When comparing "surface rights vs. mineral rights," the core difference seems straightforward. One governs the top layer of the land you can see and walk on, and the other controls the valuable resources buried beneath it. But for title professionals, abstractors, and landmen, the complexity of how these rights interact is where the real risk lies. Surface rights give an owner control over the ground itself and any buildings on it. In contrast, mineral rights grant ownership of underground resources like oil, gas, and coal, creating two entirely separate, and often conflicting, assets from a single piece of property.

Understanding this division is not just academic—it's essential for preventing title defects that can derail multi-million dollar energy projects and real estate developments.

Understanding the Split Estate

Most people assume that owning a piece of land means they own everything from the grass to the earth's core. But in property law, that's often not the case. Ownership can be split into two distinct layers, creating what’s known as a split estate or severed estate. This is where the whole surface rights vs. mineral rights discussion becomes absolutely critical for any title professional.

This separation means one person can be farming or building a house on a property, while a completely different person or company owns the right to pull oil from 20,000 feet beneath their feet. This concept is foundational in any area rich with natural resources, and it injects a ton of complexity—and potential liability—into title examinations.

Key Definitions for Title Professionals

To untangle these transactions, you have to be crystal clear on what each right entails. This distinction hits everything—property value, land use, and the potential for messy legal fights down the road.

- Surface Rights: This gives the owner the right to live on, use, and develop the surface of the land. It covers building a home, farming the soil, or even leasing the land for a solar farm. Water rights are usually part of this bundle, too.

- Mineral Rights: This grants the owner the right to explore, drill, and produce whatever minerals lie below the surface. This owner can sell or lease these rights, often collecting royalty checks from production without ever stepping foot on the property.

At its core, the split estate creates a layered ownership structure. You have two different parties whose rights are tied to the same geographic spot but at different depths. For title professionals, managing this requires an almost obsessive level of detail in your record-keeping and a deep dive into the property's title history to avoid costly errors.

Comparing the Two Estates

The table below breaks down the fundamental differences between these two types of property ownership. These distinctions are what create such complex headaches for the title abstractors and searchers tasked with delivering a clean title.

| Aspect | Surface Rights | Mineral Rights |

|---|---|---|

| Domain of Control | The land's surface, structures, and air | Subsurface resources like oil, gas, and coal |

| Primary Use | Agriculture, construction, and habitation | Exploration, extraction, and production |

| Legal Status | Considered the "servient estate" | Considered the "dominant estate" |

| Source of Value | Land use, development, and rental income | Royalties, lease bonuses, and sale of assets |

The Dominance of the Mineral Estate

When a property’s ownership is split between the surface and the minerals beneath, it’s not a partnership of equals. In nearly every jurisdiction, there’s a clear legal hierarchy that dictates how the land can be used, and it places the mineral estate firmly in the dominant position.

This setup grants the mineral estate legal precedence over the surface.

This legal framework isn't an accident; it was designed to encourage the development of natural resources. The thinking was that valuable minerals shouldn't be trapped underground just because a surface owner objects. This gives mineral rights holders the implied right to use the surface as is reasonably necessary to explore, drill, and produce whatever they own below.

In the United States, this "split estate" concept is a massive legal and economic reality. Federal data shows a staggering 57.2 million acres where the mineral rights are publicly owned while the surface is in private hands, a common scenario in western states. The principle of the dominant estate means mineral owners can access and use that private surface to get to their assets, often without the surface owner's express consent. You can get a much deeper look at this legal structure and its real-world impact in this detailed overview on mineral vs surface rights.

What Reasonable Use Actually Means

The term "reasonable use" is where the legal theory hits the dirt—and often, where the conflicts start. It isn't a blank check for the mineral owner to do whatever they want. It’s a standard that permits activities truly essential for extraction.

For a title professional, knowing what falls under this umbrella is critical for advising clients. Reasonable use typically covers things like:

- Building Access Roads: Cutting gravel or dirt roads to get heavy equipment to and from a well site.

- Clearing Drill Sites: Leveling a patch of land to set up drilling rigs, storage tanks, and other machinery.

- Installing Infrastructure: Laying pipelines to move oil or gas and running utility lines to power it all.

