When you're facilitating a property transaction, you're not just transferring a physical building and land. You're transferring the right to own and use it. That bundle of rights is what we call a real estate title.

It’s a common misconception that the title is a single document. In reality, it’s a legal concept—a collection of rights and historical records that prove legitimate ownership. A clear title is the goal of every transaction, confirming that ownership is free from any disputes that could derail a closing or create future liabilities. For industry professionals, ensuring a clear title is the cornerstone of a successful deal.

Understanding the Bundle of Rights in Property Ownership

When you hold the title to a property, you’re actually holding a "bundle of rights." It's a great analogy because it helps visualize ownership as a collection of individual privileges. Each "stick" in the bundle represents a distinct right an owner has over their property.

Getting a handle on this concept is the key to understanding why a real estate title is so much more than just a name on a deed. It's the legal bedrock of the entire investment, and your job is to ensure that bundle is complete and secure.

The Core Components of Your Ownership

The most important rights you get with a property title include:

- The Right of Possession: The fundamental right to occupy and live on the property.

- The Right of Control: The owner's right to decide how to use the property, within legal limits.

- The Right of Exclusion: The power to say who can and cannot come onto the property.

- The Right of Enjoyment: The ability to use and enjoy the property without disruption from others.

- The Right of Disposition: The right to sell, lease, or transfer the property.

When a client buys a home, they're buying this entire bundle. A "clear" title means all these sticks are present and accounted for, ready to be transferred without any legal challenges from past owners, their relatives, or any creditors.

To make this crystal clear, here’s a simple breakdown of what these rights mean for a property owner.

Your Bundle of Rights with a Clear Property Title

| Right | What It Means for You | A Real-World Example |

|---|---|---|

| Possession | You have the legal right to occupy and live on your property. | Moving into your new home after closing without worrying about the previous owner still having a key. |

| Control | You can make decisions about how the property is used. | Deciding to paint the living room, build a fence, or plant a garden in the backyard. |

| Exclusion | You can legally prevent others from entering your property. | Putting up a "No Trespassing" sign or calling the authorities if someone is on your land without permission. |

| Enjoyment | You can use your property for your pleasure without outside interference. | Hosting a backyard barbecue without a neighbor claiming they have a right to use your yard. |

| Disposition | You have the authority to transfer ownership to someone else. | Listing your home for sale, renting it out to a tenant, or leaving it to your children in your will. |

These rights are the very definition of property ownership. When you deliver a clear title, you provide the full legal power for the new owner to use and control their property as they see fit.

Why a Clear Title Is Crucial for Market Stability

The entire housing market's health hinges on the reliability of property titles. Any doubt about ownership can slow down sales and disrupt property values.

Look at what happened recently. Despite mortgage rates coming down in late 2024, existing home sales stayed surprisingly low well into 2025. With inventory for single-family homes 20-30% below previous troughs, it’s a clear sign that issues like title snags or owner hesitancy can seriously choke market activity.

When title transfers are messy or held up in disputes, it creates a bottleneck that hurts everyone. You can dig deeper into this connection by checking out J.P. Morgan's research on the U.S. housing market outlook. It drives home why a smooth, transparent title process isn't just a client service—it's an economic necessity.

The Professionals Who Handle Your Title

Getting a clear real estate title to the finish line is a team sport. It takes a crew of specialists, each playing a crucial role, to ensure ownership rights are secure. Think of it like a relay race—if even one person fumbles the baton, the whole closing can get thrown off track.

A successful closing hinges on how well this team collaborates. When wires get crossed or someone drops the ball, you're looking at serious delays that can put the entire deal in jeopardy.

The Title Company

The title company is mission control for the whole operation. As project managers, they coordinate all the different pieces to make sure the property changes hands smoothly. Their primary job is to conduct a thorough title search and then issue title insurance to protect both the buyer and the lender from any future claims.

These companies have a team of pros, from researchers to legal eagles, who dig through public records to piece together a property's complete history. This is what uncovers potential problems before they have a chance to become a client's problem. A good title company sells peace of mind.

