Imagine a property's history as its family tree. The chain of title is exactly that—a complete, unbroken story of every single owner that property has ever had. This historical ledger is the bedrock of any real estate, energy, or land management deal, proving who holds the legal right to sell or lease the property today.

If there's a missing branch or a questionable ancestor in that family tree, the whole transaction could be in jeopardy. A clean, verifiable history isn't just a nice-to-have; it's the foundation of a secure asset. For professionals, the accuracy and speed of verifying this chain are critical to closing deals efficiently and without risk.

Tracing a Property's Ownership History

At its core, the chain of title is the chronological sequence of documents that traces a property’s ownership all the way back from its very first grant to the person holding the keys right now. It's a foundational concept in real estate law because it's the official record that validates ownership.

A single broken link in that chain can derail an entire deal. It’s not just one document, but a collection of them pieced together like a historical puzzle. Each "link" represents a transfer of ownership or a significant event that legally impacted the property.

The Building Blocks of Ownership

To build this history, title professionals dig into all sorts of public records. Every document they find tells another piece of the property's story, showing how it has changed hands over the years, sometimes over centuries. The manual process of sifting through these records is notoriously time-consuming and prone to human error, creating bottlenecks for high-volume operations.

A complete and unbroken chain is the ultimate goal of any title search. It provides the confidence needed for buyers, sellers, and lenders to proceed, knowing that the ownership is clear and legally sound.

So, what are these "links" made of? Here’s a look at the key documents that form a property’s chain of title.

Key Documents Forming the Chain of Title

Each document serves a specific purpose, contributing a vital piece of information to the overall ownership puzzle. Understanding what they are and why they matter is key to grasping how a property's history is verified.

| Document Type | Purpose in the Chain of Title |

|---|---|

| Deeds | These are the primary legal instruments used to transfer property ownership from one party (the grantor) to another (the grantee). |

| Mortgages | Records of any loans secured by the property. These must be paid off or resolved before a clear title can pass to a new owner. |

| Court Records | These documents come from legal proceedings like foreclosures, divorces, or bankruptcies that directly affect who owns the property. |

| Wills & Probates | Legal records that detail how a property was transferred to heirs after an owner's death, ensuring the succession was legitimate. |

| Easements & Liens | These are filings that either grant specific rights to others (like utility access) or record debts against the property (like unpaid taxes). |

Together, these documents create a comprehensive timeline that a title professional can follow to confirm that the person selling the property has the undisputed right to do so.

Why a Flawless Chain of Title Is Non-Negotiable

An unbroken chain of title is so much more than a box to check in a real estate deal. It’s the bedrock of a secure investment. You can think of it as your ultimate insurance policy against the past, guaranteeing the property you’re about to buy is legally and financially clear. Without it, you’re walking into a minefield of potential risks.

A flawed or "clouded" title can create serious headaches long after you’ve closed. Imagine a previously unknown heir suddenly appearing with a legitimate claim to your property. Or what if an old, unpaid lien from a prior owner resurfaces, leaving you on the hook for a debt that was never yours?

These aren't just far-fetched "what-ifs." They are real-world problems that can spark expensive legal fights and even put your ownership rights in jeopardy. This is why digging into a property’s history isn't just due diligence—it's essential protection for your investment.

Securing Your Ownership Rights

At its core, a clean chain of title confirms that the seller has the undisputed legal right to sell the property to you. Any break in that historical chain—a forged deed, a document that was never properly recorded—is like leaving a door unlocked for future ownership challenges.

A verified, flawless chain of title isn’t just about getting a deal done. It’s about securing your future peace of mind and the financial integrity of your asset, protecting you from claims that could otherwise diminish or erase your equity.

Ultimately, the chain of title is a practical tool that protects buyers from future fights and financial surprises. Across the globe, real estate markets rely on this fundamental concept to make sure assets are transferred free and clear. In fact, it's estimated that 15-20% of real estate transactions worldwide hit some kind of title defect or dispute. You can dig into more real estate title examples and their importance on HelloData.ai.

Avoiding Costly Legal and Financial Burdens

It’s always cheaper to find and fix title issues before you close rather than fighting them in court later. A thorough title search acts like a diagnostic test, uncovering potential problems so they can be resolved, allowing the property to be transferred with a clean slate.

Without this crucial step, a new owner could unknowingly inherit a mess of problems:

- Surprise Liens: Contractors, tax authorities, or lenders from decades ago might still have a valid claim against the property.

