Think of a property's title as its official life story. A title search service acts as the biographer, digging through every chapter to ensure the story is complete and accurate before a property changes hands. It's an absolutely essential safeguard in any real estate transaction, but the traditional, manual process is often slow and prone to human error.

What Are Title Search Services and Why Are They Essential?

At its core, a title search is a professional investigation into public records to determine who legally owns a property and to uncover any claims, debts, or restrictions tied to it. This isn't just a formality; it’s a critical risk-management step for buyers, lenders, and title professionals. The entire point is to unearth hidden problems that could derail a transaction or lead to costly legal battles down the road.

Without an accurate search, a buyer could inherit a world of financial and legal trouble. Imagine a client closing on their dream home, only to find out a previous owner’s unpaid contractor slapped a mechanic's lien on the property. Or discovering that a long-lost heir has a legitimate claim to ownership. These aren't just scare tactics; they're real-world risks that professional title search services are designed to eliminate.

The Foundation of a Secure Transaction

A clean title is the bedrock of any real estate transaction. It’s the proof that the seller has the legal right to hand over the property, free and clear of any surprises. To achieve this, the title search process combs through historical documents to build a complete, verifiable picture of the property's past.

This detective work is what keeps the real estate market healthy. In fact, the title and settlement services industry in the United States grew to a market size of $15.4 billion, a number that proves just how critical this work is. These services provide the confidence needed for billions of dollars in property to change hands securely every year. You can dig deeper into the title and settlement services market size on kentleyinsights.com.

A title search isn’t just about reviewing documents; it’s about providing peace of mind. It transforms a complex legal history into a clear, verifiable statement of ownership, ensuring every transaction is built on solid ground.

Key Protections Offered by Title Searches

The real power of a title search is its ability to identify and resolve issues before they impact closing. It’s a proactive step that protects every party involved by confirming several crucial details.

- Verifying Legal Ownership: First and foremost, it confirms the seller is the true owner and has the authority to sell.

- Uncovering Liens and Judgments: The search flags any outstanding debts tied to the property, from unpaid taxes and contractor liens to court judgments.

- Identifying Encumbrances: It also reveals other claims or restrictions, like an easement that gives a utility company the right to access part of the land.

- Resolving Boundary Issues: A good search can help spot discrepancies in property lines or an encroachment from a neighbor's fence.

By bringing these potential "title clouds" into the light, title professionals can ensure all known issues are dealt with. This allows the new owner to take possession with confidence, protecting their financial investment and future property rights.

How the Title Search Process Actually Works

Think of a title search as a deep-dive investigation into a property's entire life story. The moment a transaction begins, a specialized professional—often called a title examiner or an abstractor—gets to work, piecing together the property's complete legal history. This isn't just about glancing at a single document; it's about meticulously following a paper trail that can stretch back for decades, a process that modern technology is making faster and more accurate than ever.

The search kicks off by digging into a massive collection of public records. We're talking about documents stored at county courthouses, recorder's offices, and other government buildings. These files include everything from deeds and mortgages to court judgments, tax records, and divorce decrees—basically, anything that could legally impact the property.

The examiner's primary goal is to build an unbroken timeline of ownership, known as the chain of title.

Each "link" in this chain represents a transfer of ownership. The examiner must verify that every single transfer was legitimate, properly documented, and legally sound. Even a small hiccup, like a forged signature from 40 years ago or a missing heir who never signed off on a sale, can throw a serious wrench into today's transaction.

Digging Deeper Into Public Records

Once the ownership history is solid, the search broadens. Now, the examiner starts hunting for any financial claims or legal restrictions attached to the property. This is a huge step because these issues, known as encumbrances, can become the new owner's headache if they aren't cleared up before closing.

This deep dive involves a few key searches:

- Lien Search: This is all about uncovering any debts tied to the property. Think unpaid property taxes, liens from contractors who never got paid for a renovation (mechanic's liens), or court judgments against a previous owner.

- Easement Review: Here, the examiner looks for any legal rights someone else has to use a part of the property. A classic example is a utility easement that lets the power company access lines running through the backyard.

