A lien is a legal claim against a property for an unpaid debt. It’s the critical first step that can eventually lead to foreclosure. For professionals in the real estate and title industries, understanding this link isn't just academic—it's the core of risk management.

Think of a lien as a red flag on a property's title. If that flag isn't dealt with, the creditor has the right to start the foreclosure process—the legal mechanism for forcing a sale to recover their investment.

Understanding the Link Between Liens and Foreclosure

At its heart, the relationship between liens and foreclosure is all about cause and effect. A lien is what establishes a creditor’s legal interest in a property, securing the debt owed. Foreclosure is the action they take to enforce that interest and collect what they're owed.

Let's say a contractor completes a major home renovation, but the property owner fails to pay the final bill. That contractor can file a mechanic's lien on the house. This doesn't force an immediate sale, but it does cloud the property's title, making it almost impossible to sell or refinance until the debt is settled.

That "red flag" has to be addressed. If the debt remains unpaid, the contractor can then initiate foreclosure proceedings to force a sale of the home, using the proceeds to cover the outstanding balance.

To make this crystal clear, here’s a quick breakdown of how these two concepts differ.

Key Differences Between Liens and Foreclosure

| Concept | What It Is | Who Initiates It | Primary Purpose |

|---|---|---|---|

| Lien | A legal claim or "hold" placed on a property. | The creditor (lender, contractor, government). | To secure a debt and cloud the property title. |

| Foreclosure | The legal process of seizing and selling a property. | The lienholder (creditor). | To recover the money owed from the property sale. |

Essentially, the lien is the warning shot, while foreclosure is the action that follows if the warning is ignored.

Why This Matters in Today's Market

Grasping this dynamic is more important than ever as economic shifts put pressure on property owners. In the first quarter of 2025 alone, 68,794 U.S. properties had foreclosure proceedings started against them—a 14 percent increase from the previous quarter. This spike shows the real-world consequences of unresolved liens. You can dig deeper by exploring the full report on recent U.S. foreclosure activity.

For any real estate professional, from investors to lenders and title abstractors, navigating this environment demands serious diligence. A single hidden lien can completely derail a transaction, lead to huge financial losses, and spark complicated legal fights. The biggest hurdles usually come down to:

- Complexity: Different liens come with their own rules and priorities.

- Time: Digging through county records manually is painfully slow and inefficient.

- Accuracy: A simple human error can mean missing a claim and facing costly consequences.

A Modern Approach to Managing Risk

This is where getting proactive about risk management becomes non-negotiable. Relying on slow, old-school methods just doesn't cut it anymore. Manually trying to track liens and gauge the potential for foreclosure is a recipe for falling behind in a market that moves this fast.

A lien is the claim; foreclosure is the consequence. Successfully managing real estate investments means mastering the ability to identify and resolve the claim before the consequence becomes inevitable.

Platforms like TitleTrackr offer a direct solution by automating the entire discovery process. By quickly and accurately flagging potential title issues, investors and property professionals can make smarter decisions, reduce their risk, and get ahead of problems before they escalate. This foundational knowledge of how liens trigger foreclosure is the first step toward truly protecting your assets.

A Closer Look at the Different Types of Property Liens

Not all liens are created equal. You can think of them as different kinds of claims staked on a property's title—some are placed there by choice, while others show up without the owner's permission. For industry professionals, mastering these categories is the first step in accurately assessing the risk attached to any piece of real estate.

The simplest way to break them down is into voluntary and involuntary liens. Each one represents a different flavor of debt and comes with its own set of rules for property owners and potential investors.

Voluntary Liens: The Ones You Agree To

A voluntary lien is just what it sounds like: a claim you willingly let a creditor place on your property as collateral for a loan. The classic example? A mortgage.

When a property is purchased with financing, the buyer agrees that the lender can hold a lien against it. If they fall behind on payments, the lender can use that lien to kick off the liens and foreclosure process and get their money back. It's a standard and expected part of almost every financed real estate transaction.

