Think of a title report as a property's official background check. It's the essential legal document that verifies who really owns a piece of property and uncovers any hidden issues before a deal closes. You wouldn't buy a used car without checking its history, right? This report does the exact same thing for real estate, revealing a property's complete story and preventing very expensive surprises down the road. For professionals in real estate and energy, a fast, accurate title report is the bedrock of every successful transaction.

Your Guide to Understanding a Title Report

Imagine buying a property, only to find out later that the seller didn't have the right to sell it, or that a construction company still has a claim against it for unpaid work. It sounds like a nightmare, but these scenarios are exactly what a title report is built to prevent. It's a non-negotiable part of due diligence for any serious investor, lender, or energy professional. Simply put, it's the foundation of a secure and transparent property transfer.

This document is meticulously designed to lay out all the critical information about a property's ownership and legal standing, making sure the title is "clean" and free of defects that could sink its value. A comprehensive report will cover everything from county records and zoning laws to tax details, the official legal description, the chain of ownership, and any open mortgages or liens. The speed and accuracy with which this information is gathered can make or break a deal.

The fact that nearly all mortgage lenders require one tells you everything you need to know about its importance—it's how they protect their investment, and it’s how you should protect yours.

The Purpose of a Title Report

At its core, a title report serves a few critical functions that safeguard everyone involved in a transaction. Its primary mission is simple but crucial: to confirm the seller has the legal authority to actually sell the property. This verification isn't just a quick search; it's a deep dive into public records handled by professional abstractors.

Beyond just confirming ownership, the report is designed to:

- Identify Liens and Encumbrances: It unearths any claims hanging over the property. Think unpaid property taxes, liens from contractors who were never paid, or outstanding mortgages that must be settled before the sale.

- Reveal Easements and Restrictions: The report details any rights others might have to use a part of the property—like a utility company’s right to access power lines. It also spells out any restrictions on how the land can be used.

- Provide a Clear Legal Description: It gives you the official boundary and location details of the property, which is absolutely critical for preventing messy disputes over property lines.

A clean title report provides peace of mind. It confirms that the property you are acquiring is free from unexpected claims, giving you confidence that your investment is secure and marketable for the future.

Key Information Found in a Title Report

To give you a clearer picture, a title report is like a puzzle, with each piece of information contributing to the full view of the property's legal health. Below is a quick breakdown of what you'll typically find inside.

| Information Category | What It Reveals |

|---|---|

| Legal Description | The property's official boundaries, as recognized by the county. |

| Property Taxes | The current tax status, including assessed value and any unpaid taxes. |

| Chain of Title | A chronological history of all past owners, showing a clear line of ownership. |

| Mortgages & Liens | Any outstanding loans, judgments, or other financial claims against the property. |

| Easements | Rights granted to others to use the property for a specific purpose (e.g., utility lines). |

| Covenants & Restrictions | Rules and limitations on how the property can be used or developed. |

Ultimately, each of these elements helps ensure there are no legal skeletons in the closet that could jeopardize your ownership down the line.

How to Read a Title Report Like a Pro

At first glance, a title report looks like an intimidating stack of legalese. But it’s not just paperwork—it’s the biography of a property. Understanding how to read it is the key to unlocking that story and moving forward with confidence.

The report is usually broken down into a few key sections, each one peeling back another layer of the property’s legal and financial history. It starts with the basics, like the legal description, before diving into the more complex parts of its ownership journey.

The Core Components of the Report

The first big section you'll run into is the chain of title. Think of this as the property's family tree, showing a chronological list of every single owner. What you’re looking for is a clean, unbroken chain. Any gaps or weird transfers are red flags that could point to an ownership dispute that needs a closer look.

Right after that, you’ll find a list of items that need your attention. One of the most important parts is the schedule of exceptions, which is basically a list of everything the title insurance policy will not cover.

This schedule is where the real detective work begins. It’s your roadmap to understanding the specific risks tied to the property, from old debts to rights held by other people.

Translating Common Title Jargon

To really get what’s in a title report, you have to speak its language. The schedule of exceptions is often loaded with terms like liens, encumbrances, and easements. Each one represents a potential claim or restriction on the property that could impact its value and how you can use it.

