Thinking about starting a title company is a major step, but with a strategic plan, it's an incredibly rewarding venture. The journey can be simplified into four key stages: establishing your legal and business foundation, securing licenses and underwriter partnerships, building your operational and tech stack, and acquiring your first clients.

From day one, your success will hinge on meticulous planning for compliance, operational efficiency, and a clear strategy that differentiates you from the competition. Let's walk through the essential steps to launch a modern title agency that's not just built to survive, but to thrive.

Your Launchpad for a Modern Title Company

Entering the title industry requires strategic precision, but for those who are well-prepared, the opportunity is significant. This guide isn’t just a checklist; it's an inside look at what it takes to build a successful, modern title company from the ground up.

We will cover everything from the initial legal hurdles to the technology you need to compete and win. This isn't just about what to do, but how successful founders navigate these exact challenges to build scalable, profitable businesses.

Understanding the Market You're Entering

Before investing time and capital, you must understand the competitive landscape. The title insurance industry is remarkably resilient. For perspective, in a recent second quarter, the industry generated approximately $4.5 billion in premiums—a 10% increase from the previous year, demonstrating steady demand even in a fluctuating real estate market.

While giants like First American Title hold significant market share, there is ample room for new agencies that are agile, technologically advanced, and laser-focused on compliance. You can explore these market dynamics further in this detailed industry report.

A successful launch isn't about having the biggest office; it's about having the smartest workflows. Your ability to close files accurately and efficiently will become your most powerful marketing tool.

In today's market, technology is the foundation of a competitive business. To outperform established agencies, you need tools that automate manual work and enhance accuracy. Key technologies include:

- Automated Document Indexing: Eliminate the manual sorting and filing of every document, freeing up your team for high-value tasks.

- AI-Driven Compliance Checks: Act as a second set of eyes, catching potential issues before they escalate into costly errors.

- Streamlined Client Communication: Provide the transparency and speed that real estate agents, lenders, and consumers now expect.

Platforms like TitleTrackr are engineered to be the operational backbone for a modern agency. By leveraging AI and automation, TitleTrackr gives a new company the power and precision of an established industry leader from day one. This guide provides the strategic overview you need for a smarter, more efficient launch.

To help you visualize the path forward, here is a breakdown of the core pillars we will cover.

Core Pillars of Your Title Company Launch

| Pillar | Key Action Items | What Success Looks Like |

|---|---|---|

| Legal & Business Foundation | Choose a business structure (LLC, Corp), register your name, get your EIN, and open business bank accounts. | A fully compliant legal entity, shielded from personal liability and ready for financial operations. |

| Licensing & Underwriting | Secure state-specific title producer licenses, meet E&O insurance requirements, and sign with a title underwriter. | You're legally authorized to issue title policies and have a crucial underwriting partner backing your transactions. |

| Operational Setup | Select your title production software, set up escrow accounting, and establish your physical or virtual office. | A smooth, efficient workflow for processing files from open to close, with secure and compliant financial practices. |

| Team & Marketing | Hire key staff (examiner, closer), develop your brand, and start building relationships with real estate agents and lenders. | A capable team in place and a steady stream of incoming orders from a growing network of referral partners. |

Mastering each of these pillars from the start is critical for building a resilient and profitable title company and will save you significant challenges down the road.

Securing Your Legal and Licensing Foundation

This is where your vision for a new title company meets the world of regulations and compliance. Establishing a solid legal and licensing foundation is arguably the most critical phase of your launch. A single misstep here can cause significant delays or even halt your progress entirely.

Your first major decision is choosing a legal structure for your business. This choice impacts personal liability, taxation, and administrative requirements, so it's vital to get it right.

Choosing Your Business Structure

For most new title agencies, the decision comes down to two primary options: the Limited Liability Company (LLC) or the S-Corporation (S-Corp). Both offer liability protection for your personal assets, but they have key differences in how they are taxed and managed.

- LLC (Limited Liability Company): This structure is known for its simplicity and flexibility. Profits and losses "pass through" to your personal tax return, avoiding the "double taxation" associated with C-Corporations. An LLC is often the preferred choice for new founders due to its low administrative burden.

- S-Corporation (S-Corp): An S-Corp can offer significant tax advantages as your business grows. It allows you to pay yourself a "reasonable salary" and take remaining profits as distributions, which are not subject to self-employment taxes. The trade-off is stricter compliance, including formal record-keeping and payroll requirements.

