A title company is the neutral third party that orchestrates a secure, legal, and clean property transfer. Acting as a fiduciary agent, they verify ownership, manage the flow of funds, and ultimately protect all parties from latent legal and financial risks.

Think of them as the architects of transactional integrity.

Why Title Companies Are Your Transaction's Guardian

In what is often a client's largest financial transaction, a title company serves as a neutral guardian. They are part historian, part detective, and part security guard, all rolled into one professional service. Their primary function is to ensure the property title is free and clear of any claims, liens, or legal encumbrances that could jeopardize the transaction or create future liabilities for the new owner.

This isn’t just a "nice to have" service—it's the bedrock of a secure closing. Without a title company, every party involved would be exposed to significant financial and legal risk.

Imagine a client buying their dream home, only to discover months later that a previous owner's unpaid contractor has placed a lien on their new property. Or worse, a previously unknown heir emerges with a valid legal claim to the house. These are not just theoretical risks; they are real-world scenarios that transform a client's dream investment into a legal and financial nightmare. This is the value your title company brings to the table.

The Detective Work of Title Services

A title company’s first critical task is performing a comprehensive title examination. This isn't a mere database query; it's a meticulous investigation into decades of public records, untangling a property's complete legal history. This process mirrors the detailed research landmen who work in the oil and gas industry undertake to trace mineral rights through complex chains of ownership.

This investigation is designed to uncover and resolve issues before they can impact the new owner. Their operational checklist includes:

- Verifying the Seller's Right to Convey: First, they confirm the current seller is the legitimate owner with full legal authority to transfer the property.

- Identifying Liens and Encumbrances: They search for outstanding mortgages, judgments from lawsuits, or unpaid tax liens attached to the property that must be satisfied at closing.

- Discovering Easements and Restrictions: They identify any "rights of way" or restrictive covenants that might limit the property's use—such as a utility company’s right to access power lines.

To provide a clearer picture, here’s a breakdown of their main responsibilities.

Core Functions of a Title Company

This table summarizes the essential roles a title company plays in every real estate transaction.

| Function | Purpose | Key Beneficiary |

|---|---|---|

| Title Search | To investigate public records and verify the seller's legal ownership, uncovering any claims, liens, or issues. | Buyer & Lender |

| Escrow Services | To securely hold and manage all funds (down payment, closing costs) until all contract conditions are met. | Buyer & Seller |

| Title Insurance | To issue policies that protect the new owner and lender against future claims or undiscovered title defects. | Buyer & Lender |

| Closing & Settlement | To coordinate the final signing of documents, disburse funds correctly, and officially record the new deed. | All Parties |

Essentially, the title company's role is to manage the intricate details, ensuring every legal and financial requirement is met with precision.

The Security Guard for Your Funds

Beyond the historical research, the title company also acts as the secure depository for all funds involved in the transaction. This is known as an escrow service. They hold the buyer’s funds—including the earnest money deposit and closing costs—in a protected, neutral account.

The title company ensures that no money changes hands until every single condition in the sales contract has been met. This protects the buyer from losing their money and the seller from handing over the deed without getting paid.

Once all documents are executed and contractual obligations are fulfilled, the title company disburses all funds. They pay off the seller's existing mortgage, cover the real estate agents' commissions, and settle any other outstanding costs. This meticulous process guarantees a clean financial slate and a smooth, secure closing for all stakeholders.

The Protective Shield of Core Title Services

A title company acts as the guardian of a real estate transaction, but where does its power come from? It’s all in a specific set of core title company services. Together, these functions build a protective shield around what is likely the biggest financial investment of your life.

Their job is to systematically dismantle risks, untangle ownership questions, and make sure the property you’re buying is legally yours—with no nasty, expensive surprises lurking in the background. It's one part meticulous background check, one part high-stakes insurance policy. Each service tackles a different potential threat, from decades-old claims to future legal battles. This is how a complex property transfer becomes a secure, final deal.

