When you boil it down, every single real estate deal involves two key players: the grantor and the grantee. It’s a simple concept, really. The grantor is the one selling or transferring the property, and the grantee is the one buying or receiving it. This give-and-take is the heart of every property transaction, and mastering its nuances is what separates efficient title professionals from the rest.

The Core Roles in Property Transfers

Think of it like a relay race, but instead of a baton, the runners are passing the property title. The grantor is the runner finishing their lap, handing off the title. The grantee is the next runner in line, ready to grab it and take over as the new owner.

Of course, this handoff is a lot more formal than a simple handshake—it’s a legal process documented in a deed. The entire system of property law is built on this foundation. A grantor legally conveys their rights, and the grantee receives those rights, making the deed the critical piece of paper that makes the whole thing official and binding. For industry professionals, ensuring this handoff is flawless is not just a goal; it's a requirement for every transaction.

To help you keep these two straight, here’s a quick breakdown of their roles.

Grantor vs Grantee At a Glance

This table sums up the fundamental differences between the two parties in a typical property sale.

| Aspect | Grantor (The Giver) | Grantee (The Receiver) |

|---|---|---|

| Primary Role | Sells or transfers the property. | Buys or receives the property. |

| Action | Signs the deed to convey ownership. | Accepts the deed to take ownership. |

| Legal Status | Must be the legal owner with the right to sell. | Becomes the new legal owner of record. |

| Key Responsibility | To legally transfer the title as promised. | To be clearly and correctly named on the deed. |

Getting these roles right is non-negotiable for a clean, secure transfer of ownership. Any error can create friction, delays, and costly rework.

Defining the Key Participants

Let’s dig a little deeper into what each person does.

-

The Grantor: This is the party giving up their interest in the property. They absolutely must have legal ownership and the clear right to transfer it. Their main job is to sign the deed, which makes the whole deal official.

-

The Grantee: This is the party on the receiving end. As the new owner, their name must be spelled out perfectly on the deed to establish their legal claim to the title.

For title searchers and abstractors, accuracy here is everything. Any mistake or bit of confusion in identifying the grantor or grantee can create massive headaches and legal problems years down the road. It underscores the vital, high-stakes work performed by abstractors who ensure every detail in the chain of title is correct—a process where modern tools can eliminate human error and provide a competitive edge.

Why This Relationship Is the Bedrock of Property Law

The whole concept of the grantor and grantee might sound like dry legal jargon, but it’s actually the structural support for all property ownership. Every single time a property changes hands, the deed naming the grantor and grantee gets officially recorded. This simple act creates another link in what we call the chain of title.

Think of the chain of title as a property's official biography. It’s the complete, verifiable history of every owner, stretching from the very first one all the way to the present day. A clean, unbroken chain isn't just nice to have—it's the ultimate defense against fraud and the key to settling any ownership disputes that might pop up.

This unbroken record is what gives the real estate market its stability and predictability. A single bad link—whether it’s missing, fraudulent, or just flawed—can blow up an entire transaction, turning a profitable deal into a legal nightmare.

This is exactly why a meticulous title search is non-negotiable for any real estate deal. The whole point is to confirm that the grantor actually has the undisputed right to transfer the property in the first place.

The Power of the Public Record

Each recorded deed does more than just transfer property; it publicly reinforces the new grantee’s claim to ownership. This formal recording process has a massive impact on market transparency. In the United States, counties will often record hundreds of thousands of deeds every year, with each one clearly detailing the grantor and grantee to keep the public record straight. These records are the front line in preventing legal battles. You can learn more about how public data strengthens property markets.

Modern digital systems have definitely sped things up. Automated searches for grantor and grantee names allow title professionals to trace ownership history way faster than they ever could with old-school manual methods.

But speed isn't everything. It’s the accuracy of each link in that chain that truly matters. One tiny error—a misspelled name, a wrong legal description—can create a cloud on the title and introduce serious risks for the new owner down the road. This is where the real value of a precise title verification platform shines. It’s not just about pushing papers; it’s about securing a client’s most valuable asset with technological precision.