For many founders, starting as an LLC provides the most straightforward path. You can elect to be taxed as an S-Corp later when your revenue justifies the additional complexity. Consulting with a CPA who understands the title industry is essential to making the right decision for your specific situation.

Navigating State Licensing and Exams

Once your business entity is formed, the next step is obtaining your title producer license. Each state has its own unique set of requirements, which can vary dramatically. Some states mandate extensive pre-licensing education, while others focus on a rigorous exam and comprehensive background check. This process can take several months, so it's crucial to start early and be meticulous.

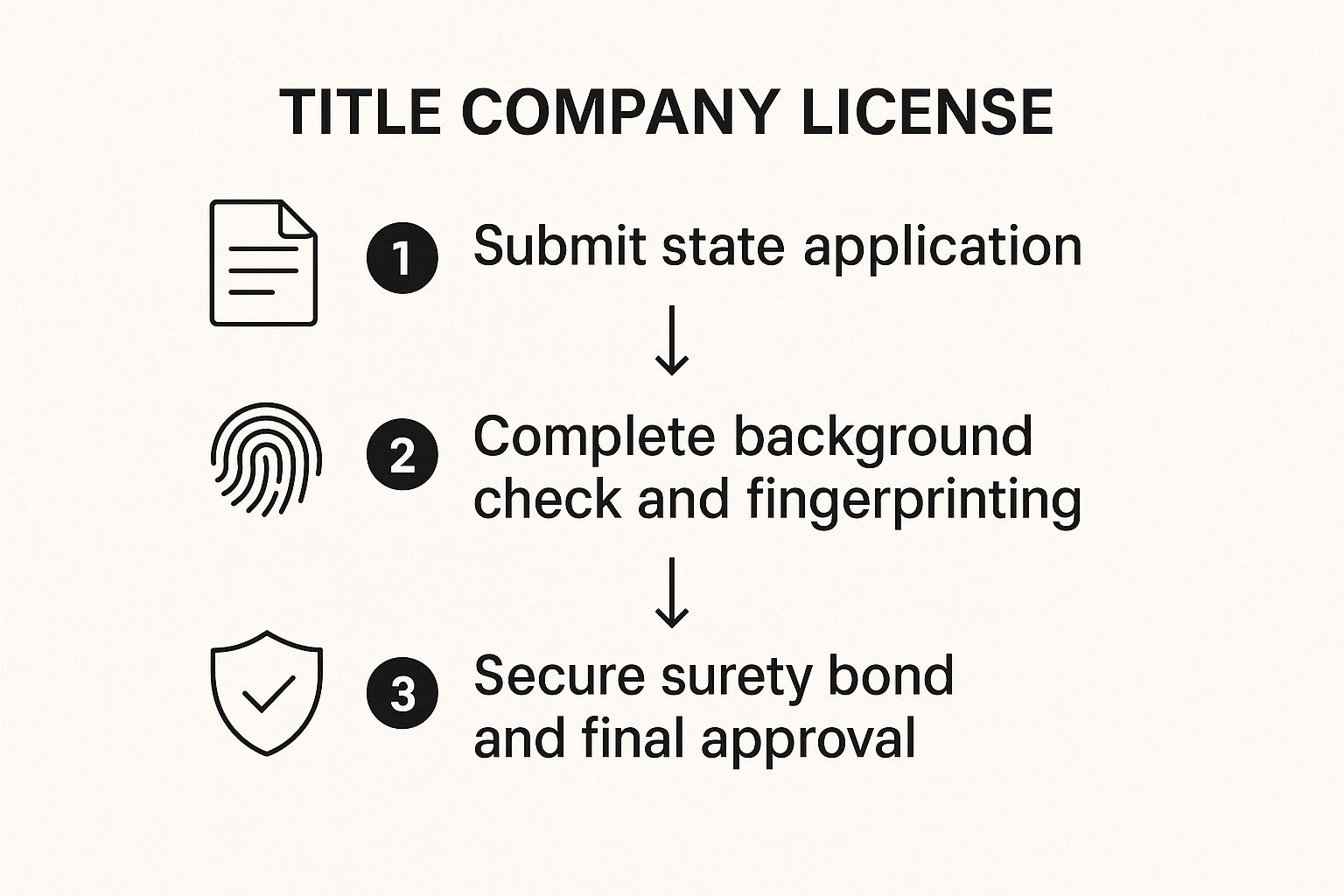

Here is a general overview of the typical licensing process.

As shown, it's a clear progression, but each step is a mandatory milestone that must be completed before you can proceed.

