A land development feasibility analysis isn't just paperwork; it’s a rigorous investigation into a real estate project's potential for success. This critical first step transforms a promising idea into a data-backed business case, answering three fundamental questions: Can we build it?, Will it be profitable?, and What hidden risks could derail the project?

For developers, this analysis is the foundation upon which every successful project is built. It’s the strategic due diligence that separates a calculated investment from a costly gamble.

Why a Feasibility Analysis Is Your Most Critical First Step

Before breaking ground, the most successful developers are deep in data. A land development feasibility analysis is the strategic backbone of any project, safeguarding your capital from ventures destined to fail.

This isn't just a procedural checklist; it's an in-depth evaluation of a property's true potential and its inherent risks.

Think of it as crafting a comprehensive business plan for the land itself. The process compels you to be realistic about market conditions, physical site limitations, complex local regulations, and—most importantly—the financial bottom line before committing significant resources.

From Speculation to Strategy

Every great development begins with a vision, but vision alone doesn't secure financing or generate returns. A thorough feasibility study translates that vision into a concrete, actionable strategy grounded in hard evidence. It systematically unpacks every variable that can make or break your project.

This process involves several key areas of investigation:

- Market Viability: Is there genuine demand for your proposed project? Identifying your target buyers or tenants and understanding the competitive landscape is essential.

- Site Suitability: What lies beneath the surface? Physical constraints like poor soil conditions, challenging topography, or environmental issues can inflate your budget or halt the project entirely.

- Regulatory Hurdles: What local zoning laws, permits, and entitlements are required? Miscalculations here can lead to months or even years of expensive delays.

- Financial Soundness: Do the numbers work? A detailed financial model is non-negotiable, projecting all costs against potential revenue to determine profitability metrics like ROI and IRR.

A well-executed feasibility study is your number one risk mitigation tool. It provides the clarity needed to make a confident go/no-go decision, secure financing, and persuade stakeholders that your project is built on solid ground.

A crucial part of this is a deep dive into the local economy, demographic trends, and the competitive environment to accurately gauge demand. A 2025 overview confirms that this type of market analysis is vital for understanding not only current demand but also the risk of future market saturation.

Ultimately, this analysis delivers the intelligence developers need to navigate the complexities of real estate development. Modern tools are also revolutionizing the process. For instance, the initial, data-intensive work of title research is being completely transformed. Solutions like TitleTrackr for developers use AI to turn weeks of painstaking manual work into minutes, giving savvy developers a powerful competitive advantage from the very beginning.

Decoding Market Demand and Site Realities

A promising piece of land is just that—a promise. Your job during a land development feasibility analysis is to determine if that promise can be fulfilled. This stage requires shifting from high-level concepts to on-the-ground investigation, focusing on two critical pillars: the market you intend to serve and the physical site you plan to build on.

Achieving this means going beyond surface-level data. True insight comes from weaving together the area's economic story with the geological story of the soil beneath your feet.

Understanding Market Appetite

A successful project always meets an existing or emerging need. To identify it, you must analyze the market with forensic detail. While basic demographic data is a starting point, it won’t reveal why people in the area make certain choices.

To gain a genuine understanding of market demand, you need to go further:

- Psychographics and Local Economics: Who lives here, and what do they value? Who are the major employers? Is the local economy dependent on a single industry, or is it diversified? The answers shape demand for everything from starter homes to high-end retail.

- Future Growth Projections: Review city planning documents and look for upcoming infrastructure projects. A new highway interchange or a university expansion can signal future growth not yet reflected in current property values.

- Competitive Landscape Analysis: Don’t just count your competitors; analyze their offerings. If the market is saturated with three-bedroom homes, there may be an unserved niche for high-quality two-bedroom townhouses or multi-generational living spaces. The goal is to find that profitable opportunity.

