Before you ever see a single shovel hit the dirt, the most important work on any land development project is already happening. That work is the land development feasibility study, and it's not just another box to check—it's the strategic foundation that separates a profitable venture from a nightmare project bleeding cash.

Why a Feasibility Study Is Your Project's Foundation

Think of it as the architect's blueprint for your entire business case. Just as a building plan ensures a skyscraper won't topple over, a feasibility study makes sure every component of your project—from financing and zoning to market demand and site conditions—actually works together. It’s a rigorous, boots-on-the-ground investigation that answers one simple but powerful question: Does this project actually make sense?

The Core Purpose of a Feasibility Study

At its heart, a feasibility study is all about managing risk. It’s a clear-eyed, unsentimental look at every potential hurdle and opportunity, allowing you to make decisions based on hard data, not just a gut feeling.

This isn't a simple site walk. A proper study digs deep to give you a complete picture of the project's potential. A well-executed one accomplishes a few critical goals:

- It Finds 'Fatal Flaws' Early On: The study is designed to uncover those deal-breaking issues before you've invested serious money. Think restrictive zoning, surprise environmental contamination, or a lack of utility access.

- It Builds Investor Confidence: Lenders and partners need more than just a good idea. A thorough report gives them the verified data they need to write the checks, proving you’ve done your homework.

- It Sharpens Your Project Plan: By truly understanding the land's limitations and advantages, you can design a development plan that is more efficient, realistic, and ultimately, more profitable.

- It Delivers a Clear Go/No-Go Decision: The final output isn't a vague summary. It’s a firm recommendation on whether to move forward, pivot your strategy, or walk away, all backed by extensive research.

A land development feasibility study transforms raw uncertainty into calculated risk. It systematically replaces guesswork with a detailed analysis of market demand, legal constraints, physical suitability, and financial returns.

Skipping this step is like setting sail without a map or a weather report. You might get lucky, but you’re far more likely to sail right into a preventable storm. For instance, a developer might find a parcel of land in a perfect location, only for a study to reveal the soil is too unstable for their building plans, requiring expensive engineering work that completely wipes out the profit margin.

To get the full picture, a study examines a project through four critical lenses, which we'll call the Four Pillars.

The Four Pillars of a Land Development Feasibility Study

Every comprehensive study rests on these four pillars. Each one scrutinizes a different aspect of the project, and if any one of them is weak, the entire venture could collapse.

| Pillar | What It Examines | Key Question Answered |

|---|---|---|

| Market Viability | Local supply and demand, target demographics, competitor analysis, and economic trends. | Is there a real, paying market for what we want to build here? |

| Legal & Regulatory Viability | Zoning laws, entitlements, building codes, environmental regulations, and deed restrictions. | Can we legally build what we want to build on this specific site? |

| Physical & Technical Viability | Topography, soil conditions, utility access (water, sewer, power), and infrastructure. | Is the land physically capable of supporting our development plan? |

| Financial Viability | Land acquisition costs, construction estimates, potential revenue, and return on investment (ROI). | After all is said and done, will this project actually make money? |

By systematically vetting each of these pillars, you create a complete, 360-degree view of the opportunity. This is the foundational work that ensures your project is built on solid ground from day one, making ambitious—and profitable—developments possible.

Breaking Down the Core Study Components

A comprehensive land development feasibility study isn’t a single, one-off report. It's more like a series of interconnected investigations, each one crucial to the final verdict. Think of it as assembling a team of specialists—a market analyst, a civil engineer, a zoning lawyer, and an environmental scientist—all examining the project from their unique angle to build a complete, 360-degree picture.

Every component is a critical piece of the puzzle. If you overlook even one, you expose your project to massive risk, potentially turning a promising venture into a costly nightmare. Let's break down the absolute non-negotiables that every thorough study must include.

Market Analysis: Who Will Buy and Why?

Before you even think about the dirt, you have to analyze the demand. A market analysis is all about figuring out if there are enough people willing and able to pay for what you want to build. This goes way beyond just having a gut feeling that an area is "up and coming."

It’s a deep dive into several key areas:

- Demographic Trends: Who lives here now, and who’s moving in? This looks at income levels, age groups, and household sizes to see if they match your target buyer or renter.

- Competitive Landscape: What other projects are already built or in the pipeline nearby? You need to understand their pricing, features, and how fast they’re selling to position your development for success.

- Economic Indicators: Things like job growth, the health of local industries, and new infrastructure investments are all signals of a market's long-term vitality.

