When buying or selling a home, the closing is the final hurdle. The title company is the unsung hero that gets you across the finish line. As a neutral party in the transaction, their job is to ensure the property title is free and clear of any legal baggage.

Choosing the right title company for closing isn’t just another item on a to-do list. It’s a critical decision that safeguards the entire investment. For title professionals, delivering a seamless closing experience is the key to building a strong reputation and growing their business.

Your Partner for a Smooth Real Estate Closing

Getting a real estate deal to closing can feel like conducting an orchestra. You have buyers, sellers, agents, and lenders all playing their parts, and someone needs to make sure it all comes together. The title company is that conductor, ensuring every step happens in sync and on schedule.

Their most critical job is to confirm that the property's title—the legal right of ownership—is clean. Without that guarantee, a new owner could find themselves inheriting someone else's unpaid debts, long-lost heir claims, or other nasty legal surprises tied to the property.

Why This Partnership Matters

A great title company does way more than just push paper. They build a foundation of security for what is likely the biggest purchase of a client's life. This guide will walk through their key responsibilities, from digging deep into property records to managing the final exchange of funds and keys.

You’ll see how picking the right partner—and equipping them with the right tools—turns a notoriously stressful process into a smooth, secure experience. Their key jobs include:

- Verifying Ownership: They conduct a detailed search of public records to make sure the seller has the legal authority to sell the property.

- Identifying Encumbrances: They act as detectives, uncovering any hidden liens, unpaid property taxes, or other claims that could cloud the new owner's rights.

- Managing Escrow: They serve as a secure middleman, holding onto all funds and documents in a protected account until every condition of the sale is met.

- Issuing Title Insurance: This is the client's safety net. They provide a policy that protects the buyer and their lender from any future claims that may arise from the property's past.

A great title company acts as the guardian of the transaction, protecting all parties by ensuring the property's legal history is clean before the keys change hands.

Ultimately, choosing a solid title company is all about managing risk and providing much-needed peace of mind. As technology continues to improve the industry, modern tools are making this whole process more transparent and efficient than ever. To see how specialized software helps professionals deliver a superior closing experience, you can explore platforms designed to optimize these critical workflows and request a demo with TitleTrackr.

What a Title Company Actually Does for You

Behind every real estate closing that goes off without a hitch, there's a title company working hard behind the scenes. Think of them as part financial detective, part neutral referee. They orchestrate a seriously complex process to make sure the property ownership can be transferred cleanly and legally. Their work is the very foundation of the deal.

Long before anyone sits down at the closing table, their process is already in motion. The first, and arguably most critical, step is the title search. This is a deep, exhaustive dive into the property's entire history.

Uncovering the Property's Past

During the search, professionals meticulously comb through decades of public records. They’re hunting for anything that could jeopardize the new owner's rights down the road. This isn't just a simple background check; it's a forensic investigation into the legal life of the property.

They’re on the lookout for red flags like:

- Unpaid Taxes: Old property tax bills from previous owners that could suddenly become the new owner's problem.

- Contractor Liens: Claims filed by contractors who did work on the house but were never paid.

- Old Ownership Claims: The discovery of a long-lost heir or an ex-spouse who might still have a legal claim to the property.

- Judgments or Lawsuits: Legal actions taken against a prior owner that resulted in a lien being placed against the real estate.

If any of these issues—known in the industry as "clouds" or "defects" on the title—pop up, the company gets to work on the curative work. This means they actively step in to resolve the problems, whether it's facilitating payment for an old lien or tracking down legal documents to clear an ownership claim.

A clean title is the bedrock of any real estate purchase. The title company’s job is to chisel away any historical issues, ensuring the foundation of your ownership is solid and undisputed.

Acting as a Neutral Third Party

Beyond its detective work, a title company for closing also serves as a neutral escrow agent. In this role, they act as a secure vault for all the moving parts of the transaction. They hold the buyer’s earnest money, the lender’s funds, and all the signed legal documents in a protected account.