A common mistake is submitting an incomplete application. Double-check every field and ensure all required documents, such as your background check authorization, are attached. A minor error can send your application to the back of the line, costing you valuable time. When studying for your exam, focus on state-specific laws regarding escrow, closing procedures, and insurance regulations, as these topics are almost always heavily weighted.

Securing Essential Insurance and Bonds

Before you can issue your first policy, you must secure two critical forms of financial protection: a surety bond and Errors & Omissions (E&O) insurance. These are non-negotiable requirements for obtaining a state license and gaining approval from a title underwriter.

- Surety Bond: This is a financial guarantee purchased to protect your clients from fraudulent or unethical acts. The required bond amount varies significantly by state and projected business volume, often ranging from $10,000 to over $100,000.

- Errors & Omissions (E&O) Insurance: This policy is your professional liability safety net, protecting your company against claims of negligence or mistakes made during a transaction. A simple typo on a legal document could lead to a substantial financial claim, and your E&O insurance is what stands between your business and financial disaster.

When shopping for coverage, remember that underwriters are evaluating your overall risk profile. A strong personal credit history, documented industry experience, and well-defined internal controls can help lower your premiums and strengthen your application.

Gaining Underwriter Approval

The final and most critical piece of your legal foundation is securing an appointment with a title insurance underwriter. These are the national giants like Fidelity, First American, or Stewart Title. You cannot issue title policies without becoming an agent for one of these companies, as they are the ones who ultimately back the policies you sell and assume the financial risk.

The application process is rigorous. Underwriters will scrutinize your business plan, personal and business finances, E&O coverage, and your team's experience. They need absolute confidence that you operate a compliant, well-managed agency. This partnership is the ultimate validation, signaling to the market that you are a legitimate, financially sound company ready for business.

Building Your Operational and Tech Stack

With your legal and licensing foundation in place, it's time to build the engine that will power your title company. This stage is about translating your business plan into practice by making the key decisions that will define your efficiency, client experience, and ultimately, your profitability.

This includes everything from your physical workspace and key hires to the technology that integrates it all. Getting this right from the outset provides a significant competitive advantage, enabling you to operate with the speed and precision of a much larger organization.

Choosing Your Workspace: Physical or Virtual?

One of your first operational decisions is determining your physical footprint. Do you need a traditional brick-and-mortar office, or can you operate a virtual or hybrid model? Both approaches have merits, and the optimal choice depends on your business model and local market expectations.

A physical office provides a professional setting for closings and client meetings, which can be crucial for building trust with local real estate agents and lenders. However, it also comes with significant overhead costs, including rent, utilities, and insurance. A virtual-first model dramatically reduces these expenses, freeing up capital to invest in superior technology and top talent. This approach is increasingly viable, especially in states that permit remote online notarization (RON).

Assembling Your Core Technology Stack

Your technology is the central nervous system of your company. It’s not just for file storage; it’s about creating a seamless, repeatable system that minimizes errors and accelerates closing times. To start, focus on three essential software categories.

The Essential Software Trio:

- Title Production Software (TPS): This is your operational command center for managing every order, from opening to closing. It handles order entry, document generation, accounting, and policy production.

- Closing Platform: This client-facing portal allows agents, lenders, and consumers to track progress, securely exchange documents, and manage closing tasks. A user-friendly platform enhances transparency and elevates the client experience.

- Secure Document Management: As a handler of sensitive personal data, a secure, cloud-based system for storing and organizing documents is an absolute must for compliance and data protection.

A well-integrated tech stack is more than just an organizational tool. It becomes part of your sales pitch, demonstrating to clients that you're efficient, secure, and modern.

This is a strategic investment that pays dividends for years. The global title insurance market is projected to grow at a Compound Annual Growth Rate of approximately 7.4%, driven by the demand for property ownership protection. As a founder, this signals that leveraging technology is essential to meet modern expectations for faster, more transparent transactions. You can explore this trend in this insightful market report.

The AI Advantage in Title Operations

While traditional title software is effective for workflow management, AI-powered platforms can fundamentally transform your operations. Imagine a system that doesn't just store your documents but also reads, understands, and organizes them automatically. That is the competitive edge provided by a platform like TitleTrackr.

By automating routine tasks such as document indexing and flagging potential compliance issues, TitleTrackr frees up your team to focus on what humans do best: building relationships and solving complex problems. This is how top-performing agencies are already operating to deliver a superior client experience. The right technology enables you to close files faster and with fewer errors, making you the preferred partner for agents and lenders.

Making Your First Critical Hires

You can't do it all alone, and your initial hires will define your company's culture and capabilities. The order of your hires should align with your own skills and background.