The Escrow Officer

Usually working within the title company, the escrow officer is the neutral third party in the transaction. They are the trusted intermediary—holding all the money, documents, and instructions from the buyer, seller, and lender until every last condition is met.

Here’s a snapshot of what they handle:

- Holding the buyer’s earnest money in a secure account.

- Drafting the closing statements that break down every dollar in the deal.

- Making sure all the terms of the purchase agreement are satisfied before any funds are released.

- Overseeing the final document signing and making sure everyone gets paid at closing.

Their impartiality builds trust and ensures everyone's interests are protected.

The Underwriter

Behind every title insurance policy stands an underwriter. This is the company with the financial muscle, the one that actually assumes the risk and promises to defend the title in court if a covered problem pops up later. Once the title search is done, the underwriter reviews the entire file to weigh the risks.

Based on that review, they give the final green light to issue the policy. The underwriter’s approval is the ultimate guarantee that ownership is insurable, giving long-term protection from skeletons in the property's closet.

A study by the American Land Title Association found that title professionals fix issues in 25% of all real estate transactions before they ever get to closing. It just goes to show how critical these experts are at solving problems clients might never even know existed.

Real Estate Attorneys and Abstractors

A real estate attorney usually steps in for more complicated deals or in states where the law requires it. They’re there to review contracts, negotiate sticky points, and offer legal advice to ensure their client is fully protected. Their expertise is a lifesaver when the title search uncovers a real head-scratcher.

Working tirelessly behind the scenes, you’ll find title abstractors. These are the detail-obsessed detectives who do the actual grunt work of the title search. They're masters at navigating county records, deeds, and court filings to assemble the property's chain of title. You can get a better sense of what they do and how tech is changing their job by exploring the role of modern title abstractors in today’s market.

When you see how all these roles connect, you can easily spot where things can go wrong. If these professionals are stuck using manual, outdated systems, miscommunication and delays are almost guaranteed. This is why a collaborative platform like TitleTrackr is so important—it keeps everyone on the same page so the transaction keeps moving forward.

How a Title Search Uncovers a Property's Past

Think of a title search as a deep-dive investigation into a property's entire life story. It's far more than a background check; it’s a professional examination that uncovers every twist in the property's history. This isn't just about verifying who owns the property now—it's about making sure the past won't create big problems for the future owner.

At the heart of this process is tracing the chain of title. This is the chronological timeline of every single owner, sometimes stretching back for a century or more. A title professional carefully pieces this history together by examining public records, ensuring there are no suspicious gaps or questionable transfers along the way.

Tracing Ownership Through Public Records

A title search is essentially a forensic review of a property's paper trail, and it all happens by digging through public records. Each document provides another piece of the puzzle, and the goal is to verify that every past transfer of ownership was legitimate and properly recorded.

This search involves scouring a ton of documents filed at local county courthouses and municipal offices, such as:

- Deeds: The official legal papers that transferred the property from one owner to the next.

- Mortgages: This includes every loan ever taken out on the property, confirming they were either paid off or are properly accounted for.

- Court Judgments: Lawsuits or other legal actions involving a past owner can result in a judgment that attaches directly to the property itself.

- Tax Records: Unpaid property taxes are a huge deal because they create a lien that jumps to the front of the line, ahead of almost all other claims.

- Wills and Divorce Decrees: Big life events directly impact who has rights to a property, so these records are checked to ensure everything was transferred correctly.

This exhaustive process confirms the seller has the undisputed right to sell the property. It can get incredibly complex, especially for older properties with a long and tangled history.

Identifying Clouds on the Title

The whole point of the title search is to find any "clouds on the title." A cloud on title is any issue, claim, or hang-up that could challenge ownership or cause a legal headache down the road. These are the red flags the process is designed to bring to light.

For instance, a search might turn up a mechanic's lien filed by a contractor five years ago for an unpaid bill. If that lien is still active, it could suddenly become the new owner’s problem to solve.