How Different Deeds Impact Grantee Protections

Not all property deeds are created equal. Far from it. The type of deed a grantor uses to hand over a property has massive implications for the grantee, defining the exact promises and legal protections they receive. For professionals, explaining these differences is key to managing client expectations and mitigating risk.

Think of it like buying a used car. A General Warranty Deed is the equivalent of getting a full, bumper-to-bumper warranty from a certified dealer. This deed offers the strongest protection possible. The grantor guarantees a clear title for the entire history of the property, promising to step in and defend the grantee against any and all claims that might pop up, no matter how old they are.

The Spectrum of Grantor Promises

A Special Warranty Deed, on the other hand, is more like a limited warranty. The grantor is only guaranteeing that they didn't cause any title problems during their period of ownership. They're making zero promises about what happened before they came along, which could leave the grantee on the hook for older, undiscovered issues. It’s a decent level of protection, but it has its limits.

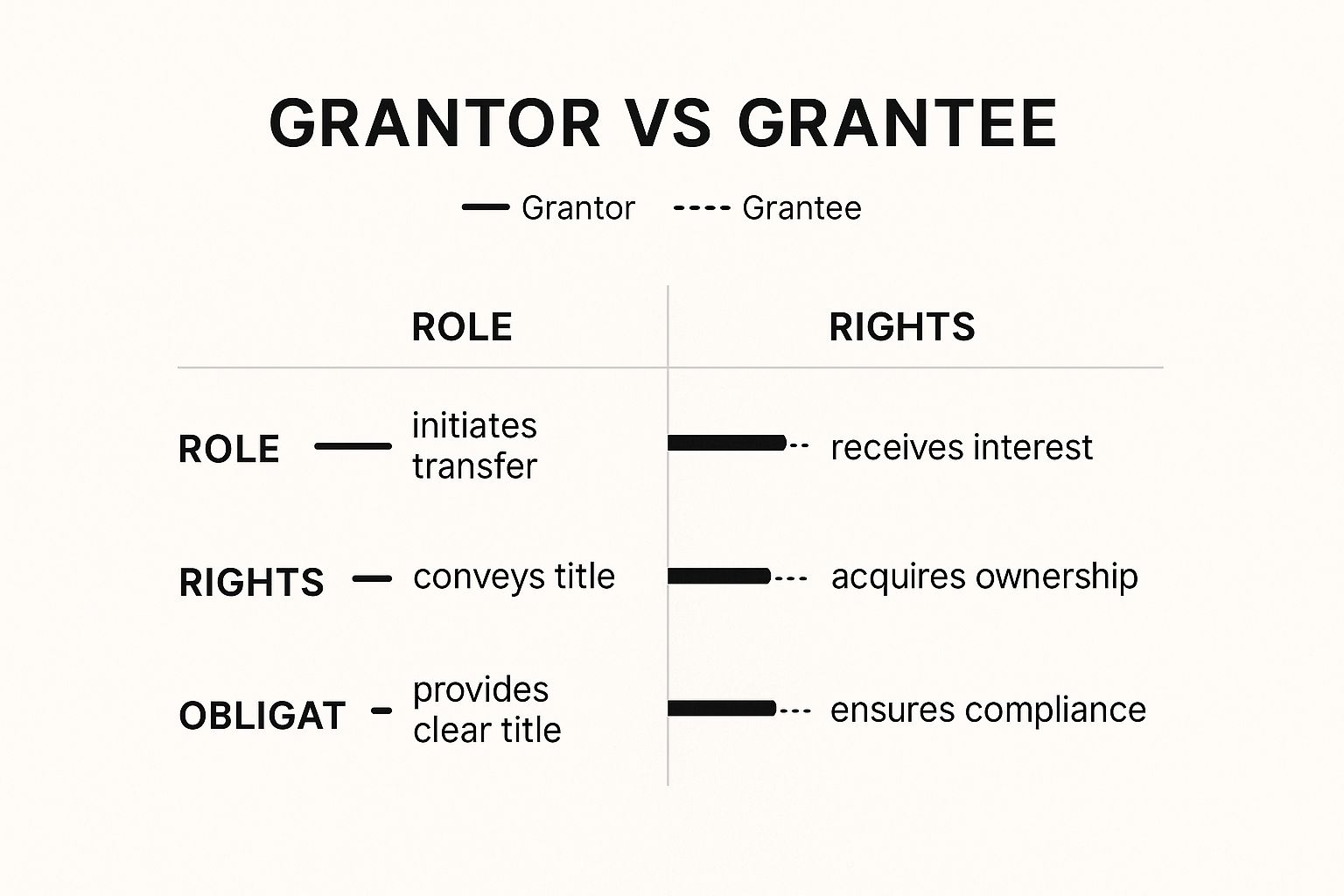

This infographic breaks down the essential roles and responsibilities that shape the relationship between a grantor and grantee in any property deal.

As you can see, the grantor’s core duty is to deliver a clear title. This obligation directly shapes how secure the grantee's ownership really is.

Understanding the Risks with Quitclaim Deeds

Then you have the Quitclaim Deed. This is the "as-is" sale of the real estate world. It comes with absolutely no guarantees. The grantor is simply transferring whatever interest they might have in the property—which could be full ownership, a partial stake, or even nothing at all.

A quitclaim deed provides zero protection for the grantee. It's often used between family members to transfer property or to clear up minor title clouds, but it's by far the riskiest way to buy real estate in a standard transaction.

To help clarify the differences, this table lays out what a grantee can expect from each common deed type.

Comparing Deed Protections for the Grantee

| Deed Type | Grantor's Promise | Level of Protection for Grantee |

|---|---|---|

| General Warranty Deed | Guarantees clear title for the property's entire history. | Highest |

| Special Warranty Deed | Guarantees clear title only during their ownership period. | Medium |

| Quitclaim Deed | Makes no promises; transfers whatever interest they have. | None |

Ultimately, the legal weight of each deed type is significant. Grant deeds, warranty deeds, and quitclaim deeds all serve different purposes. Sorting through these complexities is a daily challenge for real estate professionals, especially for the landmen who work tirelessly to secure clear land rights for energy and development projects. Having the right technology to quickly identify deed types and associated risks is a game-changer.

