So, you need a warranty deed. For industry professionals, the basic process is familiar: draft the legal document, get it signed by the grantor and notarized, then file it with the county. But the gap between knowing the steps and executing them flawlessly on every single deal is where efficiency is won or lost. This process is your client's ticket to securing the strongest possible guarantee against title claims, and your reputation depends on getting it right every time.

What a Warranty Deed Really Means for Your Clients

Before diving into the operational workflow, let’s reinforce the value you provide. A warranty deed isn't just a receipt for a real estate transaction; it’s a legally binding package of covenants from the seller to the buyer. This is the critical distinction you communicate to your clients.

It's a world away from a quitclaim deed, which merely transfers the seller's interest—whatever that may be—with zero guarantees. With a warranty deed, you are delivering robust, long-term protection that underpins the entire transaction's value.

Consider this scenario: you close a commercial lot, and five years later, an heir of a previous owner emerges, claiming partial ownership. With a warranty deed, your client is shielded. The seller who provided that deed is contractually obligated to defend the title, preserving the integrity of the original transaction.

The Six Covenants: Your Client's Built-In Protection

A general warranty deed is built on six core promises, or covenants, that the seller makes. These covenants are the bedrock of the deed's strength, making it the gold standard for property transfers and a testament to your thorough due diligence.

Here’s a quick-reference breakdown of the seller's promises.

Warranty Deed Covenants at a Glance

| Covenant Name | What It Guarantees for the Buyer |

|---|---|

| Covenant of Seisin | The seller confirms they actually own the property they're selling. |

| Right to Convey | The seller guarantees they have the legal authority to transfer the property. |

| Against Encumbrances | The seller promises the property is free of undisclosed liens or claims. |

| Quiet Enjoyment | The buyer's ownership won't be disturbed by someone with a superior claim. |

| Warranty | The seller will defend the buyer's title against any claims from third parties. |

| Further Assurances | The seller will sign any additional documents needed to perfect the title. |

These covenants provide comprehensive protection, covering both the property's status at closing and defending against future challenges.

Why This Level of Detail Is Non-Negotiable

For professionals in the title and real estate industry, these details define your work. The general warranty deed's comprehensive protection is why it’s standard, and it demands absolute precision from the title company or attorney drafting it. Every detail, from the legal description to name spellings, must be perfect.

A single mistake—a typo in a legal description or a missing signature—can create significant title clouds that take years and considerable expense to resolve. This is why leading professionals now leverage modern tools to standardize and de-risk the process.

This is where having a dialed-in, repeatable process becomes a competitive advantage. Platforms like TitleTrackr are engineered to eliminate these unforced errors from the start. This gives everyone in the workflow—from buyers to the title abstractors conducting deep-dive research—complete confidence in the integrity of the title. Ready to see how? Request a demo.

