For homeowners, a mortgage release marks the triumphant end of a loan. For industry professionals, it’s a critical—and often overlooked—procedural step where errors can create significant liability and operational drag.

This isn’t just a celebratory document; it’s a legally binding instrument that confirms a loan is paid in full, extinguishing a lender's lien on a property. Failure to execute and record it correctly can cloud a property’s title for years, creating downstream problems for servicers, title agents, and future transactions. Understanding its function is key to mitigating risk.

The Critical Final Step in the Loan Lifecycle

A mortgage acts as a lien, a legal claim the lender places on a property's title as collateral. This lien grants the lender the right to foreclose if the borrower defaults. For the entire life of the loan, that lien remains recorded in the public record.

When the loan is satisfied, the mortgage release is the legal instrument that removes that lien. It officially confirms the debt is settled, wiping the lender's claim from the property title and restoring full, unencumbered ownership to the borrower.

Why a Clear Title Is Non-Negotiable

Without a properly recorded mortgage release, the lender's lien remains on the public record. This creates a "cloud on the title," a defect that can derail future transactions.

A Release of Mortgage, once filed with the appropriate county recorder's office, officially removes the lender's lien. Until that filing occurs, the claim legally exists, capable of halting any subsequent sale or refinance. For a more detailed look, ProTitleUSA's blog have a great breakdown of the mechanics.

Failing to secure a mortgage release creates critical business risks:

- Failed Sales: A buyer's title search will flag an unreleased lien, stopping a sale dead in its tracks until the defect is cured.

- Refinancing Roadblocks: New lenders require a first-lien position. An unreleased prior mortgage prevents this, making refinancing impossible.

- Compliance Penalties: State and federal regulations impose strict timelines for lien release. Failure to comply can result in significant financial penalties.

For professionals, understanding what a mortgage release is shifts it from a simple administrative task into a crucial risk management function. Ensuring its proper execution is fundamental to maintaining a clean portfolio and facilitating smooth real estate transactions.

This glossary clarifies the core terminology essential for any professional managing the mortgage release process.

Key Mortgage Release Terms at a Glance

| Term | Simple Definition | Why It Matters for Industry Professionals |

|---|---|---|

| Mortgage Release | The official document proving a mortgage is paid, releasing the lender's lien on the property. | This is the final step in closing out a loan file. Failure to record it creates title defects and potential liability. |

| Lien | A legal claim a lender has on a property as security for a debt. | The mortgage itself creates the lien. The release is the legal instrument that extinguishes it from public record. |

| Clear Title | A property title with no liens, claims, or defects that would impede transfer of ownership. | A clear title is essential for marketability. Unreleased liens are one of the most common title-clearing hurdles. |

| County Recorder's Office | The government agency that records and maintains public real estate documents, including liens and releases. | This is the final destination for the release. Proper indexing and recording here are critical for title clearance. |

Mastering these terms is the first step toward building a more efficient and compliant mortgage release workflow.

The Mortgage Release Process Step by Step

For mortgage servicers and title professionals, the release process is a high-volume, precision-dependent workflow. From final payment to final recording, any misstep can create costly title defects that surface years later.

This process isn't just about paperwork; it's a formal, legally mandated procedure to update public records and clear a lender's claim. Here's a professional's view of how it should unfold.

Initiating the Release and Verification

The moment a borrower's final payment is processed, the compliance clock starts ticking. State laws mandate a specific timeframe—typically 30 to 90 days—for the lender or servicer to prepare and file the mortgage release.

The first phase is internal verification. The servicing team must confirm the payoff, ensure no ancillary fees are outstanding, and draft the official release document (often a "Satisfaction of Mortgage"). Document accuracy is paramount; errors in the legal description, borrower names, or recording information can invalidate the release.

