Think of title and escrow as the two most important safeguards in any real estate deal. They're separate services, but they work together to make sure a transaction is safe and sound. Title is all about verifying legal ownership—making sure the property is free and clear of any surprise claims. Escrow, on the other hand, is the neutral third party that holds onto all the money and documents until every last condition of the sale is met.

Together, they form a crucial safety net that protects everyone involved—buyers, sellers, and lenders—from getting burned.

The Foundation of a Secure Real Estate Transaction

Buying or selling a house isn't as simple as swapping keys for a check. It’s a major legal and financial event, and a lot can go wrong. This is exactly why title and escrow services aren't just a good idea; they're essential. They provide the structure that ensures the entire deal is fair, secure, and legally solid for everyone.

Imagine buying a used car without ever checking if the seller actually owns it or if they still owe money on it. You wouldn't do it, right? The risks in real estate are the same, just with a lot more zeros on the end. The title and escrow process is designed to prevent these kinds of disasters, creating a controlled environment where every detail gets checked off before the property officially changes hands.

The Role of a Property's Title

First things first: the "title" isn't a physical piece of paper. It’s a legal concept that says you have the right to own and use a property. A "clear title" means that ownership is undisputed. The title company’s job is to be a property detective. They dig deep into public records to uncover any potential issues—what we call "defects" or "clouds"—on the title.

You'd be surprised what they can find. These hidden problems might include:

- Unpaid Property Taxes: The previous owner might have an outstanding tax bill that’s now attached to the property as a lien.

- Unknown Heirs: A long-lost relative of a past owner could suddenly show up with a valid claim to the property.

- Contractor Liens: A builder or roofer who never got paid for work they did on the home could have placed a legal claim on it.

- Clerical Errors or Forgery: Simple mistakes in public records or, worse, outright fraud can create massive ownership headaches down the road.

Without a professional title search, a new buyer could walk right into these problems, inheriting a financial and legal nightmare.

A clean title is the bedrock of property ownership. It confirms that the seller has the legal right to transfer the property and that the buyer will receive all the rights and privileges that come with it.

The Function of Escrow Services

While the title company is busy investigating the property's past, the escrow company acts as a neutral referee for the present transaction. As soon as a buyer and seller sign a purchase agreement, an escrow account is opened. Think of it as a secure lockbox where the buyer’s earnest money, the lender's funds, and all the important legal documents are held.

The escrow officer follows a strict set of instructions that both the buyer and seller have agreed to. They make sure that not a single dollar or document moves until every condition in the contract—from home inspections and appraisals to final loan approval—is met. This keeps either party from just taking the money and disappearing. It’s the final layer of protection for everyone’s investment.

How The Real Estate Title Process Works

Think of the real estate title process as a deep-dive investigation into a property's entire life story. The moment a purchase agreement gets signed, title professionals essentially become property detectives. Their mission? To meticulously comb through public records and piece together a complete, unbroken timeline of ownership. It's all about making sure the seller truly has the legal right to sell and uncovering any hidden skeletons in the closet that could haunt the buyer down the road.

This forensic-level review is what we call the title search. It’s a painstaking process of digging through decades of deeds, mortgages, wills, court judgments, tax records, and more. The objective is to build a perfect "chain of title," confirming that ownership has passed cleanly from one person to the next with no weird gaps or unresolved claims popping up.

From Title Search To Title Commitment

Once the digging is done, the findings are organized into a report known as the title commitment. You can think of this as the property's report card. It spells out who the current owner is, lists any hoops that need to be jumped through before closing, and details any exceptions to the insurance coverage.

This commitment is a make-or-break document for both the buyer and their lender. It shines a spotlight on potential problems, or "defects," that have to be fixed. These can range from a simple typo on a past deed to something as serious as an old, unpaid mortgage or a lien from a contractor who never got paid for their work.

The title commitment gives everyone a crucial pause. It allows the title company, sellers, and buyers to find and fix potential ownership problems before the deal closes, saving everyone from massive legal headaches years from now.

