Securing a warranty deed is a formal legal process, but it's not just paperwork. It's how a seller (the grantor) officially transfers a property to a buyer (the grantee) while providing a rock-solid guarantee of a clear title. The process involves drafting a legally sound document with a precise property description, getting it signed and notarized, and—this is the critical last step—recording it with the county clerk. This final action makes the ownership transfer official and public record.

Why a Warranty Deed Is Your Strongest Ally

When you buy a property, you're not just getting land and a building. You're making a huge investment in your future, one that you expect to be free of legal headaches down the road. This is precisely why understanding the power of a warranty deed is so important for industry professionals and buyers alike.

Think of it as the ultimate promise from a seller. It’s a legally binding guarantee that the property's title is clean, clear, and free from any hidden claims, liens, or debts that could suddenly pop up and jeopardize the transaction. It’s so much more than a piece of paper—it's your first and best line of defense.

This is a world away from other types of deeds, like a quitclaim deed, which offers zero promises. With a warranty deed, you're getting the highest level of protection possible as a buyer, which is why it's the standard for most real estate sales.

The Core Protections You Receive

The real muscle behind a warranty deed comes from its specific legal guarantees, known in the legal world as "covenants." These aren't just vague assurances; they are concrete, enforceable promises the seller is making to you.

Essentially, the seller is putting it in writing that:

- They are the rightful owner with the full legal authority to sell.

- The property is free from liens or other encumbrances, except for any that are explicitly mentioned in the deed.

- Your new title is valid and will hold up against any third-party claims.

What's more, a general warranty deed often covers the entire history of the property, not just the time the current seller owned it. If a title issue ever comes to light—let’s say an old, unpaid contractor's lien from a previous owner suddenly surfaces—the seller is legally on the hook to defend your title and cover any financial losses you incur.

This legal recourse is what truly sets a warranty deed apart. It effectively shifts the risk of unknown title defects from you, the buyer, back onto the seller. That's a powerful safety net for your investment.

To put it simply, these covenants are the foundation of your peace of mind. Here's a quick breakdown of the promises a seller makes with a general warranty deed.

Key Protections Offered by a Warranty Deed

| Covenant Type | What It Guarantees for the Buyer |

|---|---|

| Covenant of Seisin | The seller legally owns the property and has the right to sell it. |

| Covenant Against Encumbrances | The property is free from hidden liens, mortgages, or other claims. |

| Covenant of Quiet Enjoyment | Your ownership will not be disturbed by a third party with a superior claim. |

| Covenant of Warranty | The seller will defend your title against any lawful claims from others. |

| Covenant of Further Assurances | The seller will execute any additional documents needed to perfect the title. |

These guarantees work together to provide comprehensive protection, making sure the property you bought is truly yours.

A Real-World Scenario

Imagine you buy your dream home, and everything seems perfect. Two years later, a letter arrives from an attorney representing a long-lost heir of a former owner, claiming they have a rightful stake in your property. It sounds like a nightmare, right?

Without a warranty deed, you’d be facing a costly, stressful legal battle entirely on your own.

But with a warranty deed in hand, the situation is completely different. The seller who sold you the property is legally required to step in, hire attorneys, and resolve the claim. This is because they guaranteed a clear title. In the United States, warranty deeds are considered the gold standard for a reason—they are used in approximately 90% of traditional sales where buyers want maximum protection. You can dive deeper into the role of warranty deeds in real estate transactions on LoopNet.com. This is the level of security that makes learning how to get a warranty deed an essential part of any property purchase.

General vs. Special Warranty Deeds Explained

When it comes to deeds, "warranty" isn't a one-size-fits-all term. Not all warranty deeds are created equal, and the difference between them can leave you either fully protected or completely exposed. Getting this distinction right is one of the most important parts of the entire process.

Think of a General Warranty Deed as the gold standard of protection. When a seller gives you one of these, they are guaranteeing the property’s title is clean for its entire history—long before they ever owned it. This is what you almost always see in standard residential sales, like buying a family home, because it offers the buyer the strongest possible security.

On the other hand, a Special Warranty Deed comes with a much more limited promise. With this deed, the seller only guarantees the title against problems that came up while they owned the property. They’re not making any promises about what happened before their name was on the title.

