When you're dealing with real estate, you'll hear a lot about "title." But how do you really know if the title to a property is clean? That’s where an attorney opinion letter (AOL) comes in.

Think of it as a property's legal bill of health, issued by a qualified lawyer. It’s a formal document that gives buyers, lenders, and investors the confidence that a property’s title is clear, marketable, and ready for a smooth transaction. This guide explains what an AOL is, how it works, and how modern technology is transforming the way these critical documents are created.

What Exactly Is an Attorney Opinion Letter?

At its heart, an attorney opinion letter is a critical piece of due diligence. It's the final, written statement from a lawyer who has meticulously combed through public records tied to a specific property. The entire point of this deep dive is to unearth any skeletons in the closet—any issues that could cloud the title or threaten a new owner's rights down the road.

This isn't just a simple summary; it's a professional legal analysis. The letter confirms who the rightful owner is and shines a light on any outstanding liens, pesky encumbrances, or other claims lurking in the property's history. By laying all this out, the letter provides the clarity and assurance all parties need to move forward with a deal, knowing the legal ground beneath them is solid.

For a quick reference, here’s a breakdown of what an AOL delivers.

Attorney Opinion Letter at a Glance

| Component | Description |

|---|---|

| Purpose | To provide a professional legal judgment on the status of a property's title. |

| Author | A qualified attorney who has examined the relevant public records. |

| Key Focus | Verifying ownership, identifying liens, and confirming marketability of the title. |

| Beneficiaries | Buyers, lenders, and investors who need assurance of a clear title. |

| Outcome | Mitigates risk and helps prevent future legal disputes over property rights. |

Essentially, the AOL translates complex legal history into a clear, actionable opinion, making it a cornerstone of real estate transactions.

The Purpose and Function of an AOL

The number one job of an attorney opinion letter is to manage and mitigate risk. Think about it: before a bank hands over hundreds of thousands of dollars for a mortgage, or a buyer sinks their life savings into a new home, they need to be certain the property's title is free and clear. The AOL delivers that certainty by having a legal expert officially vouch for it.

More specifically, the letter answers the make-or-break questions in any real estate deal:

- Is the title valid? Does the person selling the property actually have the legal right to do so?

- Are there any liens? Are there old mortgages, unpaid tax bills, or court judgments attached to the property that need to be cleared?

- What about encumbrances? Are there any easements or restrictions that could limit how the new owner can use the property?

- Is the title marketable? Is it clean enough that it can be easily sold or transferred again in the future without legal drama?

An AOL is the professional conclusion that comes after an exhaustive review of historical records. It takes the tangled mess of legal information from old deeds, mortgages, and court filings and distills it into a straightforward, reliable opinion.

This practice isn't new. Attorney opinion letters have been a vital part of commerce for decades, first appearing in mid-20th century U.S. business as a way for lawyers to confirm the legality of transaction documents and property titles. This history underscores just how essential they remain today. If you're curious about their evolution, Goulston & Storrs offers more insights.

Ultimately, the AOL is a proactive tool. It nips potential legal disputes in the bud by identifying and resolving title problems before everyone signs on the dotted line at closing. It’s an indispensable layer of protection that ensures a safer, smoother transaction for everyone involved.

How AOLs Work in Real Estate Transactions

An attorney opinion letter doesn’t just materialize out of thin air. It’s the final, polished product of a painstaking investigative process. Think of the attorney as part legal detective, part property historian, piecing together the story of a property’s legal past to secure its future. The real work begins long before a single word of the letter is ever written.

The journey starts with a formal request. A party involved in the deal—usually a lender, but sometimes a buyer—needs a definitive judgment on the state of the property's title. This request kicks off a deep dive into the property's history, whether it’s for a sprawling commercial development, a quirky residential home, or a straightforward mortgage refinance.

The Foundation: A Meticulous Title Search

At the heart of any solid AOL is an exhaustive title search. This isn't a quick database lookup; it's a comprehensive dig through public records to trace the property's ownership history, often going back 50 years or more. The goal is to build an unbroken "chain of title," which is the clean, sequential record of every owner from the past to the present.

This search means sifting through a mountain of documents. Attorneys, or the specialists they rely on like professional abstractors, will meticulously review:

- Deeds: The legal instruments that officially transfer ownership.