For instance, a search might turn up a forged deed from a sale that happened decades ago, which could create a bogus claim on the property. Or maybe an unknown heir of a previous owner pops up out of the blue with a legitimate claim to a piece of the pie. These are the exact kinds of nightmares the title process is built to uncover and resolve. The detailed work done by specialists here is non-negotiable; you can learn more about the crucial role of title abstractors and their responsibilities in getting this right.

Resolving Issues To Achieve A Clear Title

Finding a defect doesn’t mean the deal is dead. Not at all. It just kicks off a resolution phase where the title company works to "cure" the problems. This could mean getting a legal document to fix an error, paying off an old lien, or getting a release signed by a previous claimant.

The end goal is to hand a clear title over to the new owner at the closing table. A clear title is proof that the property is free and clear of any messy claims or burdens that could challenge the buyer's right to own it.

Finding and fixing these issues is absolutely essential. A title defect can cloud ownership, making a property difficult to sell or refinance later. Below is a quick look at some common snags and how they're typically untangled.

Common Title Defects and Their Solutions

| Title Defect | Description | Typical Resolution |

|---|---|---|

| Unknown Liens | A previous owner failed to pay debts, resulting in a claim against the property from a creditor (e.g., unpaid taxes, contractor bills). | The title company works with the seller to pay off the lien before or at closing, obtaining a formal release. |

| Errors in Public Records | Simple clerical mistakes like misspellings, incorrect legal descriptions, or filing errors in public documents. | A corrective deed or other legal instrument is filed to amend the public record and fix the mistake. |

| Illegal Prior Deeds | A past deed was made by someone without the legal power to do so (e.g., a minor, an undocumented immigrant, or someone declared mentally incompetent). | This often requires court action, such as a "quiet title" lawsuit, to legally validate the ownership chain. |

| Missing Heirs | A previous owner passed away, but a family member or heir with a rightful claim to the property was unknown or overlooked. | The title company will try to locate the heir and have them sign off on their claim, often involving a legal settlement. |

| Forgeries | A forged signature on a past deed illegally transferred ownership, making the transfer void. | Resolving this is complex and usually requires legal action to invalidate the fraudulent document and restore proper ownership. |

Once all the issues listed on the commitment are put to bed, the path is finally clear for the last step: issuing the title insurance policy. This is where the real value of the whole process comes into focus. It's so important that consumers in the United States spend roughly $22 billion on title insurance every year, a testament to how much we value protecting our ownership rights.

The final title insurance policy is the buyer's long-term shield. It's a one-time fee paid at closing that protects the new owner from financial loss if any covered title problems were missed during the search, giving them true peace of mind for as long as they own the home.