Why This Distinction Is So Critical

Let's play this out. Imagine you buy a property with a Special Warranty Deed. A year down the road, you get a notice about a mechanic’s lien filed five years ago by a contractor who worked for a previous owner.

Because this issue happened before your seller's ownership, they have zero legal obligation to help you fix it. The problem is now entirely yours.

This is exactly why Special Warranty Deeds are most common in transactions where the seller has limited or no knowledge of the property’s deep history. You'll frequently run into them in situations like:

- Bank-owned properties (foreclosures)

- Estate sales

- Properties being sold by government agencies

In these cases, the seller is understandably trying to limit their future liability for things they couldn't have known about. This is especially true in foreclosure markets. In fact, estimates show that in U.S. foreclosure sales, more than 80% of transactions use special warranty deeds so sellers can avoid responsibility for unknown historical title defects. If you want to dig deeper into the legal side of things, the Ohio State University Farm Office blog has a great breakdown of what different deeds mean.

The key takeaway is simple: A General Warranty Deed protects you from the beginning of time. A Special Warranty Deed only protects you during the seller's slice of time.

Choosing the Right Protection

For any typical homebuyer, a General Warranty Deed is the only way to go. It’s a comprehensive safety net that shields you from surprise claims from the past.

However, certain professionals, like the landmen who piece together complex energy projects, deal with Special Warranty Deeds all the time. They know these deeds demand an incredibly high level of due diligence to make up for the gaps in the seller's guarantee.

If you find yourself in a deal involving a Special Warranty Deed, it doesn't have to be a non-starter. But it does make a thorough title search and a high-quality owner's title insurance policy absolutely non-negotiable. That's how you protect yourself from the history the deed won't, giving you the peace of mind to close the deal.

Your Roadmap to Securing a Warranty Deed

So, you’ve got a signed purchase agreement. Congratulations! But that piece of paper is just the starting line. Turning that agreement into a legally sound warranty deed is a journey, not a single event. Each step in the process is designed to protect your investment, and knowing the path forward is key to a smooth, secure transaction.

The real work begins the moment the ink is dry on that contract. This is when the professionals step in to perform the necessary due diligence, making sure the property you’re buying is exactly what it seems.

