Before a single dollar changes hands, confirming who legally owns a property is the most critical step in any real estate transaction. Skipping this isn't a minor slip-up; it's a strategic error that can lead to devastating financial losses and legal battles that drain your team's time and resources. For industry professionals, mastering this process is non-negotiable.

Why You Can't Afford to Skip Ownership Verification

Think about it: you wouldn't buy a car without checking the title. Real estate deals have exponentially higher stakes, but figuring out who actually holds the deed is often far more complicated. In an industry where speed and accuracy define success, a flawed verification process is a significant liability.

This isn't just about dotting your i's and crossing your t's. It's about protecting your entire investment—and your firm's reputation—from catastrophic risk.

The High Stakes of Incomplete Due Diligence

Imagine your firm has allocated significant capital to what looks like a fantastic deal, only to discover a previous owner's unpaid debt has slapped a lien on the property. That lien is now your problem, stalling the project and eroding profit margins.

Even worse, you could be dealing with a scammer who never had the right to sell the property to begin with. These aren't just hypotheticals—they are operational realities that turn promising investments into financial black holes. The consequences are very real.

A quick look at the major risks shows just how much is on the line.

| Key Risks of Incomplete Ownership Verification | ||

|---|---|---|

| Risk Factor | Potential Consequence | Verification Goal |

| Hidden Liens or Debts | Inheriting financial obligations from previous owners (e.g., unpaid taxes, contractor liens). | Identify and clear all financial encumbrances before closing. |

| Ownership Fraud | The seller doesn't have the legal right to sell, leading to a void transaction and total investment loss. | Confirm the seller is the true, undisputed legal owner of the property. |

| Chain of Title Defects | Unresolved issues from past sales or transfers, such as forged documents or missing heirs. | Ensure a clean and unbroken history of ownership. |

| Boundary or Easement Disputes | Conflicts with neighbors over property lines or access rights that weren't disclosed. | Clarify legal boundaries and all registered easements. |

Getting this wrong can trap your assets in court for years, stall a project indefinitely, or wipe out your investment entirely.

Ownership verification is not a bureaucratic chore—it is the fundamental safeguard for any investor, real estate professional, or legal expert. It’s about managing risk from the very beginning.

This whole process gets even trickier because property ownership data can be intentionally hidden. The 2025 Opacity in Real Estate Ownership (OREO) Index recently highlighted this, revealing that not a single country achieved a perfect transparency score.

In fact, 10 of 24 major jurisdictions scored below 50%. This points to a massive, global vulnerability where true owners are concealed behind complex corporate shells. You can learn more about these global ownership challenges and what they mean for your due diligence.

Understanding these risks reframes how your organization should approach every deal. It underscores the urgent need for a faster, more reliable verification method—one that can cut through the noise and deliver the clarity your team needs to act decisively. This is where modern solutions come into play, offering a way to mitigate these risks efficiently.

Getting Your Hands Dirty: Digging Through Public Records

The traditional method of verifying property ownership starts by rolling up your sleeves and diving into public records. It’s the foundational work of due diligence, a manual search that demands significant patience and a sharp eye for the smallest details.

Your first stop is almost always the county recorder or clerk's office where the property is located. These offices are the gatekeepers of every official document tied to a piece of real estate. While some counties have decent online portals, many still require an in-person visit to access older records. The efficiency of this process is entirely dependent on the county's level of digitization.

The Paper Trail: What You're Looking For

You're hunting for a few key documents. The most critical one is the deed—this is the legal paper that officially moves ownership from one person to another. You’ll need to find the current owner (the grantee) and the previous owner (the grantor) to start mapping out the property's history, or what we call the chain of title.

Another goldmine of information is the county assessor's office, which keeps track of property taxes. Their records give you a different but equally important view, showing who is on the hook for paying the property taxes. This is a massive clue about who the current owner is. A fundamental part of the job is comparing the assessor's data with what you found at the recorder's office to catch any weird inconsistencies.

You'll quickly learn that no single document tells the whole story. Verifying ownership is like putting a puzzle together—you have to fit the pieces from deeds, tax records, and plat maps to see the full, clear picture.

Where to Look and What to Watch Out For

As you dig through these documents, you're doing more than just looking for names. You’re on the lookout for red flags that could point to a serious problem down the road.

Keep a close eye on these details:

- Legal Descriptions: Does the property description on the deed line up perfectly with what's on the tax records? Even a tiny difference can be a sign of a huge headache.

- Signatures and Notarizations: Make sure every document is properly signed and notarized. A missing signature or an old, expired notary stamp can completely invalidate a transfer.

