When clients ask, "how much is a title search?", the simple answer is often between $200 and $400 for a standard residential property. But for industry professionals, the real answer is more nuanced. This fee isn't just a line item; it's the cost of mitigating risk, ensuring a smooth closing, and protecting what is likely your client's largest financial investment.

Understanding the True Value of a Title Search

Think of a title search as mission-critical due diligence. You wouldn't advise a client to purchase a business without scrutinizing its financials, and the same rigorous logic applies to real estate. A title search is the definitive investigation that confirms the seller's legal right to transfer ownership and, more importantly, uncovers hidden liabilities that could jeopardize the entire transaction.

What Does the Fee Actually Cover?

That fee funds a meticulous examination of public records to identify and resolve issues that can create major post-closing headaches. For real estate professionals, understanding this process is key to articulating its value to clients and ensuring a secure, defensible transaction.

Here’s what the process entails:

- Verifying Legal Ownership: Confirming the seller is the undisputed owner with the full authority to sell.

- Identifying Liens and Debts: Uncovering outstanding mortgages, unpaid property taxes, mechanic's liens, or HOA liens that attach to the property.

- Finding Easements or Restrictions: Identifying any third-party rights, such as utility easements or restrictive covenants, that impact the use of the property.

To provide clients with a clear picture, here’s a breakdown of how the final cost is structured.

Title Search Cost At a Glance

The final bill for a title search is influenced by several key variables. This table outlines the typical costs and the factors that drive them, providing a useful tool for client conversations.

| Component | Average Cost Range (USA) | Key Influencer |

|---|---|---|

| Abstractor/Search Fee | $150 – $300 | Complexity and depth of the property's chain of title. |

| Examination Fee | $50 – $150 | Time required for an attorney or title officer to analyze findings. |

| Document Retrieval | $20 – $50 | County recording fees, copy charges, and administrative costs. |

While these figures vary by jurisdiction and property history, this provides a solid baseline for discussion. The more complex a property's transactional history, the more labor-intensive and costly the search becomes.

By understanding what this fee covers, real estate professionals can clearly explain its value to clients and see where innovative solutions like TitleTrackr can bring major efficiencies to the process.

What Am I Actually Paying For?

When a client questions the title search fee, what they're really asking is, "What is the ROI on this expense?" The fee isn't for a simple database query; it's for the specialized expertise of a title professional who acts as a property historian and risk analyst.

Their primary task is to construct the property's chain of title. This is an unbroken timeline of ownership, meticulously assembled by analyzing decades of public records—deeds, mortgages, tax records, and court judgments—to ensure every transfer of ownership is legitimate and properly documented.

Uncovering Hidden Property Issues

The true value lies in the expert analysis. A title professional's trained eye identifies "clouds on the title"—the subtle but significant issues that could derail a closing or lead to future litigation.

These problems can include:

- An old mortgage that was satisfied but never properly discharged from public records.

- A previously unknown heir from a prior owner who emerges with a legal claim.

- Unpaid property taxes or a lien from a contractor's unpaid invoice.

- Clerical errors in a past deed's legal description, creating boundary uncertainties.

A single undiscovered defect can escalate into costly legal battles or, in a worst-case scenario, challenge the validity of the owner's title. The search fee is a direct investment in mitigating these substantial risks.

Every document is scrutinized to assess its impact on the property's legal standing. These findings are compiled into a comprehensive title report, giving all parties a clear understanding of the property's status. To appreciate the depth of this work, you can learn more about the role of title abstractors and their detailed work on our blog.

In the end, the cost covers deep-seated expertise, meticulous labor, and the assurance that the property being conveyed has a clean and marketable title—a non-negotiable component of any secure closing.

Key Factors That Drive Up Title Search Costs

No two title searches are identical, and their costs reflect that reality. While a search on a newer home in a planned development may be straightforward, certain variables introduce complexities that increase the time, effort, and ultimately, the cost required.

For real estate professionals, anticipating these factors is crucial for setting accurate client expectations and managing closing timelines.