- Mortgages: Records of all loans secured against the property.

- Easements and Covenants: Any restrictions or rights that impact how the property can be used.

- Court Records: Filings from divorces, bankruptcies, or lawsuits that could touch the property's ownership.

- Tax Records: Information on property tax payments and any potential liens for unpaid taxes.

A title search is a fact-finding mission, plain and simple. Its purpose is to uncover every recorded event that has ever affected the property's legal standing. No stone can be left unturned before an attorney renders their final opinion.

This systematic review is absolutely critical. A single missed document or an overlooked lien could derail the entire transaction and spark expensive legal battles down the line. To see just how specialized this work is, you can learn more about the crucial role of professional title abstractors in this process.

From Analysis to Opinion

Once the search is done, the real brainwork starts. The attorney doesn’t just collect the documents; they interpret them. They scrutinize the chain of title for any "clouds" or defects—things like gaps in ownership, unresolved liens from contractors, or mortgages that were paid off but never officially released. That last one is a classic; if a prior lender never filed the release, that lien technically still clouds the title and has to be cleared.

Imagine a developer is buying a parcel for a new retail center. The attorney’s analysis might uncover a forgotten utility easement running right through the proposed building site. That discovery could completely upend the buyer's plans. Or, in a refinancing deal, the new lender needs absolute certainty that their mortgage will be in first position. An AOL provides that assurance by confirming all prior, superior mortgages have been satisfied.

Finally, the attorney synthesizes all these findings into the formal opinion letter. This document is their professional conclusion: that the title is marketable and clear of significant issues, aside from any specific exceptions they've noted. It’s this final opinion that gives lenders, buyers, and investors the confidence they need to move forward, turning a complex paper trail into a clear path to closing.

Anatomy of a Sound Attorney Opinion Letter

A well-crafted attorney opinion letter is so much more than a simple summary of a title search. It’s a structured, precise legal document where every single word carries serious weight. To really get a handle on its value—and its limitations—you have to learn to read it like the attorney who wrote it, seeing the purpose behind each section.

Think of it like a blueprint for a house. Every part has a specific job, from the foundation right up to the roof, and they all have to work together to create something solid. If any component is weak or missing, the integrity of the whole building is at risk. It’s the exact same with an attorney opinion letter. A sound letter follows a predictable, logical format that ensures everyone is on the same page and manages legal risk for all parties involved.

The Opening Statements

Every opinion letter kicks off by setting the stage. This isn't just a formality; it establishes the context and draws the legal boundaries for everything that follows.

You’ll always find three key elements right at the top:

- The Addressee: The letter is explicitly addressed to a specific person or company, like "ABC Mortgage Lender." This is non-negotiable because the opinion is valid only for that recipient. No one else can legally rely on its conclusions.

- The Date: The opinion is effective as of a specific date. This tells you the attorney is only vouching for the title's status based on the public records available up to that exact moment.

- Identification of the Property: The letter will clearly describe the real estate in question, usually with its full legal description, to leave zero room for confusion about what property is being discussed.

Defining the Scope and Basis of the Opinion

Right after the intro, the letter lays out precisely what the attorney reviewed to come to their conclusion. This section is all about transparency, showing the depth of the investigation. It’s where the attorney lists the specific documents they put their eyes on—things like the title abstract, surveys, tax records, and all the relevant deeds in the chain of title.

This “factual basis” is critical because it shows the work that was done. It confirms the opinion isn’t just a guess but is grounded in a thorough review of tangible evidence. This part of the letter essentially says, "Here is exactly what I looked at, and my conclusions are based solely on these materials." By clearly outlining the scope, the attorney sets realistic expectations.

The Heart of the Matter: The Legal Opinion

This is it—the core of the entire document. It’s the section where the attorney gives their professional judgment. After laying out the facts and the scope of the review, they deliver the conclusion everyone has been waiting for.

The opinion itself is usually a direct, carefully worded statement. For example, it might say, "Based on our examination of the foregoing records, it is our opinion that, as of the effective date, fee simple marketable title to the property is vested in John Smith."

This is the legal "seal of approval." It confirms who owns the property and that the title is considered marketable, meaning it's free from major defects that would scare off a future buyer. If there are any known issues, like a specific easement or a neighborhood covenant, they will be explicitly called out here as exceptions to an otherwise clean title.