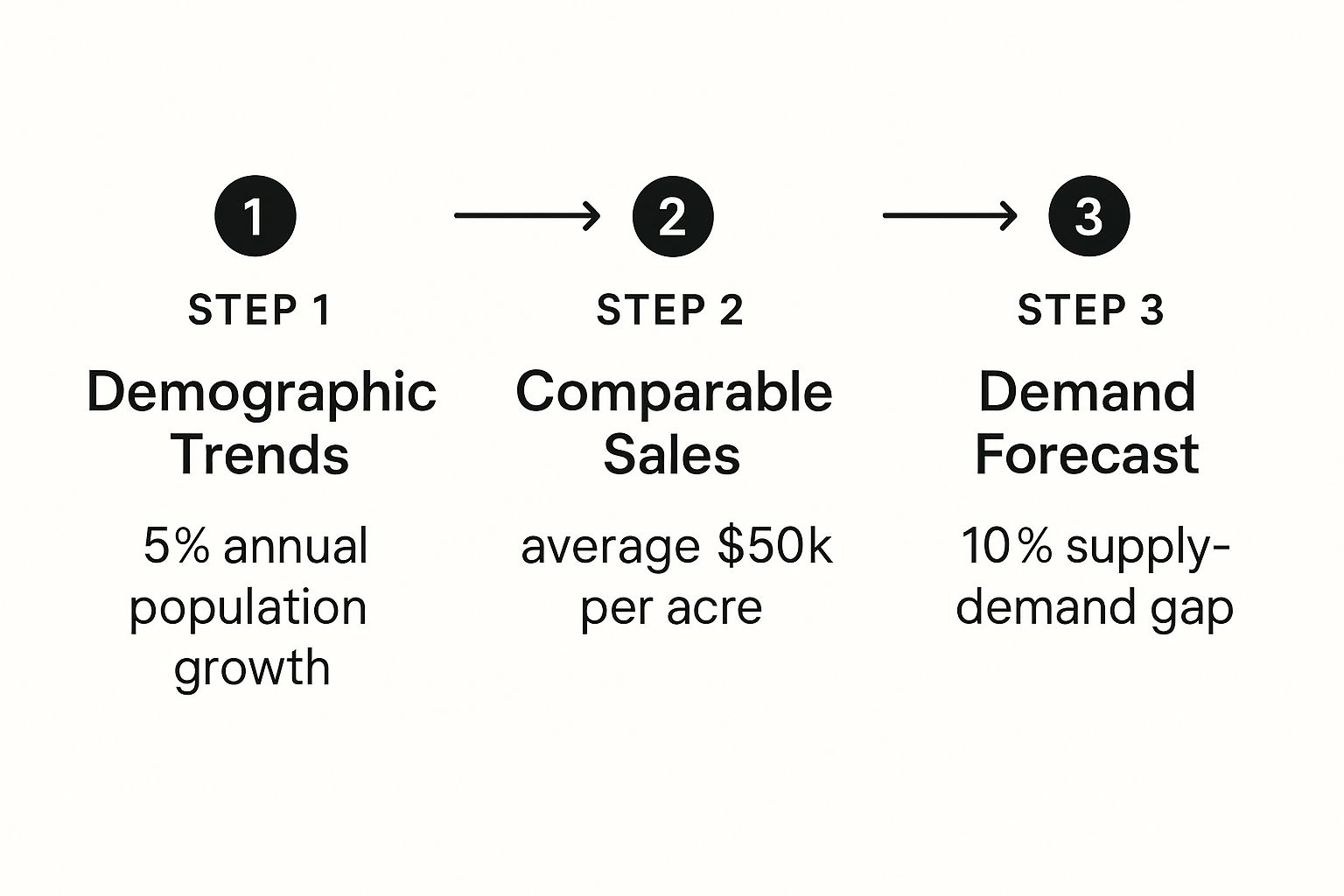

This graphic illustrates a simplified process for analyzing key data points to assess demand.

This flow, from population trends to comparable sales, can reveal a clear supply-demand gap—pointing you directly toward a strong market opportunity.

Scrutinizing the Physical Site

Once you’ve confirmed a strong market, you must verify that your site can physically support the vision. The land itself holds clues that will directly impact your budget, timeline, and the project's overall viability. Overlooking a physical issue is one of the quickest ways to turn a promising deal into a financial disaster.