- Survey and Boundary Check: Property surveys are cross-referenced to make sure the legal description is spot-on and to check for any encroachments, like a neighbor's fence that's accidentally built a few feet over the property line.

This whole process is a systematic way to uncover and deal with risks before they become real problems.

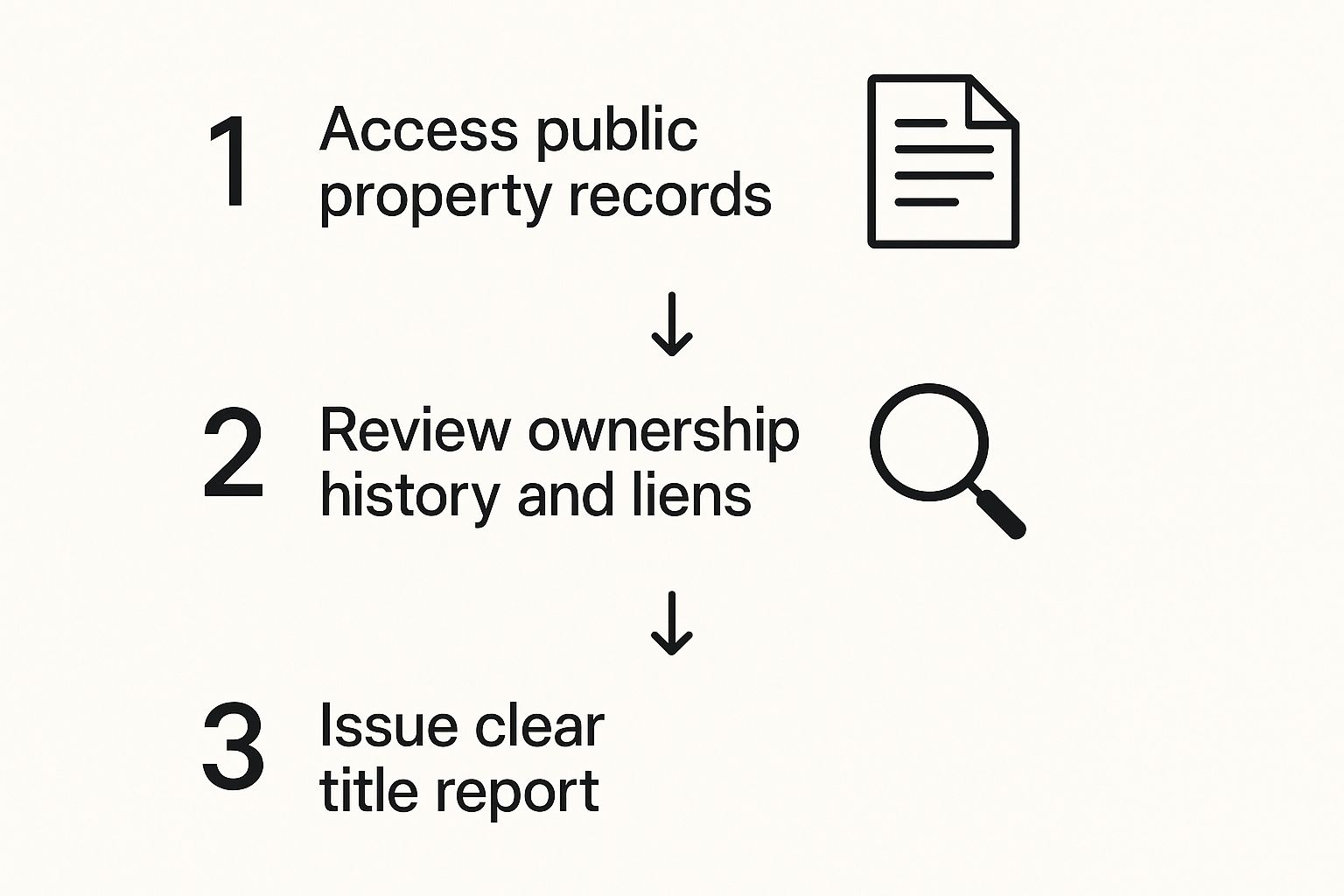

As you can see, it’s a logical flow. You gather the raw data from public records, analyze it for any potential issues, and then package it all into a clear, final report. It's a method designed to leave no stone unturned, and technology is revolutionizing each step.