Involuntary Liens: The Unwelcome Surprises

Involuntary liens, on the other hand, are the ones that get slapped on a property without the owner’s consent, usually because of an unpaid debt. These are often the hidden landmines that can blow up a transaction and create unexpected financial headaches. They come in a few common forms.

- Tax Liens: Filed by government agencies for unpaid property taxes, income taxes, or other state and federal debts. These are particularly dangerous as they often jump to the front of the line, ahead of all other liens.

- Mechanic's Liens: Placed by contractors, suppliers, or laborers who did work or provided materials for a property but never got paid for it.

- Judgment Liens: These come straight from a lawsuit. If someone wins a monetary judgment against a property owner who doesn't pay up, the court can grant a lien against their real estate.

A voluntary lien is a calculated part of a financial plan. An involuntary lien is the consequence of an unpaid bill, often popping up when you least expect it and posing a serious threat to a clean title.

How an Involuntary Lien Plays Out in the Real World

To see just how much impact these can have, let's walk through a scenario. A homeowner hires a roofing company for a $15,000 roof replacement. The job gets done, but the homeowner has a dispute over the work and refuses to pay the final bill.

The roofing company can then file a mechanic's lien with the county recorder's office. Just like that, the property’s title is clouded. The owner can't sell or refinance until that $15,000 debt is cleared. If it stays unpaid, the roofer could even move to foreclose on the home to collect their money. A single unpaid invoice has now mushroomed into a major legal and financial crisis.

Understanding Lien Priority: The Pecking Order of Debt

When a property goes into foreclosure and is sold, creditors don't just get paid in a free-for-all. They are paid based on lien priority, which sets the order of repayment. The general rule of thumb is "first in time, first in right"—meaning liens are usually paid off in the chronological order they were recorded.

But here’s where it gets tricky. There are major exceptions to that rule. Property tax liens almost always have super-priority, allowing them to leapfrog to the very front of the line, even ahead of a first mortgage recorded years earlier. This is a massive deal for lenders, since a tax foreclosure could completely wipe out their financial interest in the property.

Wrangling these details requires serious precision. For professionals in this space, knowing how to untangle a complicated lien history is everything. Title abstractors, for instance, are the experts who uncover and organize these claims. You can learn more about how technology supports title abstractors in navigating this complex work. Getting the priority right isn't just a detail—it's the key to understanding the true financial risk tied to a property.

Navigating the Foreclosure Process Step by Step

The journey from a first missed mortgage payment to a final foreclosure sale isn’t a sudden event. It's a structured, legally defined process that unfolds over weeks and months. For anyone working in real estate, understanding this roadmap is crucial, as every stage presents its own set of risks and opportunities.

It all starts when a borrower defaults on their loan, usually after missing several payments in a row. This initial period, known as pre-foreclosure, is a critical window. Here, the homeowner still has a chance to make things right by catching up on what’s owed or working out a new arrangement with their lender. If that doesn't happen, the formal legal gears start turning.

The Official Notice of Default

Once the pre-foreclosure window closes without a solution, the lender kicks off the formal process by filing a Notice of Default (NOD). This isn't just a letter; it's a legal document recorded with the county that publicly declares the borrower has broken the terms of their loan.

The NOD is what officially starts the foreclosure clock. State laws are very specific about how long the borrower has to fix the problem after this notice is filed, typically offering a grace period between 30 to 120 days. This is the borrower's last formal opportunity to prevent the property from being sold by paying the outstanding debt.

Judicial vs. Non-Judicial Foreclosure Paths

From here, the process splits into two main tracks, depending on state law and what’s written in the original loan documents. The path it takes dramatically changes how long the foreclosure will take and how complicated it gets.

- Judicial Foreclosure: This route is exactly what it sounds like—it goes through the court system. The lender has to file a lawsuit, and a judge must sign off on the foreclosure. Because it involves courts, lawyers, and potential backlogs, this path is almost always longer and more expensive.