- Using On-site Water: In some jurisdictions, this can even include using available surface or groundwater for drilling operations.

The core takeaway for any title search is that a severed mineral interest is more than just a line in a deed; it's a potential encumbrance that can dramatically alter the surface owner's plans for their property, from farming to commercial development. Identifying it is non-negotiable.

The Accommodation Doctrine: A Balancing Act

Now, to keep the dominant estate from completely steamrolling the surface owner, courts developed a counter-principle: the accommodation doctrine. Think of it as a crucial check on the mineral owner's power.

This doctrine requires mineral owners to accommodate existing surface uses whenever they can, as long as a reasonable alternative for extraction exists that isn't excessively expensive. For instance, if an oil company can place a well pad in a location that avoids a farmer’s irrigation system without hurting production, they may be legally required to do it. It forces a negotiation and tries to balance both parties' interests, even if the mineral estate still holds the upper hand.

Comparing Owner Privileges and Limitations

When a property has a split estate, you’re looking at a complex web of overlapping—and often competing—interests. Getting into the granular details of who can do what is absolutely essential for any title professional. A clear comparison of surface rights vs. mineral rights reveals exactly where the flashpoints are most likely to occur and, more importantly, how to manage them.

On the surface (pun intended), it seems straightforward. The surface owner controls the land’s use for things like agriculture, construction, and living. The mineral owner, on the other hand, holds the keys to whatever lies beneath. But in practice, their domains are in constant interaction.