The most significant cost driver is the property’s history. A home that has transferred ownership multiple times, been subject to foreclosure, or was part of a complex estate settlement has a convoluted paper trail. Each transaction adds a layer of complexity that the title examiner must investigate, increasing the labor involved.

Location and Property Type

A property's location is a critical factor. Each county maintains its own system for recording and accessing public records. Some jurisdictions have archaic, non-digitized systems that require manual, on-site searches, which are inherently more time-consuming and expensive.

Property type also plays a major role. A commercial property with a history of zoning changes and multiple easements presents a far more complex challenge than a standard single-family residence.

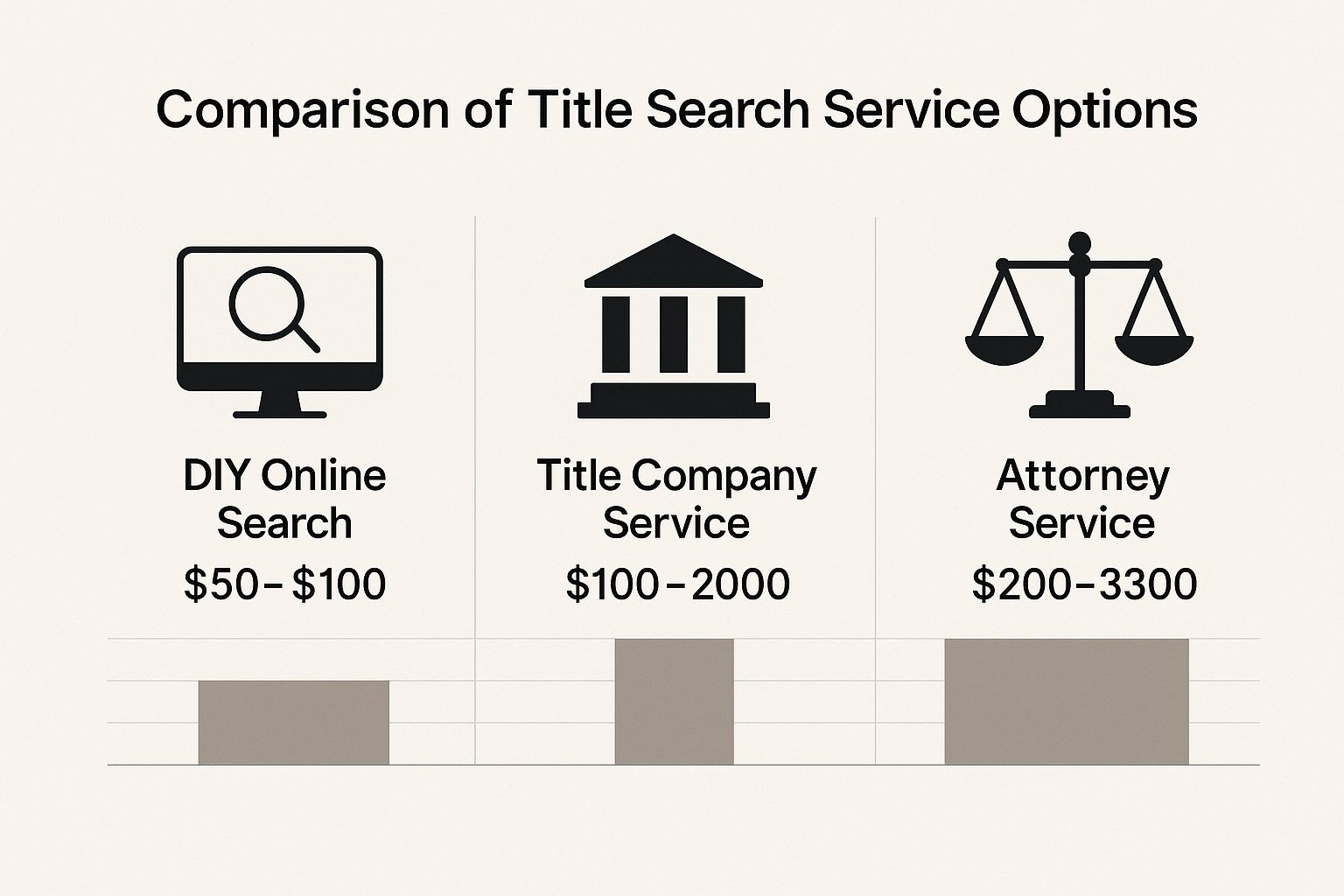

The image below illustrates how different service levels and their associated security can influence the price.