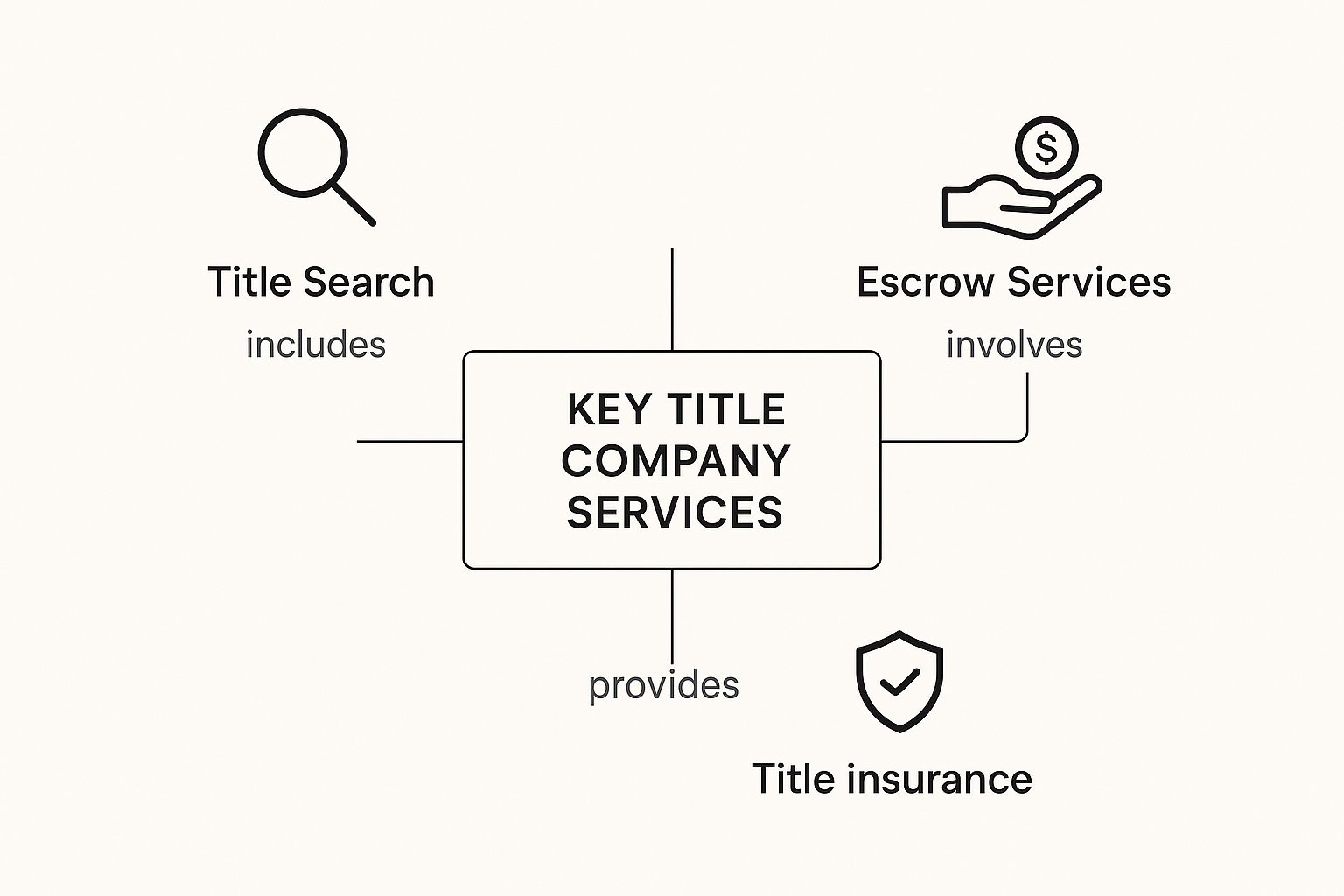

The infographic below shows how the main services—the title search, escrow, and title insurance—all work together as part of this protective system.