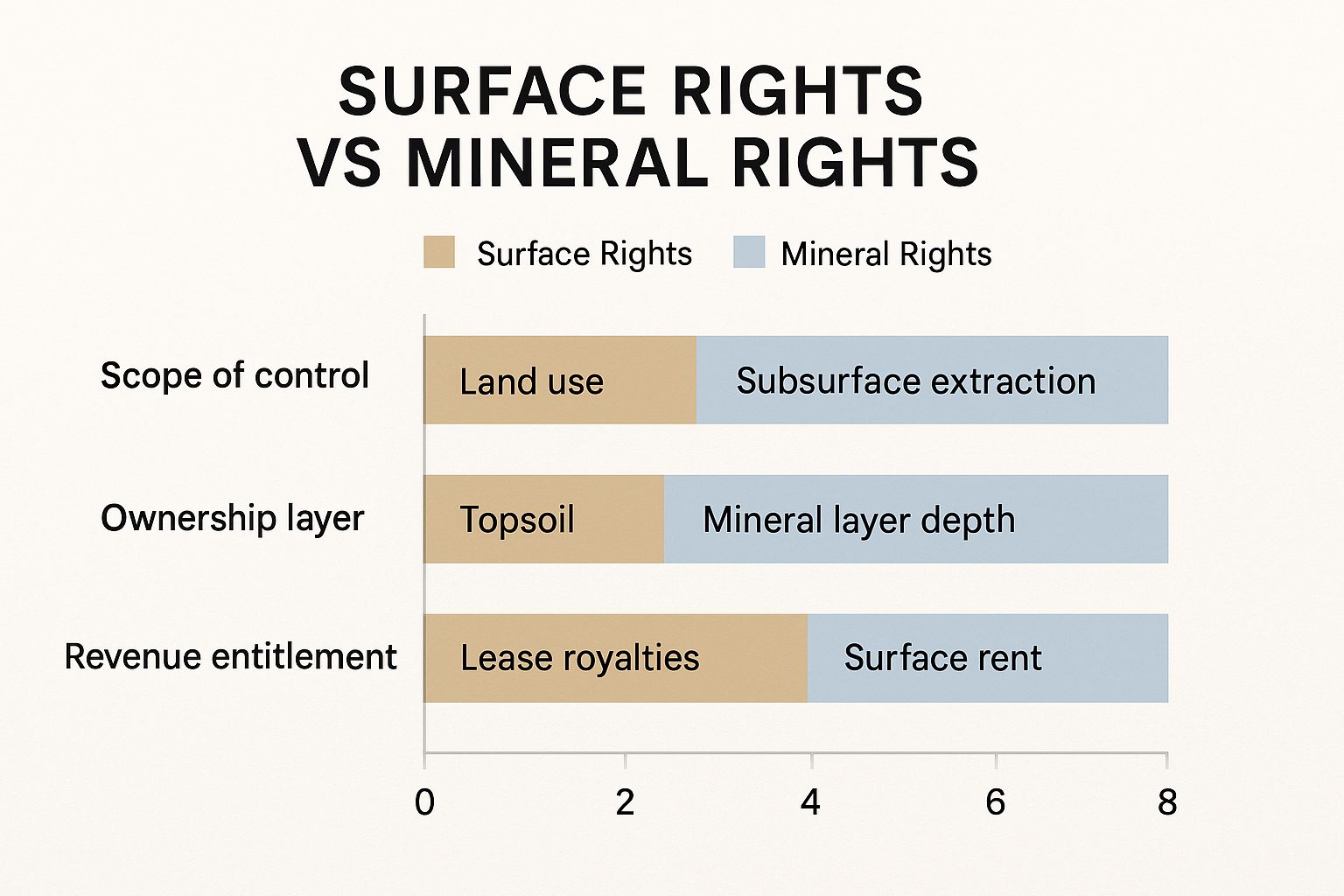

This visual breaks down the fundamental differences in control, ownership layers, and revenue streams between the two estates.

As you can see, while both owners pull value from the same plot of land, their rights are focused on entirely different physical and economic layers. This is precisely what sets the stage for potential conflict.

Specific Areas of Conflict and Control

The dominance of the mineral estate grants significant power, but that power isn't absolute. Let’s dig into how these rights collide in a few common, real-world scenarios.

A surface owner has the right to build homes, commercial buildings, or even install a field of solar panels. But a mineral owner can completely disrupt those plans by exercising their right to drill a well, build access roads, or lay pipelines. Just imagine a developer planning a new subdivision, only to find their proposed cul-de-sac is the perfect spot for a new drilling pad.

Water usage is another frequent battleground. A surface owner relies on groundwater for crops or residential use. At the same time, many extraction processes, like hydraulic fracturing, require enormous volumes of water. The mineral owner often has the right to use that water, which can lead to nasty disputes over depleted aquifers and water quality.

To give a clearer picture, this table breaks down how the rights of each party play out in different situations.

Comparison of Surface Rights vs Mineral Rights Privileges

| Area of Use | Surface Rights Holder's Privileges | Mineral Rights Holder's Privileges | Common Point of Conflict |

|---|---|---|---|

| Construction | Build homes, barns, commercial structures, solar farms, and other improvements. | Construct well pads, access roads, pipelines, and storage facilities reasonably necessary for extraction. | Mineral infrastructure interfering with planned surface development or existing structures. |

| Agriculture | Cultivate crops, raise livestock, and manage timber. | Use the surface area needed for drilling and operations, which may damage crops or require clearing timber. | Compensation for crop damage; placement of oil and gas equipment on prime farmland. |

| Water | Use groundwater and surface water for domestic, livestock, and irrigation purposes. | Use a reasonable amount of surface or groundwater for drilling and extraction operations (e.g., fracking). | Depletion of the water table or contamination, impacting the surface owner's supply. |

| Access | Control entry to the property for residential or commercial purposes. | The right to enter and cross the property to access mineral deposits. This is a right of ingress and egress. | Location and maintenance of access roads; traffic from heavy machinery disrupting the surface owner's peace. |

The most intense conflicts flare up when one owner's planned use makes the other's completely impossible.

A massive solar farm, for example, requires exclusive, long-term use of the surface. This directly clashes with a mineral lessee's right to place infrastructure anywhere that's reasonably necessary for their operations.

Forging a Path Forward

To keep these conflicts from blowing up into expensive litigation, Surface Use Agreements (SUAs) are absolutely crucial. These legal contracts act as a roadmap for coexistence, spelling out the specific terms of surface access and use. For title professionals and the oil and gas landmen who hammer out these deals, a well-drafted SUA is the single best tool for mitigating risk.

An effective SUA will almost always address:

- Location of Operations: It specifies exactly where wells, roads, and pipelines can be placed to minimize interference with what's happening on the surface.

- Compensation for Damages: The agreement clearly outlines payments to the surface owner for things like crop damage, timber removal, or general disruption.