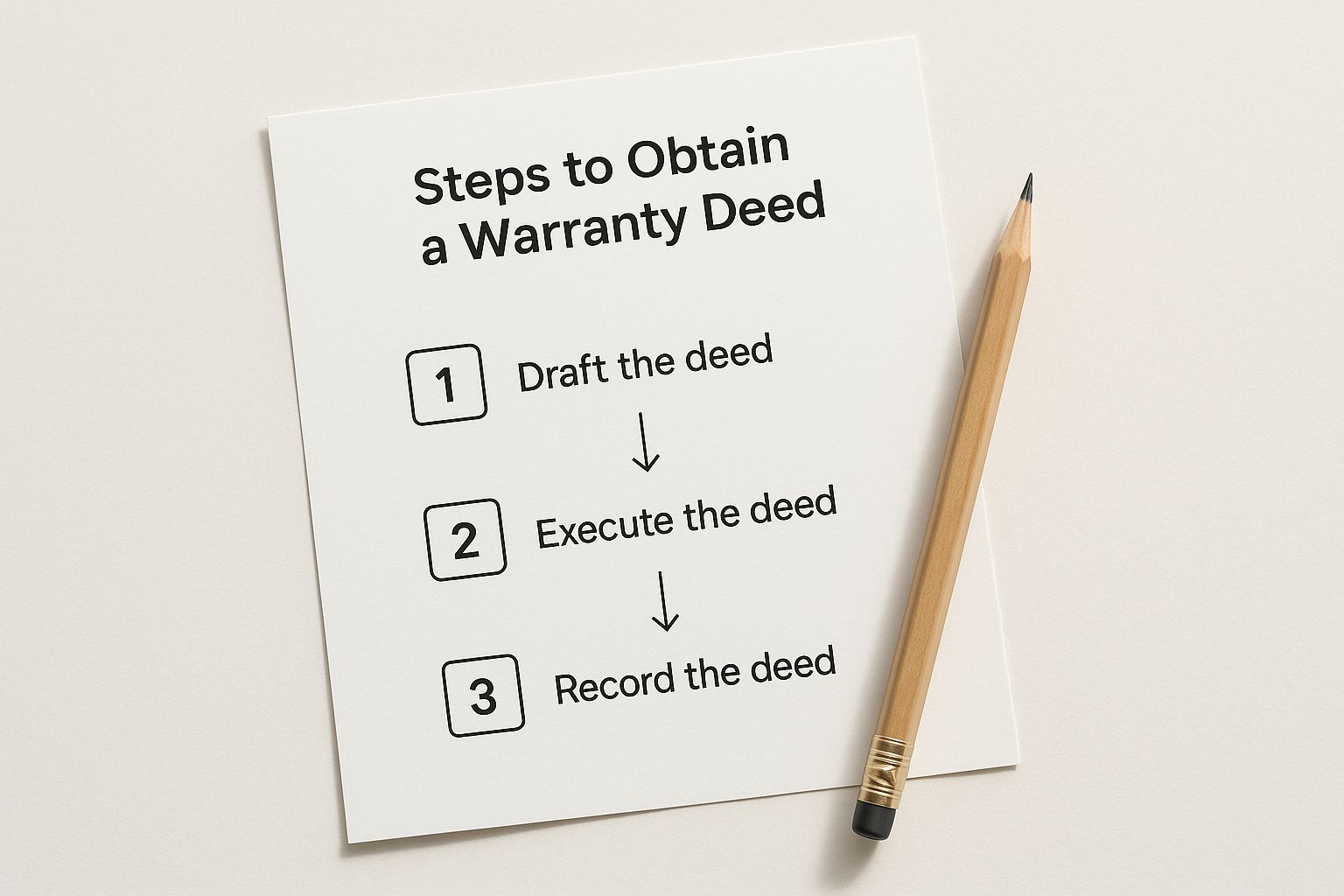

This infographic breaks down the key milestones you'll hit on the way to getting that deed in hand.

As you can see, it’s a structured procedure—far more than just signing a document at closing.

Kicking Things Off With a Title Search

Before a single word of the deed is even drafted, a title company or real estate attorney gets to work on a thorough title search. This is a deep dive into public records to confirm the seller actually has the legal right to sell the property and to uncover any skeletons lurking in its closet.

Think of it as a comprehensive background check on the property. The pros are on the hunt for red flags like:

- Unpaid property taxes or old contractor liens.

- Existing mortgages or loans still attached to the property.

- Legal judgments against former owners.

- Easements or boundary disputes that could mess with your plans for the land.

This step is non-negotiable. Finding a $15,000 mechanic's lien from a kitchen remodel ten years ago before you close is a problem that can be solved. Discovering it after you own the place? That’s a financial nightmare that’s now yours to deal with.

Drafting the Deed With Precision

Once the title search gives the all-clear, it’s time to actually draft the warranty deed. This is absolutely not the time for a generic online template. The document has to be perfect, containing precise legal language, the property’s full legal description (which is much more than just the street address), and the correctly spelled names of the grantor (seller) and grantee (buyer).

An attorney or title professional will handle this, ensuring every detail is correct. Even a single typo or a mistake in the legal description can create what’s known as a "cloud on the title." That’s a defect that can jeopardize your ownership down the road and make it a real headache to sell.

The Formalities: Execution and Notarization

With the deed drafted and reviewed, it's time for the official signing, or execution. The grantor (seller) has to sign the document in front of a notary public.

The notary's seal isn't just a fancy stamp. It's a legal verification that the person signing is who they say they are and that they're doing it willingly. This is a crucial step to prevent fraud and is required to make the deed legally valid.

Without a proper notarization, the county recorder’s office won’t even look at it. They'll reject the document flat out, bringing your entire transaction to a screeching halt.

The Final Step: Recording the Deed

This is it—the final, and arguably most important, step. After being signed and notarized, the deed must be physically taken to the county recorder's office where the property is located. The clerk there will officially record it, making your ownership part of the public record.

This is what makes your ownership official and legally binding against everyone else. If you fail to record the deed, in the eyes of the law, the transfer never truly happened. That time between closing and the deed being officially recorded is often called the "recording gap"—a little window of uncertainty that can be pretty stressful for professionals managing multiple files.

This is where modern platforms bring much-needed efficiency and peace of mind. Tools like TitleTrackr are built to help industry teams monitor the entire process, including the recording status. Instead of anxiously waiting weeks for a confirmation in the mail, you can see the progress in real-time, reducing risk and improving client communication. It’s the best way to ensure your deed is filed correctly and avoid the costly mistakes that pop up from delays and old-school manual follow-ups.

