At its core, filing a quitclaim deed means you’re creating a document to transfer a property interest, getting it signed in front of a notary, and then officially recording it with the county. The entire process hinges on getting the details right—especially the legal property description—and following local rules to the letter. While it might sound straightforward, even a small mistake can snowball into a major title issue or, worse, leave you vulnerable to fraud. For real estate and title professionals, ensuring this process is handled with precision is not just good practice—it's essential for maintaining a clean chain of title.

Your Guide to Filing a Quit Claim Deed

Industry professionals frequently use quitclaim deeds to transfer property between related parties, such as family members or business entities, or to resolve minor title defects. It's critical to understand what a quitclaim doesn't do: it offers zero guarantees that the grantor has a clear title. It simply transfers whatever interest the current owner (the grantor) might have to the new owner (the grantee). This lack of warranty is precisely why accuracy and due diligence are paramount.

This guide provides actionable steps for navigating the filing process with professional-grade precision. We'll cut through the legal jargon and show you how to handle each stage with confidence, from verifying property details to ensuring the final document is recorded correctly. The end goal is simple: a secure, legally sound, and defensible transfer of interest.

To provide a clear operational overview, the process can be broken down into a few key milestones.

Key Stages of Filing a Quitclaim Deed

Here is a quick overview of the essential milestones in the quitclaim deed filing process.

| Stage | Key Action | Primary Goal |

|---|---|---|

| Preparation | Gather the full legal description of the property and all party names. | Ensure absolute accuracy to prevent future title defects. |

| Drafting | Create the deed document using a state-compliant form or template. | Meet all legal requirements for your specific jurisdiction. |

| Execution | The grantor signs the deed in the presence of a notary public. | Formally and legally validate the transfer of interest. |

| Recording | File the original, notarized deed with the appropriate county office. | Make the property transfer an official part of the public record. |

Each stage is a critical link in the chain. Mishandling any one of them can jeopardize the entire transfer and create costly title curative work down the line.

Why Understanding This Process Matters

A quitclaim deed's simplicity is both its best feature and its biggest risk. Since it lacks the protective covenants found in warranty deeds, meticulous accuracy is non-negotiable. Any error—a misspelled name, a typo in the property description—can create a "cloud" on the title. That’s a recipe for legal headaches and unexpected costs that can derail future transactions.

These deeds have been used for centuries as a practical tool. For instance, a genealogical case study from 1856 in Fulton County, Indiana, shows how a family used quitclaim deeds to consolidate inherited land among siblings, simplifying a complex estate.

Key Takeaway: A quitclaim deed is a powerful but unforgiving instrument. Precision and strict adherence to local laws aren't just best practices—they're fundamental requirements for a valid property transfer.

The Hidden Risk: Title Fraud

Unfortunately, the straightforward nature of a quitclaim deed also makes it a prime target for criminals. Title fraud is a serious and growing problem where a scammer forges a quitclaim deed to transfer your property into their name without you ever knowing. From there, they can sell it or take out loans against it, leaving the true owner to clean up a devastating financial and legal mess.

This is exactly why modern vigilance is so critical. Proactive monitoring services like TitleTrackr offer an essential layer of defense by immediately alerting you to any new filings or changes related to your property title. Understanding how to file a quitclaim deed correctly is the first line of defense; leveraging technology to protect it afterward is just as important.

Drafting a Legally Sound Quitclaim Deed

When it comes to drafting a quitclaim deed, accuracy is everything. This is the stage where a simple data entry error can snowball into a massive headache, creating a cloud on the title that might take years and significant legal fees to resolve. Getting this right from the start ensures the property transfer is clean, smooth, and legally bulletproof.

First, you need the legal description of the property. This cannot be stressed enough: this is not the mailing address. The legal description is the specific, formal identifier used in public land records that points to one unique parcel of land and no other.

You can usually find this on the property's most recent deed, on a property tax statement, or by getting a copy directly from your county recorder’s office. You must transcribe it exactly as it appears in the official record. There is no room for paraphrasing or summarizing. Even a tiny typo can invalidate the entire deed or create ambiguity about which property was actually being transferred.