- Recorded Dates: Check the dates on everything to make sure the chain of ownership makes sense and doesn't have any gaps. If you see overlapping ownership or missing transfers, that's a major red flag.

This whole process gets infinitely harder when you're dealing with counties that haven't digitized all their records. Many haven't, which means professionals like title abstractors have to manually comb through dusty old ledgers and microfilm. It’s incredibly time-consuming and, frankly, easy to make a mistake.

This isn't just a local problem, either. The ease of accessing land ownership data varies wildly across the globe. For example, Taiwan gets a perfect 100% score for its open land registry data. But then you look at major markets like Great Britain and Norway, which score way lower at 35% and 30%. It gets even worse in other big economies like Germany and Italy, which only score 15%. This just goes to show how tough manual verification can be when the public data is locked down.

It's this fragmentation and lack of consistency that makes the traditional approach such a grind. While it's an essential skill, its limitations in both speed and accuracy are what push professionals to find a smarter, more efficient way to get the job done.

Working with Title Companies and Attorneys

While digging through public records yourself is a great first step, it's not the final word. When the stakes are high or a property has a complicated past, you absolutely need to bring in the pros. This is where title companies and real estate attorneys become your most valuable partners.

These experts aren’t just there to double-check your work. They perform a formal, exhaustive investigation into a property's history, and they're trained to spot the subtle red flags and legal traps that even a sharp amateur could easily miss.

The Professional Title Search Process

When you hire a title company, they kick off a professional title search. Their main objective is to establish a clean "chain of title"—a complete, unbroken record of ownership stretching from the current owner all the way back to the very first land grant.

Any gap, fishy transfer, or unresolved claim in this chain is what we call a "title defect" or a "cloud on the title."

Their team meticulously combs through records to find any encumbrances that could threaten your ownership rights. This includes things like:

- Unpaid property taxes that could trigger a foreclosure.

- Mechanic's liens slapped on by contractors who never got paid.

- Judgments or court rulings tied to a previous owner.

- Undisclosed heirs who might pop up later with a valid claim.

If they find a defect, their job is to get it sorted out before you close. That might mean hunting down a missing signature on a 20-year-old document or making sure an old mortgage lien is officially cleared.

Title insurance is your ultimate safety net. It’s a policy that protects you from financial loss if a hidden title defect is missed during the search. Without it, you’re on the hook for any past problems that surface after you’ve bought the property.

This need for professional help becomes even clearer when you look at the global picture. According to World Bank experts, only about 30% of the world's population has a legally registered title to their land. With so many properties undocumented or stuck in systems with tough privacy rules, professionals are often the only people who can navigate the maze. You can discover more about these global land record challenges to see just how big the problem is.

The Operational Challenges Experts Face

Even with their expertise, title companies and attorneys are often fighting against the very systems they depend on. The manual grind of ordering documents, analyzing decades of records, and piecing together information from fragmented county databases is incredibly slow and labor-intensive.

This gets even more intense in industries like oil and gas. Experts like landmen must verify mineral rights ownership, adding a whole other layer of complexity to the search.

This old-school, manual approach creates serious operational bottlenecks. Long turnaround times and high costs are common, especially for properties with a long or messy history. It’s these exact pain points—the glacial pace and the risk of human error—that highlight the urgent need for technology that can help these experts work faster and with more confidence.

