When a mortgage is finally paid off, it’s a huge milestone. But for real estate professionals, the celebration isn't over until one crucial document is secured: the release of mortgage. This is the official legal instrument that proves a home loan is fully paid and the lender's claim on the property is extinguished.

Think of it as the property's official certificate of freedom. It’s the final, non-negotiable step that clears the title, confirming the owner holds the property free and clear of that specific debt. For your firm, managing this final step efficiently is a matter of reputation and risk.

Your Guide to the Mortgage Release Document

Imagine a mortgage as a temporary chain linking a property to the lender. For the entire life of the loan, that chain—known legally as a lien—gives the lender a legal right to the property if the borrower defaults.

Once the debt is settled, the release of mortgage is the key that shatters that chain forever.

Without this officially recorded document, the property's title remains clouded. It appears as though the debt might still be outstanding, even if it was paid off years ago. This oversight creates massive headaches for homeowners, title companies, and attorneys down the road, jeopardizing future transactions.

Why This Document Is So Critical

The importance of this document, sometimes called a satisfaction or discharge of mortgage, simply can't be overstated. A mortgage release isn't just a receipt; it's a formal legal instrument that removes the lender's lien from public record. Recording it is what officially clears the property title, proving the owner holds it free and clear of that specific debt. For more insights and examples, you can find a great breakdown on CoBrief.app.

This single piece of paper is the cornerstone of a clear title, which is absolutely essential for any future real estate transaction. Its absence can bring a sale or refinance to a grinding halt.

A missing release creates a "cloud on title"—a legal discrepancy that can derail transactions and force sellers into costly, time-consuming battles to prove a decades-old loan was paid. It’s a preventable administrative error with major financial consequences.

For real estate professionals, mastering the release process isn't just good practice; it's fundamental to protecting clients, mitigating liability, and ensuring smooth closings. The stakes are incredibly high. An unrecorded release leads to:

- Delayed or Canceled Sales: A buyer's title search will flag the old lien, and they won't proceed until it's cleared.

- Refinancing Roadblocks: New lenders won't issue a loan against a property that appears to have existing claims against it.

- Legal Headaches: The property owner may have to track down a lender that has since merged, been acquired, or even gone out of business just to get the paperwork.

Mastering the mortgage release process is a non-negotiable skill for every professional in the industry.

Why a Missing Release Creates Title Nightmares

A clean property title is the bedrock of any real estate transaction. You can think of it as the property's clean bill of health, a confirmation that ownership is clear and undisputed. The release of mortgage is the document that officially gives it that clean bill after a loan has been paid off. But when it goes missing, it creates a serious legal headache known as a "cloud on title."

This cloud is basically a giant red flag in the public record. Even if the loan was paid off a decade ago, the lender’s original lien still looks active. This single discrepancy can bring a sale or a refinance to a dead halt, turning what should be a simple administrative step into a costly, time-consuming nightmare.

Imagine a seller is ready to close, only to get a call that the deal is off. The buyer’s title search dug up a lien from a mortgage that was proudly paid off 15 years ago. The problem? The lender never bothered to file the release.

The Domino Effect of an Unrecorded Lien

This isn’t just some far-fetched hypothetical; it happens every single day, putting transactions and professional reputations on the line. The seller is suddenly thrown into a frantic race against the clock, desperately trying to track down a lender that might have merged, been bought out, or even gone out of business entirely. This hunt can rack up thousands in legal fees and countless hours of administrative work—all while a major deal hangs by a thread.

The consequences ripple outwards, causing serious and widespread problems:

- Failed Transactions: Buyers and their lenders will simply walk away from a deal until the title is clear. It’s a non-starter.

- Inability to Refinance: No new lender is going to issue a loan on a property that already appears to have another outstanding mortgage on it.

- Blocked Access to Equity: Homeowners often find they can’t get a home equity line of credit (HELOC) because of the unresolved lien sitting on their title.

An unrecorded release acts like a ghost from the past, haunting a property's title and blocking its future. It represents a debt that has been paid but never legally forgotten, creating a significant barrier to any new transaction.

Title Insurance and Due Diligence

Isn't this what title insurance is for? Yes and no. Title insurance is designed to protect buyers and lenders from past, undiscovered title defects. However, a known, unreleased mortgage isn't a past problem—it's a present-day one that must be resolved before a new policy can even be issued.