Navigating the Escrow Process from Start to Finish

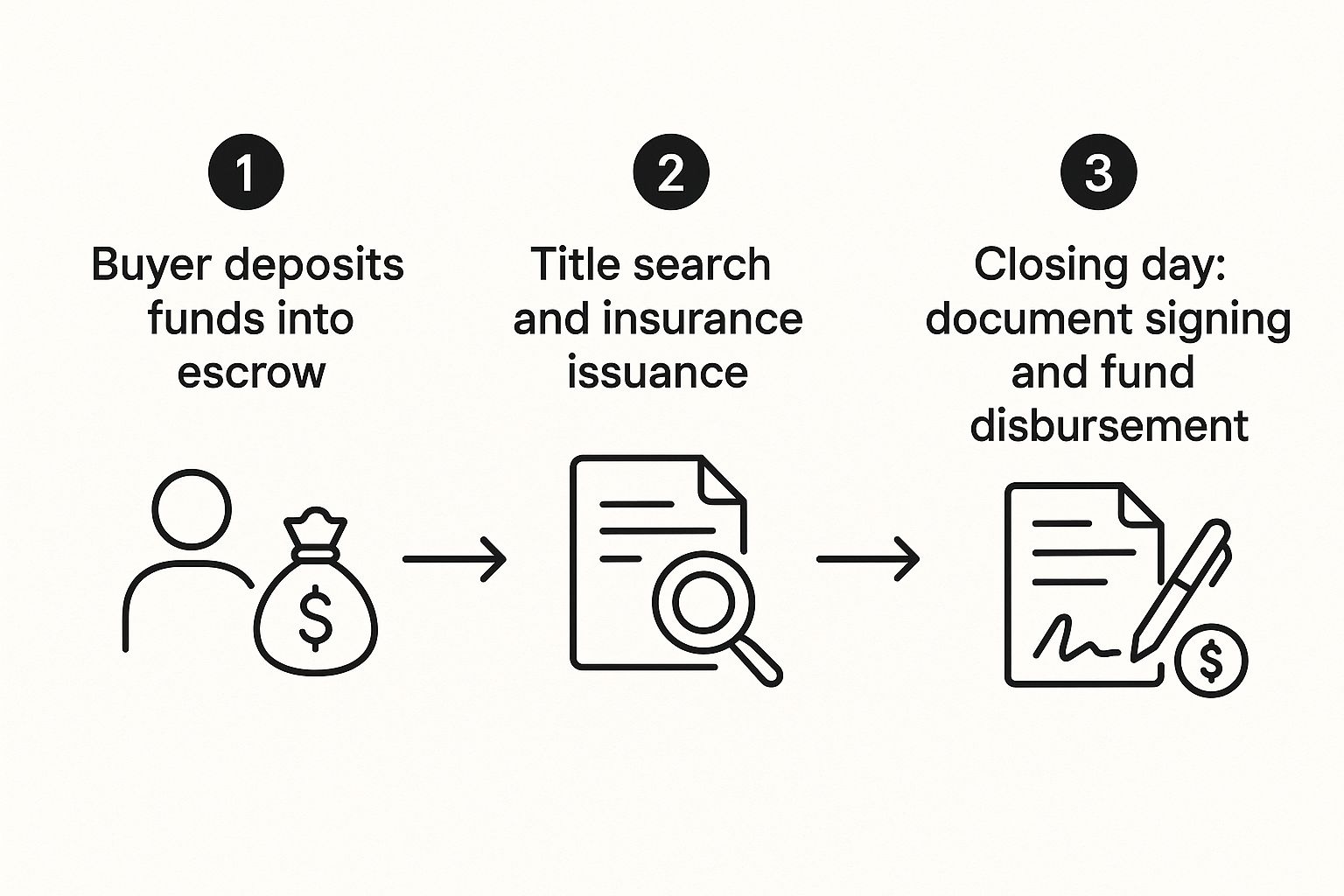

Once the title company starts digging into the property's history, the escrow process gets rolling. You can think of it as the transaction's central nervous system. An escrow officer acts as a neutral third-party referee, holding all the funds, documents, and instructions from everyone involved. Their one job is to make sure no money or property changes hands until every single condition in the purchase agreement is met.

This creates a secure, controlled space for what is often one of life's biggest financial moves. The whole process follows a clear roadmap, protecting both the buyer and seller from getting the short end of the stick. It’s a step-by-step journey, and you have to hit specific milestones before anyone gets the keys.

The Journey Begins: Opening Escrow

The moment a buyer and seller sign on the dotted line of the purchase agreement, the clock starts. That agreement gets sent over to the chosen escrow company, and an escrow account is officially opened. This is the first domino to fall, setting everything else in motion.

Right after that, the buyer needs to wire their earnest money into this secure account. It’s a good-faith deposit that tells the seller, "I'm serious about this." The escrow officer holds onto these funds, and they can't be touched without both parties agreeing or until the deal successfully closes.

Clearing Hurdles and Contingencies

With the initial funds locked in, the next phase is all about due diligence. Most purchase agreements are loaded with contingencies—basically, conditions that have to be satisfied before the sale can move forward. The escrow officer is the one keeping track of all of them.

Common hurdles that need to be cleared include:

- Home Inspection: The buyer brings in a pro to give the property a thorough once-over. If they find any nasty surprises, the buyer can negotiate for repairs or, in some cases, walk away.

- Appraisal: The buyer’s lender orders an appraisal to make sure the house is actually worth what the buyer is borrowing. If it comes in low, it's back to the negotiating table.

- Loan Approval: This is often one of the final hurdles. The buyer has to get the official, no-strings-attached green light for their mortgage.