While each service is distinct, you can see how they all connect back to the central mission: securing the real estate deal.

The Title Search: Uncovering the Property's Past

The first, and arguably most critical, service is the title search. This is where the title company puts on its detective hat. They meticulously comb through decades of public records tied to the property, aiming to build a complete chain of title—an unbroken timeline of who has owned the property—and spot any red flags.

What kind of "red flags," or title defects, are they looking for? Plenty.

- Unpaid Property Taxes or HOA Dues: Lingering debts from past owners can quickly become your problem if they aren't caught and settled.

- Contractor Liens: If a previous owner never paid for that new kitchen, the contractor could have a legal claim (a lien) on the property for the money they're owed.

- Unknown Heirs: It sounds like a movie plot, but a surprise heir from a long-lost relative could suddenly appear with a legitimate claim to the property.

- Boundary Disputes: An old survey error might mean that fence you love is actually on your neighbor's land, setting the stage for a major dispute.

Once the search is complete, the findings are compiled into a document called a title commitment. Think of this as a roadmap. It lists every issue that must be cleared and all requirements that must be met before the title can be insured and officially transferred.

Title Insurance: The Ultimate Safety Net

After the title search identifies and helps clear all known issues, title insurance steps in to protect against the unknown. It’s a one-time premium for a policy that defends ownership rights for as long as the insured party or their heirs own the property.

Here's the key distinction for industry professionals: a title search can only uncover matters of public record. Title insurance protects against hidden risks like forgery, fraud, or filing errors that even the most exhaustive search would never reveal.

You'll typically encounter two types of policies in every transaction:

Lender's Title Insurance: A mortgage lender will almost always require this. It protects their financial investment in the property, but only up to the loan amount.

Owner's Title Insurance: This policy is for the buyer. It protects their equity and ownership rights for the full purchase price of the home.

The sheer market size illustrates how essential this protection is. In 2024, the global title insurance market was valued at approximately USD 67.42 billion, with projections to reach USD 133.97 billion by 2033. This growth underscores its indispensable role in securing real estate transactions. For a deeper analysis, you can explore more data on the global title insurance market. It is the final, non-negotiable layer of security in any transaction.

Guiding Your Closing with Secure Escrow Services

If the title search is the detective work, then escrow is the secure control room where the transaction is finalized. This crucial title company service is the operational backbone of the closing process, ensuring the final steps are executed with precision, fairness, and security for all parties.

At the center of it all is the escrow officer, a licensed, neutral third party. Their role is to hold all critical assets—the buyer's funds, the seller's deed, and other legal documents—in a secure escrow account. They act as the impartial referee, ensuring the terms of the purchase agreement are strictly followed.

This structure mitigates a tremendous amount of risk. The buyer's funds are protected and are not released until every condition in the purchase agreement has been met. Simultaneously, the seller can be confident they will not relinquish the deed until payment is fully secured and ready for disbursement.

Orchestrating the Final Steps

The escrow officer manages a detailed closing checklist to guide the transaction to a smooth finish. This meticulous process prevents disputes and guarantees ownership is transferred exactly as specified in the contract.

Here's a look at the process in practice:

- Preparing the Settlement Statement: This document, typically the ALTA Settlement Statement or Closing Disclosure, provides a detailed, itemized ledger of every fee and credit for both buyer and seller. It's the transaction's final financial scorecard.

- Coordinating the Final Signing: The escrow officer schedules the closing, ensures all necessary documents are present and correctly prepared, and facilitates the signing process.

- Disbursing All Funds: Once all documents are signed and conditions are met, the escrow officer executes the financial settlement. This includes paying off the seller's existing mortgage, agent commissions, and any other third-party fees.

This careful orchestration is what defines a successful closing. It prevents last-minute chaos and ensures every legal and financial detail is handled correctly.