This neutrality is what makes the whole thing work. The title company doesn’t represent the buyer or the seller; they represent the integrity of the deal itself.

Once all the boxes are checked—inspections are done, financing is locked in, and all the paperwork is signed—the company moves on to the final steps. They wire the funds to the correct parties, pay off any existing mortgages, and officially record the new deed with the county. Only then is the property legally and officially yours.

This step-by-step process delivers true peace of mind, protecting both the buyer and the lender from any skeletons in the property's closet. The meticulous work of title searchers and abstractors is what makes this security possible. You can learn more about their specialized role in our detailed guide on the importance of title abstractors.

How to Choose the Right Title Company

Picking the right partner for your real estate closing can be the difference between a smooth celebration and a last-minute disaster. When you’re choosing a title company for closing, you're doing more than just finding the lowest fee. You're hiring a reliable, communicative, and tech-savvy team to stand guard over your investment.

Think of it like hiring a project manager for the most critical phase of your purchase. You need a company with a solid local reputation, transparent fees, and a proven ability to communicate clearly and consistently. A team that leaves you in the dark is a huge red flag.

Evaluate Reputation and Responsiveness

Your search should start with established local players. A company with deep roots in the community already has strong relationships with local realtors, lenders, and county recording offices. Those connections can be a lifesaver when unexpected issues pop up.

Dig into their online reviews on Google and Yelp, but don't just glance at the star rating—read the actual comments. Look for patterns. Are customers consistently praising them for clear communication and proactive problem-solving? Or are there recurring complaints about delays and unanswered calls? A few bad reviews happen, but consistent complaints about communication should be a dealbreaker.

Demand Technological Transparency

In today's market, the technology a title company uses is just as important as its reputation. Ask if they provide a secure online portal for accessing documents and getting real-time status updates. Modern platforms are becoming the standard because they offer unmatched transparency, letting all stakeholders track progress without playing endless games of phone tag.

This is where solutions like TitleTrackr change the game by giving title professionals the tools they need to offer a clear window into the entire closing process. A company that invests in this kind of technology is showing a real commitment to a modern, client-first experience.

The title insurance industry's role in securing real estate deals is only getting bigger. The global market hit about $4.15 billion in 2025 and is expected to climb to $5.69 billion by 2034. This growth shows just how much people rely on the protection these services offer. You can get more details on these title insurance market growth trends from HousingWire.

Verify Credentials and Insurance

Finally, do your homework. Before you sign anything, confirm the title company is properly licensed to operate in your state. You also need to verify that they carry adequate errors and omissions (E&O) insurance. This is your safety net in the rare event that a mistake is made during the title search or at the closing table.

Your title company is the guardian of your property rights. Choosing a partner based on reliability, technological capability, and proven service—not just price—is one of the most important decisions you'll make in your real estate journey.