Here’s a quick rundown of what these terms actually mean:

- Liens: These are financial claims against the property. It could be an unpaid tax bill from the IRS or a mechanic’s lien from a contractor who never got paid. These have to be settled before the property can be sold with a clear title.

- Encumbrances: This is a catch-all term for any claim or liability attached to the land. A lien is a type of encumbrance, but so are mortgages and court judgments.

- Easements: This gives someone else the right to use a part of your property for a specific reason. A classic example is a utility easement, which lets the power company access lines running through the backyard.

Early in a transaction, you'll get a preliminary title report. This document outlines what a future title insurance policy will cover and, more importantly, what it won't. It usually arrives during the escrow period, giving buyers a window of about 30 to 60 days to review everything and sort out any issues. If you want a deeper dive, Masterclass.com has a great article on the role of this report.

Why Title Reports Matter Across Industries

The need for a clean title isn't just for buying your first home. It’s a fundamental risk management tool across some of the biggest professional sectors out there. While the goal is always the same—confirm ownership and spot any red flags—the stakes and complexity skyrocket in commercial and energy deals.

In these high-value environments, a title report isn't a box to check. It's the very foundation of a sound investment. Skipping this step or cutting corners can lead to financial and legal disasters you can't walk back from.

Safeguarding High-Value Commercial Real Estate

When you get into the world of commercial real estate, you’re not dealing with individual homeowners anymore. Properties are often owned by complex entities like LLCs or partnerships, adding tangled layers to the ownership structure that a title report has to carefully unravel. And, of course, the financial stakes are exponentially higher. Meticulous due diligence isn't just a good idea; it's essential.

For a commercial investor, a title report does far more than just confirm who owns the place. It's the document that uncovers zoning restrictions that could kill a development project before it starts. It identifies existing leases that the new owner must honor and flags restrictive covenants that limit how the property can be used.

In fact, research shows that failing to conduct a thorough title investigation leads to major investment losses in up to 15% of commercial property deals every year. By catching these issues early, investors have the power to renegotiate the terms or, better yet, walk away from a bad deal entirely. You can explore more insights on how title reports impact commercial deals and protect investments by reading the full research.

For a commercial developer, an undiscovered easement could mean a planned building footprint is suddenly unworkable. A detailed title report is the only way to ensure the land can be used exactly as intended.

Securing Assets in the Energy Sector

The energy sector is another place where title reports are absolutely indispensable. Think about it: for oil and gas companies, renewable energy developers, and massive infrastructure projects, their entire business model depends on securing clear, defensible rights to land.

A title report is the tool they use to verify ownership of not just the surface of the land but, crucially, the mineral rights underneath it. Can you imagine investing millions to drill a well, only to find out another company owns the rights to everything you pull out of the ground? It happens.

Beyond mineral rights, these reports are the bedrock for:

- Acquiring Land: Whether it's for a sprawling solar farm or a field of wind turbines, developers need absolute certainty that they are buying from the rightful owner, free and clear of any competing claims.

- Negotiating Rights-of-Way: Building pipelines, transmission lines, or even simple access roads means securing easements across dozens, sometimes hundreds, of properties. Title reports are used to identify every single legal owner along the proposed route.

- Preventing Disputes: A clear title history is the best defense against costly legal battles over ownership, access, or resource rights that can pop up years after a project is finished.

In both commercial real estate and energy, a comprehensive title report is the ultimate safeguard. It’s what protects massive investments from the kind of unforeseen problems that can bring a project to its knees.

The Old Way vs. The New Way of Title Searches

The world of title reports is undergoing a massive shift. For decades, pulling a property’s history was a painstaking, manual chore that felt more like detective work than a modern business process. This meant long hours, sometimes days, spent digging through dusty county record books, deciphering fragile documents, and piecing everything together by hand.

This old way of doing things is inherently slow and packed with risk. A single missed document or a misinterpreted entry could create a critical error, leading to expensive delays or, even worse, a defect that kills the entire deal. The whole process hinged on the meticulousness of one person, making it vulnerable to human error from start to finish.