For instance, if you're planning a luxury apartment complex, you’d want to see rising household incomes and a growing professional job market. But if the data points to young families looking for single-family homes, the market analysis has already saved you from a fundamental mismatch.

Site Analysis and Zoning: Are You Allowed to Build?

This is where the physical and legal realities of the property come into sharp focus. A gorgeous piece of land is totally worthless if you can't legally or physically build your vision on it. This stage is a two-part investigation that covers both the ground under your feet and the laws that govern it.

The physical site analysis looks at tangible things like:

- Topography and Soil Conditions: Is the land steep, requiring expensive grading? Is the soil stable enough for foundations, or will you need costly remediation?

- Utility Access: How far away are the connections for water, sewer, electricity, and gas? Extending utilities can easily add unexpected six-figure costs to your budget.

- Accessibility: How will people actually get to and from the site? This involves looking at road access, existing traffic patterns, and public transportation.

At the same time, the zoning and legal analysis ensures your project plays by the rules. This is a meticulous process where tiny details can have huge consequences. Managing all this documentation is complex, but tools and resources for modern developers are making it easier to stay organized and compliant.

A prime parcel of land can be rendered useless by a single line in a zoning ordinance or an undiscovered environmental issue. This component of the feasibility study is the project's primary defense against unforeseen legal and physical barriers.

Preliminary Design and Engineering: Can It Be Built?

Okay, so the market demand is there and the site is suitable. Now it’s time to start visualizing the project. Preliminary design and engineering work to translate your concept into a tangible plan, making sure the project is actually practical from a construction standpoint.

This phase isn't about creating final architectural blueprints. It's about producing initial site plans and massing studies that answer essential questions. How many units can you realistically fit on the property while respecting setback rules? Where will you put parking, green spaces, and stormwater management systems?

Engineers will also do a preliminary check on infrastructure needs. They'll figure out the scope of work needed for roads, drainage, and utility hookups, which provides the first realistic cost estimates that feed directly into your financial analysis. This step is all about making sure your vision aligns with the physical constraints of the land and the realities of construction.

Environmental Assessments: What Lies Beneath?

Finally, an environmental assessment uncovers any potential contamination or ecological issues that could create massive liability or stop the project in its tracks. A Phase I Environmental Site Assessment (ESA) is standard practice and an absolute must.

This investigation digs into the property's history to identify potential sources of contamination, like a former gas station or an old industrial facility. If any red flags pop up, a Phase II assessment, which involves actually taking soil and water samples, might be necessary. Skipping this step is a gamble you don't want to take—it can lead to staggering cleanup costs and legal penalties down the road.

Mastering the Financial and Market Analysis

While site plans and market trends can paint an exciting picture, the financial analysis is where the rubber truly meets the road. This is the moment a project shifts from a great idea into a tangible, profitable investment. A solid financial and market analysis within your land development feasibility study answers the one question that matters most: Will this project actually make money?

This stage is all about moving beyond whether a project is merely buildable to determine if it’s financially viable. It involves a detailed breakdown of every dollar coming in and every dollar going out, making sure your venture is built on a solid financial foundation from the get-go.

Building Your Financial Pro Forma

The heart of your financial analysis is the pro forma. Think of it as a detailed financial roadmap for your project, projecting revenues, expenses, and returns over its entire life—from buying the land, through construction, and all the way to stabilization or sell-out.

A good pro forma isn't just a static spreadsheet; it’s a living document that lets you stress-test your assumptions. This model has to account for every single anticipated cost, which usually falls into three main buckets:

- Land Acquisition Costs: The upfront price of the property itself.

- Hard Costs: These are the tangible construction expenses—think materials, labor, and site improvements.

- Soft Costs: This broad category covers all the indirect expenses like architectural fees, engineering services, permits, legal fees, insurance, and marketing.

By meticulously tracking these expenses, you build a clear and realistic project budget. This is the first step toward creating a financial case that can stand up to the scrutiny of lenders and investors.

Projecting Revenue and Measuring Returns

Once your costs are nailed down, the next step is to project your potential revenue. This is where you ground your financial model in the realities of your market analysis. Based on comparable properties and local demand, you can forecast rental income or sales prices for whatever you plan to build.

This allows you to calculate the key performance indicators (KPIs) that signal a project's profitability. Metrics like Return on Investment (ROI), Internal Rate of Return (IRR), and Net Operating Income (NOI) become your best friends for evaluating financial success. These numbers don't just tell you if you'll make a profit, but how that profit stacks up against other investment opportunities.

