A property title search is the meticulous process of examining public records to verify a property's legal ownership and uncover any defects that could jeopardize a transaction. It involves a deep dive into deeds, mortgages, tax records, and court judgments to ensure the seller has the legal right to transfer the property and the buyer receives a clear title. For title professionals, mastering this process is the foundation of every secure real estate closing.

What a Property Title Search Actually Involves

Think of it as forensic analysis for real estate. Before any transaction can close, a title professional must assemble a complete, chronological history of the property’s ownership. This investigation confirms the seller's right to transfer the property and, critically, ensures the buyer receives a “clear title”—one free from unforeseen debts, claims, or encumbrances.

This process is the bedrock of a secure real estate transaction. You are searching county and municipal records for any issue that could derail a closing. A single unreleased mortgage from a decade ago or a surprise claim from an heir can bring a deal to a halt, leading to costly delays and complex legal challenges. Automating this historically manual process is a key reason why modern title agencies are turning to platforms like TitleTrackr—to accelerate turnaround times and eliminate the risk of human error.

Core Elements of a Title Search

Your investigation will focus on a few critical pieces of information, each telling part of the property's story.

A thorough title search always comes down to finding and verifying a few key components. These are the non-negotiables that form the complete picture of a property's legal standing.

| Component | What It Is | Why It Matters |

|---|---|---|

| Chain of Title | The complete history of ownership transfers, from the current owner all the way back to the original one. | An unbroken chain is essential to prove the seller has the legal right to transfer the property. Gaps are major red flags that must be resolved. |

| Liens & Encumbrances | A lien is a legal claim for an unpaid debt (like taxes or a contractor's bill). An encumbrance is a broader term for any claim that limits property use, like an easement. | These must be paid off or resolved before the sale. Otherwise, the new owner could be on the hook for someone else's debt, creating a liability. |

| Judgments | Court rulings against a person that can attach to their property as a financial obligation. | Like liens, any judgments must be satisfied to clear the title and prevent the new owner from inheriting the problem, which could lead to a title claim. |

Getting these details right is what separates a smooth closing from a potential disaster. Every document you find adds another layer to the property's legal narrative.

The entire point of a title search is to mitigate risk. Every document you uncover adds to the property's legal story, helping prevent future ownership challenges and financial losses for the new buyer.

Understanding these fundamentals is key to appreciating what's at stake. The work requires intense attention to detail—a skill highly valued among professional title abstractors. While this process is standard in the U.S., it’s a luxury in many parts of the world. In fact, World Bank experts estimate that only about 30% of the world's population has a legally registered title to their land. This really drives home the importance of the thorough record-keeping we rely on. You can learn more about global land ownership records on geospatialworld.net.

The Manual Approach To Title Examination

For decades, a title search meant hours at the county recorder’s or clerk’s office, surrounded by stacks of plat books and armed with nothing but a notepad and immense patience. This manual process, while foundational to the industry, is slow, labor-intensive, and prone to error.

At the heart of every search lies the chain of title. You start with the current owner and trace ownership backward through deed after deed—sometimes going back over a century. You’re not just logging names: you’re verifying legal descriptions, confirming signatures, and ensuring no transfer slipped through the cracks.

Everything hinges on the grantor-grantee index, the essential catalog for property records. By looking up transactions by seller (grantor) or buyer (grantee), you stitch together a timeline of who owned what, when.

Deciphering The Details In Public Records

Following ownership sets the foundation, but the real work is uncovering hidden claims that could muddy the title.

In practice, this means chasing down:

- Mortgages and Releases: You must find every mortgage on record, then hunt for the corresponding release or satisfaction. An unreleased lien from 30 years ago still clouds the title.

- Tax Liens: Dive into tax rolls to ensure no outstanding property taxes—these liens take priority over nearly all other claims.

- Judgments and Other Liens: Scan court dockets for judgments (civil suits, child support, etc.) that may attach to the land.

Reading a faded deed feels like decoding a century-old diary. One misinterpreted word or overlooked index entry can derail an entire search.