The Fine Print: Assumptions and Qualifications

This might be the most important section of all when it comes to managing risk. No attorney can see the future or guarantee against every bizarre issue, especially things that never made it into the public record. This section acts as a necessary legal safeguard.

Common qualifications you'll see are statements that the attorney:

- Assumed authenticity: They took for granted that all documents were genuine and all signatures were valid.

- Did not conduct a physical inspection: The opinion doesn't cover problems you'd only find by walking the property, like a neighbor’s fence encroaching on the land.

- Is not liable for fraud or forgery: The letter can't protect against hidden issues like a forged deed from 50 years ago.

These qualifications aren't "weasel words." They are standard, ethical disclosures that define the precise boundaries of the attorney’s liability. Understanding these limitations is the key to correctly interpreting what an attorney opinion letter does—and more importantly, does not—guarantee.

Attorney Opinion Letter vs. Title Insurance

When you get to the closing table, choosing between an attorney opinion letter and a traditional title insurance policy can feel like a major fork in the road. Both are designed to give you peace of mind about a property's title, but they get there in fundamentally different ways. Nailing down this distinction is the key to picking the right protection for your specific deal and budget.

Think of an attorney opinion letter (AOL) as a professional diagnosis. It's a legal expert's judgment, based on a deep dive into public records, that the title is clean and marketable as of a specific date. On the other hand, title insurance is more like a protection plan; it doesn't just assess the risk—it financially protects you against future losses from title defects that might have been lurking before you ever bought the property.

Core Differences in Coverage and Risk

The biggest split comes down to how each one handles risk. An AOL is a declaration of the title's health based on expert analysis, while title insurance is a contractual promise to pay for covered losses if that title turns out to be unhealthy down the road.

- An Attorney Opinion Letter zeroes in on identifying known issues found in the public record. The attorney’s liability is generally tied to negligence. If they did their homework and performed a competent search, they aren't on the hook for hidden problems like fraud, forgeries, or unrecorded claims.

- A Title Insurance Policy casts a much wider net. It covers a whole range of risks that are simply impossible to spot in public records. We're talking about protection against forged deeds, surprise heirs popping up, clerical errors at the courthouse, or outright fraud—all things an AOL isn't built to cover.