The Modern Closing Experience

While the escrow officer’s role is as vital as ever, technology is revolutionizing its efficiency. Title companies now handle the essential services of researching records, preparing documents, and filing paperwork with much greater speed. As more firms adopt digital platforms and e-closing technologies, the industry is enhancing the customer experience. You can explore how the title market is poised for growth to learn more about this trend.

By acting as a secure intermediary, the escrow service guarantees that the property transfer is smooth, legal, and free from last-minute conflicts. It transforms a complex exchange into a clear, step-by-step procedure.

Ultimately, the escrow service is the final piece of the protective puzzle offered by title companies. It provides the structure and security needed to finalize one of life's biggest financial transactions, giving both buyers and sellers the confidence to sign on the dotted line. This careful management ensures that when the keys are finally handed over, the transfer of ownership is legitimate, complete, and undisputed.

Clearing The Path When Title Problems Arise

Discovering a problem during the title search doesn't automatically kill the deal. In fact, this is where a good title company really earns its keep. They switch gears from property detective to expert problem-solver, stepping in to "cure" any defects before they have a chance to derail the closing. This whole process is designed to protect the new owner from legal and financial headaches down the road.

Finding a cloud on the title is more common than you might think. The issues can be as simple as a clerical error in the public records or something more tangled, like a contractor’s lien from a previous owner's unpaid renovation project. Another frequent snag is an old mortgage that was paid off but never properly discharged from the record.

If left unresolved, these defects could transfer to the new owner, creating a legal and financial nightmare. The title company’s job is to methodically clear these issues, ensuring the path to ownership is secure.

How Title Companies Resolve Common Issues

The resolution depends on the specific problem, but the approach always involves meticulous research, clear communication, and legal know-how. Title professionals, often working with skilled researchers, track down the source of each issue and take corrective action. The detailed work performed by these title abstractors and their role in the process is complex, but it’s what makes a clean transfer possible.

Here’s a look at how they tackle some of the usual suspects:

- Unpaid Liens: If a contractor’s lien or an unpaid tax bill is discovered, the title company ensures these debts are satisfied from the seller’s proceeds at closing. They coordinate with the lienholder to obtain a formal release, which is then recorded to officially clear the title.

- Clerical Errors: A simple misspelling of a name or an incorrect property description in a past deed can cause significant problems. The title company works to file corrective documents, such as a quitclaim deed or a scrivener's affidavit, to rectify the public record.

- Boundary Disputes: If a survey reveals a neighbor's fence encroaches on the property, the title company facilitates a resolution. This might involve negotiating a formal boundary line agreement between the owners to legally settle the dispute before the sale proceeds.

This proactive problem-solving is a cornerstone of title company services. They don't just find risks; they actively neutralize them. Their goal is to ensure the buyer receives a clean, marketable title, free from the ghosts of the property's past.

Ultimately, by managing these resolutions, the title company provides incredible value. They turn a potentially deal-breaking discovery into a manageable task, clearing the way for a secure and successful closing. All this careful work confirms that when you finally get the keys, your ownership is undisputed and fully protected.

How Modern Technology Is Upgrading Title Services

The traditional closing process has long been a source of frustration for industry professionals. For decades, it was a fragmented workflow of phone calls, disjointed email chains, and mountains of paper. This lack of a centralized system made the final steps of a real estate transaction frustratingly slow and opaque, often leaving agents, lenders, and clients in the dark.

This old-school approach to title company services created unnecessary delays, operational inefficiencies, and stress for everyone involved.

Thankfully, a technological shift is underway. The industry is rapidly moving away from these manual, siloed workflows. In their place are integrated digital platforms that deliver much-needed speed, transparency, and efficiency. This evolution isn't just about convenience; it's about solving the core operational challenges that have plagued real estate closings for years.