The ground doesn't lie. A thorough site analysis is non-negotiable because what you find—or fail to find—will have direct and often costly consequences for your project's scope and financial model.

Here’s what you must investigate.

Topography and Soil Conditions

Is the land flat, or are you facing a massive, costly grading job? A steep slope can cause foundation costs to skyrocket.

Equally important is what lies beneath the surface. A geotechnical report is essential. It will detail the soil's load-bearing capacity, hidden rock formations, or expansive clay. Unfavorable soil conditions may not kill your project, but they will certainly add unexpected expenses for remediation or specialized foundation engineering.

Environmental Red Flags

Never underestimate the potential for environmental contamination, especially on land that has been previously developed or used for industrial purposes. A Phase I Environmental Site Assessment (ESA) is a mandatory first step.

This assessment is your first line of defense, identifying potential contamination from past uses. If it raises red flags, a more intensive Phase II assessment, involving soil and water sampling, will be necessary. Cleanup costs can be astronomical, and discovering contamination late in the process can stop a project in its tracks.

Utility Access and Infrastructure

Without access to essential utilities, your project is a non-starter. You must verify the exact location and, crucially, the capacity of existing water, sewer, electricity, and gas lines.

Don't just assume you can tap into them. You must confirm that local providers have enough capacity to service your new development. If infrastructure needs to be extended to your site, the cost can be staggering—sometimes running into the hundreds of thousands of dollars—and that expense typically falls to the developer. These details are absolutely critical for an accurate land development feasibility analysis.

To get a full picture of a site's history and potential roadblocks, it's crucial to examine both market forces and the physical constraints of the land itself. This table highlights the distinct focus of each analysis.

Key Due Diligence Checklist

| Analysis Component | Market Research Focus | Site Analysis Focus |

|---|---|---|

| Data Sources | Economic reports, demographic data, competitor analysis, city growth plans. | Geotechnical reports, surveys, environmental assessments, utility maps. |

| Key Questions | Who is the buyer? What do they want? What is the competition doing? | Can this land support the structure? What hidden costs are in the ground? |

| Potential Deal-Breakers | Saturated market, negative economic trends, lack of demand. | Environmental contamination, impossible topography, no utility access. |

| Primary Goal | Validate the project's financial viability and product-market fit. | Confirm the project's physical and logistical feasibility. |

Ultimately, a successful feasibility study depends on how well you synthesize these two very different, yet completely interconnected, sets of information. It's this combined insight that allows you to move forward with confidence or wisely walk away before committing serious capital.

Navigating the Maze of Zoning and Entitlements

You’ve confirmed the market exists and the site is suitable. Now you enter what is often the most unpredictable phase of any land development project: the regulatory jungle. Zoning laws and the entitlement process are the invisible gatekeepers that can either approve your project or halt it indefinitely.

A prime site with perfect market fit is worthless if the local municipality won’t permit your planned development. This stage is less about moving dirt and more about deciphering dense legal codes and understanding local politics. It’s here that your timeline and budget can either remain on track or spiral out of control.

Conducting a Thorough Zoning Review

Your first step must be a meticulous zoning review. Don't just glance at the basic designation, like "Commercial" or "R-2 Residential." You must delve into the municipal code to understand what is truly permitted.

For instance, a property zoned for multi-family might have a density limit of only eight units per acre. This detail would make your planned 20-unit apartment complex unfeasible without a major variance. Scrutinize every line of the code.

Look for specific limitations and requirements, such as:

- Setbacks: How far must structures be from property lines, roads, and water bodies?

- Height Restrictions: Are you limited to two stories when your financial model is based on four?

- Lot Coverage: What percentage of the land can be covered by buildings and impermeable surfaces like asphalt?

- Parking Requirements: Does the code mandate two parking spaces per unit when your design only accounts for one?

Ignoring what seems like a minor detail in the land use code is a recipe for disaster. A small constraint can create a massive ripple effect, impacting your design, unit count, and, ultimately, your project’s bottom line.