While basic online searches exist, engaging a professional title company or real estate attorney provides a critical level of assurance and liability coverage that is essential for a secure transaction.

The Impact of Complex Histories

The time investment in these searches can be substantial. On average, title companies spend 22 to 45 hours per transaction to ensure a title is clear—a significant operational burden.

Furthermore, nearly 36% of all property transactions encounter a title defect that requires additional curative work. You can explore the complexities involved by reviewing this guide on resolving complex title issues from First American.

When a property has a convoluted history, the search evolves from a routine check into a forensic investigation. This is where costs escalate, as each unresolved issue represents a potential risk to the buyer, seller, and lender.

To illustrate this for your clients, consider the difference between a simple and a complex property.

Cost Factor Comparison: Simple vs. Complex Property

| Cost Factor | Simple Property (Lower Cost) | Complex Property (Higher Cost) |

|---|---|---|

| Property Age | Newer construction, built in the last 10 years. | Historic property, over 75 years old. |

| Ownership History | Only one or two previous owners. | Multiple owners, short-term sales, or family transfers. |

| Prior Liens | Clean history with no prior liens or judgments. | History of tax liens, mechanic's liens, or unresolved debts. |

| Legal Description | Standard lot and block in a platted subdivision. | Metes and bounds description with easements and boundary disputes. |

| Record Access | Digital, easily accessible county records. | Manual search required in a courthouse with poorly organized files. |

| Property Type | Single-family residential home. | Commercial building with mixed-use zoning or a rural farm. |

Ultimately, a property with a complex history is more expensive to search for one simple reason: risk. The more convoluted its past, the greater the likelihood of uncovering a hidden lien, an ownership dispute, or a documentation error that could threaten the entire transaction.

The True Cost of Skipping a Professional Search

The fee for a professional title search is a predictable closing cost. The cost of skipping one, however, is an unquantifiable liability. Forgoing this step isn't a cost-saving measure; it's a high-stakes gamble with your client's financial future, where potential losses can dwarf the initial fee.

Imagine your client closes on their dream home. Months later, a legal notice arrives. A contractor who performed work for the previous owner filed a mechanic's lien for non-payment. Because the lien attaches to the property, your client is now responsible for resolving a debt they didn't incur.

This scenario isn't hypothetical. Undiscovered title defects create legal and financial nightmares long after closing.

Real-World Financial Nightmares

These risks materialize daily. A professional title search is designed to unearth these exact problems before they become your client's liability.

Here are a few common examples of what can go wrong:

- Surprise Heirs: A previously unknown heir of a former owner emerges with a valid claim to the property, challenging your client's ownership.

- Fraudulent Deeds: The seller did not possess the legal authority to transfer the title, potentially invalidating the entire transaction.

- Unresolved Liens: Unpaid property taxes or old court judgments against a previous owner can remain attached to the property, becoming the new owner's responsibility.

Framing the title search as a mere closing cost is a critical misstep. It is essential protection—a modest, one-time investment to safeguard a six-figure asset from catastrophic liabilities and provide complete peace of mind.

Ultimately, that few hundred dollars ensures the property your client is buying is truly theirs, free and clear of the previous owner's financial and legal encumbrances.

How Automation Is Shaking Up the Title Search

For decades, the title industry has operated on manual processes—mountains of paper, trips to the courthouse, and hours of painstaking human review. This traditional approach is slow, expensive, and susceptible to human error, all factors that contribute to the cost and timeline of a title search. That paradigm is finally shifting.