The Challenge Of Incomplete Or Dispersed Information

Records rarely sit under one roof. Deeds might be in one office, tax records in another, and court judgments in a third. If you’re unlucky, none are digitized—so you’re leafing through fragile volumes by hand.

Imagine tracing a title back to the 1940s. You uncover a deed granting an easement for a neighbor’s driveway, but the full details live in a separate plat book filed years earlier. Miss that cross-reference, and the new owner won’t realize there’s a shared driveway until closing.

That’s why a single complex property can tie up even veteran abstractors for days or weeks. Juggling fragmented records and manual interpretation turns title searching into both an art and a bottleneck—exactly the pain point modern tools like TitleTrackr are designed to solve.

Navigating Common Title Search Roadblocks

Even the most straightforward title search can hit a brick wall. And when it happens, these roadblocks aren't just small hiccups—they're potential deal-breakers that demand an expert eye and immediate action. A successful search isn't just about pulling records; it's about knowing how to solve the puzzles that come with them.

Imagine you're tracing the ownership history of a property and suddenly, you hit a dead end. That's what we call a break in the chain of title. It could happen because a deed was never recorded, was filed incorrectly, or is just plain missing. This gap injects a ton of legal uncertainty into who actually owns the property. Closing that gap often means digging deep, tracking down affidavits from heirs, or sometimes even heading to court for a quiet title action.

Believe it or not, this is more common than you'd think. Globally, shaky property rights create a massive barrier to reliable record-keeping. The 2024 Prindex Report found that roughly 1.1 billion adults across 108 countries feel insecure about their land rights, a reality that directly leads to incomplete or disputed records. You can explore the full Prindex report on tenure insecurity to see just how this impacts records around the world.

Unearthing Zombie Liens and Lingering Claims

Another classic headache is the "zombie lien." This is a mortgage that was paid off decades ago, but the satisfaction or release was never officially filed. The debt is long gone, but that lien is still technically clinging to the property record, clouding the title.

Getting rid of it means hunting down the original lender, which is often a company that was sold or merged multiple times over the years. That kind of detective work is incredibly time-consuming and can easily stall a closing for weeks.

A title search is less about finding a clean history and more about identifying and resolving the messy parts. An unreleased mortgage from 1985 is just as problematic as a new tax lien filed yesterday.

Other complex issues often pop up from life events that inevitably spill over into property records. We see it all the time:

- Messy Divorces: A divorce decree might give the house to one spouse, but if a quitclaim deed wasn't properly signed and recorded, the other ex-spouse could still have a legal claim on the property.

- Probate and Inheritance Issues: When a property owner passes away, the title has to go through probate. If heirs aren't correctly identified or if one heir simply refuses to cooperate, the title can get stuck in a legal nightmare.

- Boundary Disputes: An old survey might not match a new one. Or maybe a neighbor built a fence over the property line years ago, which could lead to a claim of adverse possession.

Mitigating Risks Posed by Title Defects

Every single one of these issues brings serious financial and legal risk to the table. An undiscovered heir could show up years down the road to claim ownership. An old creditor could try to foreclose on a lien the new owner had no idea existed.

This is exactly why a meticulous title search is so valuable. It’s not just about shuffling paperwork; it's about protecting a massive investment. Understanding how to do a title search means being ready for these roadblocks. The goal is to spot them early, figure out how risky they are, and take the right legal steps to clear them up, making sure the property can be transferred free and clear of any lingering threats.

How AI Is Modernizing The Title Search

Anyone who’s been in the title business for more than a few years knows the grind. The days spent hunched over dusty record books or navigating clunky, decade-old county websites. For generations, that manual, painstaking process was just how things were done. But that's changing fast.

While the old-school approach has been the industry standard, it’s always been riddled with potential bottlenecks and, let's be honest, human error. Now, a new way of working is taking over, driven by intelligent automation that’s turning a meticulous chore into a real strategic advantage.

Instead of an abstractor manually piecing together a property's history, document by painful document, AI-powered platforms can ingest and analyze huge volumes of data from thousands of public and private sources in minutes. It's not just about doing the same work faster; it’s a complete overhaul of how the work gets done.