Nailing Down the Parties Involved

Next, you must correctly identify the grantor (the person or entity giving up their interest) and the grantee (the person or entity receiving it). Use their full legal names. No nicknames or initials unless that's their legal name. It’s also standard practice to include their current mailing addresses.

For example, if the grantor is "Jennifer M. Davis" but everyone knows her as "Jen Davis," the deed must say "Jennifer M. Davis." This level of precision prevents any future arguments or legal challenges over who was actually involved in the transfer.

This information must line up perfectly with what's already in the public record to keep the chain of title clean. Mismatched names are a classic red flag and a common reason for title defects that can derail a future sale or refinance.

What's the "Consideration"?

Every deed, including a quitclaim, must mention consideration—what was given in exchange for the property. In many quitclaim situations, particularly between family members, the property is a gift and no money changes hands.

So, how is this handled? A nominal amount is usually stated.

- You’ll often see language like, "for the sum of one dollar and other good and valuable consideration."

- This phrase is legal boilerplate that satisfies the requirement for consideration without needing to state a real purchase price.

It's a huge misconception that a quitclaim deed is just a simple fill-in-the-blank form. In reality, it’s a powerful legal instrument where every single word counts. An incorrect legal description or a misspelled name doesn't just cause a minor hiccup—it can make the entire transfer void.

While templates are widely available, every state has its own specific requirements for formatting, language, and necessary inclusions. Ignoring these local nuances is a surefire way to have the deed rejected by the recorder's office. The goal is to create a document so clear and unambiguous that it leaves zero room for future interpretation.

Navigating State-Specific Filing Rules

Treating a quitclaim deed like a one-size-fits-all document is one of the fastest ways to get it rejected. Every state has its own unique property laws, and ignoring those local nuances isn't just a small risk—it's a surefire way to create delays and add unnecessary costs to a transaction.

These aren't just minor suggestions; they are strict, non-negotiable requirements. Some states get incredibly specific, mandating things like minimum margin sizes or the exact weight of the paper you have to use. Others demand precise legal language or disclosures be printed directly on the deed itself.

The process isn't over until the county recorder's office officially accepts and records your document.

As you can see, getting that final stamp of approval depends entirely on meeting the local jurisdiction's exact standards before you even walk up to the counter.

Common State-Level Differences

So, what should you be looking for? While it’s impossible to list every rule for all 50 states, there are a few common tripwires that professionals encounter frequently.

Here are some of the most frequent variations you'll find:

- Witness Requirements: States like Florida and Georgia require the grantor's signature to be witnessed by two people. Head over to California, and you don't need any witnesses at all—just a notary.

- Notary Acknowledgment Wording: This is a big one. The specific paragraph the notary fills out (the "acknowledgment") has to be worded exactly as the state statute requires. Using a generic or out-of-state form is a classic rookie mistake and an instant rejection.

- Tax Statements: Some counties require a separate tax or transfer statement to be filed right alongside the deed, explaining the nature of the transaction for their records.

- Grantor Marital Status: In states like Ohio, the grantor must explicitly state their marital status on the deed. This is done to address any potential property rights a spouse might have.

Expert Tip: Never download a generic quitclaim deed template and assume it's compliant. The best practice is to obtain the form directly from the county recorder's office where the property is located or use a trusted legal forms provider familiar with that state's laws.

How to Stay Compliant

So, how do you make sure you're following the right rules? The absolute best source of truth is the county recorder's office itself. Depending on where you are, it might be called the Register of Deeds or the County Clerk.

Their website is your first stop. Look for instructions, downloadable forms, and a schedule of filing fees.

Honestly, a quick phone call to their office can save you weeks of headaches. Just ask them directly about their requirements for formatting, witnesses, and any other forms you'll need. Getting the information straight from the source is the single most effective way to avoid having your deed bounced back.