- Boundary Disputes: Vague or conflicting property descriptions in old deeds can easily lead to ugly conflicts with neighbors.

- Undisclosed Heirs: When an estate wasn't handled correctly in the past, descendants can pop up with a valid claim to a piece of the property.

For any serious buyer or investor, a flawless chain of title is simply non-negotiable. It elevates the title search from a routine task to a critical act of self-protection.

How Professionals Investigate a Property's Past

Figuring out a property's history is a lot like a high-stakes detective story, and title professionals are the ones on the case. They don't just take a quick look at the most recent deed; they conduct a deep dive into public records, piecing together a timeline that has to be airtight. This whole process is called a title search, and it’s a meticulous hunt for the facts.

These experts start by digging through county clerk offices, digital archives, and other public databases. They pore over every deed, mortgage, and court record tied to the property. Their main objective is to follow the "chain" link by link, making sure every single transfer of ownership was legit and properly recorded.

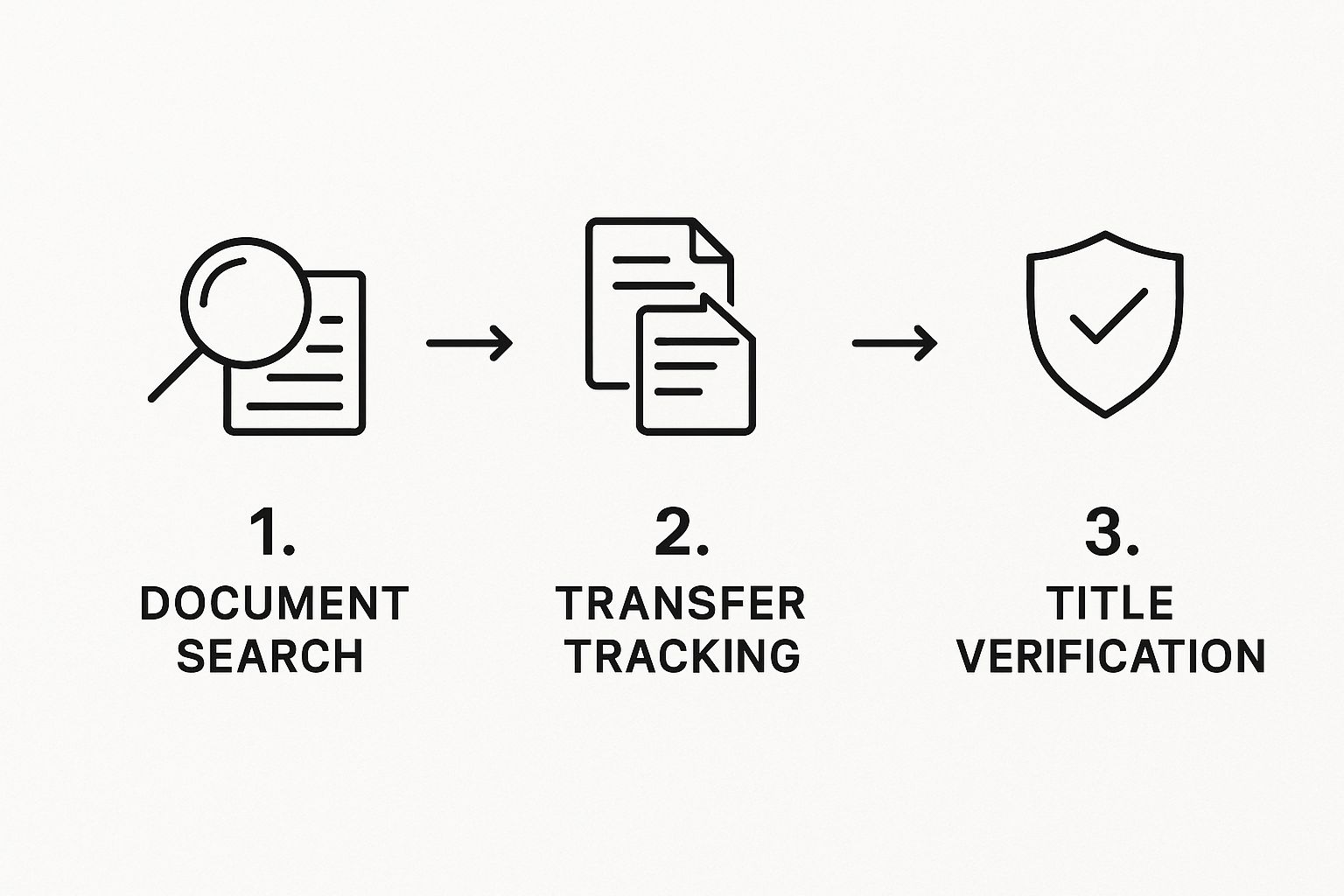

This infographic gives you a simplified look at how this investigation works.