A well-constructed pro forma does more than just calculate potential profit. It quantifies risk, justifies investment, and provides the data-driven confidence needed to secure financing and move forward with your development.

Connecting Projections to Market Realities

A financial model is only as good as its connection to the real world. Economic trends, interest rates, and the availability of capital can all have a massive impact on a project's viability. This is where your market analysis and financial projections must work in perfect harmony.

For instance, global economic shifts directly influence financing. In 2023, worldwide mergers and acquisitions in commercial real estate fell to US$158 billion—a staggering 62% drop that reflected widespread uncertainty. But the outlook has changed. Industry surveys for 2025 show renewed optimism, with 68% of real estate professionals expecting lower financing costs and 69% anticipating easier access to capital. You can dig deeper into these comprehensive industry outlook reports to understand their impact.

Ultimately, mastering the financial analysis is about building a compelling, data-backed story. It proves you've not only designed a great project but have also mapped out a clear and profitable path to making it happen. That's how you make confident decisions and secure the funding needed to bring your vision to life.

Executing Your Feasibility Study Step By Step

Alright, let's move from theory to action. Kicking off a land development feasibility study can feel like staring up at a mountain, but breaking it down into a step-by-step process turns it into a series of manageable hills. This framework is your playbook, guiding you from that first spark of an idea all the way to a final, data-backed decision.

Think of it as a series of gates. You only move on to the next, more expensive phase if the project passes the current one. This approach is critical because it stops you from sinking a ton of capital into a project with a hidden, fatal flaw that a quick preliminary check could have easily caught.

Phase 1: Preliminary Screening

This is your first, quick-and-dirty assessment. The goal here isn't a deep dive; it's a high-level scan to spot any obvious deal-breakers before you pour serious time and money into the project. You’re essentially asking, "Is there any glaring reason this is a non-starter?"

Here’s what you’re looking at:

- Zoning Check: A quick look at the local zoning map. Does it even allow for what you want to build?

- Critical Infrastructure Review: Is there basic access to major roads? How far away are essential utilities like water and sewer lines?

- Obvious Physical Constraints: A glance at aerial maps can reveal major problems like extreme slopes or wetlands that could kill a project before it starts.

If a property gets a green light here, it’s earned the right to a more serious look.

Phase 2: In-Depth Market Research

Now that you’ve confirmed the basics, it’s time to validate your gut feeling about market demand. This phase is all about swapping assumptions for hard data. You need to be sure there’s a real, paying audience for whatever you plan to build.

Get specific. If you’re planning a residential subdivision, you’ll be digging into recent home sales, average days on market, and demographic trends for that exact area. For a commercial project, your focus would be on vacancy rates, what similar properties are leasing for, and local economic growth.

A project can be perfectly designed and legally sound, but it will fail if it's built for a market that doesn't exist. This step ensures your supply aligns with a proven demand, forming the economic backbone of your entire venture.

Phase 3: Comprehensive Due Diligence

This is where things get really intensive—and often, really complex. Due diligence is a meticulous, leave-no-stone-unturned investigation to uncover any hidden legal, physical, or environmental landmines that could derail the project. This is when you call in the experts: engineers, surveyors, environmental consultants, and attorneys.

It’s a significant investment, but it's your best defense against catastrophic surprises down the road. Think of it as a full-body MRI for the property.

