Imagine trying to sell a house without a deed or a car without its title. It sounds impossible, right? That’s the very problem documents of title solve for global trade. These critical papers are the official 'deeds' for goods in storage or on the move, proving who owns what.

This simple concept allows billions of dollars in products to be bought, sold, and financed, often without anyone physically touching the cargo. However, managing these paper-based assets in a digital world introduces massive risks of fraud, loss, and costly delays.

The Keys to Global Trade and Commerce

In the intricate dance of commerce, documents of title are the foundation of trust. They’re far more than just fancy receipts; they legally represent the physical goods themselves. This unique quality turns them into keys, unlocking the flow of products across oceans and continents.

Without them, every single transaction would demand the physical handover of goods. Can you imagine the chaos? International trade would grind to a halt.

Think about it this way: a coffee importer in Europe can buy an entire shipment of beans from a supplier in South America while the cargo ship is still mid-Atlantic. The importer doesn't get the beans right away. Instead, they get the document of title. That single piece of paper gives them legal control over the coffee, which they can then use as collateral to get a loan from their bank.

Why Documents of Title Matter

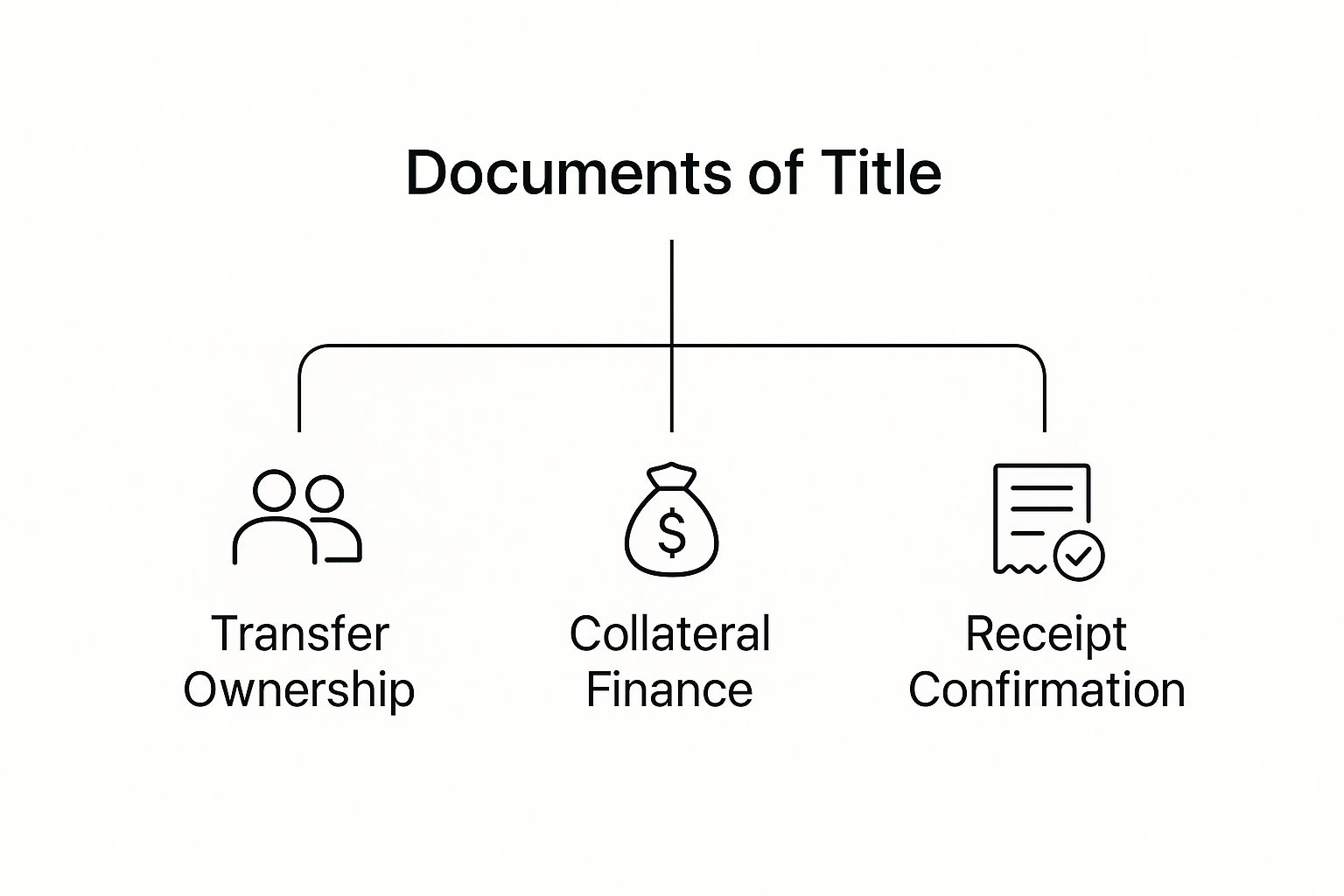

At their core, these documents bring security and predictability to an otherwise messy supply chain. They fulfill a few absolutely critical jobs that modern business depends on:

- Proof of Ownership: They offer clear, legally-binding proof of who owns the goods at any point in time.

- Contractual Agreement: The document also doubles as a contract between the goods' owner and the company hauling or storing them (like a shipping line or a warehouse).

- Transferability: Here’s the magic. Ownership can be transferred just by signing over the document to someone else, much like endorsing a check.

This ability to transfer ownership with a piece of paper is what keeps global trade so fluid. It allows goods to be sold and resold multiple times while still on a ship, creating nimble, fast-moving markets.

This guide will break down these vital documents, walking you through the main types you'll encounter and explaining what gives them their legal muscle. We’ll also see how new tools are finally dragging this paper-based world into the 21st century, replacing risky paper trails with secure, automated systems. Getting a handle on these ideas is the first step toward mastering the real backbone of commerce.

What Really Makes a Document a “Title”?

So, what’s the big deal about a document of title? What makes it different from a regular invoice or a packing slip? The secret isn’t in the paper itself, but in the unique legal weight it carries. A true document of title is a powerhouse in the world of commerce because it does three critical jobs at once.