- Non-Judicial Foreclosure: In states that permit it, this process is much quicker because it avoids the courts entirely. The right to sell the property is granted by a "power of sale" clause in the mortgage or deed of trust, letting the lender move directly to a sale after following specific notification rules.

Whether a foreclosure goes through the courts or not is one of the biggest variables in the entire process. A non-judicial sale might be wrapped up in a few months, whereas a judicial foreclosure can easily stretch for over a year.

We've been seeing an uptick in these proceedings lately. Mid-year 2025 data showed that total U.S. properties with foreclosure filings hit 187,659 in the first six months. That's a 5.8 percent increase from the first half of 2024, with new foreclosure starts jumping by 7 percent in the same period. You can dig into the specifics by reviewing the analysis of 2025 foreclosure activity.

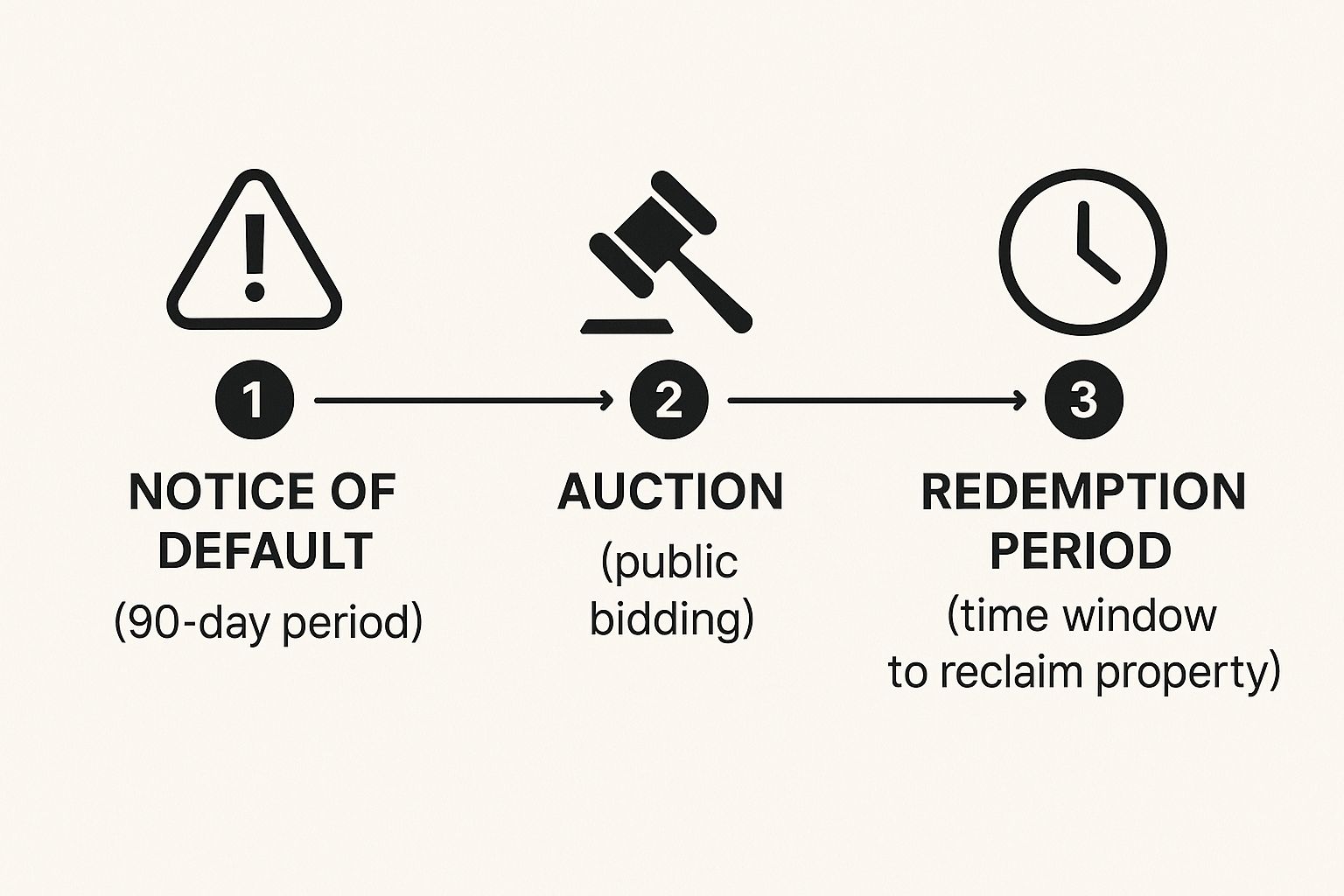

This simple infographic breaks down the three core stages that follow the initial default.

As you can see, the process is built on distinct, time-bound phases, from that first official notice all the way to the final chance for the original owner to reclaim their property.

The Auction and Post-Sale Period

If the borrower can't cure the default in time, the property is scheduled for a public auction. A Notice of Sale is published, telling the public the date, time, and location. At the auction, the property goes to the highest bidder—which could be a third-party investor or even the lender themselves.

But the story doesn't always end there. Many states have what’s called a redemption period after the sale. This gives the foreclosed homeowner one last, limited window to buy back their property by paying the full auction price, plus any extra costs and interest. How long this period lasts varies wildly from state to state, adding yet another layer of local complexity to the foreclosure landscape.

Legal Considerations and Regional Differences

If you're diving into the world of liens and foreclosure, you need to understand one thing first: this is not a one-size-fits-all game. The rulebook for enforcing a lien and selling a property can change dramatically the moment you cross a state line. What's standard procedure in one state could be a massive legal blunder in another, making local knowledge absolutely essential.