- Land Reclamation: It establishes the mineral owner's responsibility to restore the land to its original condition once the work is done.

Ultimately, navigating the privileges and limitations of each estate comes down to deep title research and proactive negotiation. By identifying potential conflicts in the deed history and understanding the power of a strong Surface Use Agreement, you can protect your clients from future headaches and ensure all parties can exercise their rights without stepping on each other's toes.

How Technology Is Reshaping Property Rights

The classic tug-of-war between surface and mineral rights is getting a lot more complicated, and technology is the reason why. New extraction methods and the explosion of renewable energy are adding fresh layers of complexity for everyone involved—landowners, mineral owners, and the title professionals trying to make sense of it all. These changes are fundamentally altering how the two estates interact and what "reasonable use" of a property even means anymore.

Drilling innovations are a huge part of this story. Things like horizontal drilling and hydraulic fracturing let energy companies tap into massive underground reserves from a much smaller surface footprint. A single drilling pad can now spiderweb for miles in every direction underground. On paper, this seems like a win for the surface owner, who sees less disruption.

But it’s not that simple. While the well site on the surface might be small, the subsurface activity is immense. This brings up thorny new questions about underground easements, the potential for subsidence, and what the long-term impact on geological formations might be.

The Rise of Solar and Surface Exclusivity

At the same time, we're seeing an explosive growth of utility-scale solar farms, which has thrown a completely different wrench into the works. An oil well might take up a few acres, but a solar project needs exclusive, long-term control over hundreds or even thousands of acres of surface land. This creates a direct collision course with the dominant mineral estate's right to access that same surface.

You can't have a mineral owner deciding to drill a well right in the middle of a multi-million dollar solar panel array. This has forced a whole new kind of negotiation. Solar companies now have to get waivers or other agreements from mineral rights holders, often paying them to give up their right to access the surface, either temporarily or forever.

This evolving landscape means title professionals are no longer just looking at historical deeds. They must now anticipate future land use conflicts driven by energy technologies that didn't exist when the original mineral reservations were made. This is where modern title tools become a competitive advantage.

Navigating the New Title Challenges

There’s no doubt these technological advances have unlocked enormous value. Better drilling techniques mean more recoverable resources, which translates to higher royalties for mineral owners. But as one analysis highlights, this also leads to more surface intrusion. The growth of solar farms just adds another layer, forcing developers to pay for land use waivers from those same mineral owners. You can get a much deeper look into these issues and learn how solar and mineral rights intersect.

For title professionals, these modern energy projects present a unique minefield:

- Subsurface Easements: How do you trace and verify complex horizontal drilling paths that cross multiple properties far below the surface?

- Solar Waivers: Are the agreements with mineral owners legally sound and properly recorded? The entire solar investment depends on it.

- Stacked Royalties: Who gets paid when multiple horizontal wells crisscross various mineral tracts deep underground?

These aren't your grandfather's title problems. They demand more than just a standard title examination; they require a forward-looking approach to risk. Figuring out how a new solar lease will be affected by a pre-existing oil and gas lease is now a critical part of due diligence. It makes having precise, comprehensive title data more vital than ever before.

Mitigating Risk in Title Examination

For title professionals, navigating a split estate isn’t some abstract legal theory. It's a high-stakes exercise in risk mitigation. The distinction between surface rights and mineral rights isn't just an academic detail; it’s a critical factor that can cloud a title, bring a transaction to a grinding halt, and expose everyone involved to serious financial and legal trouble.

One of the most severe risks in the entire process is an incomplete mineral title search. Failing to identify a severed mineral interest is like building a house on a shaky foundation—it’s only a matter of time before cracks start to show. A surface title that looks crystal clear can easily hide a tangled web of mineral ownership, empowering a third party to come in and disrupt the surface owner's use of their own land.

Uncovering Ambiguity in Historical Documents

The challenge gets a lot tougher when you’re dealing with historical deeds. Ambiguous phrasing from decades ago is a common culprit behind modern-day title clouds and messy legal battles.

Take a deed from the 1920s, for example, that reserves “all oil, gas, and other minerals.” That simple clause immediately opens a can of worms:

- Does "other minerals" include things we value today, like lithium or gravel, which weren't on anyone's radar back then?