First, it’s a receipt. It’s proof that a carrier or a warehouse has officially taken possession of specific goods. Second, it’s a contract, outlining the terms for transporting or storing those goods.

But the most important function—the one that changes everything—is its role as proof of ownership. Whoever holds that document legally controls the goods it represents.

The Magic of Negotiability

This is where documents of title get their real power. Most are negotiable, which is a fancy way of saying ownership of the actual goods can be transferred just by signing over the document to someone else. It's like turning a giant container of goods into a small, easy-to-handle piece of paper.

Imagine an importer buying a shipment of coffee beans from Brazil. The grower gives the beans to the shipping company and gets a bill of lading in return—a classic document of title. The grower can then send that bill of lading to the importer's bank.

By possessing the document of title, the bank now controls the coffee beans, even though they're on a cargo ship halfway across the ocean. This gives the bank the confidence to finance the deal, using the beans as collateral long before they arrive at port.

This mechanism is the lifeblood of the global economy. Documents of title are central to global trade finance, which is an industry valued at around $18 trillion. It's estimated that 70-80% of these transactions rely on documents like bills of lading as collateral. Closer to home, in the US agricultural sector alone, warehouse receipts represent ownership of about $15 billion in grain inventories.

The Legal Line in the Sand

It’s crucial to understand what separates a true document of title from other commercial paperwork. While both are important, they serve fundamentally different purposes. An invoice just records a sale, but a bill of lading can transfer ownership of the goods themselves.

To make this crystal clear, let's break down the differences.

Document of Title vs Standard Commercial Document

| Feature | Document of Title (e.g., Bill of Lading) | Standard Document (e.g., Commercial Invoice) |

|---|---|---|

| Primary Function | Represents ownership & control of goods | Records details of a transaction |

| Legal Power | Confers title; holder can claim the goods | Provides information; no ownership rights |

| Transferability | Can be negotiated to transfer ownership | Cannot be transferred to pass ownership |

| Use as Collateral | Yes, widely used for trade finance | No, not accepted as collateral |

| Who Issues It | Bailee (carrier or warehouse) | Seller/Shipper |

This distinction is everything. It’s what allows financiers to lend against goods they’ve never seen and gives real estate abstractors the paper trail they need to verify ownership history.