This is where diligent title searches and post-closing follow-ups are absolutely crucial. Professional title searchers and abstractors are on the front lines, tasked with digging up these exact kinds of issues before they have a chance to blow up a closing.

At the end of the day, a properly filed release of mortgage is the only real protection. It’s the undeniable proof in the public record that a debt has been fully satisfied, ensuring the property’s title is clean, clear, and marketable for whatever comes next.

How the Mortgage Release Process Actually Works

So, a loan has reached a zero balance. Congratulations! But the journey isn't quite over. Getting that official "release of mortgage" recorded to clear the property's title can feel like its own little maze. It seems simple on the surface, but a few missteps can turn a straightforward administrative task into a months-long headache that reflects poorly on your firm.

The whole thing kicks off once the loan is paid in full. You'd think that would automatically trigger the process, right? Not always. Often, the responsibility lands on the homeowner or their closing agent to get the ball rolling. Proactive follow-up is your best friend here—it ensures the file doesn't get lost in a lender's massive paper shuffle.

The Key Players and Their Roles

To navigate this smoothly, you need to know who does what. Think of it as a three-person relay race, where the baton has to be passed correctly at each stage to avoid costly fumbles.

- The Borrower/Settlement Agent: After the last payment clears, their job is to ensure the process actually starts. They must follow up on its status and, most importantly, get confirmation that the release was officially recorded.

- The Lender/Servicer: This is the institution legally on the hook for preparing and signing the release document. Their signature is the official proof that the debt is wiped clean.

- The County Recorder/Clerk: This is the finish line. The county office takes the signed release and officially enters it into the public land records, permanently erasing the lien from the property's history.