Compiling the Title Report

After all the information has been gathered, the abstractor compiles their findings into one detailed summary. This document, known as a title abstract or title report, lays out the complete history and current status of the property's title. If you want to learn more about the critical work these pros do, you can explore the role of professional property title abstractors on titletrackr.com.

This report is the finish line of the investigation. It clearly lists the current legal owner, identifies any outstanding liens or encumbrances, and spells out any requirements that need to be met before the property can legally change hands.

A title search is fundamentally a risk-mitigation process. It systematically identifies and addresses historical issues so they don't become future liabilities for the new owner.

The title company and everyone else involved in the deal will review this report carefully. If any "clouds" or defects are discovered, the title company works with the seller to get them sorted out. This might mean paying off an old lien, fixing a clerical error in a public record, or tracking down a previously unknown party to get their signature on a release.

Only when every issue is resolved and the title is deemed "clear" can the real estate transaction safely move to closing. This diligent, step-by-step process is what gives a buyer a clean, marketable title—and the peace of mind that comes with protecting such a major investment.

Common Title Defects That Can Derail a Purchase

A title search is a background check on a property, designed to find any skeletons in its closet before they come back to haunt the new owner. These hidden problems are often called title defects or "clouds on title," and they’re precisely what a professional search aims to uncover.

Think of it like this: an ideal property title is a perfectly clear pane of glass. Each defect is a crack or smudge that threatens the integrity of the whole structure. A modern title search service is the specialist who meticulously inspects that glass, leveraging technology to ensure you see the full, unblemished picture before a transaction closes. Without this critical step, a dream purchase can quickly turn into a financial nightmare.

Uncovering Hidden Liens and Judgments

One of the most common—and dangerous—defects a title search uncovers is an undisclosed lien. Simply put, a lien is a legal claim against a property used as security for a debt. If a previous owner didn't pay their bills, those debts can stick to the property, waiting for an unsuspecting new owner to deal with them.

These can pop up in a few different forms:

- Mechanic's Liens: Filed by a contractor who did work on the home but never got paid.

- Tax Liens: When federal, state, or local property taxes go unpaid, the government can place a lien that trumps almost all other claims.

- Judgment Liens: If a prior owner lost a lawsuit and has an outstanding court judgment, a lien could be placed on their property to satisfy that debt.

Without a thorough search, a new owner could inherit these financial burdens. That means they might find themselves on the hook for someone else's old debts just to keep the home.

Errors in Public Records and Forgery

You'd think public records are foolproof, but they're not. Simple clerical mistakes, filing errors, and even outright fraud can create massive title defects that put ownership at risk. An examiner might find a deed that was recorded with a misspelled name or the wrong legal description for the property. These seemingly small typos can blossom into huge legal headaches.

Even worse is discovering fraud or forgery. A forged signature on a deed from a past sale could mean the entire transfer was illegal. This can lead to a shocking realization: the person who sold the property might not have had the legal right to do so in the first place, calling the entire ownership into question.

The greatest value of a title search is its ability to find problems rooted deep in the past. It protects you not just from the seller's actions, but from the actions of every single owner who came before them.

Gaps in the Chain of Title and Unknown Heirs

A property's ownership history is documented in what’s called the "chain of title"—a chronological record of every owner. If a link in that chain is missing or broken, it creates a serious problem. This often happens when a deceased owner's estate wasn't settled correctly, leaving a gap in the record.

This leads directly to another major issue: undiscovered heirs. Imagine a property was sold from an estate, but one of the children was missing or unknown at the time. Years later, that heir could show up with a valid legal claim to a piece of the property. Title search services dig into probate records and family histories to prevent these exact scenarios, making sure all rightful parties have signed off and the seller can truly pass the title, free and clear.

To give you a clearer picture, here’s a look at some common defects and the real-world risks they carry.