Mapping the Entitlement Timeline

Once you have a firm grasp on zoning rules, you need to map out the entire entitlement process. This is not a single step but a sequence of applications, reviews, and public meetings that can stretch for months—or even years. The timeline is rarely a straight line.

A typical path might involve:

- Pre-Application Meeting: An informal discussion with the planning department to get their initial feedback.

- Application Submission: Filing the complete package, including site plans, architectural drawings, and required impact studies.

- Staff Review: The town's planning staff reviews your application for compliance and prepares a report.

- Public Hearings: Presenting your project to the Planning Commission and possibly the City Council, where community members can voice support or opposition.

- Final Approval & Conditions: If approved, the municipality will issue a list of conditions you must meet before breaking ground.

Each of these steps is a potential bottleneck. A simple request for more information from planning staff can add weeks to your schedule. Strong community opposition can add months of redesigns and additional hearings, increasing holding costs and eating into your budget.

Proactive Engagement and Common Pitfalls

The key to navigating this maze successfully is proactive engagement. Don't wait for the public hearing to introduce your project to the community. Meet with neighborhood associations and local leaders early to address their concerns and build support. A developer who works with the community has a much better chance of a favorable outcome than one who tries to force a project through.

A major pitfall is assuming this process is purely technical. It's not. Municipal priorities can shift with elections. A project that seemed certain one year could face new political headwinds the next. Successful developers build relationships with planning staff and stay informed about the local political climate.

This human intelligence is as critical as technical data. The process also involves a mountain of paperwork where a clear title is paramount. Experienced title abstractors and searchers are crucial here, ensuring every legal and ownership detail is locked down before you even approach the city.

Building a Bulletproof Financial Model

After grappling with market data, site assessments, and local regulations, everything comes down to one question: do the numbers work? A project can have a perfect location and strong community support, but if the financial model is built on shaky assumptions, it's destined to fail.

This is where you build your pro forma. Think of it as the financial story of your project, and it must be compelling enough to withstand intense scrutiny from investors, lenders, and your own team.

Your financial model translates your vision into the universal language of money. It’s not just a budget; it’s a dynamic document that tracks every dollar in and out over the entire project lifecycle.

Forecasting Your Project Costs

First, you need an honest, brutally detailed picture of what the project will actually cost. These costs are typically divided into two categories, and underestimating either one is a classic—and often fatal—mistake.

- Hard Costs: These are the tangible "bricks and mortar" expenses: lumber, concrete, labor, and site work. As these are usually the largest line items, you’ll need to work closely with contractors to get solid, market-rate estimates.

- Soft Costs: These are the less obvious but equally critical expenses that enable the project. This includes architectural and engineering fees, legal costs, permit and impact fees, financing charges, and marketing budgets. Many developers get into trouble by not allocating enough capital for these items.

A pro tip: always include a contingency. A good rule of thumb is to add a 5-10% contingency on top of your total budget. This buffer protects you against unexpected events, like a sudden spike in material prices or unforeseen issues during excavation.

Projecting Realistic Revenue Streams

Once you have a firm grip on costs, it's time to project revenue. This is no place for wishful thinking. Your revenue forecasts must be anchored in the hard market data you gathered earlier.

You’ll need to analyze comparable sales (comps) to set realistic sales prices or lease rates. Avoid the trap of cherry-picking the highest comps; use a balanced average that reflects current market conditions.

You must also factor in the absorption rate—the pace at which your units will sell or lease. While the market may support 100 new townhomes, they won't all sell the day construction is complete. A realistic absorption rate is crucial for accurate cash flow projections.

