Think of lender's title insurance as the financial armor that protects a mortgage lender's investment. It's a mandatory insurance policy that shields them from any financial fallout caused by hidden problems with a property's title—ghosts from the past, you could say. Before a lender wires hundreds of thousands of dollars for your home loan, they need absolute certainty that their investment is safe from old claims, surprise liens, or messy ownership disputes.

Protecting the Lender's Stake

When you buy a home, the property's title—the legal document proving you own it—is officially transferred into your name. But a title can carry a complicated history, sometimes with "defects" that aren't visible at first glance. These issues could pop up years down the road, challenging your ownership and, by extension, jeopardizing the lender's collateral.

That one-time fee you pay for it at closing isn't just another line item. It's the very foundation of a secure deal for the financial institution, ensuring their stake in the property is protected against any unexpected title troubles that predate your ownership.

Why Lenders Insist On It

Lender's title insurance has long been a non-negotiable part of the mortgage process, and for good reason. It’s built to protect lenders from the specific risks tied to property titles. Because it’s so critical for shielding their investment against things like unpaid property taxes or old legal claims, virtually all lenders require it to keep the lending process secure.

The journey from the initial title search to the final closing involves a lot of moving parts. This complexity can easily lead to delays and a frustrating lack of transparency for everyone involved. This is exactly where modern platforms are stepping in to bring much-needed efficiency.

For instance, a platform like TitleTrackr gives all stakeholders real-time visibility into the entire title and closing workflow. This transparency helps deals close faster and with fewer last-minute surprises—a huge win for lenders, agents, and homebuyers. You can see how TitleTrackr improves workflow transparency in our free trial.

How Lender Title Insurance Protects the Loan

So, how does this protection actually work? It’s less about predicting the future and more about digging into the past. Think of it as a historical background check on the property itself.

It all kicks off when a title company or abstractor dives deep into years of public records. They’re on the hunt for any red flags—or title defects—that could come back to haunt a lender’s investment down the road.

This title search is the most critical step. Its whole purpose is to uncover hidden problems before they can turn into real financial headaches, making sure the property’s chain of title is clean and the seller actually has the right to sell it.

From Title Search to Policy Issuance

The search is designed to find and fix all sorts of issues that might cloud the title. We see these all the time:

- Unpaid property taxes that have turned into a lien against the property.

- Contractor liens from a renovation project where someone didn't get paid.

- Surprise heirs from a previous owner who suddenly show up with a claim to the property.

- Filing errors or outright forgeries buried in old deeds or public records.

Once the search is done and any lurking issues are cleared up, the title is considered “clean.” Only then will the title company issue the lender's title insurance policy, which usually happens at closing. The borrower pays a one-time premium, and that single payment keeps the policy active for the entire life of the loan.

This protection is all about the past. It doesn't cover anything that might happen in the future; it shields the lender from any title problems that existed before the policy was issued, keeping their collateral safe.

This entire workflow, from the initial search to the final policy, has a lot of moving parts and people involved. That’s where things often get messy, leading to frustrating communication gaps and delays that nobody wants.

This is exactly the kind of problem platforms like TitleTrackr were built to solve. By giving everyone real-time visibility into every single stage of the title process, it connects all parties and gets rid of the guesswork. That transparency is what prevents delays and makes sure closings go off without a hitch for lenders, agents, and buyers.