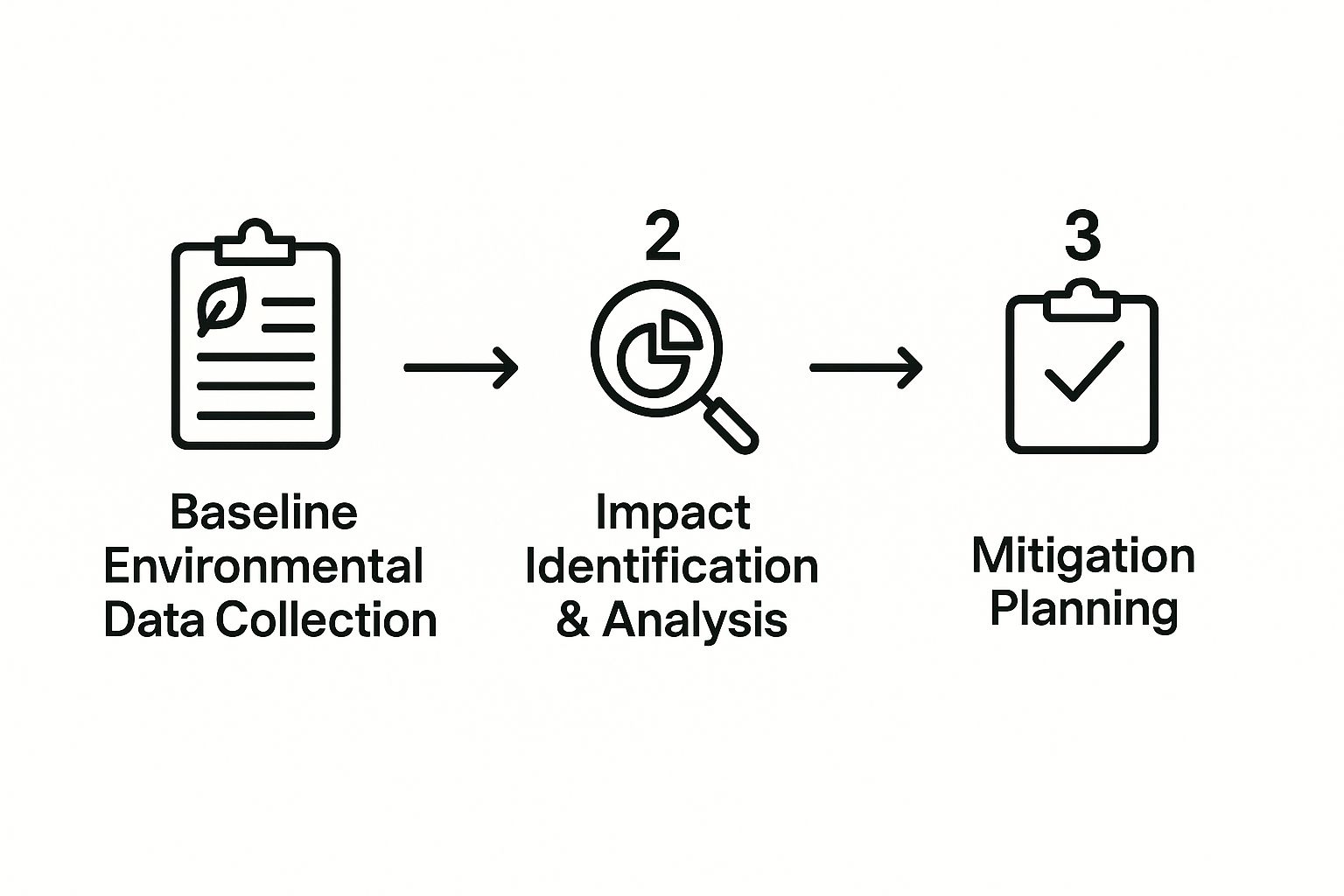

This visual shows the structured approach for the environmental part of due diligence, moving from data collection to actionable planning.

This process shows how a systematic environmental review identifies risks and helps you figure out how to solve them before they become six-figure problems during construction.

Phase 4: Financial Modeling

With a solid grasp of the site's condition and market potential, you're ready to build a detailed financial model, often called a pro forma. This is where you crunch the numbers to see if the project will actually be profitable. Using all the data you’ve gathered, you'll estimate every cost imaginable, from buying the land and paying for permits to the hard costs of construction.

Then, you project your potential revenue based on the market research. The model lets you calculate key metrics like Return on Investment (ROI) and run "what-if" scenarios. This sensitivity analysis shows how a spike in interest rates or a jump in material costs could impact your bottom line, making sure your project is built on solid financial ground.

Phase 5: The Final Recommendation

The last step is to pull everything together. You’ll synthesize all your findings into a single, cohesive report that ends with a clear "go" or "no-go" decision. This document summarizes the most important insights from each phase—the market demand, site challenges, financial projections, and all the risks you've identified.

But this isn't just a data dump. It’s a compelling story that lays out the project's full potential. It gives you and your investors the confidence to make that final, informed call, turning months of complex investigation into a decisive action plan.

To keep track of this entire process, a simple checklist can be invaluable. It ensures no critical step is missed as you move from one phase to the next.