Ultimately, these documents are the trusted currency of trade because they provide legal certainty. They allow people to buy, sell, and finance massive quantities of goods with confidence, knowing their rights are protected by the document they hold.

The Most Common Types of Title Documents

While the idea of a "document of title" sounds a bit abstract, in the real world, you'll really only run into three main kinds. Each one has a specific job, and together they are the workhorses that keep global commerce moving. Think of this as your field guide to the "big three" documents you'll see every day.

Let's dive into what they are and how they work.

This visual breaks down their core functions: proving ownership, securing financing, and acting as a receipt.

As you can see, these roles all feed into one another. Each document supports one or more of these critical commercial activities, making sure business gets done smoothly.

The Bill of Lading

The Bill of Lading (B/L) is the undisputed champion of international trade, especially when goods are moving by sea. A carrier issues it to a shipper, and it serves as the official record of what’s being shipped, how much of it there is, and where it’s going. This is the key that unlocks global cargo movement.

A B/L generally comes in two main flavors:

- Negotiable Bill of Lading: This is the powerful one. It’s made out "to order," which means whoever is in legal possession of the physical document can claim the goods. This flexibility is what allows cargo to be bought and sold over and over again while it’s still on a container ship in the middle of the ocean.

- Non-negotiable Bill of Lading: Sometimes called a "straight" bill of lading, this version is much simpler. It names a specific recipient, and that’s it—the goods can only be delivered to them. This makes it less of a tradable title and more of a straightforward contract and receipt.

Here’s a classic example: An exporter in Vietnam ships a container of furniture to a buyer in Los Angeles. The exporter can use a negotiable B/L to secure payment. They give the B/L to their bank, which sends it to the buyer's bank. Only after the buyer pays for the furniture does their bank release the B/L to them, giving them the right to pick up their container at the port.

The Warehouse Receipt

If the Bill of Lading is for goods on the move, the Warehouse Receipt is for goods at rest. When you store products in a third-party warehouse, the operator gives you this document as proof that they are holding your specific goods. It's an indispensable tool for any business that needs to keep inventory, from farmers storing grain to electronics companies stocking up on components.

Just like a B/L, a warehouse receipt can also be negotiable, and that’s where its real power lies. It turns a static, physical asset sitting in a building into a flexible financial tool.

Picture a farmer who has just harvested 10,000 bushels of corn. They can store it at a local silo and get a negotiable warehouse receipt in return. Instead of having to sell the corn right away, the farmer can take that receipt to a bank and use it as collateral for a loan. The bank holds the receipt—giving them control over the grain—until the loan is paid off. That piece of paper just turned a pile of corn into immediate working capital.

The Delivery Order

The Delivery Order is a bit different, but no less important. It's essentially a written instruction from the owner of the goods to whoever is holding them—a warehouse, a carrier, etc.—telling them to release the goods to a specific person or company.

Here’s the key difference: a Bill of Lading or Warehouse Receipt usually covers the entire shipment or stored lot. A delivery order, on the other hand, can be used to release just a portion of those goods. This makes it a fantastic tool for breaking up a large bulk shipment to fulfill smaller sales orders without moving everything at once.

The Shift from Paper Trails to Digital Trust

For centuries, the rhythm of commerce has been set by the rustle of paper. It was a reliable system, but it always carried a heavy burden of risk. Think fraud, physical loss, and the kind of costly delays that could grind an entire supply chain to a halt. The industry’s move away from these tangible documents toward secure electronic records isn't just an upgrade; it's a fundamental change in how global trade works.

This isn't about convenience for convenience's sake. It’s a direct answer to the intense pressures of doing business today. The old way of doing things—stuffing documents into a courier pack and sending them across continents—can take weeks. In a market that moves at the speed of a click, those delays mean tied-up capital and missed opportunities, costing businesses billions every year.