Keeping up with these details is a constant challenge, which is why professionals in the field rely on specialized tools and resources. For more insights on managing property records and the complexities of title, you might find some useful information by exploring additional articles on the TitleTrackr blog.

Getting Your Deed Signed and On the Record

Once you’ve drafted the quitclaim deed, double-checked the property's legal description, and ensured every name is spelled perfectly, it's still just a piece of paper. The next steps—execution and recording—are what transform it into a legally binding property transfer.

This is where the process becomes formal. The grantor must sign the deed, but they can't just scribble their name on it anywhere. The signature needs to be properly witnessed to be valid, and in almost every case, that means signing it right in front of a notary public.

A notary's function is to verify the identity of the signatory and witness the act of signing. It’s a critical safeguard against fraud, ensuring the person conveying the property interest is exactly who they claim to be. A valid, government-issued photo ID, such as a driver's license or passport, is required.

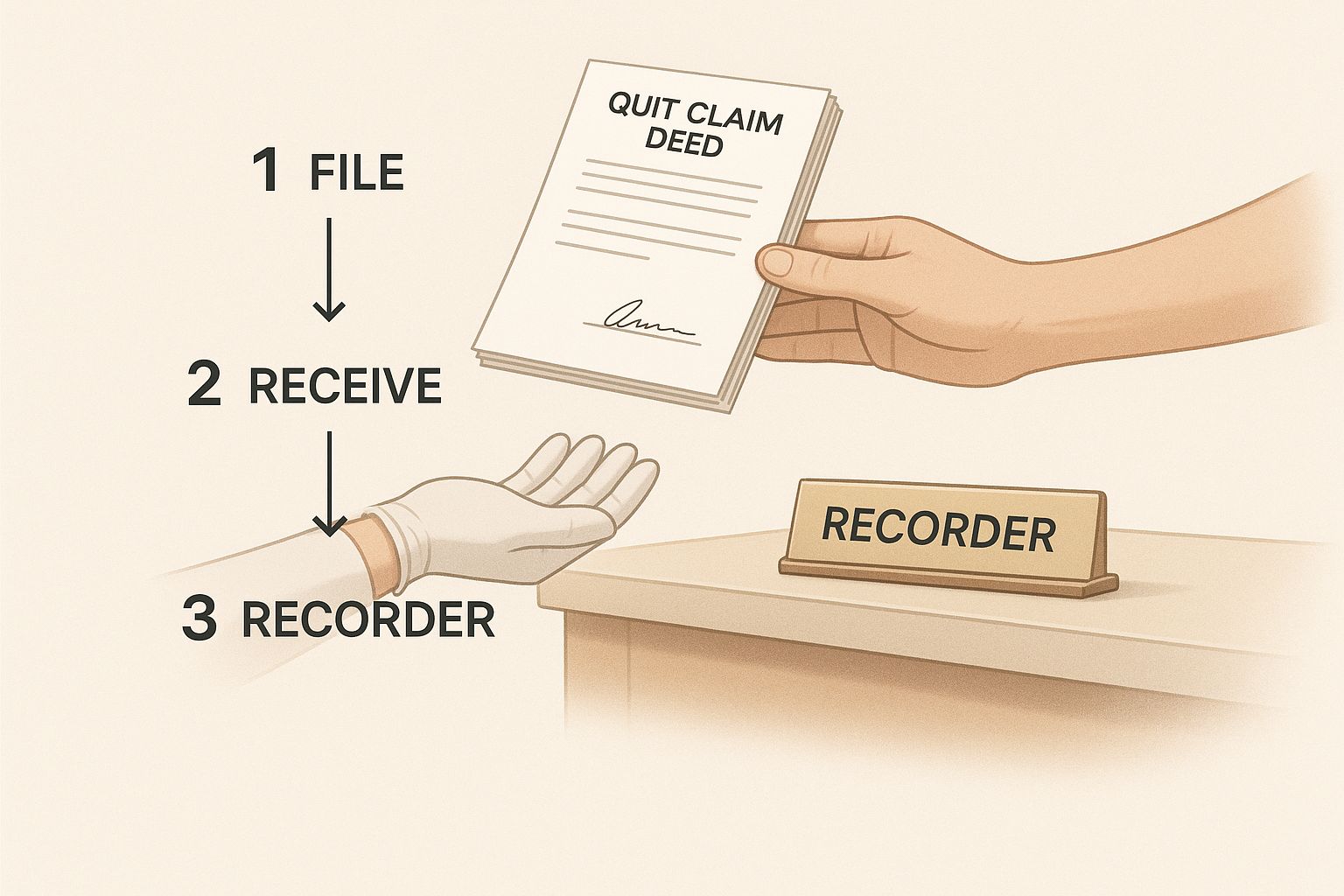

Making It Official with the County

Once the ink is dry and the notary's seal is on the deed, you're on to the final, most important step: getting it recorded. This involves taking the original, signed deed down to the right government office in the county where the property sits. Depending on where you are, this office might be called the County Recorder, Register of Deeds, or even the County Clerk.

Recording the deed is what puts the transfer on the public record. It provides constructive notice to the world—lenders, future buyers, tax assessors, everyone—that the property has a new owner. If you skip this step, the transfer isn't legally complete. The new owner's interest is left unprotected and vulnerable.

Here’s a quick rundown of what happens at the recorder's office:

- Submission: You’ll hand the original, notarized deed to the clerk.

- Payment: Get ready to pay a recording fee. This can vary a lot from one county to the next. You might also owe transfer taxes, depending on your state's laws and the reason for the transfer.

- The Official Stamp: The clerk will stamp the document with the date and time, then assign it a unique identifier, like a book and page number, officially placing it into the county’s records.

Don't Forget Your Copy

After the county office processes the document, they will typically mail the original back to the new owner (the grantee) or the filer. This can take anywhere from a few days to several weeks. This recorded copy, with the county's official stamp on it, is your ultimate proof that the transfer happened.