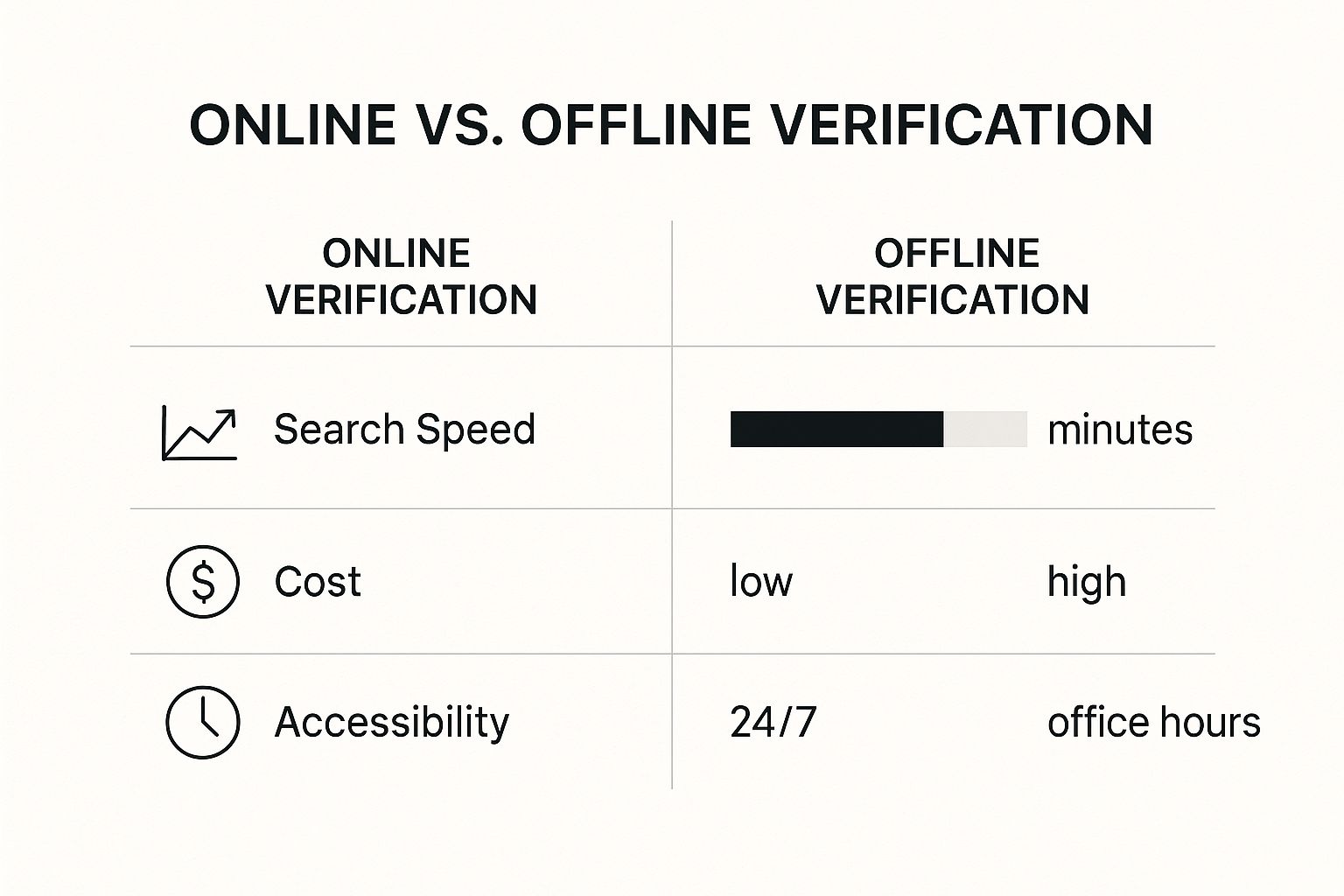

Using AI to Verify Properties in Minutes, Not Days

The traditional methods of digging through records and coordinating with title professionals are still fundamental, but they're a massive operational bottleneck. Time is money, especially in a competitive market. Spending days, or even weeks, verifying a single property means you’re watching dozens of other opportunities fly by. This is where the process desperately needs a modern upgrade, shifting from manual grunt work to intelligent automation.

AI-powered platforms are completely changing how professionals verify property ownership. Instead of your team hunting down documents one by one across clunky county websites, these systems pull data from countless digital sources all at once. We're talking county records, tax assessments, court filings, and more—all scraped and organized in seconds.

The real magic isn't just the speed. It's the analysis. AI can instantly cross-reference information, flag inconsistencies, and spot potential risks that a trained human eye might miss after hours of staring at a screen. This is a massive competitive advantage.

From a Week of Work to a Morning of Insight

Imagine this scenario: your team needs to vet ten properties before the end of the day. The traditional way would be pure chaos. You'd be juggling multiple county websites, making phone calls, and trying to piece together a puzzle with missing pieces, all while hoping a critical error doesn't slip through the cracks.

Now, let's look at a smarter workflow. A team using an AI-powered platform like TitleTrackr can upload the details for all ten assets at once. In just a few minutes, the system kicks back preliminary reports for each one. These reports highlight clear ownership data, point out potential liens, and flag any weird breaks in the chain of title.

The efficiency gains are impossible to ignore.

The difference is stark. What once took days of tedious effort can now be done in minutes, with far greater accuracy and much lower overhead.

Making AI-Powered Verification Truly Actionable

The point of this technology isn't to just dump raw data on you faster. It’s about delivering clear, actionable insights that help you make better, faster decisions. A well-designed platform takes all that complex property data and organizes it into a format that you can actually understand at a glance.