The New Standard of Digital Closings

Modern title service platforms consolidate the entire closing process into a single, secure digital hub. This eliminates the need to chase down updates or hunt for documents. All stakeholders in the transaction can access real-time information with a few clicks—a level of transparency that was previously impossible.

These digital solutions automate many of the most time-consuming tasks:

- Centralized Communication: All messages and updates are logged in one place, ending confusing back-and-forth email threads.

- Real-Time Status Updates: Every party can track progress 24/7, from the initial title search all the way to final recording.

- Automated Document Handling: Documents are securely uploaded, shared, and managed digitally, reducing errors and the risk of lost paperwork.

This shift to a digital-first approach means closings are no longer a black box. Technology brings order and predictability to what was once a chaotic process, giving everyone the confidence that the deal is moving forward smoothly and securely.

Platforms like TitleTrackr, for instance, are purpose-built to create a unified and intelligent workflow from start to finish.

This screenshot from the TitleTrackr platform shows how critical data is extracted and organized into a clean, actionable interface.

What you're seeing is the power of turning dense, unstructured legal documents into structured, actionable data. It dramatically accelerates research, reporting, and decision-making for title professionals.

By leveraging tools that automate document analysis and streamline communication, title companies can deliver faster, more accurate services. This doesn't just make life easier for agents and lenders; it gives buyers and sellers the modern, seamless experience they expect. The future of title services is here—and it’s faster, smarter, and more transparent than ever.

Ready to see how this efficiency can transform your closings? Request a demo with TitleTrackr and experience the new standard firsthand.

Common Questions About Title Company Services

As we've walked through what a title company does—from digging through records to securing the closing—it's totally normal for a few questions to pop up. Getting a handle on title company services is one of the best ways to make sure your closing is a smooth one. Let’s clear up a few of the most common questions we hear from real estate pros and their clients.

Why Do I Need Title Insurance If a Title Search Was Done?

This is an excellent question that highlights the core value of comprehensive risk management. A title search is an examination of a property's recorded history, designed to uncover known issues like liens or ownership disputes.

But what about risks that cannot be found in public records? These "hidden defects" pose the greatest threat. We’re talking about issues like a forged signature on a prior deed, an undisclosed heir with a valid claim, or a clerical error made at the courthouse years ago.

That is where owner's title insurance becomes essential. It is a one-time safeguard against these undiscoverable threats. It protects the owner's investment from future claims for as long as they or their heirs own the property, ensuring their asset is secure.

Who Typically Chooses the Title Company?

While local customs can vary, the buyer generally has the right to choose the title company. This is primarily because they are purchasing the title insurance policies for both themselves and their lender.

In practice, however, the choice is often a collaborative decision. Real estate agents representing both the buyer and seller typically maintain relationships with trusted title companies known for their reliability and service. Ultimately, the focus should be on selecting a reputable, professional firm that can execute a smooth and secure closing.

The core services that title companies provide are surprisingly complex and have a long history. A comprehensive analysis of the industry shows these services—including title searching, document preparation, and conducting closings—are critical in real estate markets globally. This sector spans four major global regions, encompassing 195 countries. You can discover more insights about the global title services sector and its history.

How Long Does the Title Process Usually Take?

A typical title process, from opening an order to being "clear to close," generally takes anywhere from a few days to about two weeks. The timeline depends heavily on the complexity of the property's history and the efficiency of the local county recording offices.

However, if the search uncovers a "title defect" that requires curative action, the timeline can be extended significantly. This is precisely where modern technology delivers a competitive advantage. Platforms that automate the search and centralize communication can dramatically reduce turnaround times, getting all parties to the closing table faster.

If you have more questions about the process, you can find additional answers in our comprehensive FAQ section.

The right technology doesn't just make things faster—it adds a layer of clarity and security to every transaction. TitleTrackr uses AI-driven tools to automate manual tasks, centralize communication, and deliver accurate reports in seconds, empowering you to close deals with confidence.

See how it works and request your personalized demo with TitleTrackr today!