This legal patchwork all starts with a fundamental difference in how states treat property ownership. The country is split into two camps: lien theory states and title theory states. This single distinction determines who actually holds legal title to a property while a mortgage is being paid off, and it changes everything.

Lien Theory Versus Title Theory

In a lien theory state, the homebuyer holds both the legal and equitable title right from day one. Think of the mortgage as just a claim—a lien—the lender places against the property. The lender has a right to the property if the loan defaults, but they don't own it. Most states, including Florida and Illinois, operate this way.

Now, flip that around for a title theory state like California or Texas. Here, the lender holds the legal title until the very last mortgage payment is made. The borrower gets to live in and use the property (that’s the equitable title), but on paper, the lender is the owner. It might sound like a small difference, but it gives lenders in title theory states a much faster track to foreclosure if a borrower defaults.

The legal theory a state follows—lien or title—is the foundation upon which its entire foreclosure framework is built. Understanding this single detail is the first step in assessing risk and timelines in any given market.

State-Specific Rules That Change Everything

Beyond that core difference, a whole spiderweb of state-specific laws dictates every step of the foreclosure process. These local rules can create huge opportunities for savvy investors or devastating traps for the unprepared.

Here are just a few examples of how wild the variations can be:

- Redemption Periods: Some states give the original homeowner a "redemption period" after a foreclosure sale to buy back their property. In Texas, this window is pretty limited. But head over to a state like California, and that period can stretch for months, leaving the new buyer in limbo.

- Notification Requirements: The law is incredibly picky about how a lender must notify a borrower about an upcoming foreclosure. Florida, for instance, has very precise rules on how and when notices have to be sent. One tiny procedural mistake can get the whole case tossed out of court.

- Judicial vs. Non-Judicial Processes: As we've touched on, some states require a court-supervised (judicial) foreclosure, while others allow a much quicker non-judicial process. This factor alone can be the difference between a foreclosure that’s over in a few months and one that drags on for more than a year.