The escrow officer is the one collecting and verifying all the paperwork that proves each contingency has been met or waived. They’re meticulously checking off each box to keep the transaction on track.

This flow shows just how escrow acts as the coordinator, making sure the money moves securely while the critical title work gets done—all leading up to a smooth closing day.

Preparing for the Final Closing

As the contingencies fall away and the loan documents are finalized, the escrow officer switches gears to prepare for the grand finale. They start putting together all the necessary paperwork and crunching the final numbers for the Closing Disclosure, which is the master document that shows where every penny is going.

The escrow officer meticulously balances the books for the entire transaction. They account for every single dollar, from the purchase price and loan amounts to prorated property taxes, HOA fees, and real estate commissions.

This detailed accounting gives both the buyer and seller a crystal-clear picture of the financials. The officer coordinates with the lender to get the loan funds wired in and preps the stack of final documents for signing, including the deed that will transfer ownership.

Finally, with all documents ready and funds accounted for, the escrow officer schedules the official closing. This is the culmination of weeks of careful coordination. At the closing table, they guide everyone through signing a mountain of paperwork.

Once the last signature is down, their final act is to disburse all funds to the right people—paying off the seller's old mortgage, cutting checks to the agents, and settling all closing costs. The very last thing they do is send the new deed to the county recorder's office, making the transfer of ownership official and bringing the escrow loop to a successful close.

Understanding Who Does What in a Closing

A real estate closing is a lot like a well-rehearsed play. Every person involved has a specific role, and if someone misses their cue, the whole production can grind to a halt. The title and escrow process is the backstage crew, managing a team of specialists who all need to work in perfect sync.

When even a single ball gets dropped, it can lead to frustrating delays for everyone. That's why it’s so critical to understand exactly who is responsible for what.

This web of communication is really the backbone of a smooth transaction. When buyers, sellers, and agents know who to call with a specific question, the whole thing feels more transparent and a lot less stressful.

The Core Professional Team

At the very center of it all are the title and escrow officers. Think of them as the central hub where all the legal and financial details of the deal come together.

-

The Title Officer: This person is essentially a property detective. Their main job is to dig through public records during the title search and put together the title commitment. If they uncover any issues—like old liens or ownership disputes, often called "clouds" on the title—the title officer is the one who coordinates the effort to get them cleared up.

-

The Escrow Officer: Acting as a neutral third party, the escrow officer is the transaction's financial gatekeeper. They hold all the funds and documents in a secure account, follow the instructions from the purchase agreement to the letter, and prepare the final closing statements. Once everything is signed and sealed, they’re the one who cuts the checks.

A great way to think about it is that the Title Officer is the historian who validates the property’s past, while the Escrow Officer is the project manager overseeing the transaction's present and future.

Other Key Stakeholders

Beyond that core team, a few other players have indispensable roles. Without their timely input, the deal simply can't move forward toward the closing table.

To make it clear who handles what, let's break down the key players and their main duties.

Roles and Responsibilities in the Closing Process

| Stakeholder | Primary Role | Key Responsibilities |

|---|---|---|

| Real Estate Agents | Client Advocate & Coordinator | Guide their client (buyer or seller), negotiate terms, coordinate inspections and repairs, and ensure contractual deadlines are met. |

| Lender | Financial Provider | Underwrite the loan, order the property appraisal, confirm the property's value, and prepare the final loan documents for closing. |

| Buyer & Seller | Transaction Principals | Provide all necessary personal and financial information, sign documents promptly, and fulfill all conditions of the purchase agreement. |

| Title Officer | Property Researcher | Conduct the title search, examine public records, identify title defects, and work to resolve any issues to ensure a clear title. |

| Escrow Officer | Neutral Third Party | Hold funds and documents securely, follow contract instructions, prepare closing statements, and disburse all money at closing. |

As you can see, it's a true team effort where every stakeholder depends on the others to keep the process on track.

The importance of getting these roles right is only growing. The global title insurance market is projected to expand at a compound annual growth rate (CAGR) of 7.4% from 2025 to 2034. This growth highlights just how crucial secure, professionally managed property transfers have become. You can learn more by checking out these insights on the expanding title insurance market.