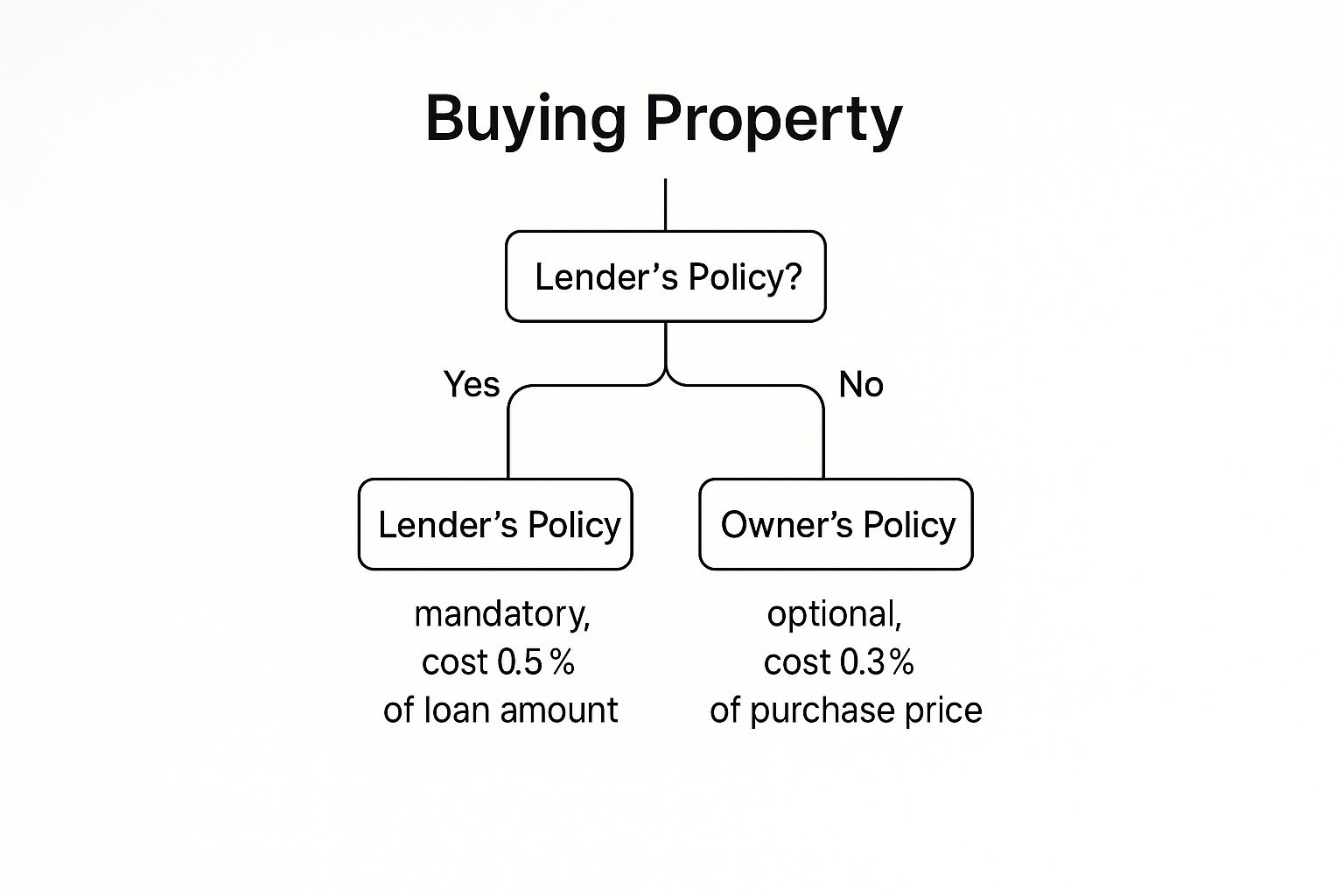

This decision tree breaks down the two main types of title insurance you'll run into when buying a property.

As you can see, the lender's policy is required to protect the mortgage company. The owner's policy, while optional, is the critical layer of protection for your investment.

Understanding Your Title Insurance Policy

When you bring a title company for closing into the picture, you’re really buying their main product: title insurance. But don't mistake it for your car or home insurance. Those policies protect you from future accidents. Title insurance is different—it looks backward, shielding you from skeletons in the property's closet.

It’s all about protecting your ownership rights from things that went wrong long before you came along. Think of issues like a forged signature on a decades-old deed, a surprise heir showing up with a claim to the land, or old construction liens that were never officially paid off. You make a one-time purchase, and that policy defends your right to the property for as long as you own it.

Lender’s Policy vs. Owner’s Policy

As you get closer to closing, you'll hear about two kinds of title insurance. It's crucial to know who each one is for.

- Lender’s Policy: Your mortgage lender will almost always require this. It’s designed to protect their money. If a title issue pops up, this policy ensures their loan is secure against any defects. It does nothing to protect your down payment or equity.

- Owner’s Policy: This one is all about you, the homebuyer. It's your direct line of defense, protecting your investment and your legal claim to the property. While it's sometimes presented as optional, skipping it means you're financially exposed to any title problems that might surface down the road.