You can see the real-world impact of these differences in the national foreclosure numbers. For example, recent data from July 2025 showed foreclosure "hot spots" clustering in certain states. Nevada had the highest distress level with one foreclosure filing for every 2,326 housing units, with Florida (1 in 2,420) and Maryland (1 in 2,566) right behind. You can dig deeper into these regional foreclosure trends on SafeguardProperties.com.

Trying to keep all these complex and constantly changing rules straight across multiple states is a recipe for disaster. A missed deadline or a misunderstood local statute can have serious financial and legal blowback. This is exactly why a tool like TitleTrackr is so crucial. It's built to navigate these different legal requirements for you, ensuring compliance and cutting down the risk of a costly mistake, no matter where the property is.

Automating Lien Research with TitleTrackr

Knowing the ins and outs of liens and foreclosure is one thing. Actually digging through the records yourself? That’s a whole different beast. The old way of doing title and lien searches is painfully slow, getting bogged down in messy county-level data where it’s all too easy for a human to make a mistake. An analyst can burn hours, even days, sifting through dense public records, and one missed document can lead to a financial catastrophe.

Trying to do this manually is like assembling a million-piece puzzle without the picture on the box. For investors, lenders, and title professionals, this outdated method injects an unacceptable amount of risk and delay into every single deal.

The High Cost of Manual Inefficiency

The root of the problem is that property data isn't all in one place. It’s scattered across thousands of county offices, and each one has its own unique system for recording and organizing information. This fragmentation means a manual search isn’t just time-consuming—it's inherently risky.

A simple clerical error, a misspelled name, or an overlooked filing can cause a critical lien to go completely undiscovered. This is exactly how investors end up with properties that have clouded titles, suddenly facing claims from creditors they never even knew existed. The manual process just wasn't built for the speed and scale of today's real estate market.

Speed and Precision with Automated Technology

This is where TitleTrackr completely changes the game. Our platform swaps out the slow, error-prone manual search for a powerful, automated system built for speed, accuracy, and total coverage. Using advanced AI and machine learning, TitleTrackr scans millions of records from all those scattered sources in minutes, not days.

It intelligently flags all relevant encumbrances tied to a property, including things like:

- Mortgage liens and deeds of trust

- Involuntary liens like tax, mechanic's, and judgment liens

- Easements, covenants, and other potential title clouds

- Pending legal actions that could impact ownership

Instead of relying on a tired pair of eyes, our system cross-references data points and verifies information with a level of precision that a human just can't match. This drops the risk of overlooking a critical detail to nearly zero.

Here's a look at the TitleTrackr dashboard, which gives you a clean, organized view of all the important property data and potential title issues.

The dashboard takes all that complex information and puts it into an easy-to-read format, so you can quickly size up the risk and make a smart call without wading through raw documents.

A Real-World Scenario Uncovering Hidden Risk

Let’s walk through a common situation. An investor is looking at a promising foreclosure property. A standard, manual title search comes back clean, showing just the primary mortgage lien. Based on that report, the investor gets their bid ready for the auction, feeling good about the property’s value.

But what if the manual search missed something? What if a contractor filed a $25,000 mechanic's lien just a few weeks ago, and the paperwork got misindexed at the county office?

This kind of thing trips up even seasoned pros. An investor using TitleTrackr, however, would have a completely different outcome. Our AI doesn’t just look at the standard records; it casts a much wider net, analyzing recent filings and other related documents. In this case, TitleTrackr would flag that mechanic's lien instantly, giving the investor a heads-up about the hidden liability.

That one piece of information changes the entire financial picture. Armed with this knowledge, the investor can adjust their bid to account for the $25,000 debt or simply walk away from a deal that would have turned into an immediate, unexpected loss. That's the power of automated, comprehensive research—it turns hidden risks into calculated decisions.