Common Title Defects and Their Potential Impact

| Title Defect | Description | Potential Risk to Owner |

|---|---|---|

| Undisclosed Liens | A legal claim against the property for an unpaid debt from a previous owner (e.g., unpaid taxes, contractor bills, or court judgments). | You may become responsible for paying off the previous owner's debt to prevent foreclosure. |

| Errors in Public Records | Mistakes made in the property's public records, such as incorrect names, legal descriptions, or filing errors. | Can create disputes over property boundaries or ownership, requiring legal action to correct the record (a "quiet title" action). |

| Illegal Deeds/Forgery | A past deed was signed by a minor, someone not mentally competent, or was outright forged. | The transfer of ownership may be invalid, meaning your claim to the property is legally void. |

| Missing Heirs | A previous owner passed away, and an unknown or missing heir with a rightful claim to the property was not included in the estate settlement. | The heir could surface years later and claim ownership rights, potentially forcing a sale or requiring you to buy out their share. |

| Boundary/Survey Disputes | A neighbor's property or a recorded survey shows a different boundary line than what is understood, often due to encroachments. | You could lose part of your land, be forced to move a fence or structure, or get into a costly legal battle with a neighbor. |

| Undiscovered Will | A previous owner's will surfaces after the property has already been sold, changing who has rights to the property. | The property could be pulled back into the estate, invalidating your purchase and leaving you with a total financial loss. |

These are just a few of the potential landmines that a professional title search is designed to find and defuse before you close the deal.

Title Search vs. Title Insurance: What's the Difference?

This is easily one of the most common questions in real estate: "If the title search was so thorough, why do I need to buy title insurance?" It's a great question, and the answer gets to the heart of what makes a real estate transaction secure.

Think of it like this: a title search is a detailed diagnostic exam of a property's history, while title insurance is the comprehensive protection plan that covers any surprise issues that pop up later. They serve two totally different, yet complementary, purposes.

A title search is all about looking backward. It’s an expert deep-dive into public records to find any existing defects, liens, or ownership claims tied to the property. But even the most diligent search has its limits. It can only uncover what's officially on the record.

That's where title insurance steps in. It’s your safety net against the unknown and the undiscoverable. While the search flags known threats from the property's past, the insurance policy protects your financial future from hidden dangers that could emerge long after you've moved in.

The Search Finds Problems, The Insurance Fixes Them

The real power is in how these two work together. The title search is your chance to clean up any known issues before you sign on the dotted line. The insurance policy is your shield against the "what ifs" that no one could have possibly seen coming.

What kind of "what ifs" are we talking about?

- Forgeries and Fraud: A signature on a deed from 30 years ago could have been forged. A records search would never catch that, but it could invalidate your ownership.

- Undisclosed Heirs: Someone's long-lost relative could appear years from now with a legitimate claim to the property.

- Filing Errors: A simple clerical mistake at the county recorder's office could create a massive title defect that doesn't surface for decades.

- Issues with a Prior Signer: A past owner might have been mentally incompetent or a minor when they signed the deed, potentially making the transfer illegitimate.

Title insurance is a unique beast. Unlike your car or home insurance that protects you from future accidents, title insurance protects you from problems that already happened in the past but just haven't been discovered yet.

Owner's vs. Lender's Policy: Who's Protected?

It’s also critical to know that not all title insurance is created equal. There are two main types of policies, and for complete protection, both are necessary. One protects your bank, and the other protects you.

The demand for this kind of protection is growing. The global title insurance market is expected to expand at a compound annual growth rate (CAGR) of 7.4% through 2034. This is driven by a strong real estate market and a greater desire for financial security against hidden title problems. A policy ensures that if an ownership dispute arises, both the owner and the lender are compensated for their losses. You can find more expert analysis on the title insurance market here.

1. Lender's Title Insurance

This is the policy your mortgage lender will almost certainly require you to buy. It protects their investment in the property, not your equity. If a title claim pops up that threatens their collateral (your home), this policy makes sure the bank gets their money back up to the loan amount.