Feasibility Study Phase Checklist

| Phase | Key Activities | Primary Outcome |

|---|---|---|

| 1. Preliminary Screening | Zoning review, utility access check, high-level site constraint analysis. | A quick "pass/fail" on the project's most basic viability. |

| 2. Market Research | Analyze sales comps, demographic trends, vacancy rates, lease rates. | Confirmation that a profitable market exists for the proposed project. |

| 3. Due Diligence | Site surveys, environmental assessments, title search, engineering reports. | A complete understanding of all physical, legal, and environmental risks. |

| 4. Financial Modeling | Cost estimation, revenue projection, ROI calculation, sensitivity analysis. | A clear picture of the project's financial viability and potential profit. |

| 5. Final Recommendation | Synthesize all data into a comprehensive report with a clear decision. | A final, data-backed "go" or "no-go" decision for stakeholders. |

This checklist acts as a high-level roadmap, ensuring each piece of the puzzle is in place before you commit to the next stage of investment.

Navigating Common Challenges and Costly Pitfalls

Every land development project is an exercise in navigating a minefield of potential risks. Even the most promising piece of ground can quickly turn into a money pit if you’re not careful. That's where a comprehensive land development feasibility study comes in—it’s your early warning system, designed to spot and neutralize these common pitfalls before they blow up your budget.

Think of it as a strategic stress test. The study is designed to poke holes in your assumptions and uncover the hidden weaknesses in your plan. Without this rigorous check, you're just gambling on a smooth ride in an industry known for its bumps.

Uncovering Hidden Site Issues

Some of the most expensive surprises are buried just beneath the surface. I've seen developers get excited about a seemingly perfect parcel, only to discover soil contamination from a long-forgotten industrial site. That discovery instantly triggers expensive remediation protocols and can sideline a project for months, sometimes years.

It's not just contamination. A site analysis might reveal nasty geotechnical problems, like unstable soil or a high water table, that demand serious and costly engineering workarounds. A good feasibility study flags these physical risks early, giving you the choice to either budget for the fix or walk away from a bad deal before you’re in too deep.

The Maze of Zoning and Entitlements

Zoning disputes are another classic project killer. It’s easy to assume a property is zoned for your intended use, but then you find yourself stuck in a long, expensive battle with the local planning commission over a minor variance or an obscure ordinance.

A proper study digs deep into local land use codes, flagging potential conflicts and mapping out a clear path through the approvals process. This legal due diligence is absolutely critical. It’s not just about knowing the rules; it’s about understanding the local political climate to create a realistic timeline for getting all your permits. This is where expert title professionals and skilled abstractors become invaluable, ensuring a property's legal history is clean before you commit.

A feasibility study transforms risk management from a reactive scramble into a proactive strategy. It systematically identifies potential threats—be they physical, legal, or financial—and provides the data needed to build resilience into your project plan from day one.

Volatile Markets and Underestimated Costs

Maybe the most dynamic threat of all is financial volatility. Underestimating construction costs is an incredibly common mistake, especially in a market where material prices and labor availability can swing wildly. A sudden spike in the price of lumber or steel can completely tear apart a well-laid budget.

This is where stress-testing your financial models is non-negotiable. The global landscape is currently being reshaped by supply constraints and rising costs, with commercial real estate in North America and Europe feeling the pinch. In 2025, factors like economic uncertainty and inflation have thinned supply pipelines and driven up construction expenses, making it harder for new projects to pencil out. For instance, developments relying on significant debt now face higher leverage costs than anticipated, impacting the ability to launch new schemes. Keeping an eye on how global real estate markets are shifting is crucial.

Misjudging Market Demand

Finally, even a perfectly built project can fail if you build something the market doesn't actually want. The market analysis component of your feasibility study is your best defense against building the wrong product for the right place. It’s about validating your assumptions about who your buyers are, what they’ll pay, and how fast they’ll show up.

By analyzing competitor projects and demographic trends, you can avoid common pitfalls like:

- Overbuilding a Niche: Building too many luxury condos in a market that's really crying out for mid-range family homes.

- Ignoring Local Trends: Designing a sprawling, car-dependent retail center when the local community is shifting toward walkable, mixed-use spaces.

- Missing Absorption Rates: Overestimating how quickly your units will sell or lease, leaving you with massive carrying costs that eat away at every dollar of profit.

By getting ahead of these challenges, a feasibility study gives you the strategic foresight to navigate the complexities of land development with confidence.

How Technology Is Reshaping Modern Feasibility Studies

Long gone are the days of wading through dusty file rooms, wrestling with manual spreadsheets, and chasing down physical records. Technology isn't just changing the land development feasibility study—it's completely reshaping it from a slow, paper-choked process into something faster, smarter, and far more insightful.