A clean and verifiable real estate title is the foundation of market stability not just locally, but globally. Title assurance, achieved through diligent public record searches and insurance, is what builds the necessary trust for smooth transactions and confident investment across the nearly 290 city-sectors analyzed worldwide.

Finding these clouds before closing is absolutely critical. You can learn more about the global importance of clear titles in this real estate analysis from UBS, which shows how solid title systems support market confidence everywhere.

The Role of Specialized Researchers

This isn't a job for just anyone. This intricate work is carried out by highly specialized professionals like title abstractors and landmen. They're the detectives who have a deep understanding of local record-keeping systems and real estate law, knowing exactly where to look and how to interpret the often archaic language found in old documents.

Their expertise is especially vital in sectors like energy development, where mineral rights and land use records add whole new layers of complexity. These pros are trained to spot subtle issues an untrained eye would easily miss—like a forged signature on a deed from 1950 or an undiscovered heir who might have a claim.

The detailed work landmen do to benefit the real estate industry ensures these critical details aren't overlooked. By catching these risks early, a thorough title search paves the way for a secure investment and a smooth closing, giving your clients confidence in their new property.

Common Issues That Can Cloud a Title

Even a picture-perfect house can have a messy history hidden in public records. A professional title search is like a forensic investigation, digging through decades of documents to uncover potential "clouds"—any claim, lien, or unresolved issue that could threaten the right to ownership.

These hidden defects are far more common than most people realize. They can bring a closing to a screeching halt and turn a dream home into a legal nightmare. Understanding what could go wrong is the first step in protecting every transaction.

This is where your expertise, backed by title insurance, becomes critical, acting as the financial shield against the very issues we're about to dive into.