Who Should You Hire First?

- If you’re a natural at sales and business development: Your first hire should be an experienced Title Examiner or Processor. You need a technical expert to manage files meticulously while you focus on generating business. An examiner's expertise in local recording practices is invaluable.

- If your background is in examination or processing: Consider hiring a dedicated Escrow Officer or Closer. This individual will be the face of your company at the closing table, managing funds and communicating with all parties to ensure a smooth transaction.

- If you have a strong operations background: Hiring both a processor and a closer from the start may be wise. This allows you to step back from day-to-day file management and focus on strategic growth, compliance, and business oversight. For a closer look at these roles, our guide on working with professional title abstractors offers great insights.

Regardless of the role, seek individuals who are experienced, adaptable, and technologically proficient. A lean, effective team empowered by the right technology is the key to scaling your company intelligently.

Winning Clients in a Crowded Market

You've secured your license and set up your operations. Now comes the most critical challenge: building a client base from the ground up.

In the title industry, success is built on relationships. You must connect with local real estate agents, lenders, and attorneys who control the flow of transactions. They are the gatekeepers, and earning their trust is paramount.

This requires more than generic marketing. You must become an indispensable partner—the expert they call because you solve problems and make their jobs easier. You need to provide a compelling reason for them to switch from their established title company to yours.

What's Your Hook? Defining Your Value

In a market saturated with claims of "great service," you need to be specific. What is the one thing you do better than anyone else? This is your unique value proposition (UVP), and it should be at the heart of every client interaction.

Consider what truly matters to a busy real estate professional:

- Raw Speed: Can you consistently deliver a title commitment faster than your competitors? A 24-hour turnaround time can be a game-changer for an agent on a tight deadline.

- Painless Tech: Is your process truly digital and user-friendly? A clean, intuitive client portal for tracking progress and uploading documents provides a massive advantage over competitors relying on cumbersome email chains.

- Niche Knowledge: Can you become the go-to expert for complex transactions? Mastering commercial deals, new construction, or challenging probate sales can attract high-value clients.

Your UVP isn't just a marketing slogan; it's a promise you have to keep on every single file. If you say you're the fastest, you better be. Authenticity is what turns a single closing into a steady stream of referrals.

Once you have defined what makes you different, you can build a marketing plan to deliver that message to the right audience.

Getting Found: Your Digital Marketing Playbook

Your potential referral partners are online, and your digital presence is non-negotiable. A focused digital strategy is how you get in front of agents and lenders actively seeking a better title partner.

Nail Your Local SEO

When a real estate agent searches for a "title company near me," you need to be at the top of the results. This is achieved through Local Search Engine Optimization (SEO).

Here's where to start:

- Your Google Business Profile: This is your digital storefront. Claim your profile and complete every section: services, hours, photos, and address. A complete profile builds trust.

- Get Those Reviews: After a successful closing, ask your satisfied clients to leave a Google review. A consistent stream of five-star reviews is one of the most powerful trust signals you can have.

- Think Local: Integrate local keywords naturally into your website content. Phrases like "title services in Chicago" or "Cook County real estate closings" help Google understand who you serve.

A strong local SEO foundation establishes credibility before you ever make a sales call.

Use Social Media to Be an Expert, Not a Salesperson

Use social media to demonstrate your expertise, not just to post holiday greetings. The goal is to share valuable content that helps your referral partners succeed.

What does this look like in practice? Record a short video explaining the top three title issues that delay closings in your county and how to avoid them. Or, write an informative post about a recent change in local recording fees that agents need to know.

By consistently providing value, you transition from being just another vendor to becoming a trusted resource. This is how you build a powerful reputation that drives business.

Managing Escrow and Mitigating Business Risks

Let’s focus on the two pillars that will determine the long-term viability of your title company: impeccable financial management and relentless risk mitigation.

Mistakes in these areas can have severe consequences, especially when handling client funds. Your escrow accounts are the financial heart of your operation and demand absolute precision.

The Sacred Duty of Escrow Management

An escrow account is not a standard business bank account; it is a trust account. You are a fiduciary holding funds for buyers, sellers, and lenders. The slightest error can result in the loss of your license and severe penalties under RESPA.

The cardinal rule is strict separation. You must maintain a dedicated escrow account, completely isolated from your operating funds. Commingling funds—even accidentally paying a business expense from escrow—is a critical violation that can shut down your company.

To protect your business, conduct regular reconciliations. At a minimum, you must perform a three-way reconciliation every month, balancing:

- The escrow trust account bank statement.