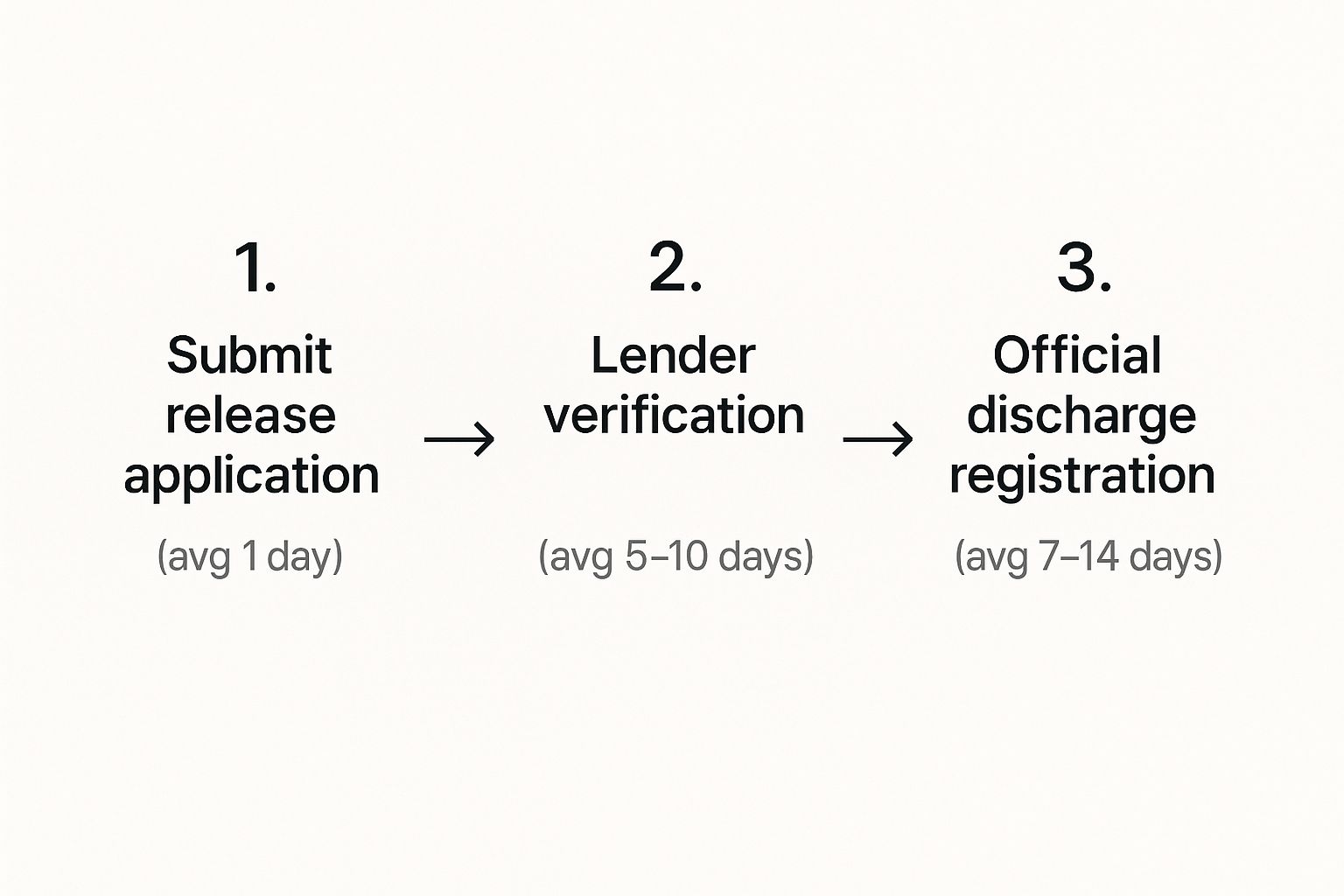

This infographic outlines the critical path of the release process.

As shown, the county recording stage is the final, definitive step that clears the lien. Delays or errors here are where most problems originate.

Document Preparation and Filing

Once payoff is confirmed, the formal release document is executed. It must be signed by an authorized party and notarized to become a legally binding instrument.

The executed document is then transmitted to the correct county office where the original mortgage was recorded—typically the County Recorder or Clerk of Court. This is the moment of truth. Filing the document officially removes the lien from the property's title records. This is a specialized task where professionals like real estate title abstractors provide immense value by ensuring accuracy.

One of the biggest operational risks we see is filing a release in the wrong jurisdiction or with incorrect property details. These clerical errors create 'clouds' on the title that require costly curative work to resolve, often under extreme time pressure during a subsequent transaction.

Final Verification and Quality Control

When the county recorder’s office receives the release, it is stamped, recorded in the public ledger, and indexed against the property. This action makes the release a permanent part of the property's chain of title.

After recording, the original document is returned. However, best practice dictates a final verification step. It is crucial to confirm that the filing was completed and correctly indexed. This can be done by checking county records or using a technology platform to automate the verification. This final QC step provides auditable proof that the lien has been successfully released.

Why a Missing Mortgage Release Creates Problems

When a mortgage is paid off, the lender is legally obligated to file a release document to clear the lien from the public record. But in a high-volume servicing environment, errors happen. Documents get lost, filed in the wrong county, or simply forgotten.

When that release is never filed, the lien persists on the record—a "ghost" of a paid-off debt. This isn't a minor clerical issue; it’s a tangible "cloud" on the property’s title that can halt future transactions and create significant liability.

Real-World Consequences of Unreleased Liens

Imagine a closing is scheduled for tomorrow. The title search flags a lien from a mortgage paid off 15 years ago. The original lender has since been acquired twice. The scramble to identify the successor, navigate their bureaucracy, and secure an emergency release is a nightmare scenario for any title agent or lender.