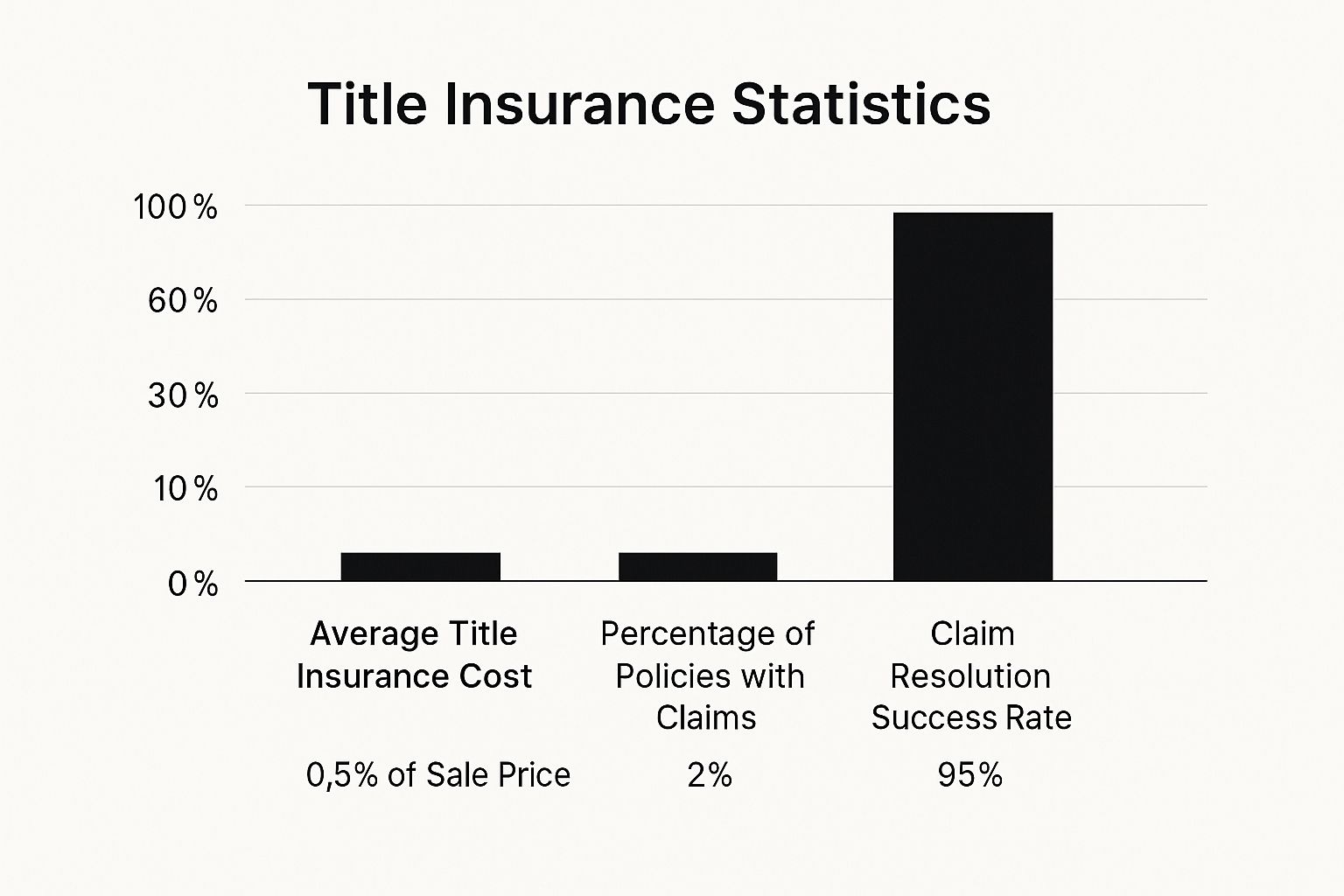

While claims aren't an everyday event, the data shows just how effective the system is at making things right when they do pop up. It's a one-time investment for long-term peace of mind.

A thorough title search is designed to catch these problems before the closing table. Let’s look at some of the most common title defects a search can uncover.

| Title Issue | What It Is | Potential Impact on Your Ownership |

|---|---|---|

| Outstanding Liens | A legal claim on the property from a creditor for an unpaid debt (e.g., taxes, mortgage, contractor bills). | You could be forced to pay off the previous owner's debts to keep your home. |

| Clerical or Filing Errors | Simple mistakes like a misspelled name or incorrect property description in public records. | These errors can create a break in the "chain of title," making it hard to prove you're the rightful owner. |

| Undiscovered Heirs | A long-lost relative of a previous owner shows up with a valid claim to the property. | You could find yourself in a legal battle, potentially losing a portion or all of your ownership. |

| Forgeries & Fraud | A past deed or document was signed illegally or by someone without the authority to do so. | The transfer of ownership could be deemed invalid, meaning you never legally owned the property. |

| Boundary Disputes | A neighbor claims part of your land is theirs, often due to an old, incorrect survey. | You might lose part of your yard or have to pay to resolve the dispute legally. |

| Illegal Prior Structures | A previous owner built an addition or deck without the proper permits. | You could be required by the city to tear down the structure at your own expense. |

These are just a handful of the issues that can pop up. A clean title search and a solid insurance policy are the best defense against these unexpected—and often expensive—surprises.

Liens and Outstanding Debts

One of the most frequent roadblocks is an outstanding lien. A lien is a legal claim a creditor puts on a property to secure an unpaid debt. If the old owner skipped out on their bills, those debts attach directly to the real estate itself. They don't just vanish when the keys change hands.

Some of the usual suspects include:

- Unpaid Property Taxes: The government always gets its money, and tax liens almost always jump to the front of the line.

- Unpaid Mortgages: An old, forgotten mortgage that was never properly discharged can pop up years later.

- Mechanic's Liens: A contractor who renovated the kitchen but never got paid can place a lien on the house.

- Judgment Liens: If a prior owner lost a lawsuit, the court can place a lien on their property to satisfy the judgment.

If these aren't cleared before closing, the new owner could suddenly be on the hook for someone else's old debts.

Public Record and Clerical Errors

The entire system of property records is run by people, and people make mistakes. A simple typo, a filing error, or a misplaced document from decades ago can create massive headaches and cast serious doubt on the validity of a real estate title.