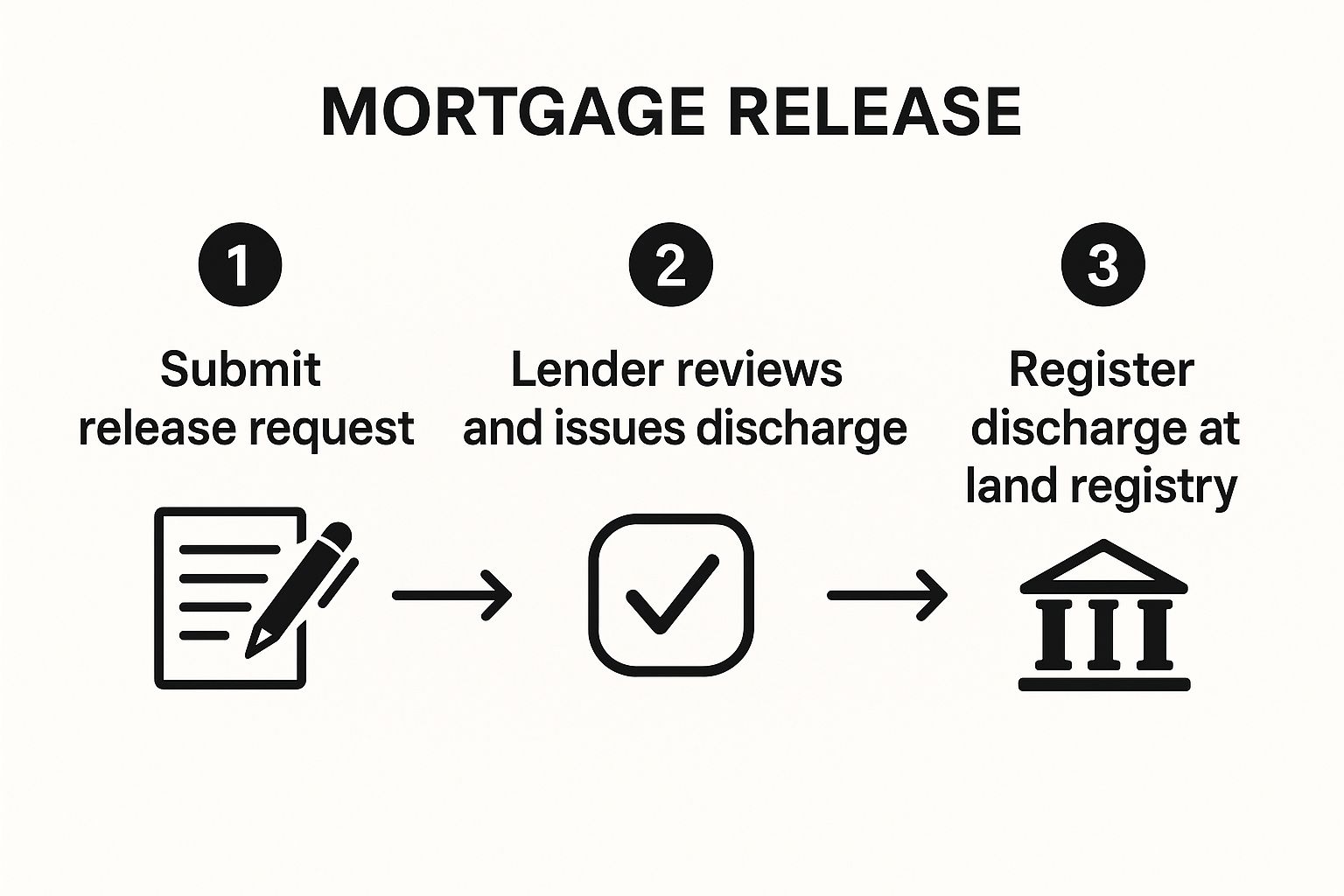

This simple graphic breaks down the core steps from that final payment to a truly clear title.

As you can see, getting from request to recording requires precise coordination between the borrower, the lender, and the county.

To give you a clearer picture, here’s a breakdown of the typical workflow.

Key Stages in the Mortgage Release Workflow

This table maps out the critical steps, who's responsible for what, and where things can go wrong.

| Stage | Responsible Party | Key Action | Common Pitfall |

|---|---|---|---|

| Loan Payoff | Borrower | Submits the final payment to satisfy the loan balance. | Miscalculating the final payoff amount, including interest. |

| Release Request | Borrower/Settlement Agent | Formally requests the release document from the lender. | Assuming the process is automatic and failing to initiate the request. |

| Document Preparation | Lender/Servicer | Drafts, verifies, and executes the official release or satisfaction document. | Internal backlogs causing significant delays in document preparation. |

| Recording Submission | Lender/Servicer | Sends the executed document to the correct county recorder's office with fees. | Submitting to the wrong county or with incorrect fees/formatting. |

| Public Recording | County Recorder's Office | Records the document in the official public land records. | Rejecting the document due to minor errors, restarting the process. |

| Verification | Borrower/Settlement Agent | Obtains a copy of the recorded release to confirm the lien is cleared. | Forgetting to verify and only discovering the issue years later. |

Understanding this flow helps you know when to follow up and what to ask for at each step, preventing a file from getting stuck in limbo.

Common Bottlenecks in the Release Workflow

Unfortunately, the road to a clear title is often bumpy. Lender processing delays are a huge problem. We’ve seen release requests sit untouched for weeks, buried in an internal backlog. The Consumer Financial Protection Bureau consistently fields complaints about mortgage servicing errors, and you guessed it—release processing is a frequent star of the show.

Another major hurdle? Incorrect recording. Every single county has its own rulebook for fees, document formatting, and how they want things submitted. A tiny error—like being a few dollars short on the recording fee or missing a notary stamp—is all it takes for the county clerk to reject the document. When that happens, it gets mailed back to the lender, and the clock starts all over again.

The most critical failure point is often the last mile: ensuring the lender not only issues the release but successfully records it with the correct county office. A release sitting in a file cabinet is worthless; only its public recording provides true legal finality.

This is exactly why staying on top of the process is so vital. Without a system to track each step—from the initial request to getting that final confirmation from the county—a release can easily stall for months. This leaves a cloud on your title that can create massive risks for any future sale or refinance.

Navigating the Complex Maze of State Laws

When you're dealing with a release of mortgage, there’s no single, national rulebook to follow. Instead, you're playing a state-by-state game governed by a patchwork of local regulations. This jurisdictional mess is one of the biggest headaches in the post-closing process, turning what should be a routine procedure into a high-stakes tightrope walk.

The rules for releasing a mortgage can change dramatically the moment you cross a state line. A process that works perfectly in Texas could get your firm hit with significant penalties just one state over. This variability makes local expertise not just a nice-to-have but an absolute necessity for any firm operating in multiple regions.