This happens daily. A sale can be delayed for weeks, jeopardizing rate locks and potentially killing the deal. The financial and reputational fallout for the professionals involved can be severe.

These unresolved title issues create major business roadblocks:

- Selling a Property: No title insurance company will issue a policy on a property with an outstanding lien. The transaction is dead on arrival until the title is cleared.

- Refinancing a Home: A new lender will not proceed without a first-lien position, which is impossible until all prior mortgage liens are officially released.

- Settling an Estate: For families managing an estate, an old, unreleased lien adds legal costs and delays to the already difficult process of transferring property to heirs.

A missing release transforms a satisfied debt into a modern-day obstacle. It's a solvable problem, but the time, expense, and stress of curative work—often under the gun of a closing deadline—are substantial.

The Power of Proactive Monitoring

The only way to mitigate this risk is to shift from reactive, costly curative work to a proactive, technology-driven strategy. Instead of waiting for a title search to uncover a problem, industry leaders use modern tools to ensure every release is handled correctly from the start.

This is where a platform like TitleTrackr provides a competitive advantage. By automating the tracking and verification of the mortgage release process, you gain operational control. You can monitor document status, verify correct county filing, and build an auditable record that every title is clear.

This proactive approach is the best defense against hidden title defects, ensuring your assets are secure and your transactions close smoothly. Don't leave your portfolio or reputation exposed to clerical errors. Request a demo of TitleTrackr and see how you can streamline your release management today.

When you hear "mortgage release," the standard payoff scenario is the first thing that comes to mind. But for industry professionals, the term encompasses a range of specialized legal tools used to manage complex real estate transactions and financial situations.

Think of it less as a simple receipt and more as a flexible legal instrument. Beyond a standard payoff, a mortgage release is essential for everything from land development to foreclosure prevention. It's the mechanism that formally alters a lender's claim, which is vital for maintaining a clear and marketable title.

The Partial Mortgage Release

Consider a developer who owns a 100-acre tract of land secured by a single blanket mortgage. They plan to sell a 10-acre parcel to a commercial builder. The problem? They can't deliver a clean title for that parcel because the entire tract is collateral for their loan.

This is the precise use case for a partial mortgage release.

In this agreement, the lender agrees to release its lien from only the 10-acre parcel being sold. In exchange, the developer typically applies the sale proceeds to make a principal curtailment on their loan. This allows the sale to proceed with a clear title for the buyer, while the original mortgage lien remains intact on the remaining 90 acres.

A Lifeline for Foreclosure Prevention

In times of financial distress, a mortgage release can be a critical tool for loss mitigation. When a borrower is unable to make payments and a sale isn't feasible, a deed-in-lieu of foreclosure offers a structured exit that avoids a lengthy and costly legal battle.

Here’s the process: the borrower voluntarily transfers the property deed to the lender. In return, the lender issues a mortgage release, officially canceling the debt and terminating the lien. This allows both parties to avoid a formal foreclosure, which would severely damage the borrower's credit.

This strategy is a win-win. Borrowers mitigate the worst credit impacts of default, with some programs offering relocation assistance up to $7,500. A borrower using this strategy may qualify for a new mortgage in as little as two years, versus the seven-year stain of a foreclosure. You can learn more about how Fannie Mae helps borrowers avoid foreclosure.

By providing a formal, mutually agreed-upon exit, the mortgage release transforms from a simple administrative document into a powerful tool for loss mitigation and financial recovery.

Whether managing a complex land deal or a distressed asset, the execution and recording of the release must be flawless. For professionals handling these scenarios, tracking every document is essential. Platforms like TitleTrackr automate the verification process, ensuring every lien—full or partial—is properly released. This precision protects all parties from future title defects and maintains the integrity of property records.

What Mortgage Release Data Reveals About the Market

A single mortgage release document signifies the closing of one loan. But in aggregate, this data tells a powerful story about the health of the housing market, borrower behavior, and emerging economic trends.

Each release is a data point. When thousands are analyzed together, they reveal patterns that lenders, investors, and analysts use to make strategic decisions. This collective data provides a near-real-time view of market activity.

Tracking Economic Health Through Releases

What do these patterns reveal? A sharp increase in mortgage releases is a classic indicator of a refinancing boom. When interest rates fall, homeowners rush to secure better terms, paying off old loans and triggering a wave of release filings. Conversely, a slowdown in release volume can signal rising rates or a stagnant housing market.

This is more than academic; it's predictive data. By tracking release volume and velocity, financial institutions can gauge consumer confidence and forecast lending demand. It's a direct window into the financial pulse of homeowners.

Using Data for Risk Management

For industry professionals, this data is essential for managing risk. After the record $4 trillion in mortgage originations in 2021, driven by historically low rates, the market shifted dramatically. As rates rose to combat inflation, refinancing activity collapsed.