Preparing an Ironclad Warranty Deed

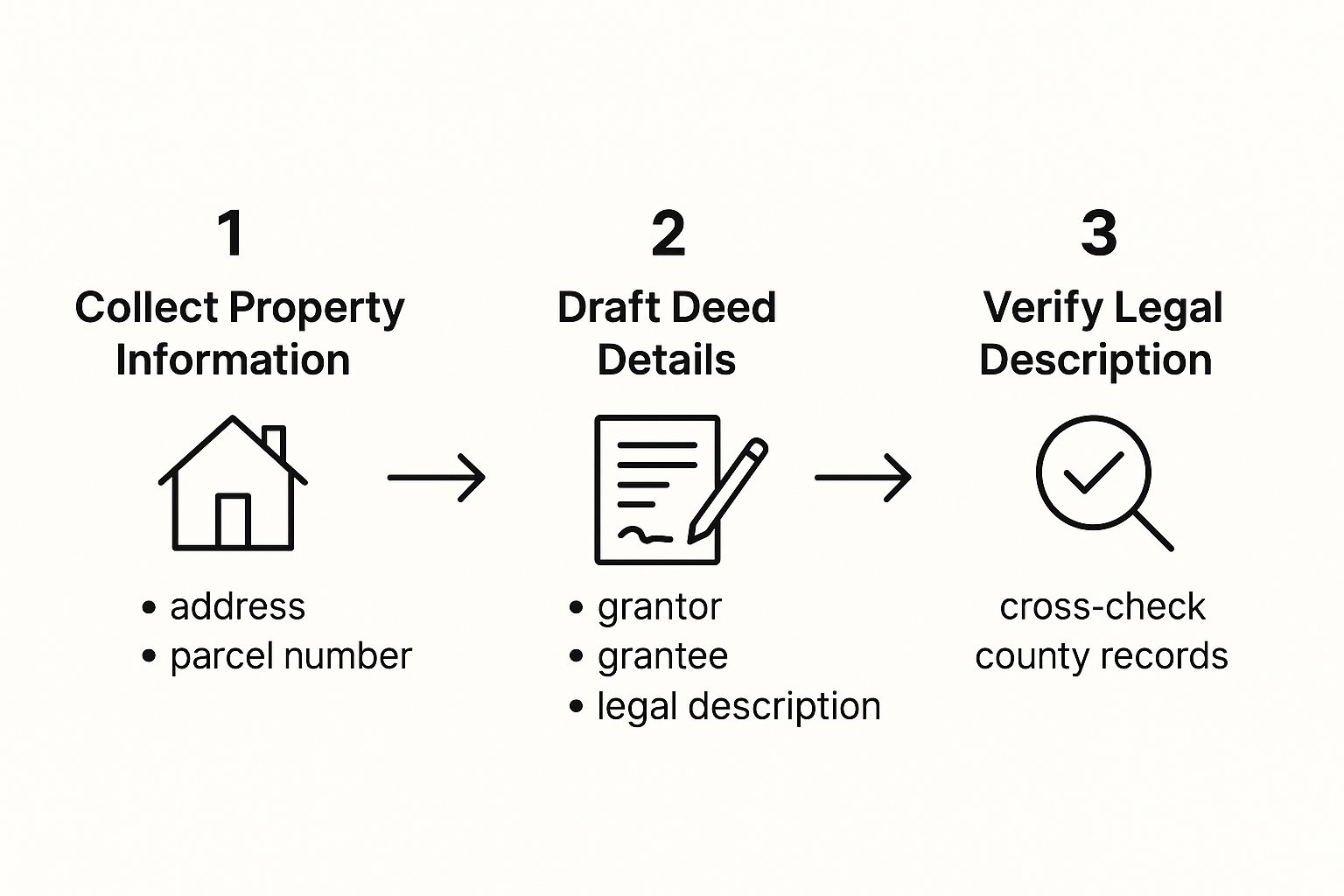

In the drafting stage of a warranty deed, precision is non-negotiable. A minor error here can snowball into a significant title issue years later. The objective for any professional is simple: create a legally sound document that is clear, accurate, and can withstand any future scrutiny.

Achieving this starts with correctly identifying all involved parties. This requires the full legal names of the grantor (the seller) and the grantee (the buyer). Nicknames or abbreviations are unacceptable and create validation problems that can delay or invalidate a recording.

Crafting the Core Components

With the parties clearly identified, the next critical element is the legal description of the property. This is far more than a street address; it's a specific, detailed description—using systems like metes and bounds or lot and block—that uniquely identifies the exact parcel of land being transferred.

A single typo in this section can cloud a title for decades, making the property a nightmare to sell or refinance. Imagine a surveyor discovering a boundary discrepancy because of a transposed number in a deed from twenty years prior. That's the kind of scenario that keeps title professionals on high alert.

Precision isn't just a best practice; it's the foundation of a clear title. The deed must leave zero room for interpretation about who is selling, who is buying, and exactly what property is changing hands.

Another key component is the consideration—the value exchanged for the property. This is typically the purchase price and must be clearly stated in the deed to validate the transfer.

Avoiding Unforced Errors in Deed Preparation

Mistakes in deed preparation are more common than many clients realize. While general warranty deeds are standard, data from the Texas Real Estate Research Center shows an estimated 30-40% of individual sellers attempt to prepare documents without professional help. This DIY approach is a recipe for errors that threaten a buyer's ownership security. You can find more insights on property deeds.

This is exactly why specialized platforms have become indispensable for industry leaders. Solutions like TitleTrackr are purpose-built to catch these common human errors before they cause downstream issues. They ensure every field is correctly populated and every legal description is verified, helping pros like oil and gas landmen maintain compliance and accuracy at scale.

When it comes to deeds, first-time accuracy is the only metric that matters.

Getting the Deed Signed and Notarized

A perfectly drafted warranty deed is worthless until it's properly executed. The signing and notarization ceremony transforms the document from a draft into a legally binding instrument. It’s a critical formality, and any misstep can invalidate the entire transfer.

The process begins with the grantor's signature. A common error is a signature that doesn't exactly match the printed legal name on the document. Using an initial instead of a full middle name, for example, is often enough to trigger a rejection from the county recorder's office, causing frustrating delays.

This is why verifying details before the signing appointment is a crucial part of any professional workflow.

As you can see, collecting correct information and double-checking it against official records is the bedrock of a valid deed. There's no room for shortcuts.

The Role of Witnesses and Notaries

Depending on state law, you will likely need witnesses present during the signing. The required number varies, so always confirm local statutes. Witnesses must be impartial third parties with no financial or other interest in the transaction.

Finally, the non-negotiable step: notarization. This process authenticates the grantor's identity and their signature. A notary public will verify the signer's ID, observe the signing, and affix their official seal or stamp to the document.

A deed without a proper notarization is invalid. Common errors include a notary forgetting their seal, using an expired commission, or failing to log the event correctly. These simple mistakes can create major headaches and liability.

These strict procedures exist to prevent fraud and ensure the transfer's legitimacy. Getting these verification steps right is paramount. This is where integrated platforms can build a digital safety net, creating checklists and flagging missing information to significantly reduce the risk of human error derailing a deal. See how TitleTrackr can streamline this for your team by requesting a demo.

Recording Your Deed to Make It Official

You’ve drafted the document and secured the signatures. But the warranty deed isn’t final until one last critical step is complete: recording. This action makes the property transfer a matter of public record, officially cementing the new owner's rights and protecting them from future claims.