The Traditional Title Search Grind

Picture this: a title abstractor walks into the county courthouse armed with nothing but a legal description. Their day is a marathon of pulling heavy ledger books off shelves, trying to make sense of handwritten deeds from the 1800s, and manually cross-referencing old tax maps. Every single document has to be tracked down, reviewed, and copied one by one.

It’s a process defined by its limitations:

- Painfully Slow: A search could easily drag on for days or even weeks, especially for properties with a long, complicated past.

- High Risk of Error: Overlooking a lien, misreading a name, or getting a legal description wrong could have serious financial blowback.

- Geographic Handcuffs: Researchers were often stuck working in a single county, which made it nearly impossible to scale operations or handle properties in unfamiliar territory.

This built-in inefficiency created a major bottleneck in real estate and energy transactions, where speed and accuracy are everything.

The Modern Solution with AI Automation

Now, technology is completely flipping the script. Modern solutions driven by AI automation are replacing that slow, manual grind with intelligent, high-speed analysis. Instead of camping out in a courthouse for days, professionals can now access and analyze records digitally in a tiny fraction of the time.

Take a look at how the two approaches stack up.

Traditional Title Search vs AI-Powered Automation

| Feature | Traditional Process | AI-Powered Automation (TitleTrackr) |

|---|---|---|

| Speed | Days or weeks | Minutes or hours |

| Accuracy | Prone to human error | High precision with automated flagging |

| Data Access | Manual retrieval from physical records | Instant access to digital data sources |

| Scalability | Geographically limited and hard to scale | Easily scalable across multiple counties |

| Cost | High labor and time costs | Reduced operational costs |

| Risk | High risk of missed liens or defects | Minimized risk with comprehensive checks |

Platforms like TitleTrackr use AI to instantly pull data from countless sources, intelligently analyze legal documents, and automatically flag potential risks. This isn't just about doing the same work faster—it’s about reaching a level of accuracy and efficiency that was simply out of reach before.

The new way of title searching transforms the process from a labor-intensive chore into a strategic advantage. It allows professionals to focus on resolving issues rather than just finding them.