How to Sidestep Common Closing Delays

Even the smoothest real estate deals can hit a last-minute snag. A delayed closing isn't just an inconvenience—it can trigger a cascade of problems, from expired loan rate locks to upended moving plans and a whole lot of stress for everyone. The thing is, these delays are rarely a surprise. They almost always come from the same predictable weak spots in the traditional title and escrow process.

If you know where to look, you can see these hurdles coming. By anticipating where a transaction is likely to stumble, everyone involved can work together to keep things on track for a successful, on-time closing.

Finding the Real Source of Delays

Most closing fumbles fall into just a few categories, and nearly all of them trace back to manual work and choppy communication. When information is locked away in different systems and tasks are managed by hand, the chances of human error and crossed wires go through the roof.

Here are the usual suspects that throw a wrench in closing timelines:

- Surprise Title Defects: Finding a lien, an ownership dispute, or a simple mistake in public records at the eleventh hour can stop the entire process cold until it's fixed.

- Loan Document Headaches: Issues with the buyer’s financing are a huge source of frustration. This could be anything from missing paperwork to last-minute loan term changes or underwriting hold-ups.

- Closing Cost Disagreements: A simple error or misunderstanding on the final closing disclosure can spark a dispute between the buyer and seller, forcing corrections that burn valuable time.

- Basic Communication Breakdowns: A lack of transparency is a classic bottleneck. When agents, lenders, and their clients don’t have a clear, real-time view of where things stand, deadlines get missed. It’s that simple.

The real problem is the absence of a single source of truth. When everyone is working from their own set of information, a minor hiccup can quickly spiral into a major delay, creating a ton of unnecessary risk and anxiety.

This lack of cohesion is a stubborn challenge for an industry that plays such a huge role in the economy. In 2024 alone, the Title and Settlement Services sector in the U.S. hit about $15.4 billion in revenue, handling the critical work of verifying titles, preparing documents, and moving funds. You can read more about the title and settlement services market to get a sense of its economic footprint.

Shifting to a Proactive Strategy

Getting ahead of these delays means moving from a reactive "firefighting" mindset to a proactive one. Instead of waiting for something to go wrong, a modern approach is built on transparency and efficiency right from the start. The goal is to solve potential problems before they ever get a chance to mess with the closing date.

A proactive game plan involves a few key moves:

- Get Documents in Early: Buyers and sellers need to hand over all their financial and personal documents as soon as possible. This gives the lender and title company plenty of breathing room to review everything without a mad dash at the end.

- Keep the Lines Open: Regular check-ins between the real estate agents, lender, and title company are non-negotiable. Using a central communication platform can stop crucial details from getting buried in a never-ending email thread.

- Review Everything, Immediately: All parties should comb through the title commitment and closing disclosure the moment they get them. Catching an error on day one is a whole lot easier than trying to fix it at the closing table.

Ultimately, these manual prevention tactics just prove we need a better system. The stress, risk, and manual effort tied to old-school processes make a powerful case for a more reliable, technology-driven way to manage real estate closings.

The Modern Solution to Old-School Problems

Let's be honest, the chronic delays and communication blackouts in a typical closing aren't just small hiccups. They're symptoms of a much bigger problem: an industry stuck on old-school, manual workflows. The constant juggling of fragmented information and never-ending email chains adds a ton of unnecessary risk and stress to what should be an exciting time for clients.

The good news? Modern technology is finally tackling these headaches head-on, bringing some much-needed efficiency and clarity to real estate closings.

Intelligent platforms are now automating the most grueling parts of the transaction. Instead of an examiner spending hours manually digging through documents, these tools can pull out critical data, flag potential red flags, and organize everything in seconds. This isn't about replacing people; it's about freeing up title and escrow professionals to focus on solving the real problems instead of getting buried in paperwork.

Centralizing the Closing Experience

For years, the core problem has been the lack of a single source of truth. One person has one version of the story, someone else has another. Technology fixes this by creating one central hub where everyone involved—the real estate agent, the lender, the buyer, the seller—can see the exact same information in real time. This simple change gets everyone on the same page and cuts out the confusion.