As you can see, the process is methodical, moving from a broad collection of documents to the specific verification of each transfer.

The Search for Red Flags

But the investigation isn't just about confirming who owned the property and when. Professionals are actively on the lookout for problems—or "clouds"—that could put the new owner's rights at risk. These are the red flags that can quickly turn a dream property into a legal nightmare.

Some of the most common issues they hunt for include:

- Unresolved Liens: They're looking for any outstanding debts against the property. Think unpaid contractors, tax authorities, or lenders whose claims were never settled.

- Easements and Covenants: This involves identifying any legal rights someone else might have to the land, like a utility company needing to access a power line.

- Clerical Errors: You'd be surprised how often a simple mistake—like a misspelled name or an incorrect property description in a public record—can cause massive headaches down the road.

- Undisclosed Heirs: They'll also check probate records to make sure no rightful heirs were accidentally overlooked during a past inheritance.

This painstaking work is exactly why professional expertise is so crucial. A title search isn’t just about gathering documents; it's about understanding what they mean and ensuring nothing is missed that could threaten a buyer's ownership.

The role of a title abstractor is key here. They are the specialists who compile and analyze this history, making sense of it all. This manual effort, however, is where delays and errors often originate, highlighting the need for technological solutions that can automate and streamline this critical verification step. Every document tells a piece of the story, and it's their job to make sure that story has a happy ending for the next owner.

Common Issues That Can Cloud a Property's Title

Even a property history that seems perfectly clean on the surface can hide some nasty, expensive surprises. These problems, known in the industry as title defects or "clouds," are breaks in the chain of title that can unleash a storm of legal and financial chaos for a new owner.

This is exactly why a deep-dive title search isn't just a box to check—it's essential protection. A cloud on a title is any lingering document, claim, or unreleased lien that casts doubt on the current owner's right to the property. These defects make ownership questionable, bringing sales to a screeching halt, blocking refinancing, and often leading to pricey legal fights just to clear the air.

Hidden Liens and Unpaid Debts

One of the most common ghosts we find hiding in a property's past is an unresolved lien from a previous owner. These are legal claims staked against the property, usually over an unpaid debt. It could be anything—maybe a prior owner skipped out on their property taxes, or a contractor filed a mechanic's lien years ago for an unpaid renovation bill.

Here’s the scary part: these liens don’t just vanish when the property changes hands. They stick to the property itself, meaning the new owner could suddenly be on the hook for a debt they knew nothing about.

Uncovering these financial skeletons is a primary goal of a title search. Without it, a buyer could inherit thousands of dollars in liabilities, turning a great investment into a financial burden overnight.

Errors in Public Records and Outright Fraud

You'd think public records would be airtight, but they're not always perfect. Simple human error can throw a major wrench into the chain of title.

- Clerical Errors: A misspelled name, an incorrect legal description, or a simple filing mistake at the county recorder’s office can create serious confusion about who truly owns what.

- Forgeries and Fraud: It sounds like something out of a movie, but it happens. Documents like deeds can be forged, and a fraudulent signature could render a past property transfer completely void.

- Missing Heirs: If a previous owner passed away without a clear will, or an heir was overlooked during the probate process, that person may still have a legitimate legal claim to the property years down the line.

These issues are a stark reminder of the detective work needed to confirm every single link in the ownership chain. Even a seemingly small problem has to be ironed out before a clear title can be passed to the next owner.

To get a better sense of how messy these clouds can get, here’s a look at some frequent title defects and the trouble they can cause.