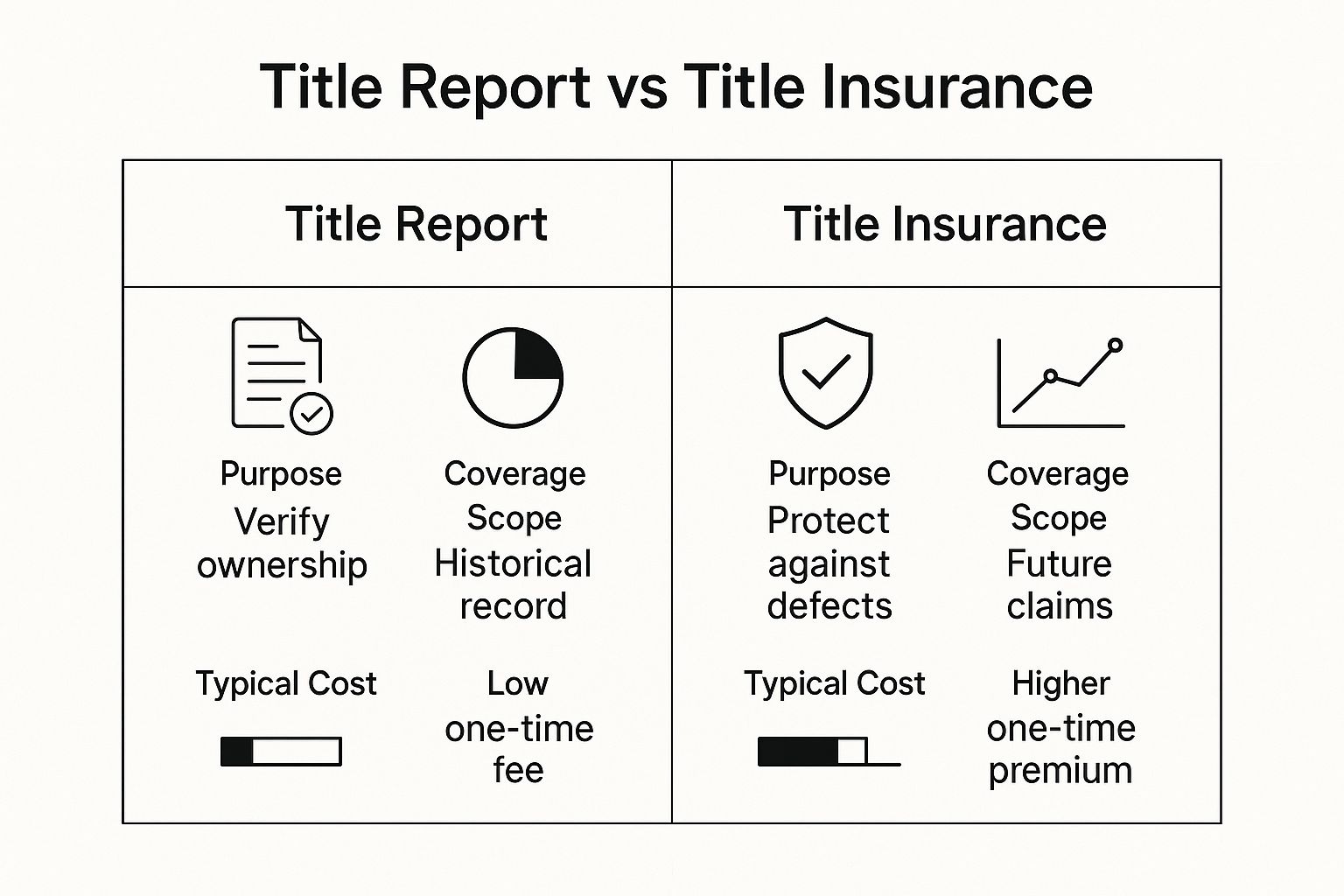

This infographic does a great job of showing the difference between a title report (the result of the search) and title insurance (the protection that comes after).

As you can see, the title report uncovers the past, while title insurance protects you from any surprises that past might hold.

Ultimately, AI automation delivers unmatched speed, superior accuracy, and greater efficiency, solving the legacy problems that have held the industry back for so long. For energy professionals, the ability to quickly clear title on multiple parcels at once is a total game-changer. You can learn more about how this technology directly impacts landmen and their workflows. By embracing AI, companies aren’t just getting new tools—they’re fundamentally changing how they do business.

How Automated Title Reports Give You a Serious Competitive Edge

In a market where speed and certainty win deals, moving faster and with more confidence isn't just a nice-to-have—it's everything. Automation is what gives you that power. It turns the title report from a roadblock into a tool that helps you close deals before the competition even gets their paperwork back.

The real value here isn't just about saving a few hours. It’s about completely changing how you operate, turning old-school problems like project delays and surprise title defects into massive opportunities.

Say Goodbye to Long Turnaround Times

The most immediate win is how drastically you can shrink your timelines. Manual searches can drag on for days, sometimes even weeks. But an AI-powered system? It can generate a full report in a tiny fraction of that time.

This speed means you can make decisions faster, get your offers in sooner, and lock down transactions while others are stuck waiting. For real estate investors, this is the difference between snagging a great opportunity and watching it disappear. For energy developers, it’s how you fast-track land acquisition and keep huge infrastructure projects on schedule and on budget.

Lower Your Costs, Raise Your Margins

When you automate the grunt work of the title search process, your operational costs drop. Plain and simple. Fewer hours spent digging through documents and double-checking details go straight to your bottom line.

This efficiency lets your team take on a much higher volume of work without needing to hire more people, allowing you to scale your business in a way that just wasn't possible before. These aren't just small savings, either. They boost your profit margins on every single deal, freeing up cash you can put right back into growing your business.

The real competitive edge comes from what you do with all that reclaimed time. Instead of spending 90% of your time just finding information, you can now spend it analyzing that information and making the kind of strategic moves that put you ahead of the market.

Better Accuracy Means Less Risk

Let's be honest, human error is a real risk in any manual process. One missed lien or a badly interpreted legal description can blow up a deal, leading to expensive legal fights or even a voided transaction. Automated systems bring that risk way down.