Lender Policy vs. Owner Policy Explained

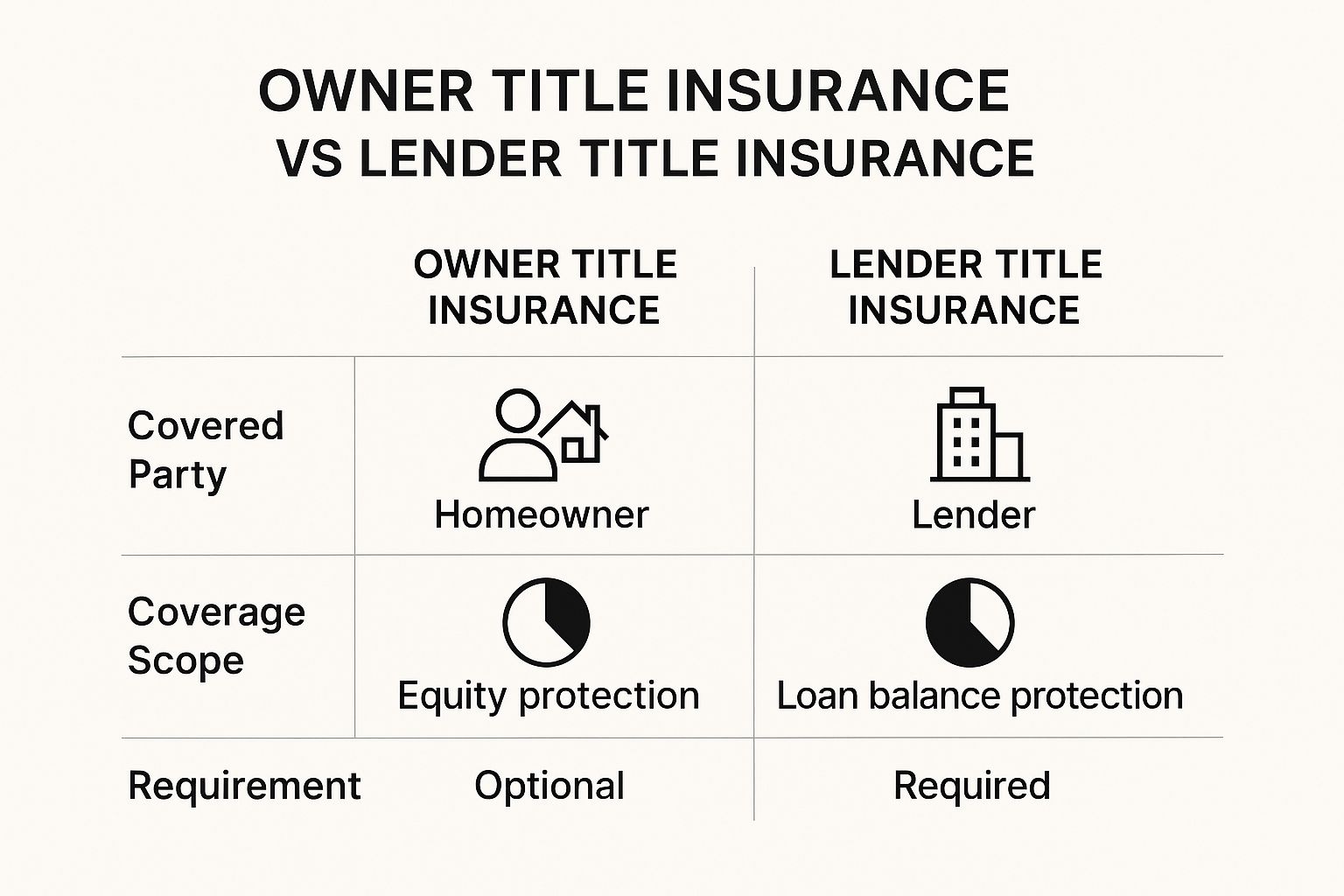

One of the most common questions that pop up during a real estate closing is about the two different kinds of title insurance. You’ve got a lender’s policy and an owner’s policy, and while they sound similar, they protect two completely different parties. Getting this straight is one of the keys to a smooth, confusion-free closing.

Think of it this way: lender's title insurance is all about protecting the bank's money. It’s almost always a required part of getting a mortgage. This policy guarantees the lender that their investment is safe from any old title claims or liens that might surface down the road. Its coverage is tied directly to the loan balance, so if a title issue ever threatens their collateral, they can get their money back.

Protecting the Loan vs. Protecting Your Home

Now, an owner’s title insurance policy is for you, the homebuyer. While it’s usually optional, skipping it is a big gamble. This policy is what protects your ownership rights and the equity you're building in your home. The lender’s policy protects their loan, but your owner’s policy protects your actual home.