2. Owner's Title Insurance

This one is for you. An owner's policy protects your equity and your right to the property for as long as you or your heirs own it. You typically pay a one-time premium for it at closing, and it defends you against any legal challenges to your title. Without it, you’d be on the hook for all the legal fees and potential financial losses from a claim—which could be devastating.

At the end of the day, title search services and title insurance are two sides of the same coin. The search minimizes the risks you know about, and the insurance policy protects you from the financial fallout of the ones you don't. Together, they deliver the peace of mind every property owner deserves.

How to Choose the Right Title Search Provider

Choosing the right partner for your title search services is one of the most critical decisions in any real estate transaction. The provider you pick directly impacts the speed, accuracy, and security of the entire deal. The choice goes far beyond price—it’s about evaluating genuine expertise, reliability, and the technology they use to protect your clients and your business.

A great title partner is more than a vendor; they're your first line of defense. They blend deep local knowledge with a near-obsessive attention to detail, making sure every potential issue gets flagged and handled. Rushing this decision or choosing a provider still stuck in manual processes can lead to expensive delays and missed title defects down the road.

Key Criteria for Vetting Providers

When you start comparing title search companies, you need a solid checklist of what really matters. A provider's reputation is a good place to start, but you have to dig deeper into how they actually operate, communicate, and leverage modern tools.

Here are the core areas to focus on:

- Local Expertise and Reputation: Do they have a proven track record in the specific county or region? Real estate is hyper-local, and a provider who knows the ins and outs of the area's record-keeping systems is invaluable.

- Technology and Automation: What tools do they use? In today's market, relying on manual searches alone is a competitive disadvantage. Ask if they use AI and automation to improve accuracy and speed.

- Turnaround Time and Accuracy: What are their average turnaround times, and what is their process for ensuring accuracy? The best providers balance speed with diligence, never sacrificing one for the other.

- Communication and Transparency: How do they keep you in the loop? Look for a partner who provides clear, proactive updates and a transparent fee structure without hidden costs.

Choosing a title partner is about entrusting someone with the legal integrity of your property. The right provider combines traditional diligence with modern technology to deliver not just a report, but confidence.

The Growing Role of Technology in Title Searches

The title industry is in the middle of a massive technological shift, delivering faster and more accurate results than ever before. While manual searches were once the standard, modern, tech-forward platforms are setting a new benchmark for efficiency and reliability. These solutions use automation and artificial intelligence to comb through mountains of data with a precision that manual methods simply can't match.

A provider using advanced tech can scan thousands of documents in minutes, flagging inconsistencies a human eye might miss. This doesn't just accelerate timelines; it dramatically reduces the risk of human error—a critical factor when millions of dollars are on the line.

The American Land Title Association (ALTA) is a key resource for industry best practices, guiding how technology is responsibly woven into the title and settlement process.

This focus on high standards and innovation shows that industry leaders see technology as the clear path forward for improving the quality of title search services.

Platforms like TitleTrackr are at the forefront of this movement. By integrating AI-driven tools, we transform clunky manual workflows into a streamlined, automated process. Our system extracts critical data from legal documents with incredible precision, generating comprehensive reports that give you unmatched transparency and control over your workflow.

When you choose a forward-thinking provider, you aren't just getting a title search; you're getting a partner equipped to handle the complexities of the modern real estate market. Ready to see how technology can revolutionize your title search process?

Request a demo of TitleTrackr today and discover how our AI-powered solutions deliver the speed and accuracy your business deserves.

The Future of Title Searches and Real Estate Tech

The title industry is undergoing a massive transformation. The old-school method of manually digging through dusty courthouse records is being replaced by technology that is reshaping how we verify property ownership. The future of title search services is being written with code, data, and smart automation. This isn't just about making things faster; it's about setting a new, higher standard for accuracy and security in every real estate deal.

This evolution couldn't come at a better time. The title insurance industry recently collected an impressive $3.9 billion in premiums in a single quarter, an 18% jump from the previous year. This growth proves that the demand for reliable title services is soaring, highlighting the urgent need for solutions that can handle more volume without sacrificing quality. You can see the full breakdown in the American Land Title Association's quarterly report.