Strict Deadlines and Steep Penalties

Some states are notoriously tough, imposing tight deadlines and severe financial penalties for getting it wrong. Massachusetts, for example, has some of the strictest regulations in the country. Lenders who drag their feet on recording a mortgage release can face hefty fines, showing just how little tolerance the state has for delays that cloud a property's title.

New York is another one to watch. Its laws set very clear timeframes for lenders to act after a loan is paid off. Missing these deadlines isn’t just a slap on the wrist; it can lead to financial consequences that pile up fast, creating a major compliance risk for lenders and a nightmare for title professionals trying to clear the record.

These deadlines are a critical piece of the puzzle, and they’re all over the map:

- 30-Day States: Some jurisdictions demand action within a month of the final payment.

- 60-Day States: A more common window, giving lenders about two months to get the release processed and recorded.

- 90-Day States: More lenient states might allow up to three months, but that deadline is still firm.

Missing these dates just isn't an option. The penalties are there for a reason—to protect consumers and ensure property records stay clean and accurate.

The Broader Economic Picture

The pressure to process these releases quickly gets even more intense during certain economic cycles. When interest rates drop, refinancing activity explodes, and the rate of mortgage payoffs goes through the roof. During the refi boom of 2020-2021, for instance, over 15 million homeowners refinanced their mortgages. Every single one of those transactions required a release for the old loan.

With 30-40% of all mortgages being paid off before their term ends, the volume of releases is always massive. You can get a better sense of these trends and their impact over at the Hypothèques.ca blog.

The sheer volume of transactions, combined with a complex web of state-specific laws, creates a perfect storm for compliance errors. A single mistake—like miscalculating a county recording fee or missing a deadline by one day—can jeopardize a closing and expose a firm to liability.

This is exactly why modern, automated compliance tools have become so essential. Trying to manually track deadlines, document requirements, and recording fees across hundreds of counties and dozens of states is just asking for trouble. It's inefficient and full of opportunities for human error. Technology offers a way to navigate this complex maze, making sure every release is handled correctly, on time, and in full compliance with local laws, no matter where the property is.

When a Release Is More Than Just a Payoff

Most people think a release of mortgage is something you only see at the end of a long road—a celebration after the final loan payment. But in reality, its role can be far more complex. This powerful document also serves as a critical financial lifeline for homeowners facing the daunting prospect of foreclosure.

In these tough situations, a mortgage release becomes a key piece of a foreclosure avoidance strategy, one known as a deed-in-lieu of foreclosure. This isn't about popping champagne over a paid-off loan. It's about making a smart, albeit difficult, financial move to sidestep a much worse outcome.

A Financial Lifeline in Foreclosure Avoidance

So, what is a deed-in-lieu of foreclosure? It’s an agreement where a homeowner in distress voluntarily signs the property's title back over to the lender. In exchange, the lender agrees to release the mortgage and, crucially, forgive the rest of the debt. It's a mutual off-ramp from a situation that's no longer sustainable.

This process is less of a simple transaction and more of a strategic negotiation. It allows the homeowner to avoid the long, public, and damaging process of a formal foreclosure, which can wreak havoc on their credit and financial future. The release of mortgage is the legal instrument that seals the deal.

In a deed-in-lieu of foreclosure, the mortgage release isn't a trophy for a paid-off loan. Instead, it’s a tool for a clean break—a way for both the borrower and lender to mitigate losses and move forward without a protracted legal battle.

The impact on credit recovery is huge. While a deed-in-lieu does affect a credit score, it's often viewed far less severely by creditors than a full-blown foreclosure. That difference can shave years off the time it takes to get back on solid financial ground.

Take programs like Fannie Mae’s Mortgage Release, which are designed for this exact scenario. By deeding the property back, a borrower can often qualify for a new mortgage in as little as two years. A foreclosure, on the other hand, could keep them on the sidelines for up to seven years. You can dig into these foreclosure avoidance options on Fannie Mae’s website.

Understanding these alternative uses shows just how versatile a mortgage release document is. It’s not just an administrative checkbox; it’s a vital tool that can resolve messy real estate challenges and provide a much faster path to financial recovery.

Stop Chasing Paperwork and Automate Your Process

If your firm is still manually tracking every single release of mortgage, you're playing a risky—and exhausting—game. This approach throws your team into a never-ending cycle of chasing down lenders, navigating confusing county clerk offices, and juggling a spiderweb of state-specific deadlines.