This isn't just about a few fancy new tools. We're talking about a fundamental shift. Data analytics platforms can now chew through massive datasets on market trends and demographics, uncovering opportunities that would have been impossible to spot otherwise. At the same time, Geographic Information System (GIS) mapping lets you overlay zoning, environmental, and topographical data onto a single, interactive map. What used to take weeks of painstaking work now takes minutes.

The Power of Specialized Software

But the real game-changer is the rise of specialized software built specifically to handle the headaches of land development. These platforms are designed from the ground up to manage the immense complexity and risk that comes with due diligence.

Instead of juggling dozens of disconnected files, endless email chains, and sticky notes, developers now have a central hub to:

- Automate checklists and keep track of every deadline.

- Bring critical documents like surveys, environmental reports, and title searches into one place.

- Cut through the noise of complex title and record searches with intelligent data extraction.

This technological leap couldn't come at a better time. The global land planning and development market is booming—valued at around USD 8.5 billion in 2024, it's expected to climb to USD 12.2 billion by 2033, all thanks to rapid urbanization. That kind of growth demands more efficient ways to get projects off the ground. You can dig into these market projections for more details.

Bringing Your Projects into Focus

This is exactly where a solution like TitleTrackr steps in. It tackles the core challenges of complexity and risk head-on by giving you a single, AI-powered platform that automates the most frustrating parts of due diligence.

By consolidating document management, automating data extraction, and simplifying title searches, modern platforms turn a chaotic process into a structured, predictable workflow. This empowers developers to make better, faster decisions with greater confidence.

With a tool like TitleTrackr, your team gets instant access to the information they need, when they need it. You can track progress on every single task and generate professional reports in seconds. It connects all the dots, giving you a clear, real-time view of your project's feasibility. This isn't just about saving time—it's about gaining the clarity you need to navigate complicated deals and come out on top.

Ready to see what this level of efficiency looks like for your next project?

Request a demo of TitleTrackr today and see the future of due diligence in action.

Frequently Asked Questions

Even after walking through the entire process, it's natural to have a few more questions pop up. A land development feasibility study is a complex beast, after all. Let's tackle some of the most common things developers, investors, and landowners ask to get you some extra clarity.

How Long Does a Feasibility Study Typically Take?

There’s no single answer here—it really depends on the project's size and complexity. For a small, straightforward plot of land, a preliminary look might only take a few weeks. But if you're looking at a large, mixed-use development that needs deep environmental studies or has to navigate tricky zoning laws, you could easily be looking at six months or more.

What stretches out the timeline? A few key things:

- Scope of the Project: Bigger, more detailed developments just have more moving parts to analyze.

- Regulatory Hurdles: Waiting for answers from local planning and zoning departments can seriously slow things down.

- Third-Party Consultant Availability: Good engineers, surveyors, and environmental experts are in demand, and getting them scheduled can impact your timeline.

What Is the Average Cost of a Feasibility Study?

Just like the timeline, the cost can be all over the map. A basic study for a simple project might only run a few thousand dollars. For a major commercial or residential development, though, the cost can climb into the tens or even hundreds of thousands. The price is tied directly to how deep you need to go and how many specialists you need to bring in.

It might feel like a big upfront expense, but it’s nothing compared to the cost of a failed project. Think of it as an insurance policy against a multi-million dollar mistake. The smartest money you'll spend is on reducing uncertainty.

Can a Project Still Fail After a Favorable Study?

Yes, absolutely. A positive feasibility study isn't a crystal ball. It does a fantastic job of flagging known risks and variables, but it can't predict the future. Things like a sudden economic downturn, a natural disaster, or even a political shift at city hall can still derail a project.

The real value of a thorough study is that it builds resilience. By stress-testing your financial models and creating contingency plans from the start, you're far better equipped to pivot when the market shifts or unexpected challenges pop up.

Is a Feasibility Study Legally Required?

For the most part, no, a feasibility study isn't something the government legally requires you to do. It’s a business requirement. Lenders, investors, and any developer who knows what they're doing will demand one. A bank will almost never sign off on a major land development loan without a comprehensive study to prove the project is viable and to protect their own investment.

If you're looking for more answers, head over to our complete FAQ page for additional insights. At the end of the day, the study is just smart due diligence that protects everyone involved.

A successful land development feasibility study comes down to managing a mountain of data and documents with absolute precision. TitleTrackr provides the AI-powered tools your team needs to automate due diligence, bring critical records into one place, and get the clarity required to make confident, data-backed decisions.

Request a demo of TitleTrackr and see how you can transform your project workflow.