Keep this recorded copy in a safe place with your other important property documents. It's the definitive evidence that the transfer was completed and is now a matter of public record, solidifying your legal standing.

This final stage is where many administrative errors occur. If the deed doesn't meet the county's specific formatting rules (like margin sizes or paper type) or if the correct fee is not included, it will be rejected. This is why strict adherence to local rules is absolutely essential for a smooth filing.

How to Protect Your Property from Deed Fraud

The very thing that makes a quitclaim deed so useful—its simplicity—is also its biggest vulnerability. Because the process is so straightforward, it leaves a dangerous opening for criminals to exploit. This has given rise to a devastating and surprisingly common crime: deed fraud.

Deed fraud occurs when a forger creates a fake quitclaim deed to transfer your property into their name without your knowledge. Once they have a fraudulent title, they can quickly sell your property to an unsuspecting buyer or take out massive loans against it. You're left with a legal and financial nightmare that can take years to unravel.

This isn't just a theoretical problem. It's a real and growing threat that has federal law enforcement sounding the alarm. The FBI has issued warnings as quitclaim deed fraud cases have surged, especially in major U.S. cities. Criminals often use stolen identities to forge the deeds, which can lead to the legitimate owners facing eviction notices and unbelievable stress. You can read the full FBI warning on rising deed fraud to get a sense of just how serious this is.

Shifting from Reactive to Proactive Defense

For years, the only way a homeowner found out about deed fraud was by accident. An eviction notice would show up. A foreclosure letter would arrive from a lender they’d never heard of. By that point, the damage was already done, forcing the true owner into a costly, draining legal battle just to get their own property back. That reactive approach is no longer sufficient.

A modern defense means getting ahead of the problem by proactively monitoring your property's title records. This is exactly what platforms like TitleTrackr were built for. Instead of waiting for a disaster to hit, you get an alert the moment a new document is filed against your property.

This immediate notification completely changes the game.

- Real-Time Alerts: Get an instant notification if any deed, lien, or other document is recorded on your property's title.