Understanding Key Performance Indicators

A pro forma is more than a list of numbers; it’s a tool for measuring profitability. Lenders and investors will focus on a few key performance indicators (KPIs) to quickly assess your project's financial health.

| KPI | What It Measures | Why It Matters |

|---|---|---|

| Return on Investment (ROI) | The total profit as a percentage of the total project cost. | It’s a simple, high-level look at overall profitability. |

| Internal Rate of Return (IRR) | The annualized rate of return, accounting for the time value of money. | This is a more advanced metric that investors love because it considers when cash flows occur, not just the total amount. |

| Net Operating Income (NOI) | The annual income generated by a property after all operating expenses are paid. | This is the fundamental measure of a property's ability to generate positive cash flow. |

From a financing perspective, your feasibility analysis is all about return metrics and risk. For instance, the capitalization rate (Cap Rate)—the rate of return based on the property’s projected income—is a vital benchmark lenders use to assess risk. To dive deeper, you can learn more about assessing financial feasibility in real estate development and get comfortable with these metrics.

Your financial model is your project’s resume. If the KPIs don't meet industry benchmarks, you will have an extremely difficult time securing the financing you need to move forward.

The Importance of Stress Testing

Finally, a truly bulletproof financial model is one you've tried to break. You need to run multiple scenarios to see how your project performs under pressure. This process, called stress testing, shows investors you’ve thought through the risks.

Run a few "what-if" scenarios:

- What happens if interest rates jump by 2%?

- What’s the financial hit from a six-month construction delay?

- How do the numbers look if sales are 20% slower than you projected?

By stress-testing your assumptions, you identify weak spots in your plan and can build in safeguards. This rigorous approach is what separates a speculative gamble from a well-planned, data-driven investment.

Making the Final Go or No-Go Decision

This is the moment of truth. After weeks, or even months, of painstaking analysis, you’ve reached the final decision point.

All the market research, site assessments, regulatory reviews, and financial modeling have led to a single, critical choice: do you move forward, or do you walk away? This is the ultimate go/no-go decision, the culmination of your entire land development feasibility study.

This isn't about a gut feeling; it’s a calculated conclusion based on the comprehensive data you've gathered. The objective is to synthesize all your findings into a clear, defensible position that weighs potential rewards against the very real risks you’ve uncovered.

Conducting the Final Risk Assessment

Before making the final call, you must conduct one last, holistic risk assessment. Think of it as creating a balanced scorecard that pits opportunities against challenges. Grouping your findings into a clear framework helps you see the entire picture, not just its isolated parts.

A practical way to structure this is to ask some hard questions:

- Market & Revenue Risks: How solid are your absorption rates and final sales price projections? A sudden market downturn or a new competitor could eliminate your profits.

- Site & Cost Risks: What are the real odds of encountering unexpected bedrock or discovering environmental contamination during excavation? These physical unknowns can cause massive budget overruns.

- Regulatory & Timeline Risks: Is there a chance that community opposition could gain traction and derail the project? Or that a key permit gets stuck in bureaucratic limbo for months? Every day of delay adds holding costs and erodes your return.

- Financial & Capital Risks: What happens if interest rates spike just when you need to draw on your construction loan? Access to capital is critical, and you must be prepared for volatility.

The goal of a final risk assessment isn't to eliminate every single risk—that's impossible. It's to understand them, quantify them, and have a solid mitigation plan ready for each one. You can't afford to be blindsided by a problem you should have seen coming.

Creating a Compelling Feasibility Report

Making an internal decision is only half the battle. Now, you must convince others. To secure financing and get stakeholders on board, you need to package all your findings into a compelling feasibility report. This document tells the story of your project, and it must be clear, concise, and backed by undeniable data.

A strong report doesn’t just present numbers; it builds a narrative. It should walk the reader through your entire analytical process, from identifying the initial market opportunity to presenting the final, stress-tested pro forma. This demonstrates a level of diligence that gives lenders and investors the confidence they need. It shows them you've done your homework.

The current economic climate is also a crucial part of this story. For instance, industry sentiment is shifting dramatically toward optimism. A 2024 Deloitte report revealed that over 68% of commercial real estate leaders expect fundamentals to improve in 2025—a huge jump from just 27% the previous year. This confidence is fueled by expectations of better financing conditions, with 69% anticipating easier access to capital. You can dig into the specifics in their commercial real estate outlook.