Gathering the Right Information for Your Deed

When you're drafting a legal document as rock-solid as a warranty deed, there's no room for "close enough." Precision is everything. Even a simple typo in a name or a slight mistake in the property description can create a "cloud on title"—a defect that can snowball into serious legal and financial headaches later on.

Getting it right means gathering the correct information before you even think about drafting the document.

Think of it like a pre-flight checklist for your property transaction. You have to get the basics perfect, starting with the full, correct legal names of every single person involved. That means the seller (the grantor) and the buyer (the grantee). "Jon Smith" is not good enough if his legal name is "Jonathan T. Smith."

Beyond the Street Address

Next up, and this one is crucial, is the property's legal description. This is not the same thing as the street address you'd punch into Google Maps. A legal description is a formal, precise identifier that might use metes and bounds, lot and block numbers from a plat map, or references to a public land survey system.

You can usually find this description on the seller's current deed. An incorrect legal description is one of the most common—and most expensive—mistakes I see in deed preparation.

For those of us in the industry, this is where experienced professionals are worth their weight in gold. They verify these details to ensure accuracy at every step. You can learn more about the vital work of title abstractors and the role they play in this process.

Think of the legal description as the property's unique fingerprint. Without it, the deed is ambiguous and potentially invalid, as it doesn't clearly identify what is being transferred.

Before you can draft a clean warranty deed, you need to collect several key pieces of information. The checklist below breaks down exactly what you need and why each element is absolutely essential.

Required Information Checklist for a Warranty Deed

| Information Category | Specific Details Required | Why It's Critical |

| :— | :— |

| Party Identification | Full legal names of all grantors (sellers) and grantees (buyers), plus their mailing addresses. | Ensures the property is transferred from and to the correct legal entities. Prevents future ownership disputes. |

| Property Information | The complete and accurate legal description of the property (not just the street address). | Unambiguously identifies the exact parcel of land being conveyed, preventing boundary issues or invalid transfers. |

| Transaction Details | The consideration—the amount of money or value exchanged for the property. | Establishes the terms of the sale and is often required for calculating transfer taxes. |

| Vesting Language | How the grantees will hold title (e.g., as joint tenants with rights of survivorship, tenants in common). | Defines the legal rights and ownership shares of multiple buyers, impacting inheritance and sale rights. |

| Exceptions/Reservations | Any known easements, covenants, restrictions, or mineral rights being retained by the grantor. | Discloses any limitations on the property's use or ownership, providing a clear title to the grantee. |

Once this information is meticulously gathered and verified, you're in a much stronger position to create a deed that stands up to scrutiny.

After confirming the parties and the property, the deed itself needs specific legal language. This includes the conveyance clause, which is the part that explicitly states the grantor is transferring the property to the grantee.

Finally, you must document any special conditions. This could be anything from an easement that gives a neighbor the right to use your driveway to specific covenants that restrict what you can build on the land. Every single piece of information must be triple-checked to ensure the final warranty deed is ironclad and provides clear, undisputed ownership.

Dodging the Most Common (and Costly) Deed Mistakes

Even with a perfect plan, the path to securing a warranty deed can have some serious potholes. Knowing where these traps are hidden is the best way to avoid them, making sure your property transfer is both smooth and legally bulletproof. Trust me, a tiny oversight now can snowball into a massive title headache later, costing you a fortune in time, money, and stress.

One of the most tempting shortcuts I see people take is grabbing a generic, fill-in-the-blank deed template from the internet. They seem easy, but these documents are often a disaster waiting to happen. Most of them lack the specific legal language your state or county requires, which can make the whole deed invalid. You might not even find out about this defective title until years down the line when you try to sell.

Another classic blunder is waiting too long to record the deed after closing. Until that deed is officially filed with the county, your ownership isn't on the public record. This creates a dangerous gap where a shady actor could file fraudulent claims or liens against the property under the old owner's name.

The Real Danger of Cutting Corners

The single biggest risk you can take? Skipping a professional title search. A clean title search is what gives a warranty deed its power. Without one, you’re essentially flying blind, completely unaware of ticking time bombs like undisclosed heirs, messy boundary disputes, or old mortgages that could pop up and threaten your claim to the property.