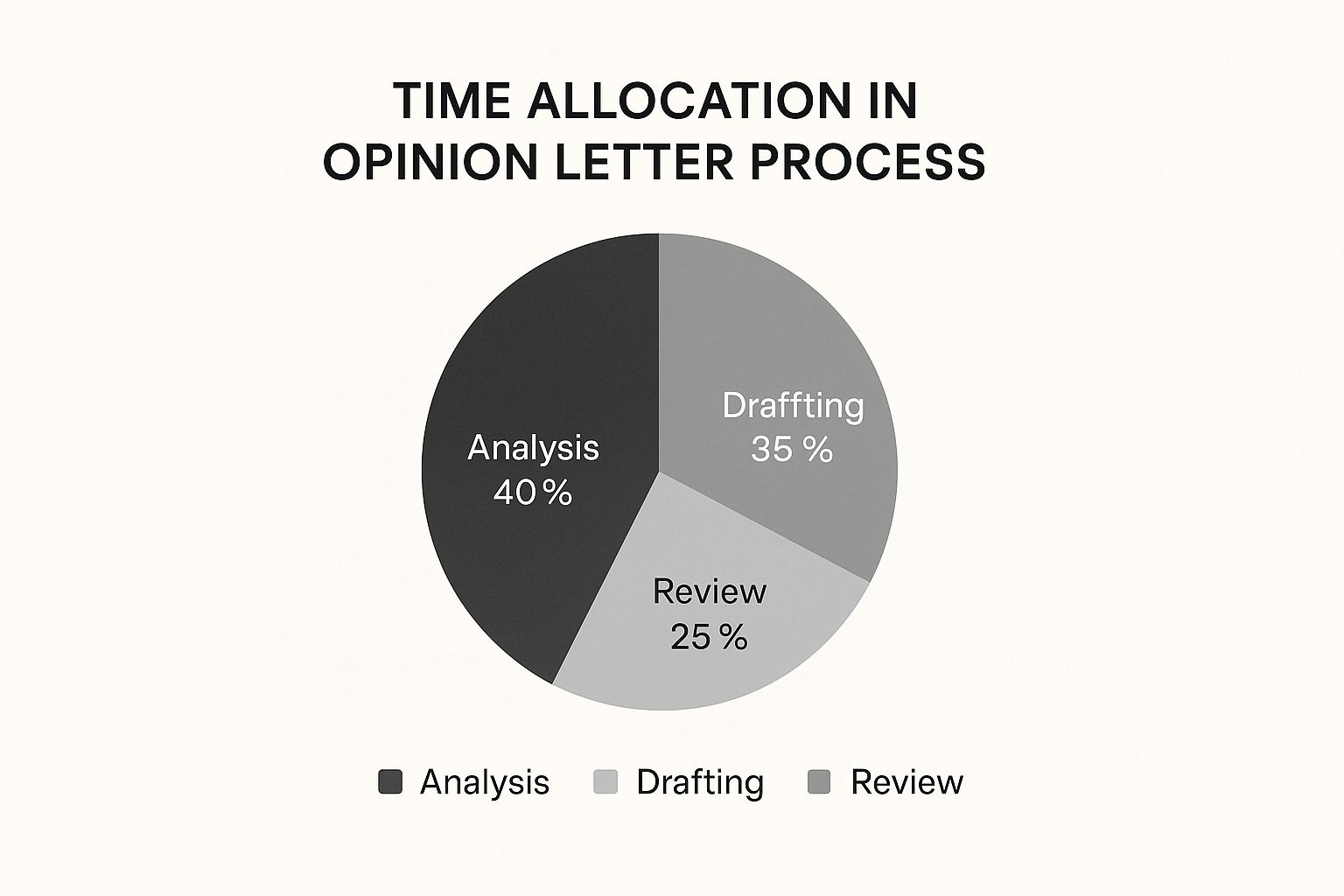

This infographic shows just how an attorney’s time is typically spent in the AOL process, with the lion's share dedicated to careful analysis and drafting.

What this really drives home is that a combined 75% of the attorney's effort is poured into the analytical and drafting stages. It underscores that the document’s entire value is built on a foundation of expert legal review.

A Head-to-Head Comparison

To make the choice even clearer, let's put these two side-by-side. The table below breaks down the key differences between an Attorney Opinion Letter and a Title Insurance Policy, helping you see where each one shines.

Comparing Attorney Opinion Letters and Title Insurance

| Feature | Attorney Opinion Letter | Title Insurance Policy |

|---|---|---|

| Primary Function | Provides a professional legal opinion on title status. | Indemnifies against financial loss from title defects. |

| Basis of Protection | Attorney's due diligence and professional standard of care. | A contractual insurance agreement. |

| Cost Structure | Typically a one-time flat fee. | A one-time premium based on the property's value. |

| Claims Process | Requires proving attorney negligence, often via lawsuit. | A direct claim process with the insurance underwriter. |

| Hidden Risk Coverage | Does not cover unrecorded risks like fraud or forgery. | Explicitly covers many unrecorded and hidden risks. |

This comparison highlights that your choice really depends on what you're trying to protect against: the known and knowable, or the unknown and unexpected.

The Rise of Hybrid Solutions and Cost Considerations

Lately, attorney opinion letters have been making a comeback as a cost-effective alternative to traditional title insurance. While title insurance premiums can run anywhere from 0.3% to 0.6% of the home's purchase price, insured AOLs often deliver similar risk coverage at a lower upfront cost.

A 2022 report revealed that AOLs made up around 15-20% of title risk coverage alternatives in some U.S. urban markets. That's a huge jump from less than 5% just a decade ago. You can dig into the numbers yourself in the full report on the Mortgage Bankers Association website.

This trend has paved the way for the Insured Attorney Opinion Letter (IAOL)—a powerful hybrid solution. An IAOL fuses the expert legal analysis of an AOL with an insurance policy that backs up the attorney’s opinion.

This hybrid model offers a compelling middle ground. It gives you the detailed legal scrutiny of an AOL while adding a layer of financial protection that plugs many of the gaps, often at a more competitive price than a full title insurance policy.