- What happens if a later deed in the chain completely fails to mention this reservation, creating a gap in the title history?

Vague language like this can easily lead to conflicting interpretations generations later, especially when the economic stakes get high. Mineral rights values are often tied directly to global commodity prices, which can trigger a frenzy of extraction activity. The US shale boom, for instance, was driven by fluctuating oil prices and turned once-ignored mineral rights into incredibly valuable assets. You can discover more about how commodity prices impact mineral rights to see how quickly things can change.

A thorough title examination means looking way beyond the most recent conveyance. It demands a meticulous trace of every single reservation, exception, and transfer in the property’s history to make sure no mineral interest has been overlooked or misinterpreted. This is a process ripe for technological innovation.

How TitleTrackr Provides a Solution

This is exactly where modern tools become indispensable. Manually tracing complex ownership chains through dense, aging documents isn't just painfully slow; it’s also wide open to human error. TitleTrackr directly tackles these pain points, using AI to bring clarity and precision to the title examination process.

The platform’s advanced tools were built to analyze legal documents with incredible speed and accuracy. It can instantly spot and flag the critical clauses that reserve or convey mineral interests, no matter how deep they’re buried in the title history.

By automating the most tedious parts of the search, TitleTrackr empowers professionals to:

- Trace complex ownership chains with much greater confidence and efficiency.

- Flag severed mineral rights and ambiguous deed language in an instant.

- Reduce the inherent risks that come with split estates.

This streamlines the entire title examination workflow, offering solid protection for every party in a transaction. By replacing manual guesswork with data-driven certainty, TitleTrackr ensures that no mineral right goes undiscovered.

Frequently Asked Questions

When you're dealing with the tangled web of surface vs. mineral rights, a lot of questions come up for everyone involved—from title pros and developers to the landowners themselves. Getting the right answers is non-negotiable if you want to sidestep expensive legal battles and make sure every deal is on solid ground. Here are some of the most common questions we hear.

Can I Sell My Mineral Rights But Keep My Land?

You absolutely can. This is the classic definition of a split estate. A landowner has every right to sell or lease the mineral rights beneath their property to someone else while holding onto complete ownership of the surface. It's a common move, especially in areas rich with natural resources, that lets property owners cash in on their mineral assets without having to sell the farm.

What Happens if a Mineral Owner Damages My Property?

While mineral owners have the right to reasonable use of the surface to get to their minerals, it's not a free pass for negligence or causing excessive damage. In most states, and typically outlined in a Surface Use Agreement (SUA), the mineral owner is on the hook to compensate the surface owner for any damage to crops, structures, or livestock. Once they're done, they're usually required to restore the land back to the way they found it.

A critical piece of advice for surface owners: document the condition of your land before any operations start. Photos and videos create a clear baseline, making it much easier to prove the extent of any damage and secure fair compensation.

How Do I Find Out if I Own Mineral Rights?

Figuring this out takes more than your standard title search. You'll need a deep dive into the property's chain of title, often going all the way back to the original government patent. The goal is to find out if the mineral rights were ever severed or reserved in a past transaction. This means digging through old deeds, probate records, and other historical documents.

It’s complex, detailed work that is perfectly suited for AI-powered platforms that can scan and analyze historical documents in a fraction of the time it would take a human. For a closer look at specific situations, you can find a ton of helpful information by exploring our comprehensive FAQ page.

Does Owning Mineral Rights Mean I Can Block Surface Development?

Not in a direct, "veto power" kind of way. Even though the mineral estate is legally dominant, a mineral owner can't just arbitrarily shut down a surface owner's plans. That said, their right to access the minerals can throw a major wrench in the works. If a developer wants to build a subdivision right on top of a prime drilling spot, the mineral owner can exercise their right to use that surface—effectively halting the project unless the two parties can negotiate an accommodation or a waiver.

Managing the fine print of severed estates requires absolute precision. TitleTrackr gives title professionals the advanced AI tools needed to trace these complicated ownership chains, spot critical language in deeds, and reduce the risks that come with every surface vs. mineral rights examination. Let us show you how our platform can bring clarity to your most challenging files.