Think of it as the ultimate safeguard for your client. Recording provides constructive notice that the property has a new, legitimate owner. It legally prevents the seller from attempting to sell the same property to someone else. For more on the legal protections this step offers, check out these insights on property deeds.

This simple act is your client's shield.

Locating the Right Office and What to Expect

To complete the process, you must file the deed with the County Recorder's Office—sometimes called the Register of Deeds or County Clerk. Critically, it must be filed in the county where the property is physically located. A quick online search can confirm the correct office and its specific requirements.

Before filing, you must be prepared for the fees. These are set at the county level and can vary significantly, often based on the number of pages. A call or visit to the county’s website is a smart move to confirm costs and accepted payment methods.

Turnaround times are a huge variable. Some counties might record a deed the same day it's submitted. In others, backlogs can mean waiting several weeks. That delay creates a risky gap where the property's title is vulnerable and your deal is in limbo.

Navigating Recording Bottlenecks

This recording phase can become a frustrating operational bottleneck, especially for professionals managing multiple transactions. The uncertainty of when a deed will officially be recorded can add significant stress and even delay closings.

This is where modern solutions provide immense value. A platform like TitleTrackr can slash through the recording process with e-filing capabilities and real-time status updates. For professionals managing a portfolio of properties, this removes the guesswork. You gain the certainty that the final, crucial step in securing that warranty deed is completed correctly and efficiently.

Don't Let These Costly Deed Mistakes Derail Your Transfer

Even seasoned professionals can get tripped up by the details of preparing a warranty deed. It’s a process where one small oversight can bring a transfer to a halt. The real challenge is that most of these pitfalls are entirely avoidable with the right systems in place.

One of the most common blunders is an outdated or incorrect legal description. A property’s boundaries may have been adjusted by a recent survey, and failing to use the latest information creates a serious cloud on the title. Another classic mistake is failing to identify and clear every lien. That’s a problem guaranteed to haunt the new owner and reflect poorly on the professionals involved.

Proactive Checks to Keep Your Title Clean

The only way to avoid these headaches is through a proactive, systemized approach. Always cross-reference the legal description against the most recent county records and surveys. A thorough title search is non-negotiable for unearthing any hidden encumbrances that must be resolved before closing.

Here are a few other common missteps to build checks for in your workflow:

- Improper Notarization: A missing seal, an expired commission, or a signature mismatch can invalidate the entire document.

- Recording Delays: You can't just sign the deed and consider the job done. Failing to file it promptly with the county recorder leaves the property exposed to competing claims.

A small oversight today can easily balloon into a five-figure legal battle tomorrow. Your value as a professional lies in catching these issues before they become problems.

Ensuring you follow proper procedures dramatically cuts the risk of title defects. While these issues only affect around 1% of real estate transactions, getting caught in that 1% can lead to astronomical litigation costs. You can learn more about how a warranty deed protects you.

This is precisely where a tool like TitleTrackr becomes an essential safety net for your business. It uses smart automation to flag inconsistencies and ensure every detail is finalized before you file, protecting your work, your clients' assets, and your reputation.

Got Questions About Warranty Deeds? We’ve Got Answers.

Even with a clear process, specific questions about warranty deeds are inevitable. The nuances can challenge even experienced professionals, so let's clarify some of the most common points of confusion.

General vs. Special Warranty Deeds

This is a critical distinction, and the confusion is understandable. While they sound similar, the level of protection they offer is fundamentally different.

A general warranty deed is the gold standard. It represents the seller’s promise that the title is clean throughout the entire history of the property—not just during their ownership. This is a comprehensive, lifetime guarantee against all claims.

In contrast, a special warranty deed is more limited. The seller only guarantees the title against issues that arose during their period of ownership. If a claim from a previous owner emerges, the new buyer is responsible for resolving it.

The choice between deed types fundamentally changes the level of risk a buyer assumes. As a professional, your ability to clearly explain this difference is key to advising your clients effectively.

Can I Just Prepare a Deed Myself?

While technically possible in some states, it's a high-risk endeavor. Real estate law is a minefield of hyper-specific requirements that vary by jurisdiction. A single mistake in the legal description or a missed signature requirement can create a "cloud" on the title—a significant and expensive legal problem. Using a qualified real estate attorney or a purpose-built platform is always the safer, more professional route.

For a deeper dive, you can check out our full FAQ on title and deed topics.

So, How Long Does Recording Take?

This is the classic "it depends" answer that frustrates every professional in the field. The time it takes for a deed to be officially recorded varies wildly between counties.

In-person filing might result in on-the-spot recording, but if the office is backlogged, the wait could be weeks. This unpredictability is a major industry pain point. It’s exactly why so many professionals now rely on e-recording services to accelerate the process and get a clear tracking trail, so you know the moment the transaction is officially on the books.

Managing the complexities of deeds, titles, and recording shouldn't be a bottleneck for your business. TitleTrackr uses AI-driven workflows to ensure every document is accurate and filed efficiently, giving you confidence and control. See how TitleTrackr works by requesting a demo today.