Common Red Flags in Grantor and Grantee Records

While the idea of a grantor and grantee seems simple enough, the real-world records telling their stories are often messy. We’re not talking about minor typos here. These are legal landmines that can blow up a property’s title and stop a closing dead in its tracks. A single mistake can snowball into massive financial and legal headaches.

Think about it. A grantor, "Jon Smith," sells a property, but the deed accidentally records his name as "John Smith." It seems small, but years down the line, a title search slams into a brick wall. The chain of title looks broken because the seller's name doesn't match the previous grantee's record. Just like that, you’ve got a cloud on the title that has to be cleared before the property can ever be sold again.

Critical Issues to Watch For

These little errors are notorious for causing big problems. They aren't just clerical slips; they're complex puzzles that demand absolute precision—and the right tools to solve them without wasting everyone's time. Here are some of the most common red flags title professionals run into every day:

- Name Discrephonies: Misspelled names, inconsistent middle initials, or name changes from marriage or divorce can make tracing the true line of ownership a nightmare.

- Breaks in the Title Chain: A missing deed from a past sale creates a huge gap in the property's history. Without that link, the current grantor has no way to prove they ever received a clear title to pass on.

- Unrecorded or Improperly Filed Deeds: If a grantee forgets to record their deed with the county, it’s like the transfer never officially happened. This leaves them wide open to other claims against the property.

- Surprise Liens or Encumbrances: A lien from a prior owner's unpaid taxes or an old contractor's bill can stick to a property for years, becoming the new grantee’s problem if it isn't caught.

Each of these issues is a potential deal-killer. Fixing them means digging through records, getting legal clarification, and dealing with significant delays that frustrate everyone involved.

The real challenge is that these mistakes are buried in decades of public records. Trying to manually spot a misspelled name from 40 years ago or find an unrecorded easement is incredibly time-consuming and dangerously prone to human error. This is exactly why modern title work demands a more powerful approach.

At TitleTrackr, we built our platform to spot these red flags instantly. Request a demo to see how our AI-driven system untangles these complex title histories with speed and accuracy, letting your team focus on closing, not chasing clerical errors.