Mortgage release data provides a clear signal of these market shifts, showing precisely when loans are being paid off and how quickly homeowners are building equity. This helps lenders and investors manage portfolio risk and verify that title assets are unencumbered. For a deeper analysis, review the market dynamics outlined by The Warren Group.

Tracking mortgage releases isn't just about closing old loans; it’s about understanding capital velocity in the housing market. This data helps predict lending volumes, assess portfolio risk, and identify emerging opportunities.

Each individual transaction is a vital data point in a vast financial ecosystem. For professionals navigating this system, accurate, real-time access to release data is non-negotiable. This is where tools like TitleTrackr provide a decisive edge, offering the sophisticated monitoring needed to stay ahead of market trends and make data-driven decisions.

It’s Time to Take Control of Your Property Title

Understanding what a mortgage release is from a technical standpoint is just the beginning. The real challenge is moving from concept to execution—implementing a workflow that eliminates errors and ensures compliance. A single clerical mistake or a lost document at the recorder's office can encumber a valuable asset for years, creating downstream liabilities.

A proactive, technology-first approach is the only reliable solution. By actively managing and monitoring title documents, you can guarantee every lien is properly released, ensuring clear ownership and mitigating risk. This isn't a matter of convenience; it’s a core business function that protects your portfolio and your reputation.

From Knowledge to Action

Whether you're a lender, servicer, or title professional, the stakes are too high to leave this critical final step to outdated, manual processes. An unreleased lien can derail a sale, block a refinance, or create a legal nightmare. The operational efficiency and peace of mind that come from a verified, clean title are invaluable.

Here’s why a passive approach is no longer acceptable:

- Prevent Costly Delays: Early error detection means you aren't forced into expensive, last-minute curative work to save a transaction.

- Ensure Compliance: Automated tracking provides an auditable trail, ensuring you meet state-mandated deadlines for release filing.

- Protect Your Assets: A clean title is essential for preserving an asset's value and marketability.

The final step in the loan lifecycle shouldn’t be a liability. Taking control of the release process with the right technology is the only way to guarantee your property titles are clear and your operations are secure.

Are you ready to stop worrying about hidden defects in your property records? Take the next step and implement the proper safeguards. See how easy it is to protect your titles by exploring our no-obligation trial offer.

For a detailed look at how TitleTrackr delivers the clarity, compliance, and security your business needs, request a personalized demo today.

Frequently Asked Questions About Mortgage Releases

Even for seasoned professionals, the nuances of the mortgage release process can raise questions. Ensuring compliance and maintaining clear titles across thousands of loans requires precision. Here are answers to some of the most common questions industry experts face.

How Long Does It Take to Get a Mortgage Release

The timeline is dictated by state law and a lender's operational efficiency. Generally, the legally mandated window for filing a release after payoff is 30 to 90 days.

Many states impose financial penalties on lenders for failing to meet these deadlines. Best practice is to have an internal system that tracks these dates and automatically flags any files approaching their statutory deadline. Proactive monitoring prevents compliance breaches and ensures timely title clearance.

What if My Lender Went Out of Business

This is a common source of title defects. When a lending institution is acquired or goes defunct, its legal obligations—including filing mortgage releases—are transferred to a successor entity.

The challenge is identifying that successor. This often requires forensic research, including contacting the FDIC or state banking regulators. A robust document management system is crucial for tracking the chain of assignment and ensuring releases are obtained from the correct legal entity, even years after the original lender has disappeared.

We refer to these as "zombie mortgages"—liens from defunct lenders that reappear at the worst possible moment, like during a time-sensitive closing. Proactive verification that a release was filed is the only way to ensure these old debts don't derail future transactions.

Can I Sell My Home if the Release Was Never Filed

No. A property cannot be conveyed with a clear title if a prior mortgage lien remains on the public record.

Any title search will immediately flag the unreleased lien as a "cloud" on the title, halting the transaction. The seller is then responsible for curing the defect, which involves tracking down the lender or its successor to get the release filed—a process that can cause significant and costly delays.

Is a Satisfaction of Mortgage the Same Thing

Yes. These terms are used interchangeably within the industry.

Depending on the jurisdiction, the official document may be titled a Satisfaction of Mortgage, a Release of Deed of Trust, or a Certificate of Discharge. All three serve the exact same legal function: to officially declare the loan paid in full and remove the lender’s lien from the property's title. For a deeper dive into specific terminology and state-by-state requirements, check out our comprehensive FAQ page.

Don't let clerical errors or process gaps jeopardize your assets or your reputation. With TitleTrackr, you can automate the tracking and verification of your title documents, ensuring every lien is properly released and every title is clear. Request a demo today to see how we deliver the operational control and peace of mind your business deserves. https://titletrackr.com