- Your internal book balance for the account.

- The individual client ledger balances.

This triple-check process ensures every dollar is accounted for and prevents discrepancies.

Think of your escrow account like a sterile operating room. Every instrument (dollar) must be accounted for, and nothing foreign (like your operating funds) is ever allowed inside. This level of discipline is non-negotiable. It’s how you build trust and stay compliant.

Building a Strong Defense Against Wire Fraud

Wire fraud is the single greatest external threat to your new title company. Cybercriminals use sophisticated social engineering tactics to impersonate parties in a transaction and divert funds to fraudulent accounts.

A single diverted wire can destroy your company's finances and reputation. Your defense must be proactive and multi-layered. Start by establishing ironclad internal protocols for verifying any changes to wire instructions.

Actionable Security Protocols:

- Always Call to Confirm: Never accept changes to wire instructions via email. Always use a trusted phone number to verbally confirm the request with the relevant party.

- Use Secure Portals: Avoid sending sensitive information, such as wire instructions, through standard email. A secure closing portal is a much safer method for sharing critical details.

- Educate Everyone: Continuously train your team and educate your clients. Every email from your office should include a clear warning about wire fraud, instructing clients to call you before initiating any wire transfer.

These are not theoretical risks. U.S. title professionals consistently rank fraud prevention and compliance as top priorities. As a new company, you must build secure workflows from day one. You can dig deeper into the challenges facing title companies today on ClosingLock.com.

Turning ALTA Best Practices Into Your Framework for Resilience

Many view the American Land Title Association (ALTA) Best Practices as a simple compliance checklist. This is a missed opportunity. Instead, see it as a strategic framework for building a resilient, defensible business.

Integrate these principles into your daily operations. For example, Best Practice Pillar #3, which focuses on written procedures for escrow trust accounting, should be the foundation of your daily reconciliation habits—not just a manual that sits on a shelf.

Similarly, Pillar #4 addresses secure settlement processes and aligns directly with your wire fraud defense plan. By adopting these practices as your operational foundation, you are not just preparing for an audit; you are building a culture of security and professionalism that becomes a core competitive advantage.

Common Questions About Starting a Title Company

, and E&O insurance premiums. Additionally, you will need to invest in robust title production software and have sufficient working capital to sustain operations for at least six months before revenue becomes consistent. A realistic startup budget for a small agency typically falls between $75,000 and $250,000.

Can I Succeed Without Prior Title Industry Experience?

While technically possible in some states, launching a title company without direct industry experience is extremely risky. Most jurisdictions require the owner or a managing agent to be a licensed title professional with a proven track record.

Beyond regulations, the title business is built on trust. Underwriters, lenders, and real estate agents must have confidence in your ability to handle complex transactions. Without a deep understanding of title examination, escrow procedures, and compliance, a single error can lead to catastrophic financial losses. The recommended path is to gain several years of industry experience or partner with a seasoned veteran.

The credibility you bring from past experience is not just a line on your resume; it's the collateral you use to secure your underwriter partnership and your first clients. It proves you understand the weight of the responsibility you're taking on.

If you have more questions like these, we have compiled extensive resources. Find more answers on our TitleTrackr FAQ page.

What Is the Role of a Title Insurance Underwriter?

Your underwriter is the financial bedrock of your company. These large, established corporations (e.g., Fidelity, First American) grant you the authority to issue their title insurance policies. Critically, they assume the financial risk if a claim is filed on a policy you issue.

Operating without an underwriter is impossible. Securing an appointment involves a rigorous vetting process where the underwriter examines your financial stability, professional experience, and operational controls. This partnership provides the legitimacy and insured products that lenders and homebuyers require.

What Is the Single Biggest Operational Challenge for New Agencies?

While client acquisition is a primary focus, the biggest internal challenge for new agencies is establishing efficient, repeatable, and compliant workflows. Many startups become overwhelmed by manual tasks, leading to errors, closing delays, and employee burnout.

This is where your technology choice becomes your greatest strategic advantage. From day one, implement a modern platform that automates repetitive tasks like document sorting, data entry, and client updates. Such a system allows a small team to perform with the efficiency of a much larger organization, freeing you to focus on growth rather than administrative burdens.

Ready to build an agency that’s efficient from the moment you open your doors? The right technology is your biggest advantage. TitleTrackr uses AI to automate the time-consuming tasks that slow new companies down, from document indexing to report generation.

Request a personalized demo to see how you can launch with the operational power of an industry leader.