The Power Of Automated Data Analysis

Imagine a system that can instantly reconstruct a complex chain of title, flag potential liens or encumbrances with incredible accuracy, and then organize everything into a clean, actionable report. That’s exactly what platforms like TitleTrackr do. The tech uses sophisticated algorithms to read, interpret, and connect bits of information that are scattered across dozens of different databases.

This immediate access to structured data is a true game-changer. An effective title search absolutely depends on the transparency and accessibility of ownership records, and digital aggregation has finally cracked that nut. Commercial platforms now pull together billions of public records—from deeds and mortgages to tax assessments—making a genuinely comprehensive search possible in a fraction of the time. If you want a sense of just how vast this data is, you can discover more insights about land ownership records on gijn.org.

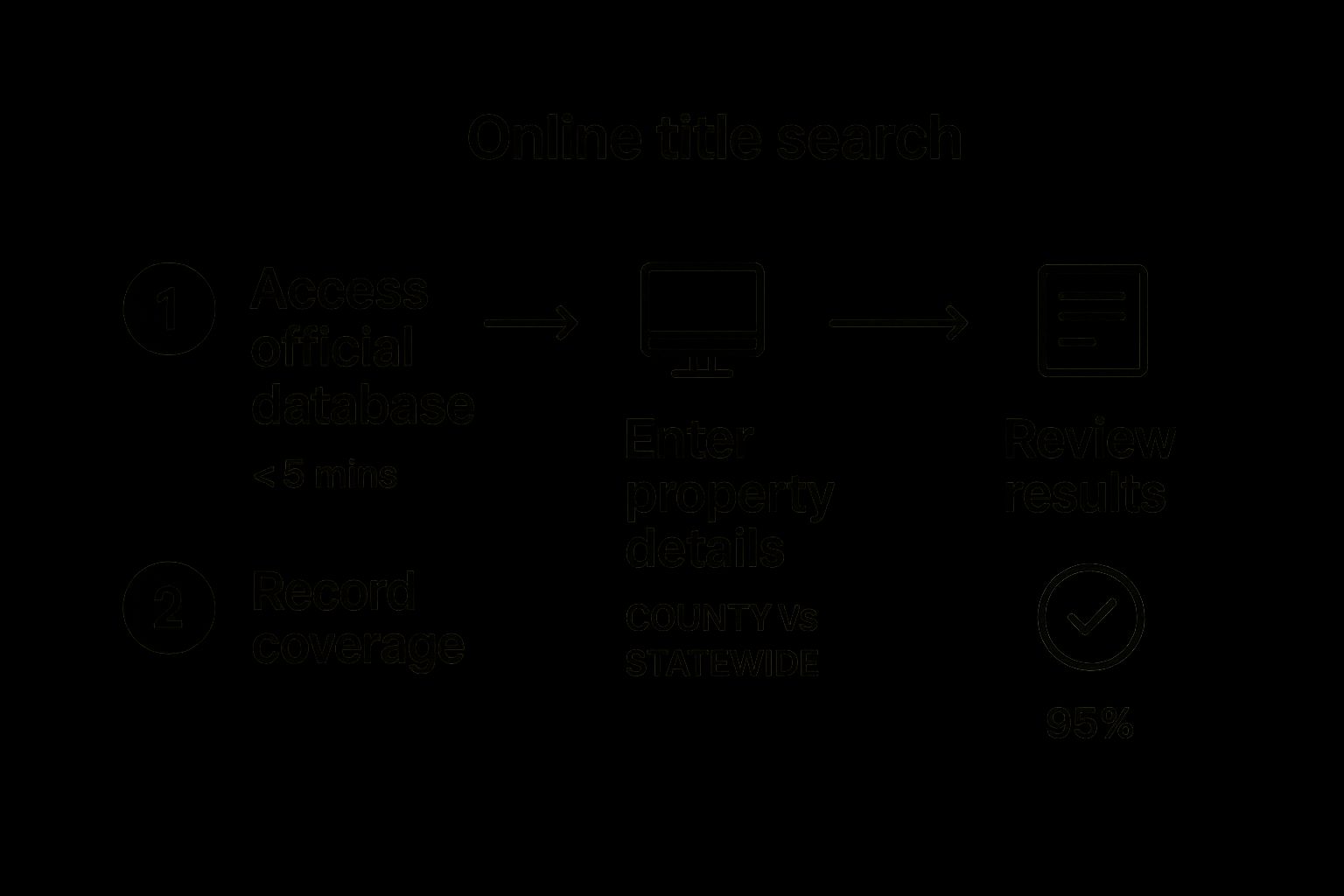

This image really simplifies the process flow and shows the key data points in a modern, automated title search.

As you can see, the right technology condenses what was once a multi-day effort into a task that takes less than five minutes, all while maintaining an exceptional accuracy rate.

To put it into perspective, let's look at a side-by-side comparison.

Manual Effort vs AI Automation

This table breaks down how a traditional title search really stacks up against an AI-powered platform like TitleTrackr. The differences aren't just minor improvements; they represent a fundamental shift in efficiency and reliability.

| Feature | Manual Search | AI Search (TitleTrackr) |

|---|---|---|

| Time to Complete | Hours to days, depending on complexity. | Under 5 minutes for a comprehensive report. |

| Data Sources | Limited to accessible public records, often one at a time. | Aggregates billions of records from thousands of sources. |

| Error Potential | High. Prone to typos, missed details, and fatigue. | Extremely low. Algorithms consistently catch discrepancies. |

| Labor Requirement | Requires a skilled professional for the entire process. | Frees up experts to focus on analysis, not data entry. |

| Scalability | Limited by headcount. More searches require more staff. | Highly scalable. Handle massive volume without adding staff. |

| Cost Per Search | High, driven by hours of skilled labor. | Dramatically lower due to automation and efficiency. |

The takeaway is clear: automation doesn't just make the process faster, it makes it fundamentally better by reducing costs and minimizing the risk of human error.