This constant, manual follow-up doesn't just eat up valuable time and resources; it opens the door to huge operational risks and client dissatisfaction with every file.

The problems are obvious. An unrecorded document leaves a nasty cloud on the title. A missed compliance deadline triggers costly penalties. All that back-and-forth communication just grinds productivity to a halt. It’s exactly why top-performing firms are making a change, turning their post-closing operations from a chaotic headache into a smooth, predictable system.

The Modern Solution to Post-Closing Chaos

The answer is simple: stop chasing paper and start automating the process. Modern platforms are built to kill the manual, error-prone tasks that cause these bottlenecks in the first place. Forget about relying on spreadsheets and calendar reminders—technology can now run your entire release tracking workflow for you.

This shift isn't just about convenience; it delivers real, measurable benefits that hit your bottom line. Automation lets you:

- Slash Operational Costs: Free up your skilled team from administrative grunt work so they can focus on high-value tasks that actually generate revenue.

- Ensure Flawless Compliance: Automatically track state-specific deadlines and document rules, which practically eliminates the risk of human error and financial penalties.

- Deliver a Superior Client Experience: Close files faster and give clients the confidence that their title is clear. It’s a simple way to reinforce your firm’s reputation for getting things done right.

By automating your release tracking, you transform a reactive cost center into a proactive, efficient, and profitable part of your operation. The goal is no longer just to manage risk—it's to create a real competitive advantage.

Technology is the key to ending the chase for good. With an automated system, you finally get complete visibility and control over your post-closing pipeline. Instead of just wondering about the status of a release, you have real-time data right at your fingertips, ensuring nothing ever falls through the cracks. It's time to see how automation can redefine your workflow. Request a demo of TitleTrackr to experience the difference firsthand.

Frequently Asked Questions About Mortgage Releases

Even for seasoned professionals, a few crucial questions always pop up around mortgage releases. The details can be surprisingly tricky, and a simple misunderstanding can create long-term headaches for a property's title. Let's clear up some of the most common points of confusion.

Getting this last step right is absolutely critical for maintaining a clean chain of title. A small slip-up here can cause major delays and complications years down the road.

What Happens If a Release of Mortgage Is Never Recorded?

This is the big one. If a release is never officially recorded with the county, the lender's original lien remains on the public record. This creates a massive problem known as a "cloud on title," which makes it look like there’s still an outstanding debt on the property, even if it was paid off a decade ago. That cloud can stop a sale or refinance dead in its tracks.

Fixing it is a nightmare. The property owner has to hunt down the original lender—a task that gets incredibly difficult if the bank has since merged, been acquired, or simply gone out of business—and force them to file the right paperwork. This process almost always causes significant delays and can rack up serious legal fees.

How Long Does a Lender Have to Issue a Mortgage Release?

The timeline for a lender to issue a mortgage release isn't a suggestion; it's the law, and it varies quite a bit from state to state. These statutory deadlines are firm requirements that come with real financial penalties for lenders who don't comply.

- Some states are strict, requiring lenders to issue and record the release within 30 days of receiving the final loan payment.

- Other states are a bit more lenient, giving lenders a wider window of 60 or even 90 days.

Lenders who blow past these deadlines can face hefty fines, which are often paid directly to the borrower. This legal pressure really highlights how important it is for them to process these documents quickly and accurately.

Is a Paid in Full Letter the Same as a Release of Mortgage?

Absolutely not, and this is a critical distinction that trips up a lot of people. A "paid in full" letter is just an informal confirmation from your lender saying the loan balance is zero. It's great for personal records, but it is not a legal document that can clear a property's title.

Only the official, recordable release of mortgage (sometimes called a satisfaction or discharge of mortgage) has the legal power to remove the lien from the public record. This formal instrument must be recorded to ensure a clear and marketable title. For more deep-dive answers, feel free to check out our comprehensive mortgage release FAQ page.

At TitleTrackr, we take the guesswork and endless follow-up out of the release tracking process. Our platform automates compliance, prevents these kinds of costly errors, and makes sure every title is cleared the right way, every time. Request a demo today to see how we can completely transform your post-closing workflow. Learn more at https://titletrackr.com.