A warranty deed is a promise from the seller, but that promise is only as good as the diligence performed beforehand. Skipping a title search is like buying a car without ever looking under the hood—you're accepting all the hidden problems as your own.

There’s a reason warranty deeds became the gold standard. Before they were common, property buyers were taking on huge risks. Back around 1850, it's estimated that over 20% of property deals ended up in court because of unclear titles. Fast forward to today, and thanks to warranty deeds and title insurance, that number has dropped to less than 0.5%. It just goes to show how critical a guaranteed, verified title really is. You can dive deeper into the history and impact of warranty deeds on Houzeo.com.

How to Stay Out of Trouble

So, how do you steer clear of these expensive mistakes? It boils down to a mix of professional help and smart technology. This is not the time for a DIY project. You need to bring in a qualified real estate attorney or a reputable title company to make sure every single step—from the deep dive of the title search to the final recording—is handled perfectly.

These pros are your safety net. They'll verify every last detail, from the property's legal description to the notarization of every signature. Think of this professional review as your best defense against errors.

And to truly seal the deal, modern tools like TitleTrackr are changing the game. It gives you real-time tracking of the entire process, including that critical recording stage. This completely gets rid of the uncertainty and risk of the "recording gap." Instead of sitting around hoping your deed was filed correctly, you get instant confirmation. This proactive approach stops errors from becoming disputes and ensures your path to ownership is secure from day one.

Frequently Asked Questions About Warranty Deeds

Navigating the world of real estate deeds can feel like learning a new language. Even when you think you have the process down, specific questions always pop up.

Here are some of the most common ones we hear from people trying to secure a warranty deed. We'll give you straightforward answers to help you move forward with confidence.

Can I Prepare a Warranty Deed Myself?

While you technically can in some states, preparing your own warranty deed is a bad idea. Seriously. We strongly advise against it. This isn't just a form you fill out; it's a complex legal instrument where the smallest mistake can have disastrous consequences.

A simple typo in the property's legal description, a misspelled name, or using the wrong legal phrasing can invalidate the entire deed or create what's known as a "cloud on title." Fixing these mistakes can lead to incredibly expensive legal battles and even put your ownership of the property at risk.

Always, always use a qualified real estate attorney or a reputable title company. It’s the only way to ensure the document is ironclad and gives you the full legal protection you're paying for.

What Is the Difference Between a Warranty Deed and Title Insurance?

This is a fantastic question because these two things are cornerstones of your protection plan, but they serve very different roles. They're designed to work together to secure your investment.

A warranty deed is a direct promise from the seller to you, the buyer. They are guaranteeing that the title is clear and that they have the right to sell it. If a problem emerges later, your only legal path is to sue the seller based on the promises made in that deed.

Title insurance, on the other hand, is a policy you buy from an independent, third-party insurer. It’s your financial shield. It protects you from financial losses caused by title defects that were missed during the title search—things like old liens, undiscovered heirs, or recording errors. Lenders always require it, but getting your own owner's policy is just as crucial.

Think of it this way: The deed is the seller's guarantee. Title insurance is your financial safety net from an independent company. You absolutely need both for complete peace of mind.

How Long Does It Take to Record a Warranty Deed?

This can be a bit of a wild card, as recording times vary dramatically from one county to the next. After you close, the signed and notarized deed is sent to the county recorder's office to be officially entered into the public record.

Some tech-forward offices can record documents electronically and have it done in a few days. Many others, however, are still working with manual systems that can take weeks or even months to process the paperwork. This delay is known in the industry as the "recording gap," and it can be a surprisingly risky period for a new owner.

What Happens If I Lose My Original Warranty Deed?

First off, don't panic! While you should definitely keep your original documents in a safe place, losing your copy of the warranty deed is not a catastrophe.

The most important step was getting the deed recorded with the county right after your closing. The copy held by the recorder’s office is the official, legally recognized public record of your ownership. You can always get a certified copy from their office for a small fee, and that certified copy serves as absolute legal proof that you own the property.

For more detailed answers to common questions, you can also check out our comprehensive TitleTrackr FAQ page.

Managing all the details of a warranty deed, especially tracking its recording status, can be a major source of stress and operational drag. TitleTrackr eliminates this uncertainty by giving your team real-time visibility into the entire process. See for yourself how our AI-driven platform can bring efficiency and control to your title workflows. Request a demo today.