From Manual Chore To Strategic Advantage

For title agencies, the business benefits of switching from manual searching to AI automation are immediate and hit the bottom line directly.

Here’s what that looks like in the real world:

- Faster Turnaround Times: Closing deals quicker isn't just a nice-to-have. It means happier clients and gives you the capacity to handle more transactions without burning out your team.

- Reduced Operational Costs: When you automate the repetitive data-gathering work, you free up your most experienced people to focus on what they do best: analyzing complex title issues and solving problems.

- Drastically Lower Error Rates: An AI system doesn’t get tired on a Friday afternoon or overlook a small detail in a 100-page document. It consistently catches the kinds of discrepancies a human eye might miss, which seriously reduces the risk of a costly post-closing claim down the road.

By automating the most labor-intensive parts of a title search, agencies can reallocate their most valuable resource—their people—to higher-value work that requires critical thinking and expertise.

This technological leap doesn't just put the old process on steroids; it fundamentally changes what’s possible. It allows for a level of thoroughness and efficiency that was simply unattainable before. For businesses that need to build this into their own workflows, you can explore integration options with the TitleTrackr API for developers.

Ultimately, embracing this shift empowers agencies to deliver better, more reliable results while gaining a serious competitive edge in a crowded market.

Your Essential Title Search Workflow Checklist

A really solid title search isn’t about a single "aha!" moment. It's about a methodical, step-by-step process of verification. To make sure nothing slips through the cracks, your best friend is a consistent workflow.

We've put together a checklist that pulls together the key steps for your next examination. It's designed to be your go-to resource, and it also highlights the exact points where manual work can grind everything to a halt. Think of each step as a non-negotiable checkpoint.

Pre-Search Groundwork

Before you even think about diving into the records, you need to get your initial data straight. This part is all about setting a solid foundation so you aren't chasing ghosts or wasting time on the wrong property.

- Property Identification: Get the full legal description, the physical address, and the parcel identification number (PIN). No shortcuts here.