We're talking about things like:

- A misspelled name on a deed from the 1970s.

- An incorrect legal description of the property boundaries.

- Paperwork filed in the wrong county or indexed improperly.

These aren't just minor clerical issues. They can create a break in the chain of title, making it nearly impossible to prove a clear and unbroken line of ownership.

According to the American Land Title Association, title professionals find and fix defects in more than 25% of all real estate transactions before the deal closes. That statistic really drives home how often these hidden problems exist and why expert review is so crucial.

Catching these tiny errors requires a meticulous eye for detail, which is where modern technology has become a game-changer. Advanced systems can flag inconsistencies across documents that even a trained human eye might miss, preventing major delays and legal battles down the road.

Undiscovered Heirs and Ownership Claims

Some of the most serious title clouds come from unexpected people. Life events like a death or a divorce can make property ownership incredibly complicated in ways that aren't obvious on the surface. These problems often crawl out of the woodwork years after a sale is complete.

Just imagine one of these scenarios:

- Missing Heirs: A previous owner died without a clear will, and a long-lost cousin suddenly appears with a legitimate claim to a piece of the property.

- Ex-Spouses: A divorce decree was vague or never properly addressed the property's ownership, leaving an ex-spouse with a lingering legal interest in the new home.

- Forgeries and Fraud: It happens. Deeds can be forged, signed under duress, or signed by someone who had no legal right to do so, which makes the entire transfer void.

These situations can spark incredibly complex and expensive legal fights over who the rightful owner truly is. A comprehensive title search aims to confirm that every single past owner, heir, and interested party has legally signed away their rights, ensuring your client won't face a surprise challenge.

Why Title Insurance Is Your Safety Net

Most insurance policies—health, auto, home—protect against future events. Title insurance flips that script. It’s a unique form of protection that looks backward, defending against issues from the property’s past.

Think of it as a financial shield against problems that have already happened but just haven't been discovered yet. We’re talking about things like undiscovered liens, old forgeries, or clerical errors that even the most detailed title search can miss.

Title insurance ensures those old problems don’t become your client's new, expensive legal nightmares. It's an absolutely critical piece of a secure real estate title transfer.

Differentiating the Two Types of Policies

At closing, two different kinds of title insurance policies come into play. They sound similar, but they protect completely different parties in the transaction. Understanding the distinction is key to advising your clients.

The two main policies are:

- Lender's Policy: If there's a mortgage, this policy is mandatory. It protects the lender's investment, ensuring their loan is backed by a valid lien. It does not protect the homeowner's equity.

- Owner's Policy: This is the policy that protects your client. An owner's policy defends their right to the property against any covered title defects that arise after closing, and it lasts for as long as they or their heirs own the home.

The bank will always require their policy. But the owner's policy is the homeowner's personal safeguard against future claims.

The Owner’s Policy: Your Long-Term Protection

An Owner’s Title Insurance policy is a one-time purchase, paid for at closing. There are no monthly premiums or renewals. That single payment delivers lasting peace of mind.

It protects the owner's equity from a host of potential title clouds that could surface months, years, or even decades later.

Without an owner's policy, you would be left to pay for your own legal defense against title claims. These disputes can cost tens of thousands of dollars in legal fees and, in a worst-case scenario, could result in the loss of your home.

This one-time investment is a non-negotiable part of any smart home purchase. If an old property tax lien, an unknown heir, or a forged signature from a decade ago ever comes knocking, the title insurance company steps in to defend the owner and cover the losses.

The need for solid title systems is getting more attention on a global scale. As real estate investors push into secondary and tertiary urban markets, having reliable title records and insurance is a major driver of growth. Strong title infrastructures give investors the legal certainty they need to bring in institutional money, which helps stabilize property values and support sustainable development. You can find more insights on how title systems impact global real estate trends on protitleusa.com. It just goes to show how fundamental title security is to any healthy, growing market.