Technology is revolutionizing the title examination process. Modern platforms are fundamentally changing how title searches are conducted. Instead of a person manually sifting through disparate record systems, automated solutions can scan, aggregate, and analyze digitized records in seconds. This leap forward isn't just about speed; it's about delivering a new standard of accuracy.

The Real Power of AI in Title Examination

AI-driven tools can instantly identify potential red flags and document inconsistencies that might take a human examiner hours to uncover. These platforms can cross-reference multiple data sources and automatically generate comprehensive preliminary reports. For title companies and real estate professionals, this translates into a dramatic reduction in labor hours, directly impacting the operational cost of a title search.

This technological shift is a key driver behind the growth of the global title insurance market, which was valued at $56.8 billion in 2022. As transaction volumes increase, digital tools are becoming essential for maintaining efficiency and accuracy. You can discover more insights about this market growth on Allied Market Research.

Automation doesn't replace the title professional's expertise; it amplifies it. By handling the repetitive, data-intensive tasks, these tools free up experts to focus on complex problem-solving, risk assessment, and client communication—delivering a higher quality result, faster.

A modern dashboard can transform a mountain of complex title data into a clear, intuitive overview.

This centralized view provides a property's complete history at a glance, instantly flagging areas that require expert review. By consolidating information, platforms like TitleTrackr convert scattered data into actionable intelligence. This empowers professionals to close deals faster, with greater confidence and reduced risk. It’s not just about cutting costs—it’s about building a smarter, more reliable foundation for every transaction.

Put Your Closings on the Fast Track with TitleTrackr

It’s time to move beyond the slow, manual, and unpredictable methods of traditional title searches. For title agents, attorneys, and real estate professionals, operational efficiency is directly tied to profitability. Every hour spent on manual research, every closing delayed by unforeseen issues, and every risk of human error impacts your bottom line and your client's experience.

TitleTrackr was engineered to solve these exact challenges. Our platform is laser-focused on delivering the speed, accuracy, and efficiency your business needs to thrive.

Speed Up Your Transaction Timelines

Instead of losing valuable hours to tedious record retrieval, TitleTrackr’s AI-powered platform automates the heavy lifting. Our system collapses a process that often takes days into minutes, instantly pulling and analyzing property records. This velocity allows your team to increase capacity and handle more volume without sacrificing quality or accuracy.

By minimizing manual labor, TitleTrackr helps you avoid the costly human errors that can derail a closing. Our system is designed to proactively flag potential issues, enabling your team to resolve them before they escalate into significant problems, protecting both your workflow and your professional reputation.

Faster, more accurate results lead directly to smoother closings and more satisfied clients. It’s that simple. Discover how you can elevate your service, enhance your operational capacity, and gain a competitive edge. You can request a demo of TitleTrackr to see exactly how our platform can transform your operations and reduce the labor-intensive costs associated with every title search.

Frequently Asked Questions About Title Search Costs

Every real estate transaction comes with questions, particularly around costs. Here, we address two common queries from a professional's perspective to help you guide your clients.

Is a Title Search the Same As Title Insurance?

No, they are two distinct but related components. The title search is the diagnostic process—the investigative work performed to assess the health of a property's title. Title insurance is the policy you obtain based on that investigation, providing financial protection against any undiscovered defects that could surface in the future.

A clean title search is a prerequisite for issuing a title insurance policy. The search minimizes known risks, while the insurance protects against unknown risks.

Who Usually Pays For The Title Search?

This is determined by local custom and the terms of the purchase agreement. In many markets, the allocation is as follows:

- Buyer typically pays for the title search and the lender’s title insurance policy.

- Seller often pays for the owner’s title insurance policy.

These terms are almost always negotiable. As a professional, your role is to ensure your client understands what they are paying for and why it's a critical part of the transaction.

Advising a client to attempt a DIY title search is a significant liability risk. The nuances of legal documents and property records require professional expertise to avoid costly oversights.

For a deeper dive into common concerns, explore common title search topics on our FAQ page.

Ready to see how automation can reduce your operational costs and accelerate your closing timelines? With TitleTrackr, you can replace days of manual work with minutes of precise, AI-driven analysis.