Ultimately, the right choice boils down to your transaction's complexity, your personal tolerance for risk, and what your lender requires. For a lower-risk deal or a simple refinance, a standard AOL might be all you need. But for a high-value property or any situation that demands ironclad protection against the unknown, title insurance or an IAOL offers a far more complete safety net.

The High-Stakes World of Drafting an AOL

Drafting an attorney opinion letter isn't just another administrative task on the checklist. It's a serious legal exercise where every detail matters. When an attorney signs off on that letter, they're putting their professional reputation—and legal liability—squarely on the line. It's a huge duty of care to the person receiving it.

This pressure-cooker environment means there’s zero room for error. The whole process hinges on painstaking, manual research. Attorneys and their teams can spend days, even weeks, sifting through decades of records, tracing a property's history one document at a time. This kind of intense, time-consuming work is a perfect recipe for human error, creating risks that can completely undermine the assurance the letter is supposed to provide.

The Pitfalls of Manual Title Research

The old-school method of creating an attorney opinion letter—a deep dive into dusty historical records—is both its greatest strength and its biggest weakness. Relying only on a manual review opens the door to some common, yet critical, mistakes that can blow up a transaction and put an attorney in legal jeopardy.

These challenges usually pop up because of the sheer volume and complexity of the information. A single property can have a history stretching back over a century, tangled up in dozens of deeds, mortgages, and court filings.

Some of the most frequent mistakes we see include:

- Overlooking Hidden Title Defects: It's surprisingly easy to miss something in a sea of paperwork. A junior mortgage that was never properly released, a forgotten easement, or a clean break in the chain of title can be lurking just out of sight.

- Relying on Incomplete or Outdated Data: Public records aren't always perfectly organized or updated in real-time. An opinion letter built on incomplete information is fundamentally broken from the start.

- Failing to Qualify the Opinion Correctly: Those assumptions and limitations aren't just boilerplate you can copy and paste. They are a critical part of the document. If you don't clearly define the scope of your review, you could accidentally expand your liability way beyond what you intended.

The core challenge here is simple: a manual process is only as reliable as the person doing it. Fatigue, time pressure, and the headaches of deciphering archaic legal documents can lead to oversights that modern technology is specifically designed to catch.

Every one of these potential errors is a major risk. It's a risk for the attorney, for the lender who is counting on that opinion to fund a loan, and for the buyer who just wants peace of mind.

The Heavy Cost of Getting It Wrong

When a mistake finds its way into an attorney opinion letter, the fallout can be brutal.

A missed lien could mean a lender's security isn't actually in the first position, potentially costing them tens of thousands of dollars in a foreclosure. An undiscovered ownership claim could trap the new property owner in years of expensive litigation.

And what about the attorney who issued the flawed opinion? They’re looking at professional liability claims that can destroy their reputation and lead to costly malpractice lawsuits. The standard of care is incredibly high, and if a key document in the public record was overlooked, proving negligence can be pretty straightforward.

This high-risk environment is exactly why the legal and real estate industries are looking for better solutions. Professionals are actively searching for modern tools to cut down on these risks, boost accuracy, and reduce the manual grind that opens the door to expensive mistakes. It's not about replacing legal expertise—it's about augmenting it. The goal is to make sure the final attorney opinion letter is as solid and reliable as it can possibly be, protecting everyone involved in the deal.

Modernize Your AOL Workflow with TitleTrackr

Let's be honest. The old way of drafting an attorney opinion letter is a high-wire act without a net. It's a grind of manual, painstaking work where one tiny mistake buried in decades of records can create massive liability. For attorneys, lenders, and buyers, the stakes are just too high to keep doing things the old-fashioned way.

This is where technology comes in—not to replace your legal expertise, but to make it more powerful. All the classic headaches of manual research, like missed defects or incomplete records, are exactly what modern platforms are designed to solve. It’s no longer about working harder; it’s about working smarter.

From Manual Grind to Intelligent Automation

We built TitleTrackr to tackle the real-world frustrations that legal and title pros deal with every single day. It’s designed to transform the slow, labor-intensive slog of title research into a streamlined, automated workflow. Think about turning hours of digging through documents into a task you can knock out in minutes.