From Maritime Origins to Modern Hurdles

The story of paper documents of title is really a story about the sea. Their use exploded back in the 19th century with the rise of the bill of lading. By the late 1800s, an incredible 70% of international cargo shipments relied on negotiable bills of lading. This simple piece of paper was revolutionary, allowing ownership of goods to change hands while they were still on a ship halfway across the world. It was the key that unlocked global trade, financing, and smarter risk management. You can find more great insights into the history of trade documentation from UNCTAD.

But here's the irony: the very physicality that once made these documents trustworthy now makes them a massive liability. A single lost or forged bill of lading can freeze a multi-million dollar shipment in its tracks. That means expensive port storage fees, messy legal fights, and deeply damaged business relationships. This is the friction that’s forcing the industry’s hand toward a digital future.

The core problem with paper is the lag between physical reality and documented reality. Digital documents close this gap, allowing ownership and information to travel at the speed of light, not the speed of a courier service.

The solution is already here in the form of electronic documents of title, like the electronic Bill of Lading (eBL). We're not talking about a simple PDF scan. These are cryptographically secure digital assets that carry the exact same legal weight as the paper they replace.

Building a Framework for Digital Trust

Making this switch isn't a leap of faith; it's backed by solid international legal frameworks that give businesses the confidence they need. One of the most important developments is the UNCITRAL Model Law on Electronic Transferable Records (MLETR). This model law gives electronic documents full legal recognition, ensuring they can be used to transfer ownership and secure financing, just like their paper ancestors.

Adopting electronic documents of title brings some pretty incredible benefits to the table:

- Instantaneous Transfers: Ownership changes hands with a click. This completely gets rid of courier delays and means everyone gets paid faster.

- Enhanced Security: Cryptographic signatures and secure registries make fraud and accidental duplication nearly impossible.

- Reduced Costs: Businesses slash spending on administrative work, courier fees, and fixing costly human errors.

- Greater Visibility: Every party involved has a real-time, transparent view of who owns the document and its entire history.

This move from paper trails to digital trust is more than just a trend. It's the only way forward for a more secure and efficient world of commerce.

How to Automate and Secure Your Title Documents

Once you understand the headaches of manual tracking and the constant risk of fraud, the next question is obvious: how do we fix this? The answer isn't just about scanning paper. It’s about ditching outdated systems for a modern solution built specifically for automating and securing your documents of title.

Think about it. This is a complete reinvention of the process.

Imagine a single dashboard where every title document is tracked in real-time. No more chasing down paperwork or spending hours on manual compliance checks—it all happens automatically. Transferring ownership of a high-value asset becomes as simple and secure as a click.

From Manual Burden to Strategic Advantage

A platform like TitleTrackr was built to solve these exact problems. It’s designed to tackle the inherent risks of manual document handling by swapping uncertainty for dependable, automated workflows.

A system like this provides a layered defense against the most common pitfalls:

- Automated Verification: The platform instantly cross-references document details against your business rules and data sources, flagging discrepancies a person might easily overlook. This cuts down on the kind of errors that can derail a major transaction.

- Secure Transfer Protocols: By using cryptographic security, the system makes every title transfer verifiable and permanent. This makes forgery or unauthorized duplication practically impossible.

- Centralized Control: All your documents are in one secure, easy-to-access place. Nothing gets lost in transit or buried in an email thread, giving you a crystal-clear, up-to-the-minute view of your assets.

The real game-changer is turning a reactive, paper-chasing scramble into a proactive, digitally-managed operation. This isn't just about adding security; it's about injecting speed and confidence into every transaction, giving your business a serious competitive edge.

Taking Control of Your Title Workflow

By taking the manual grind out of the equation, a platform like TitleTrackr frees up your team to focus on what they do best, instead of putting out administrative fires. The system handles the tedious, high-risk tasks, letting your experts make smarter decisions, faster. For teams that want to build their own integrations, our documentation for developers is a great place to start.