How Technology Is Modernizing Title Verification

Not too long ago, verifying a title meant spending hours—sometimes days—sifting through dusty ledgers in a county records office. It was a painstaking, manual process that was not only slow and expensive but also dangerously prone to human error.

A single missed document or a misinterpreted entry could put an entire deal in jeopardy. This traditional approach has long been a major bottleneck for title companies, law firms, and lenders who need to move quickly but can't afford to compromise on accuracy.

Thankfully, those days are over. Modern automation is finally tackling these age-old problems head-on. Today’s sophisticated systems can digitize and analyze millions of public records in mere moments, instantly piecing together the complete grantor-grantee chain of title. This isn't just about being faster; it's about achieving a level of precision that was never possible before.

The Shift to Automated Assurance

So, how does it work? Automated title verification platforms systematically scan documents, pull out key data points, and spot inconsistencies that even a trained eye might miss. The technology brings a whole new level of certainty to the table.

- Mapping Ownership Chains: AI-driven tools instantly connect every grantor and grantee in the property's history. They build a clear, chronological map of ownership without any manual cross-referencing.

- Flagging Inconsistencies: The system acts like a second set of eyes, automatically flagging potential red flags. Think name variations, gaps in the title history, or missing signatures—directing attention to the exact areas that need an expert review.

- Eliminating Human Error: Let's be honest, repetitive data entry is where mistakes happen. By automating the grunt work of data extraction and comparison, these systems dramatically cut the risk of clerical errors that can cloud a title.

This shift from manual searching to intelligent verification means that title professionals can close deals faster and with far greater confidence. It transforms a high-risk, time-consuming task into a reliable, efficient part of the workflow.

This kind of automation doesn't just save time—it provides a profound level of assurance. With the ability to instantly verify the grantor-grantee relationship and uncover hidden issues, firms can deliver cleaner titles and more secure transactions for their clients.

At TitleTrackr, our platform is built to provide this exact level of clarity and control. We turn complex, tangled record searches into a straightforward, streamlined process, empowering you to operate with unmatched speed and accuracy.

Frequently Asked Questions About Grantors and Grantees

Even when you’ve got a solid grasp on the basics, real-world property deals can throw some curveballs. Let’s tackle a few of the most common questions that pop up about grantors and grantees to make sure these key concepts are crystal clear.

Can a Grantor and Grantee Be the Same Person?

Believe it or not, yes. This happens all the time, especially when someone is setting up their estate plan.

Imagine you own a property in your own name. You might act as the grantor to transfer that property into a new legal structure you control, like a living trust or an LLC you've created. In that scenario, your trust or company becomes the grantee. You're essentially passing the property from one of your pockets to another for better liability protection or tax planning.

What Happens If a Deed Is Not Recorded?

An unrecorded deed can still be a perfectly valid contract between the grantor and grantee. The real problem is that it doesn’t provide public notice of the ownership change—and that’s a huge risk for the new owner.

If the deed isn't recorded, a shady grantor could technically sell the property again to someone else. If that second buyer records their deed first, they could potentially snatch away the title. Recording is what makes your ownership official and protects you from these kinds of claims.

This act of public recording is what solidifies a grantee's place in the chain of title. It officially announces their ownership rights to the world, making their claim legally defensible against others. For industry professionals, ensuring timely and accurate recording is a core part of protecting their clients' interests.

Does Signing a Deed Immediately Transfer Ownership?

Not quite. It's a critical step, but a few more things need to happen. For the transfer to be legally complete, the deed must be:

- Signed by the grantor.

- Delivered to the grantee.

- Accepted by the grantee.

The physical "delivery" of the deed is what shows the grantor's intent to make the transfer final. Once those three things happen, the ownership has moved between the two parties. But recording the deed is the final, crucial step that protects that new ownership from everyone else and truly secures the grantee’s investment.

Understanding the grantor-grantee relationship is the bedrock of a clean, defensible title. But knowing is only half the battle. Executing flawless title searches quickly and efficiently is what truly sets your business apart. At TitleTrackr, our platform automates this entire verification process, helping you spot potential issues with incredible speed and accuracy. Request a demo of TitleTrackr today to see how you can bring total clarity to your title workflows and accelerate your closings.