By applying a consistent, rules-based analysis to every single document, these tools can flag potential problems with a precision that’s almost impossible to match manually. This gives you a critical layer of protection against things like:

- Blown Deadlines: Reliable reports mean you stay on track.

- Budget Overruns: Catching problems early saves you from costly fixes later on.

- Legal Headaches: A more accurate report is your best defense against future claims.

Platforms like TitleTrackr were built to solve exactly these problems, giving your team the ability to move with speed and confidence that your competitors can't match. By turning a manual workflow into a strategic advantage, you can consistently outperform the competition. Ready to see how it works? Request a demo today.

Solving Common Title Report Problems

Stumbling upon an issue in a title report doesn't have to kill the deal. In fact, it’s a good sign—it means the system is working exactly as it should, flagging potential disasters before they can blow up.

When you’re armed with a clear strategy for these common roadblocks, a potential crisis turns into just another manageable task on your checklist. Most of the problems that pop up are just old baggage from a property's long history, ranging from minor clerical errors to serious financial claims that have to be settled before the property can change hands cleanly.

Identifying and Addressing Frequent Issues

Most title defects fall into a few familiar categories. A classic example is an undisclosed lien from a previous owner's unpaid taxes or a contractor's bill that never got settled. Another frequent headache is a boundary dispute, where the property lines aren't clearly defined or a neighbor is contesting where their yard ends and yours begins.

You'll also run into simple errors in public records, like a misspelled name or an incorrect property description. They seem small, but these little mistakes can create massive legal confusion down the road if they aren't corrected. And finally, hidden easements can surface, giving a utility company or another party the right to use a slice of the land, which could derail your development plans.

Finding a problem is not the end of the road; it's the beginning of the resolution. Each issue has a solution, and having the right information and tools is key to navigating the path forward efficiently.

Actionable Steps for Clearing Title Defects

Once a problem is flagged, the next move is to fix it. The right approach depends entirely on the specific issue uncovered in the title report.

Here are some practical steps for tackling these common challenges:

- Negotiating Liens: For financial claims like tax or mechanic's liens, the fix usually involves negotiating a payoff. The seller is typically on the hook for settling these debts at or before closing, often using proceeds from the sale to clear the title.

- Correcting Public Records: Clerical mistakes generally require filing corrective legal paperwork with the county recorder's office. This could mean a corrective deed or an affidavit to set the record straight and clean up the public file.

- Resolving Boundary Issues: If property lines are fuzzy, the best first step is to commission a new, official property survey. This gives you a definitive map that can be used to settle disputes with neighbors or to update the official legal descriptions.

Effectively managing these problems cements your reputation as a capable problem-solver. Modern tools like TitleTrackr give you the speed and accuracy to spot these issues faster, which means you get more time to focus on the fix and keep your deals moving forward.

Your Top Questions About Title Reports, Answered

To wrap things up, let's tackle some of the most common questions we hear from professionals about title reports and their role in a real estate deal.

What's the Difference Between a Title Report and Title Insurance?

Think of it this way: a title report is the diagnostic tool, while title insurance is the protection plan.

The report is the research document itself—it’s the deep dive into a property's history that uncovers the current state of ownership and flags any issues like liens, easements, or other claims. The insurance, on the other hand, is a policy that protects the buyer or lender from financial loss if a hidden title defect that was missed during the search pops up later.

One identifies the risks; the other shields you from them.

How Long Does It Take to Get a Title Report?

The classic answer is, "it depends." Traditionally, pulling a title report can take anywhere from a few days to several weeks. The timeline really hinges on how messy the property's history is and how quickly the local county records office can turn things around.

But this is where technology really changes the game. With AI-powered solutions, that waiting period gets crushed. It's now possible to get comprehensive reports back in a tiny fraction of that time. This is the competitive edge TitleTrackr provides, transforming weeks of waiting into hours of action.

What happens if the report finds a major problem? Typically, the seller is on the hook to fix it before the deal can move forward. That might mean paying off an old lien or correcting a public record to clear what’s known as a "cloud on title."

For more answers to your questions, feel free to dig into our FAQ page.

Ready to see how AI automation can completely change your title search workflow? TitleTrackr delivers the speed and accuracy you need to close deals faster and with total confidence. Request your demo today

Article created using Outrank