Common Title Defects and Their Impact

| Title Defect | Potential Impact on Owner | Common Resolution |

|---|---|---|

| Unpaid Property Taxes | County can foreclose on the property. | Pay the delinquent taxes, penalties, and interest. |

| Mechanic's Liens | Contractor can force the sale of the property to get paid. | Settle the debt with the contractor to get the lien released. |

| Undisclosed Heirs | A previously unknown heir could claim ownership. | Legal action (quiet title suit) to determine rightful ownership. |

| Clerical/Filing Errors | Creates ambiguity, making it hard to sell or finance. | Correct the public record through a corrective deed or court order. |

| Boundary/Survey Disputes | Neighbor may claim part of your land. | A new survey and legal agreements (easements) are often needed. |

As you can see, none of these are simple fixes. Each one reinforces why professional diligence is completely non-negotiable in any real estate deal.

For more insights into property ownership challenges and industry trends, feel free to explore the other articles on our TitleTrackr blog.

Modernizing Title Verification with Technology

After seeing the risks of a clouded title and the painstaking work that goes into a manual search, it’s obvious the process is ripe for an upgrade. The traditional method, while thorough, is a slow, meticulous dig through mountains of documents. It’s a system that leaves far too much room for human error and delays that can derail a deal. This is exactly where technology is stepping in.

The old-school approach simply can’t keep up with the pace of today’s real estate and energy sectors. Professionals need tools that can chew through enormous volumes of data with speed and precision—something manual methods just can’t promise.

Automation and Accuracy in Title Searches

Modern solutions are swapping out slow, manual searches for automated workflows that bring speed, accuracy, and even continuous monitoring to the table. This shift frees up title professionals to do what they do best: analyze complex issues and solve problems, instead of spending weeks buried in dusty archives. By automating the grunt work of pulling data from deeds, liens, and other legal documents, these platforms slash the risk of human error.

Instead of just speeding up the old process, technology redefines it. It empowers professionals with the ability to catch critical issues faster, providing the confidence needed to close complex deals securely and efficiently.

Leaving outdated methods behind is how the leading firms are protecting their clients and safeguarding their investments. They aren't just working faster; they're working smarter, with a degree of certainty that was impossible before.

A New Standard for Secure Transactions

The benefits of bringing technology into the chain of title process aren't just theoretical—they’re immediate and tangible. It's about building a more resilient and trustworthy system for one of the most critical parts of any property transaction.

Here are the key advantages:

- Reduced Human Error: Automation minimizes the chances of a missed document, a typo, or a misinterpretation that could cloud a title.

- Increased Speed: What once took days or even weeks of painstaking research can now be done in a fraction of the time, getting deals to the closing table faster.

- Enhanced Confidence: With precise data analysis and continuous monitoring, professionals can advise their clients with a much higher level of assurance.

By embracing these advancements, the industry is setting a new standard for both security and efficiency.

TitleTrackr is at the forefront of this movement, offering a powerful platform that automates and secures the entire title verification process. See for yourself how our technology can safeguard your transactions. Request a demo of TitleTrackr today.

Common Questions About Chain of Title

Even after you get the hang of what a chain of title is, some practical questions always seem to pop up during a real estate deal. Let's clear up a few of the most common ones to make sure these core concepts are crystal clear.

Key Distinctions and Timelines

People often mix up the chain of title and an abstract of title. Think of it this way: the chain of title is the actual story—the complete sequence of ownership transfers over time. The abstract of title is the report summarizing that story, pulling together all the important documents like deeds, liens, and easements into one condensed file.

Another thing people always ask is how far back a title search needs to go. The standard is typically 40 to 60 years, though this can vary based on state laws. The real goal is to trace ownership back to a solid starting point, often called the "root of title," to confirm the property has a clean, unbroken history.

Title insurance is your safety net. It’s a policy that protects you (and your lender) from financial losses if any title problems are discovered after you’ve already closed on the property. A title company won’t issue a policy until its search confirms the title is clear, making it a non-negotiable safeguard against nasty surprises.

Can You Do It Yourself?

Technically, property records are public, but trying to trace a chain of title on your own is a huge gamble. Professionals know how to read between the lines of dense legal documents and have access to specialized databases you can't just find on Google.

It's easy to miss a small but critical detail—a filing mistake, an unreleased lien, a forgotten heir. Overlooking just one thing can lead to massive legal headaches and financial pain down the road. The cost of having a professional handle the search is tiny compared to the risk of a future ownership dispute.

For a deeper dive into other common questions, feel free to check out our comprehensive FAQ page.

Are you ready to stop wrestling with manual searches and bring speed, accuracy, and confidence to your title verification process? See how TitleTrackr uses AI to automate document analysis and deliver clear, actionable reports in a fraction of the time. Request your personalized demo today!