The Rise of AI and Machine Learning

Leading this charge are Artificial Intelligence (AI) and machine learning. These technologies act as the ultimate assistants, automating the most repetitive, time-consuming parts of a title search, like document analysis and data extraction. Instead of a person spending hours reading through decades of deeds, AI can scan, understand, and flag potential problems in a fraction of the time.

This empowers skilled title professionals to stop being data miners and start being strategic problem solvers, focusing their expertise on untangling complex title issues. It’s a direct solution to the core challenge of title work: finding the needle of an anomaly in a haystack of information. By training algorithms on what to look for, modern platforms slash the risk of human error and deliver cleaner, more dependable title reports.

Blockchain and Unchangeable Ledgers

Looking further down the road, blockchain technology holds incredible potential for the industry. At its heart, a blockchain is a secure, unchangeable digital ledger—a perfect match for recording property ownership. Imagine a "digital title" that holds a complete, verified, and unalterable history of every transaction, lien, and easement tied to a property.

The core promise of future real estate technology is certainty. By using tools like AI and blockchain, the industry is moving toward a system where title defects can be prevented proactively, not just discovered retroactively.

This creates a crystal-clear, tamper-proof record that could one day make traditional title searches much simpler or even obsolete for some properties. While we're still a few years from widespread adoption, it's a clear signal of where the industry is headed: a future of nearly instant, completely secure property transfers.

The New Standard of Digital Closings

Finally, the boom in Remote Online Notarization (RON) is turning fully digital closings from a niche option into a reality. RON allows people to sign and notarize documents securely over the internet, eliminating the need for in-person meetings. This is the kind of digital convenience that modern clients now expect.

In this environment, partnering with a forward-thinking company like TitleTrackr, which has embraced these tech advancements, isn't just a good idea—it’s essential for staying competitive. To see more on how tech is shaping our world, check out the other topics on our real estate tech blog. Working with innovators is the only way to ensure you're ready to deliver the fast, secure solutions the market demands.

Frequently Asked Questions About Title Services

Even with a good grasp of the basics, a few practical questions always seem to pop up about title searches. Let's tackle the most common ones head-on to clear up any lingering confusion and help you move forward with total confidence.

How Long Does a Title Search Usually Take?

You can typically expect a standard title search to take between 5 to 10 business days. This gives the professionals enough time to do their due diligence, digging through all the necessary public records and putting together a solid report.

Of course, that timeline can shift. The property's age, the complexity of its ownership history, and the organization of local county records can all play a role. If complex issues or "clouds" on the title are uncovered, it will take more time to investigate and resolve them.

The real goal of a title search isn't just speed—it's thoroughness. A few extra days of digging to fix a potential problem is a tiny price to pay for decades of secure, worry-free ownership.

Can I Do a Title Search Myself?

Technically, property records are public, so you could try. But honestly, it's a terrible idea. Professionals have the specialized know-how to read dense legal documents, navigate a maze of different databases, and—most importantly—spot the subtle red flags that an untrained eye will almost certainly miss.

The real value you're paying for isn't just someone gathering papers; it's their ability to understand the legal weight of what's in them. Besides, working with a professional company and getting title insurance is the only way to be financially protected if a claim pops up down the road. That's a safety net you just can't create on your own. For more answers, you can check out our full title services FAQ on titletrackr.com.

What Happens If a Problem Is Found?

Finding a problem during a title search is actually a good thing! It means the process is working exactly as it should. When a title defect comes to light, the title company gets to work with the seller to "cure" it, or resolve the issue, long before you get to the closing table.

This could mean a few different things, like:

- Paying off an old, forgotten lien from a contractor.

- Fixing a simple clerical error on a document filed with the county.

- Hunting down a missing heir to get a much-needed signature.

The vast majority of common issues are fixable. The title pros handle all the legwork to make sure the defect is cleared, allowing the sale to move forward and giving you a clean, marketable title.

Ready to see what happens when modern technology brings speed, accuracy, and reliability to title search services? The AI-driven platform from TitleTrackr turns what was once complex manual work into a simple, automated process.

Request a demo of TitleTrackr today and discover how to sharpen your efficiency and gain absolute confidence in your title workflow.