A centralized system brings real, tangible benefits that put a stop to common delays:

- Real-Time Transaction Tracking: Everyone can see the status of key milestones, from the title search to the loan approval. This kills the need for those constant "just checking in" phone calls and emails that clog up everyone's day.

- Secure Communication Portals: Sensitive information and documents get shared in a protected environment. This massively reduces the risk of wire fraud and data breaches, which often exploit the chaos of messy email threads.

- Automated Document Review: AI-powered tools can instantly scan legal documents for errors, inconsistencies, or missing signatures, catching potential deal-breakers long before they have a chance to blow up a closing.

By pulling all the communication, documents, and progress updates into one unified space, modern platforms transform a chaotic process into a predictable, orderly workflow.

The Power of Predictive Insights

Today’s technology does more than just organize information; it can actually anticipate problems before they even happen. By analyzing data from thousands of past transactions, predictive analytics can spot patterns that usually lead to delays. For instance, a system might flag a file that shares traits with others that previously ran into funding trouble, giving the team a heads-up to get ahead of the issue.

This screenshot shows how a modern platform like TitleTrackr provides a clean, organized interface for managing complex title and escrow workflows.

The clean dashboard and straightforward layout make it easy for professionals to monitor progress, manage documents, and collaborate without getting lost in a cluttered inbox. It's a true command center for the closing.

This proactive approach is a total game-changer. Instead of constantly putting out fires, title and escrow teams can prevent them from starting in the first place. This doesn’t just help ensure on-time closings; it delivers a far better experience for clients, building the kind of trust that leads to repeat business. The future of the industry lies in adopting these tools to build faster, more secure, and more transparent processes for everyone.

To see how AI-driven automation can transform your operations, you can learn more about the solutions offered by TitleTrackr. Request a demo to discover how to achieve more secure and efficient closings today.

A Few Common Questions About Title and Escrow

Even with a clear roadmap, it's completely normal to have a few questions about the nitty-gritty details of title and escrow. These are complex legal and financial waters to navigate, and a little extra clarity can go a long way in making you feel confident at the closing table.

Think of this as a quick Q&A to tackle the practical concerns we see pop up all the time.

How Much Does Title Insurance Cost and Who Pays for It?

Title insurance is a one-time fee you pay at closing, not an ongoing expense. As a rule of thumb, it typically costs between 0.5% and 1.0% of the home's final sale price.

So, who foots the bill? That's entirely up for negotiation. The answer often comes down to local customs and what was agreed upon in the purchase contract. In some markets, sellers traditionally cover it. In others, it's the buyer's responsibility or the cost gets split down the middle.

What Is the Difference Between a Lender's Policy and an Owner's Policy?

It’s easy to get these two mixed up, but they protect completely different parties in the transaction.

- A lender's title insurance policy is almost always a requirement from your mortgage company. It’s their safety net, protecting their investment in the property from any surprises in the title's history.

- An owner's title insurance policy is technically optional, but it's one of the smartest investments a homebuyer can make. This policy protects your stake in the property—your equity and ownership rights—for as long as you or your heirs own it.

Think of it this way: the lender's policy protects the bank's investment, while the owner's policy protects your investment. Skipping an owner's policy could leave you exposed and financially vulnerable if a hidden title issue from the past ever comes to light.

How Long Does the Title and Escrow Process Usually Take?

While every deal is different, you can generally expect the process to take between 30 to 60 days. This clock starts ticking the moment escrow is opened and stops when the keys are finally in your hand.

Several things can stretch or shrink this timeline, like how complicated the title search is, how quickly the lender moves, and just how busy the local market is. A clean title and proactive parties who stay on top of their paperwork can definitely keep things moving along quickly.

If you have more questions, our comprehensive title and escrow FAQ page is a great resource.

Ready to eliminate delays and bring clarity to your closing process? TitleTrackr uses AI-driven automation to provide faster, more accurate, and transparent title and escrow workflows. Request a demo to see how you can achieve a new level of efficiency.