Imagine this: years after you've settled in, you discover a previous owner's signature on the deed was a fake. Without an Owner's Policy, you’d be facing a massive legal battle to prove you own your home, all on your own dime. That one-time premium you paid at closing suddenly looks like the best money you ever spent, covering legal fees and protecting your hard-earned equity.

An Owner's Title Insurance Policy transforms a simple closing cost into a permanent shield for your property rights. It’s your personal guarantee that the home you buy is truly yours, free from the ghosts of its past.

This unique, backward-looking protection is what holds the real estate industry together. The global title insurance market was valued at around $56.8 billion in 2022 and is expected to climb to a staggering $161.6 billion by 2032. That growth underscores just how vital this insurance is for securing property deals everywhere. You can read more on the expanding title insurance market from Allied Market Research.

To make the distinction crystal clear, here’s a simple breakdown of how the two policies stack up against each other.

Owner's Policy vs. Lender's Policy At a Glance

| Feature | Owner's Title Insurance | Lender's Title Insurance |

|---|---|---|

| Who It Protects | You, the property owner | The mortgage lender |

| Coverage Focus | Your full purchase price (equity) | The outstanding loan balance |

| Is It Required? | Usually optional, but highly recommended | Almost always required by the lender |

| Premium | One-time fee paid at closing | One-time fee, often paid by the borrower |

| Policy Duration | As long as you or your heirs own the property | Until the mortgage is paid off |

Seeing them side-by-side really highlights their different jobs. The lender's policy is a non-negotiable part of getting a mortgage, but the owner's policy is your personal safety net.

A One-Time Investment for Lasting Peace of Mind

Here's the best part. Unlike just about every other insurance policy you have, title insurance isn't a recurring monthly bill. You pay a single premium at the closing table, and that’s it.

That one payment provides coverage that lasts for as long as you or your heirs own the property. This structure makes it one of the most powerful and cost-effective forms of protection a homeowner can buy, keeping your biggest investment safe for decades.

Navigating Common Problems at Closing

Even the smoothest real estate deals can hit a patch of turbulence right before landing. These last-minute snags are stressful, but a great title company for closing is like an experienced pilot—they know how to navigate the storm and get you to your destination safely. Understanding what these common hurdles look like shows you just how valuable a seasoned professional is when you're in the final stretch.

A lot of issues boil down to simple human error or an overlooked detail. A typo in a legal document, an incorrect loan amount, or even a single missing signature can bring the whole process to a dead stop. Other times, the problems are more complex, hiding in the property's history until the very last minute.

Common Last-Minute Hurdles

Picture this: you're just hours away from getting the keys when the title search digs up an old lien from a previous owner's unpaid utility bill. Or maybe a new survey reveals the backyard fence is actually three feet onto your neighbor's property. These aren't just hypotheticals—they are real-world problems that derail closings every day.

Here are a few of the most frequent surprises a title company has to untangle:

- Surprise Liens: An old, unpaid debt from a contractor or the city can pop up at the worst possible time, creating a legal claim against the property that has to be settled.

- Boundary Disputes: Unclear property lines or conflicting surveys can create ownership questions that must be answered before the sale can proceed.

- Clerical Errors: A simple mistake, like a misspelled name or the wrong legal description on the deed, is enough to invalidate the document if it isn't caught and fixed.

A skilled title professional doesn't just point out problems; they actively solve them. Their ability to negotiate a lien release or file corrective paperwork is what separates a delayed closing from a canceled one.

Proactive Solutions and Modern Prevention

An experienced title team sees these issues coming. When a lien appears, they don't just send an email—they get on the phone to negotiate a release. If a document has an error, they know exactly how to file the right paperwork with the county to keep things moving. This hands-on, proactive approach is what sets the best title companies apart.

This is also where modern technology makes a huge difference. Closing platforms like TitleTrackr are designed to head off many of these problems from the start. By creating a central, shared space for all documents and communication, these systems ensure everyone is on the same page, which dramatically cuts down on the risk of clerical mistakes.