How Technology Is Transforming the Title Process

For a long time, the real estate title industry was defined by stacks of paper and long days spent doing manual searches at the courthouse. The entire process hinged on physical records and a messy chain of phone calls and emails. Those days are finally fading.

Modern technology is stepping in to fix old inefficiencies. This isn't just about moving faster; it's about building a more accurate, secure, and transparent title process from the ground up.

For decades, verifying a real estate title was incredibly labor-intensive. It meant an expert had to physically visit a county records room and sift through dense, dusty legal documents. While thorough, this approach was slow and wide open to human error. Today, automation and digital platforms are changing everything.

The Rise of Automation and Artificial Intelligence

Leading this charge are automation and artificial intelligence (AI). These tools aren't here to replace human expertise. Instead, they supercharge it, freeing up professionals to focus on sharp analysis instead of tedious data gathering.

AI-powered tools can now scan and make sense of complex legal documents, pulling out key information with incredible precision. Imagine an AI that instantly spots specific clauses, dates, and names across hundreds of pages of deeds and mortgages—that's exactly what modern platforms do.

These systems can flag inconsistencies or potential red flags that a human eye might easily miss after hours of review. This adds a powerful new layer of risk detection, helping to catch and resolve title issues much earlier in the game.

The result? Faster turnarounds and a much higher degree of accuracy in every title search. That means fewer closing delays and more confidence for everyone involved in the deal.

Centralized Platforms and Seamless Collaboration

Another massive leap forward is the shift to unified, collaborative platforms. In the past, title agents, attorneys, underwriters, and lenders often worked in their own separate worlds. Communication was a disjointed mess of emails and phone tag, creating bottlenecks and misunderstandings.

Modern software is breaking down those walls. Centralized workspaces give all parties real-time access to the same information. For professionals, this means:

- Improved Transparency: Everyone has a crystal-clear view of the transaction's progress.

- Enhanced Communication: Real-time updates and built-in messaging keep the whole team on the same page.

- Greater Efficiency: Automated workflows handle the grunt work, keeping the process moving smoothly.

This all comes together in platforms like TitleTrackr, which let you manage the entire title examination from a single dashboard. It empowers you to spot risks, collaborate effortlessly, and close deals with a new level of confidence. If you're ready to leave manual processes behind, it's time to see how this technology can redefine your workflow.

Request a demo with TitleTrackr today and experience the future of title management for yourself.

Frequently Asked Questions About Real Estate Titles

Even for seasoned professionals, questions can pop up around the complexities of real estate titles. This section provides a quick reference to clarify some of the most common points of confusion.

Let's start with a big one: What's the difference between a real estate title and a deed? The title is the abstract legal right to own and use the property. The deed is the physical, legal document that actually transfers those ownership rights from one party to another.

Here’s a simple way to remember it: The title is the status of ownership, and the deed is the receipt that proves its transfer.

Key Questions on the Title Process

How long does the whole title search process take? There’s no single answer—it depends entirely on the property's history. A straightforward search on a newer property might only take a few days. But for an older property with a long, tangled chain of ownership, it could easily take several weeks to conduct a thorough examination.

That brings us to another critical question: Can you just do a title search yourself? While public records are technically accessible, attempting a DIY title search is a massive risk. Professionals are trained to spot subtle red flags, interpret dense legal language, and navigate the quirks of local record-keeping that an untrained eye would almost certainly miss.

Overlooking just one critical issue could expose your client and your business to massive financial and legal headaches.

The real value of a professional title search and subsequent Owner's Title Insurance is risk mitigation. You aren't just paying for a service; you're investing in a financial safeguard that protects what is likely your largest asset from unforeseen historical claims.

This one-time investment protects an owner from having to personally fund a legal defense against a claim on their property, which could save them tens of thousands of dollars. For a deeper dive, check out our guide on frequently asked real estate title questions.

At TitleTrackr, we empower title professionals to deliver faster, more accurate results by automating the most time-consuming parts of the title search process. See how our AI-driven platform can transform your workflow and reduce risk. Request a demo with TitleTrackr today.