If you’re ready to leave the vulnerabilities of paper behind, the best next step is to see a modern solution for yourself. It’s a chance to witness firsthand how technology can deliver the kind of security and efficiency that old-school methods just can’t touch. Request a demo of TitleTrackr today to see how you can secure and automate your entire title management process.

Navigating Legal Compliance in a Digital World

Moving from paper to digital documents of title might feel like a big step, but it’s a jump that’s fully backed by international law. Strong legal frameworks have been built specifically to ensure electronic versions are just as valid and enforceable as the physical copies they replace. This gives businesses the legal certainty they need to operate. It’s not just about going paperless; it’s about modernizing in a legally recognized way.

Think of these frameworks as the guardrails for digital trade. They’re there to make sure every transaction is secure and protected. Key regulations, like the UNCITRAL Model Laws, have set a globally accepted standard for electronic transferable records. They legally confirm that an electronic document can do everything a paper original can, from proving ownership to being used as collateral.

Global Adoption and Automated Security

The industry has really gotten behind this shift, with major shipping lines and ports leading the way. This wasn't a random decision; it was a direct response to the real-world risks of sticking with paper.

For years, relying on paper bills of lading led to huge losses from forgery and theft, costing the global trade industry an estimated 1-2% of its total value annually. To fight back, ports from Rotterdam to Singapore and Los Angeles have started using platforms for electronic bills of lading (eBLs). You can learn more about how digital adoption is securing global trade.pdf) and its impact.

By building on these established legal standards, digital systems make cross-border trade safer and far more predictable. It removes ambiguity and replaces it with a clear, enforceable digital record.

Modern platforms like TitleTrackr take this a step further by weaving these legal standards right into their DNA. Compliance isn't a box to check at the end; it's an automated, built-in part of the process.

The system makes sure every digital document of title created or transferred meets all the necessary legal rules, taking that complex burden off your team’s shoulders. This built-in security makes every transaction more efficient and much safer than it ever could be on paper. For any business looking to move forward, this kind of automated compliance is the key to operating with real confidence.

Frequently Asked Questions

Getting a handle on documents of title is one of those things that can feel a bit abstract until you see it in action. Let's walk through some of the most common questions we hear to clear things up and show you how they work in the real world.

What's the Real Difference Between Negotiable and Non-Negotiable?

Think of a negotiable document like cash or a personal check made out to "cash." Whoever holds it, owns it. A simple signature (an endorsement) is all it takes to pass ownership of the goods to someone else. This flexibility is what makes them so powerful in fast-moving trade and finance.

A non-negotiable document, on the other hand, is more like a check written to a specific person's name—and only that person can cash it. It names a single, specific party who can receive the goods. You can't just sign it over to a third party, which makes it a much more direct, but less flexible, shipping instruction.

Can You Actually Use a Digital Document as Loan Collateral?

Yes, you absolutely can. This isn't a legal gray area anymore. Thanks to laws like the Model Law on Electronic Transferable Records (MLETR), digital documents of title have the same legal weight as their paper counterparts for securing financing.

In fact, lenders often prefer them. Digital systems give them a crystal-clear, unchangeable history of ownership. This transparency dramatically cuts down on risk and makes the whole financing process smoother for everyone.

How Does Automation Stop Document Fraud?

This is where technology really shines. When you try to prevent fraud with paper, you're basically just hoping you can spot a good forgery. Automation, however, builds security right into the document's DNA.

Platforms use things like cryptographic signatures and permanent, un-editable audit trails. These digital safeguards make it practically impossible to forge, duplicate, or secretly alter a document without someone knowing.

Automation creates one undisputed record—a single source of truth. It gets rid of the guesswork and weak spots that have always made paper-based systems a target for fraud, locking in the integrity of every single document.

These are just a few of the big questions, but we know you probably have more. For a deeper dive, check out our comprehensive FAQ section.

Ready to swap fraud risk for absolute certainty in your operations? TitleTrackr can replace your manual document headaches with secure, automated workflows. Request a demo with TitleTrackr