Building a Foundation for Success with TitleTrackr

Ultimately, the strength of your decision—and your report—depends on the quality of your initial data. An analysis built on a shaky foundation of incomplete or inaccurate information is worthless. This is especially true for something as fundamental as property title data.

When you start your land development feasibility analysis with a tool like TitleTrackr, you ensure this critical first step is rock-solid. By using AI to rapidly extract accurate title data, you sidestep the risks of manual errors and shave a huge amount of time off the due diligence process.

That precision from day one has a ripple effect. It makes your site analysis more reliable, your risk assessment more accurate, and your final report more persuasive. When you can show your capital partners that your project is built on a bedrock of verified, clean title data from the very beginning, you make your project fundamentally more attractive and easier to finance. Better data doesn't just inform your go/no-go decision; it paves the way for a successful "go."

Common Feasibility Analysis Questions

Even after mastering the core components of a feasibility study, questions are bound to arise. It happens on every deal. Let's tackle some of the most common inquiries from developers navigating this critical stage.

How Long Does a Typical Analysis Take?

The timeline for a feasibility analysis can vary significantly depending on the project's complexity.

For a quick, preliminary review of a straightforward single-family lot, you might complete it in 30 to 60 days.

However, for a large-scale, mixed-use development requiring major zoning changes or facing significant environmental concerns, you could be looking at six months to a full year. The biggest delays usually stem from waiting on municipal departments, coordinating specialized consultants, and the depth of due diligence required.

This is where modern technology provides a significant advantage. Platforms like TitleTrackr can automate the extraction of essential title and lien data, shaving valuable time off the initial due diligence sprint and enabling you to make key decisions much faster.

What Is the Biggest Mistake Developers Make?

A classic and costly mistake is underestimating soft costs and the entitlement timeline. Too many developers create meticulous budgets for hard costs—the tangible materials like lumber and concrete—but get blindsided by less tangible expenses.

These include:

- Architectural fees

- Engineering reports

- Legal counsel

- Permit fees

- Financing charges

Furthermore, many create overly optimistic construction schedules, completely overlooking the unpredictable and often slow entitlement process.

A delay of just a few months waiting for a permit approval can add substantial holding costs to the project. That alone can be enough to derail your financial model. A smart analysis always includes realistic buffers for both time and money.

Can I Perform a Feasibility Analysis Myself?

An experienced developer can certainly handle a high-level, preliminary analysis to quickly screen properties and filter out non-starters.

However, when it's time to build a comprehensive, bankable study—the kind you present to lenders and investors—you need a team of specialists. Think of it as building a legal and financial case for your project; it needs to be bulletproof.

To get it right, you’ll need to bring in the pros:

- A civil engineer to assess topography, drainage, and utility access.

- A real estate attorney who can navigate local zoning codes and the entitlement maze.

- A market analyst to provide data-backed revenue projections.

- An environmental consultant to handle the necessary site assessments.

The money spent on these experts is not just an expense; it’s one of the best investments you can make in risk mitigation. Their expertise helps you avoid the kind of devastatingly costly mistakes that can sink a project.

How Does Technology Impact the Process?

Technology is completely transforming the land development feasibility analysis, making it faster, more accurate, and more data-driven than ever before.

AI-powered platforms can analyze massive datasets to identify subtle market trends and forecast demand with a level of precision that was unimaginable a decade ago.

Tools like TitleTrackr use automation to extract critical title, lien, and encumbrance information from dense legal documents in minutes—a task that previously required days of tedious manual work. This allows your team to evaluate more opportunities with much higher confidence. Additionally, GIS mapping offers sophisticated spatial analysis, while drones can conduct hyper-accurate topographical surveys in a fraction of the time.

For more information on common inquiries, you can review our comprehensive FAQ page.

Ready to see how AI can accelerate your due diligence and provide a rock-solid foundation for your next project? TitleTrackr transforms weeks of manual title research into minutes, giving you the accurate data you need to make faster, more confident decisions. Request a demo with TitleTrackr today.