Our platform helps you take control of the entire AOL process by:

- Automating Title Searches: Instead of manually pulling records, our system instantly scans digital archives to build a clear chain of title.

- Centralizing Document Analysis: No more juggling stacks of paper. All your deeds, mortgages, liens, and other critical files are brought into one clean, organized workspace.

- Flagging Potential Issues: Our system is trained to spot the kinds of anomalies and inconsistencies that are easy to miss during a manual review, flagging them for your attention.

This approach hits the weak points of the traditional process head-on. By cutting out the manual grind, TitleTrackr drastically reduces the risk of human error and gives you a much more solid foundation for your legal opinion.

Delivering a More Secure Opinion Letter

At the end of the day, you need to deliver an attorney opinion letter that’s bulletproof—one that gives your clients total confidence. TitleTrackr gets you there by boosting accuracy and slashing your turnaround times. You get to spend less time bogged down in administrative data gathering and more time on what you do best: high-level legal analysis.

By bringing clarity and control to the workflow, TitleTrackr empowers you to provide superior service. It’s about elevating your practice from the risks of manual review to the certainty of data-driven analysis, ensuring every opinion is built on the most solid ground possible.

This is the new standard for due diligence. See for yourself how you can cut your risks and crank up your efficiency. Stop chasing paperwork and start delivering faster, more reliable opinions that protect both your clients and your reputation.

Take the first step and check out a free trial of TitleTrackr.

Frequently Asked Questions

The world of real estate closings can get complicated, and it's natural to have questions. To clear things up, we've put together answers to some of the most common questions we hear about attorney opinion letters. Think of this as your quick-reference guide to help you move forward with confidence.

How Much Does an Attorney Opinion Letter Cost?

There’s no single price tag for an attorney opinion letter. The cost really hinges on a few key things, with the biggest one being the complexity of the property's title history. A property that’s changed hands a dozen times with tangled records is going to take a lot more digging than one with a clean, simple past.

An attorney’s hourly rate and even the property's location can also factor in. That said, an AOL is often a more budget-friendly choice than a full-blown title insurance policy, especially for things like a refinance or on properties with a clear, recent title search. The best bet is always to ask a qualified real estate attorney for a quote tailored to your specific situation.

When Is an Attorney Opinion Letter Used?

You’ll most often see an attorney opinion letter pop up in real estate deals when someone needs a formal, legal assurance about the status of the title. While they can work in almost any sale, they’re especially common in a few specific scenarios.

These situations often include:

- Mortgage Refinancing: Lenders frequently accept an AOL as proof that their new loan will be in the first lien position, which is their top priority.

- Commercial Real Estate Deals: These are complex transactions, and the detailed legal breakdown from an attorney is often essential.

- Cash Transactions: When a buyer is paying with cash, they might choose an AOL as a smart, cost-effective way to do their due diligence on the title.

- Areas with Established Precedent: In some states and local markets, using AOLs to verify title is just the standard way of doing business.

Do Lenders Accept an Attorney Opinion Letter?

Yes, many do. A lot of lenders are perfectly happy to accept an attorney opinion letter instead of a traditional title insurance policy, particularly when it comes to refinancing. At the end of the day, what a lender really needs is solid assurance that their mortgage is secure and has priority over any other claims. A carefully drafted opinion from a reputable attorney gives them just that.

However, it's not a universal yes. Acceptance depends on the lender’s own internal policies and the kind of loan you're getting. It's absolutely crucial to check with your lender beforehand to make sure an AOL meets their underwriting rules. Taking this simple step can prevent major headaches and last-minute surprises at the closing table. For more answers, feel free to check out our comprehensive FAQ page for even more insights.

How Do I Obtain an Attorney Opinion Letter?

Getting an attorney opinion letter is actually a pretty straightforward process. You or your lender will hire a real estate attorney who specializes in title examination. That attorney then gets to work, performing a deep dive into all the relevant public records to conduct a thorough title search.

Based on what they find, they’ll draft the formal opinion letter. This final document is then handed over to whoever requested it—usually the lender or the buyer—giving them the legal confidence they need to move forward with the deal.

Ready to move past the risks and inefficiencies of manual title research? TitleTrackr uses intelligent automation to help you generate faster, more accurate, and more reliable opinion letters. Reduce your liability, impress your clients, and modernize your entire workflow.