- Early Intervention: An immediate alert gives you the crucial head start you need to contact authorities and legal counsel before a fraudulent sale or loan can go through.

- Complete Peace of Mind: Knowing your portfolio is being monitored 24/7 provides a powerful sense of security against these sophisticated fraud schemes.

By actively monitoring public records, you catch unauthorized activity right at the source. This shifts your defense from a messy, expensive cleanup effort into a preventative shield, protecting your ownership before it’s ever truly compromised.

The Power of Continuous Monitoring

Think of it like a home security system, but for your property's legal status. You wouldn't leave your front door unlocked, so why leave your title—your legal ownership—unprotected? Continuous monitoring ensures that no changes can be made to your ownership records without you knowing about it.

This is especially critical for professionals managing multiple properties, vacant land, or rental portfolios, as these are often prime targets for fraudsters who assume no one is paying close attention.

For industry professionals, staying ahead of these risks is just part of the job. The same principles of diligent record-watching and verification are what separate the best from the rest. Our resources for title abstractors and real estate professionals show how technology is making this level of vigilance easier and more effective than ever before.

With TitleTrackr, this professional-grade oversight is now available to you, giving you ultimate control and turning the tables on would-be criminals. Request a demo today to see how modernizing your workflow can protect your assets and your clients.

Still Have Questions About Quitclaim Deeds?

Even with a step-by-step guide, it's natural to have a few lingering questions about quitclaim deeds. It’s a process filled with nuances, and getting the details right is critical. Let’s clear up some of the most common points of confusion.

Getting these answers straight can help you avoid simple but surprisingly costly mistakes down the road.

What’s the Real Difference Between a Quitclaim and a Warranty Deed?

This is easily the biggest source of confusion, and the distinction is massive. It all comes down to the level of protection the new owner gets.

A quitclaim deed simply transfers whatever ownership interest the grantor has—if any. It comes with zero promises or guarantees about the title's history. It is an "as-is" transfer of interest. The grantee receives the property and any hidden issues that might come with it.

On the other hand, a warranty deed is the gold standard. It provides a rock-solid guarantee that the grantor holds a clear title and will legally defend the new owner against any future claims. It’s the difference between buying a used car with no history report and buying one that’s certified pre-owned with a full protection plan.

Will a Quitclaim Deed Affect My Mortgage?

Yes, and this is a big one. It's a common misconception that signing over the deed frees the grantor from the loan. It absolutely does not.

Transferring property with a quitclaim doesn't remove the original owner's name or financial responsibility from the mortgage. What’s more, most mortgages have a "due-on-sale" clause. This language gives the lender the right to demand the entire loan balance be paid in full the moment the property is transferred. You must talk to your lender before filing anything to understand the potential fallout.

What About Taxes?

The financial implications don't stop with the mortgage. A quitclaim deed can trigger some serious tax events that often catch people by surprise.

Important Reminder: A quitclaim deed can have significant tax consequences. The transfer may be subject to a federal gift tax if the property's value exceeds the annual exclusion limit. State and local transfer taxes might also apply. Consulting a tax advisor is the only way to understand the full financial impact.

Can I Just Prepare a Quitclaim Deed Myself?

While countless templates are available online, the DIY approach is a risky path for a high-value asset.

Real estate law is incredibly specific and varies wildly from state to state, and even county to county. A tiny mistake—a typo in the legal description, using an outdated form, or missing a required witness signature—can invalidate the entire deed. Worse, it can create a "cloud" on the title that costs thousands to fix years later.

Hiring a real estate attorney is always the safest bet. They will ensure everything is drafted and filed correctly according to local laws. For more specific situations, you can also find answers to other frequently asked quitclaim deed questions on our FAQ page.

Navigating the world of property records is a tough job, but the right tools make all the difference. TitleTrackr gives you the clarity and control you need to monitor property titles, generate instant reports, and protect your assets against fraud. Request a demo to see how we can bring precision and efficiency to your workflow at https://titletrackr.com.