse basements, piecing together fragmented records by hand, to today's integrated, tech-forward workflows. In a market that moves this fast, automation isn't just a nice-to-have—it's a requirement for staying in the game.

This isn't just about moving faster. The demand for rock-solid, timely due diligence is only getting stronger, a trend you can see in the industry's bottom line. In the first quarter of 2025 alone, the title insurance industry pulled in around $3.9 billion in premiums. That’s a hefty increase from the $3.3 billion seen in the same quarter last year. You can dig into the numbers yourself and see how market dynamics underscore the need for efficient title work.

Moving Beyond Software to a Strategic Partnership

In this kind of environment, a platform like TitleTrackr isn't just another piece of software. It becomes a strategic partner. It gives title professionals, lenders, and attorneys the tools to work with a level of speed, accuracy, and confidence that was impossible just a few years ago. The point isn't to replace experts, but to empower them.

When an intelligent platform handles the repetitive, data-heavy lifting of a search, it gives your team the one thing they can't make more of: time. This frees them up to shift their focus from mind-numbing research to high-value analysis and talking to clients.

The real goal of modern due diligence is empowerment. By bringing in intelligent solutions, you turn your team from data-gatherers into strategic advisors who are ready to solve complex problems and push the business forward.

Scaling Your Business the Right Way

The takeaway here is all about opportunity. Adopting smart automation for title searches isn't just about closing your next deal a little quicker. It’s about building an operation that's more resilient, scalable, and profitable for years to come.

When you free your best people from the manual grind, you unlock what they're really capable of. They can finally concentrate on what actually matters:

- Solving tricky title issues that need real human expertise.

- Building stronger client relationships by providing better service.

- Focusing on strategic growth that helps scale the business.

This is where real estate due diligence is heading—a smart blend of human insight and machine precision that builds a stronger foundation for every single transaction. To see how TitleTrackr can become your strategic partner in this new reality, request a demo today and find a smarter way to manage property risk.

Frequently Asked Questions

When you're dealing with something as important as a property's history, it's natural to have a few questions. Let's tackle some of the most common ones we hear to clear up any confusion about the world of land title searches.

How Long Does a Title Search Take?

This is a classic "it depends" situation, and what it depends on is the method. A traditional, manual search can really drag on, sometimes taking several days or even a couple of weeks to finish. This is especially true if the property has a long, tangled history with lots of owners and documents.

On the flip side, this is where modern tools shine. An automated platform can often crunch through the same records and deliver a full report in just a few minutes or hours. That massive speed boost is a game-changer for getting deals to the closing table faster.

What's the Difference Between a Title Search and Title Insurance?

It’s really easy to get these two mixed up, but they play completely different roles in protecting a real estate transaction.

- Title Search: Think of this as the investigation. It’s the proactive deep dive into public records to find any existing problems—like liens or ownership disputes—before you close.

- Title Insurance: This is your protection. It's an insurance policy that safeguards the new owner (and their lender) from financial losses if a hidden title defect, one the search missed, pops up later on.

A good analogy is that the search is like a home inspection for the property's legal history, while the insurance is the policy that covers you if the inspector missed some hidden structural damage.

Can I Do My Own Title Search?

Technically, anyone can go down to the courthouse and look at public records. But should you? Absolutely not. Performing your own title search is incredibly risky and something we strongly advise against.

The process demands a deep understanding of real estate law, the ability to decipher complex and often archaic legal documents, and access to specialized databases that the general public can't just log into. One small mistake or an overlooked document could snowball into a legal and financial nightmare for you years from now.

Professional expertise isn't just a nice-to-have; it's essential for a truly thorough and accurate search. For more answers, feel free to check out our full list of frequently asked questions on titletrackr.com/faq.

Ready to see how intelligent automation can transform your title search workflow? At TitleTrackr, we empower your team to work faster and more accurately than ever before. Eliminate bottlenecks, reduce operational costs, and scale your business with confidence.