- Current Owner Verification: You need to confirm the current owner's name exactly as it shows up in the public records.

- Effective Date: Nail down the starting date for your search period. This defines the scope of your entire examination.

Honestly, these first few steps are where tools like TitleTrackr immediately prove their worth. Instead of you having to manually look up these details across different county or municipal websites, it pulls everything together in an instant.

Each item on this checklist represents a point where accuracy is non-negotiable and where hours of manual work can be condensed into minutes with the right technology.

The Core Examination Process

Okay, this is where the real deep dive begins. Following these steps methodically is how you ensure every potential title defect gets uncovered.

- Trace the Chain of Title: You have to work backward from the current owner, carefully documenting every single deed and transfer. Your goal is a perfect, unbroken chain of ownership.

- Scrutinize Every Deed: Don't just skim. Examine each document for proper execution, make sure the legal descriptions are crystal clear, and look for any restrictive covenants or easements that impact the property.

- Search for Financial Encumbrances: Now you're actively hunting for any open mortgages, judgments, and tax liens filed against all previous owners within the statutory period.

- Check for Other Liens: Broaden your search. Are there mechanic's liens? HOA liens? Any other specific claims that could be attached to that property?

As you get into the rhythm of this process, it becomes painfully obvious how much time you spend just cross-referencing names, dates, and legal descriptions over and over again. It’s exactly this kind of repetitive, detail-heavy work where an automated solution can reduce costly human errors and slash your turnaround times.

Still Have Questions About Title Searches?

Even after walking through the process, it's natural for a few more specific questions to pop up. Having the answers ready not only builds confidence but helps you navigate the finer points of the process like a seasoned pro.

Let's dive into some of the most common queries we hear. These questions get into the practical realities of title work, from timelines to the critical difference between the search itself and the insurance that follows.

How Long Does a Typical Property Title Search Take?

This is the classic "it depends" answer, but for good reason. The timeline for a title search can swing wildly based on the property's history.

For a newer home with a clean, straightforward past—maybe only one or two owners—a manual search might only take a few hours or a couple of days. Simple stuff.

But throw in a property with a complicated history, multiple owners over decades, or a tangle of existing liens, and a manual search can easily stretch to a week or more. Every layer of complexity adds time spent digging through dusty records and verifying details. This is where AI-driven tools make a massive impact, often cutting the search and data compilation down to a matter of minutes. That speed lets professionals get straight to the analysis instead of getting bogged down in data retrieval.

What Is the Difference Between a Title Search and Title Insurance?

This is a huge one, and it's a critical distinction to understand.

A title search is the investigation. It's the process of digging through public records to figure out who legally owns a property and to uncover any clouds on the title—liens, judgments, you name it. Think of it as the diagnostic exam for the property's history.

Title insurance, on the other hand, is the protection plan you get after the exam. It's a policy that shields owners and lenders from financial loss if a hidden title defect pops up later on, something the initial search didn't catch. We're talking about nasty surprises like forgeries, unknown heirs, or old filing errors.

A rock-solid title search is the absolute foundation for getting title insurance. The quality of that initial investigation directly shapes the risk assessment for the policy, making it the most important step in any secure transaction.

Can I Perform a Title Search On My Own?

Technically, yes, you can walk into a county recorder's office and start digging through public records yourself. But for an actual transaction? It's a terrible idea.

The process is incredibly complex, and it takes a trained eye to correctly interpret dense legal documents. The risk of missing a crucial piece of information is incredibly high, and the consequences can be financially devastating.

Professionals in the title industry rely on their expertise and specialized tools to guarantee accuracy. For a deeper dive into questions like this, we've put together more answers in our comprehensive guide to frequently asked title search questions. But the bottom line for any consumer is this: always trust an experienced professional to ensure you're getting a clear title.

Ready to see how AI can shrink your title search workflow from days into minutes? The team at TitleTrackr can show you how to ditch manual data entry, slash errors, and scale your operations. Request a personalized demo today and discover a faster, more accurate way to work.