The image below gives a great visual breakdown of who’s covered and what’s at stake with each policy.

As you can see, only the owner's policy puts a shield around your financial stake in the property, guarding you against issues from the past that you had no way of knowing about.

To make things even clearer, let's look at a side-by-side comparison.

Lender's Policy vs. Owner's Policy At a Glance

| Feature | Lender's Title Insurance | Owner's Title Insurance |

|---|---|---|

| Who it Protects | The mortgage lender | The property owner/homebuyer |

| Is it Required? | Almost always mandatory for a loan | Optional, but highly recommended |

| What it Covers | The outstanding loan balance | The full purchase price of the home |

| How Long it Lasts | For the life of the mortgage loan | As long as you or your heirs own the property |

| Payment | One-time premium paid at closing | One-time premium paid at closing |

This table really highlights the fundamental difference: one policy is for the lender's security, and the other is for your peace of mind and financial protection.

Here’s a great tip that many homebuyers miss out on: the "simultaneous issue" discount. When you buy both policies at the same time from the same title company, you can often get a serious price break. Why? Because all the heavy lifting of the title search was already done for the lender's policy, making it much easier and cheaper to issue your owner's policy at the same time.

What a Lender Policy Actually Covers

So, what specific nightmares does a lender’s title insurance policy actually guard against? This is where we get past the technical jargon and look at the real-world problems that could put a lender's financial stake in a property at risk.

Imagine discovering years after closing that a previous sale involved a forged signature. It sounds like something out of a movie, but it happens. That single fraudulent act could invalidate the entire chain of title, putting the lender's claim in serious jeopardy. Without a policy, they'd be staring down a costly and lengthy legal battle just to protect their investment.

Here's another classic headache: an unknown lien from a contractor pops up out of nowhere. If a previous owner never paid for that new roof they had installed, the roofing company could slap a lien on the property. That lien could demand payment and even take priority over the mortgage.

Common Title Defects Covered

Each of these situations is what we call a “title defect,” and they are precisely what lender’s title insurance is designed to cover. The policy acts as a financial shield against a whole range of historical issues that a standard title search might not catch.

These complex searches are the critical work performed by title professionals, requiring incredible attention to detail. Our guide on optimizing title search workflows for abstractors goes into more detail on just how complex this crucial step can be.

Here are some of the most common risks a lender's policy will cover:

- Ownership Challenges: Claims from undisclosed heirs who suddenly appear, believing they have a right to the property.

- Public Record Errors: Simple clerical mistakes in filing, indexing, or recording deeds and other legal documents can create massive clouds on the title.

- Unresolved Legal Judgments: Outstanding court judgments or lawsuits against a prior owner that are attached to the property itself.

- Boundary and Survey Disputes: Issues where a property’s legal description is inaccurate or, worse, overlaps with a neighbor's property.

Any one of these defects could threaten the lender’s security interest, which is exactly why they demand this protection before handing over hundreds of thousands of dollars. It defends their position as the primary lienholder against any claims crawling out of the property's past.

Demystifying Title Insurance Costs and Disclosures

When it comes to title insurance costs, there’s actually some good news: predictability. Unlike so many other homeownership expenses, lender’s title insurance isn't a surprise monthly bill you’ll be paying for years. It’s a one-time premium paid at closing that protects the lender for the entire life of your loan.

So, how much will it set you back? The exact amount hinges on a couple of key factors. The biggest driver is your loan amount—a larger loan naturally requires a higher premium. Your property’s location also plays a role, since title insurance rates are often regulated at the state level.

No More Surprise Fees at the Closing Table

Thankfully, this is one cost that won’t catch you off guard. Federal consumer protection laws make sure transparency is baked right into the mortgage process, giving you a clear, early look at all your closing costs.