Make Faster, More Confident Decisions

At the end of the day, success in real estate boils down to making smart, fast, and informed decisions. By automating the most tedious and high-stakes part of due diligence, TitleTrackr lets you do just that. You can evaluate more properties in less time, cut down your exposure to title-related risks, and jump on opportunities with a level of confidence that manual research could never provide.

Stop letting outdated processes hold you back. It’s time to see how automation can protect your investments and speed up your workflow. You can explore our platform further by starting a free trial of TitleTrackr today.

Common Questions About Liens and Foreclosure

Even after you get the basics down, the world of liens and foreclosure can feel like it's full of tripwires and "what ifs." It's a corner of the real estate world where the rules are very specific and the scenarios can get complicated fast.

Let's clear up some of the most common questions that pop up for investors, real estate pros, and even homeowners. Getting these details right isn't just about knowing the terminology; it's about protecting your financial interests and legal standing.

Can You Sell a Property with a Lien on It?

Absolutely, but there’s a big catch. A property with a lien can be sold, but that lien has to be paid off—or "satisfied"—before the title can be cleanly transferred to the new owner. This isn't optional; it's a fundamental part of closing the deal.

Typically, the money from the sale is used to pay the lienholder first. If the sale price doesn't cover the entire debt, the seller might have to bring cash to the closing table to cover the shortfall. An undiscovered lien can bring a transaction to a dead stop, which is exactly why a comprehensive title search is so critical.

How Long Does Foreclosure Usually Take?

There's no single, simple answer here. The timeline for a foreclosure can vary wildly depending on two huge factors: the state you're in and the type of foreclosure.

- A non-judicial foreclosure is the faster route. Since it doesn't go through the court system, it can sometimes be wrapped up in just a few months.

- A judicial foreclosure is a different story. It requires court supervision, making it a much longer and more drawn-out process. It can easily take many months, and in some cases, well over a year, especially if the court has a backlog or there are legal challenges.

This massive difference in timing makes it crucial for anyone involved to have up-to-date, accurate information on a property’s status.

What Is Lien Priority and Why Is It So Important?

Think of lien priority as the "pecking order" for who gets paid after a foreclosure sale. It’s the system that decides which creditors get their money first. The general rule is "first in time, first in right," which means liens are usually paid off in the order they were recorded.

But here’s where it gets interesting—there are major exceptions. Some liens, like those for unpaid property taxes, get what's called "super-priority" status by law. This lets them jump to the very front of the line, getting paid even before a first mortgage that was recorded years ago.

Understanding lien priority is everything for lenders and junior lienholders. It determines whether they’ll get any of their investment back or if their claim will be completely wiped out by debts that are higher up the chain.

For a deeper dive, you can find more answers on our extensive TitleTrackr FAQ page, which covers a whole range of topics on titles and property records.

How Can I Find Out If There Are Liens on My Property?

The old-school way to find liens is to head down to the county recorder’s office and do a manual title search. This means physically digging through giant books of public records—a process that not only takes forever but is also wide open to human error.

A much smarter and more reliable way is to use a modern digital platform. An automated system can rip through millions of local and national records in minutes. It spits out a full report that details any liens, judgments, or other title problems, giving you a crystal-clear picture of where the property stands.

Can a Lien Just Expire?

Yes, liens don't stick around forever. Every state has a statute of limitations, which is basically a deadline for a creditor to take legal action to enforce their lien. If the creditor doesn't start foreclosure proceedings within that window, the lien can become unenforceable.

For example, a mechanic's lien might be void after just one year if the contractor doesn't file a lawsuit. On the other hand, judgment liens can often be renewed, giving them a much longer lifespan. It’s vital to track these dates, because an expired lien can still show up on a title report and will need to be formally removed.

Navigating the minefield of liens, foreclosures, and title issues demands both speed and precision. At TitleTrackr, we give you the AI-powered tools to automate your research, cut down your risk, and make faster, more confident decisions.

Request a demo of TitleTrackr today and see for yourself how our platform can bring clarity and control to your work.