Real-time progress tracking keeps the buyer, seller, agent, and lender in the loop, closing the communication gaps where delays love to hide. Title and settlement services are a cornerstone of the real estate market. In the US alone, the industry hit an estimated market value of $15.4 billion in 2024, a number that shows just how essential this work is. You can learn more about the title and settlement services industry from Kentley Insights. By embracing technology, the best companies are making this critical process more dependable than ever before.

How Technology Is Transforming Real Estate Closings

The days of frantically chasing down faxes and playing phone tag for closing updates are thankfully coming to an end. Anyone who’s been in real estate for a while remembers the traditional closing process—it was often slow, clunky, and left everyone in the dark. Clients and agents alike were left guessing about the status of their deal.

Now, technology is finally fixing some of the industry's oldest headaches, swapping that old uncertainty for real efficiency and clarity.

If you had to sum up the modern closing experience in one word, it would be transparency. Today’s best platforms are built to eliminate communication gaps, secure sensitive information, and give everyone involved real-time status updates. Instead of juggling scattered emails and phone calls, every party can see exactly where things stand in one central, organized place.

By bringing every step of the closing process into a secure digital hub, technology ensures that buyers, sellers, and agents are always informed and aligned, preventing costly delays and frustration.

This is exactly where a modern title company for closing proves its worth. Platforms like TitleTrackr make this vision a reality, offering a single, unified system for managing documents, tracking progress, and keeping communication lines wide open. This approach doesn't just speed up the entire workflow; it creates a far better, less stressful experience for clients who’ve come to expect instant access to information in every other part of their lives.

For title companies and real estate professionals, this technology is a game-changer. It allows you to spend less time bogged down in administrative busywork and more time actually serving your clients. Adopting these tools isn't a luxury anymore—it's fast becoming the new standard for a successful closing.

Ready to see how a modern platform can elevate your closing process? Request a demo of TitleTrackr today and discover how to deliver the seamless experience your clients deserve.

Got Questions About Title Companies? We’ve Got Answers.

Even with a good grasp of the closing process, a few key questions always seem to pop up for buyers, sellers, and even seasoned agents. Getting those lingering questions answered is the best way to make sure everyone walks up to the closing table feeling confident and ready.

Let's tackle some of the most common ones we hear.

Who Actually Chooses the Title Company?

This is a great question, and the answer can shift depending on your state and what’s in the purchase agreement. But generally, the person paying for the title insurance—which is usually the buyer or their lender—gets to make the call.

While a seller or real estate agent might have a go-to title company they love working with, the final decision typically rests with the buyer. It's always smart to do your own homework and pick a company that feels responsive and has a solid reputation.

What’s This Going to Cost Me?

There’s no single, flat fee for title services. The cost is a mix of things, mostly tied to the home's purchase price and local county regulations.

The total bill usually covers the title search, all the settlement and closing services, and the one-time premiums for both the lender's and owner's title insurance policies. You won't be in the dark, though—you’ll see a clean, itemized breakdown of every single cost on your Closing Disclosure form long before you sign anything.

Choosing a title partner is a critical step in securing your real estate investment. Don't hesitate to ask for a detailed fee schedule upfront to avoid any surprises at the closing table.

How Long Does a Title Search Even Take?

A standard title search can take anywhere from a few days to a couple of weeks. What makes the timeline vary so much? It really boils down to the property's history—the more complex, the longer it takes—and how quickly the public records can be pulled from that specific county.

A proactive title company gets the ball rolling on this the second the property is under contract. That way, they can spot and start clearing up any potential snags right away.

Have more questions? We’ve got a whole lot more answers. You can check out our comprehensive title company FAQ page for a deeper dive.

By improving communication and providing real-time updates, TitleTrackr helps title companies, agents, and their clients navigate the closing process with greater transparency and efficiency. Ready to see how a modern platform can elevate your closing experience? Request a demo of TitleTrackr today.