This is all thanks to the TILA-RESPA Integrated Disclosure (TRID) rule, which combines the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). Under TRID, your lender has to give you a Loan Estimate within three business days of receiving your application. This document clearly spells out the cost of the lender’s title insurance. You can explore the specific requirements of these disclosures to better understand your rights.

This early look means you have plenty of time to review and understand every single fee tied to your mortgage long before you ever sit down to sign the final papers. It turns a potentially overwhelming process into a much more manageable one.

While the premium for lender's title insurance is a necessary closing cost, knowing it’s a regulated and fully transparent fee offers real peace of mind. It’s not just another line item; it's a critical service that makes the whole transaction secure for everyone involved.

Taking the Pain Out of the Title and Closing Process

Knowing what lender title insurance is and why you need it is half the battle. The other half? Actually getting through the closing process itself. Anyone in the industry knows the traditional workflow can be a real headache—slow, confusing, and full of communication black holes.

You're left chasing down documents manually and wondering where things stand. It's a recipe for delays that creates unnecessary stress for lenders, agents, and especially their clients. This is exactly where modern, purpose-built platforms are making a world of difference.

Finally, Some Real Visibility Into Your Workflow

Tools like TitleTrackr were created specifically to fix these long-standing problems. It acts as a central command center for the entire title and closing workflow, breaking down the frustrating information silos that slow everything down.

Suddenly, everyone involved can see real-time updates on crucial steps, including:

- The current status of the title search

- Which documents have been reviewed and approved

- What's happening with closing coordination tasks

For lenders and real estate pros, this isn't just a minor improvement; it means drastically reduced closing times, fewer costly errors, and much happier clients. Instead of playing phone tag and sending endless "any update?" emails, you get a clear, transparent view of the entire transaction from start to finish.

Think about this: the average real estate transaction, even a smooth one, involves over 20 hours of manual work. Smart platforms slash that time by automating the tedious steps and keeping communication flowing seamlessly.

Want to learn more about how to make your closings smoother? Check out the strategies and tips on the TitleTrackr blog.

Ready to see how TitleTrackr can completely transform your closing experience for the better? Request a demo today and see it in action.

Common Questions About Lender Title Insurance

Even after you get the basic concept down, a few practical questions about lender title insurance almost always pop up. Let's tackle some of the most common ones to clear up any confusion and show you exactly how this protection works in a real transaction.

One of the biggest questions we hear is whether a new policy is needed for a refinance. The answer is a clear and simple yes. When you refinance, you're not just adjusting your old loan—you're getting a brand-new one to pay off and replace the original. The first lender's policy was tied specifically to that original mortgage, so your new lender will naturally require a fresh policy to protect their new loan.

But here's the good news: you won't be starting from scratch. You can almost always get a "reissue rate" or a refinance discount on the premium. This is because most of the heavy lifting on the title search was done the first time around.

Who Makes the Call and Can You Save Money

Another point that often trips people up is who actually chooses the title insurance company. The law is straightforward: whoever pays for the policy gets to pick the provider. In most purchase deals, that’s the homebuyer.

Your lender will have a list of title companies they’ve already vetted and are comfortable working with, and it’s usually a good idea to start there. But you absolutely have the right to shop around among their approved partners to compare service levels and, more importantly, their other fees.

This brings up a great follow-up question: is the cost of lender's title insurance negotiable? While the base premium rates are usually set by the state and can't be haggled, you can definitely find ways to save money.

The real savings come from comparing the other fees that title and settlement companies charge. Keep an eye out for things like:

- Courier and administrative fees

- Closing or settlement fees

- Document preparation costs

And here's the single biggest tip: always ask for the “simultaneous issue” discount if you're also buying an owner’s policy. This is a huge money-saver. The insurer has already done the title search for the lender's policy, so they can issue your owner's policy at the same time for a steep discount.

Juggling all these moving parts across multiple deals can feel overwhelming, but it doesn't have to be. TitleTrackr creates a central hub that gives you a clear view of every stage in the title and closing process, cutting out the communication headaches and costly errors. See how you can get your workflow in order and ensure smoother closings by requesting a demo of TitleTrackr today.