This is where you can see the difference between a simple data scraper and a true professional tool. The goal is to get a complete picture, fast. For instance, a dashboard might visualize a property's entire history, clearly mapping out the chain of title and flagging specific documents that need a closer look from an expert.

This kind of interface lets your team focus on analysis and strategy, not data entry. By automating the most tedious parts of the verification process, you free up your people to do what they do best: analyze deals, negotiate terms, and close more transactions with confidence.

To see how much more efficient this process can be, let's compare the old way with the new.

Comparing Verification Methods Manual vs TitleTrackr AI

This table breaks down the practical differences between slogging through records by hand versus letting an AI do the heavy lifting. The gains in speed, accuracy, and overall efficiency become pretty clear.

| Feature | Traditional Manual Search | AI-Powered Search (TitleTrackr) |

|---|---|---|

| Speed | Days or even weeks per property | Minutes for a preliminary report |

| Data Sources | Limited to what a human can find, one source at a time | Simultaneously pulls from thousands of public & private databases |

| Accuracy | Prone to human error, typos, and missed details | Cross-references data to flag inconsistencies; reduces human error |

| Cost | High labor costs, plus fees for individual record pulls | Lower operational cost, scalable subscription model |

| Scalability | Very difficult; adding more properties exponentially adds time | Effortlessly handles hundreds of properties simultaneously |

| Actionable Insights | Requires manual compilation and interpretation of raw data | Generates organized reports, visual timelines, and risk alerts |

The takeaway here is that AI doesn't just make the process faster—it makes it fundamentally better and more reliable.

The core benefit is simple: AI transforms property verification from a reactive, time-draining chore into a proactive, strategic advantage. It empowers you to assess more opportunities with greater accuracy and less risk.

This approach doesn't replace the need for an expert eye from title professionals or attorneys. Far from it. Instead, it arms them with better, faster information so they can do their jobs more effectively. It’s about building a workflow where technology handles the repetitive work, allowing human expertise to shine where it matters most.

Creating Your Modern Verification Workflow

The smartest way to verify property ownership isn’t a battle between new tech and old-school expertise. It’s about creating a powerful hybrid system where they work together. This approach lets you move faster, cut costs, and make better decisions, all without losing the legal certainty only a human expert can give you.

It's all about using the right tool for the right stage of the game. We see this modern workflow breaking down into two clear phases: the first is built for speed and volume, and the second is all about precision and getting the deal done right.

Front-End Due Diligence with AI

Let's get real for a minute. Say you're looking at a pipeline of fifty potential properties. Ordering a full title search from a company for every single one? That would be incredibly slow and burn through your budget in no time.

This is exactly where an AI-powered tool like TitleTrackr becomes your secret weapon.

You can run your entire list of properties through the platform and get preliminary reports back in minutes. This first pass acts as a powerful filter, instantly weeding out properties with obvious red flags like a broken chain of title or major liens. Suddenly, your team can zero in on the top 10% of deals that are actually worth pursuing.

This strategy pays off in a few huge ways:

- Cost Efficiency: You’re only spending the big bucks on full title searches for properties that have already passed an initial screening.

- Time Savings: Your team can review dozens of opportunities in the time it used to take to research just one. That's a massive competitive edge.

- Risk Reduction: By catching problems early, you stop wasting time and money chasing deals that were doomed from the start.

Think of it this way: a hybrid workflow uses technology as a powerful filter. It lets you qualify a high volume of opportunities fast, so your expert resources are only spent on the most promising, pre-vetted properties.

Engaging Experts for the Final Mile

Once AI has done the heavy lifting and narrowed your list down to the best candidates, it’s time to bring in the pros. You can hand over the clean, organized preliminary data from TitleTrackr directly to your go-to title company or real estate attorney.

They now have a massive head start.

Instead of digging through records from square one, they can use this initial data to jump straight into their deep-dive investigation. Their role is still absolutely essential—they’re the ones who perform the official search, untangle any complex title issues, and ultimately issue the title insurance policy that legally protects your investment.

This approach doesn't replace professionals; it makes them more efficient. You truly get the best of both worlds: the lightning speed of automation for the initial review and the irreplaceable expertise of a human for the final, critical steps.

Seeing how this all fits together is the best way to grasp its power.

Find out how TitleTrackr can slot into your own operations by requesting a personalized demo today.

Frequently Asked Questions

Jumping into property ownership verification, especially with new tech in the mix, naturally brings up a few questions. We get it. Below, we've tackled some of the most common things that come up when professionals are looking to sharpen their workflow.

Think of this as a quick guide to how modern tools can slot right into your established due diligence process.

How Fast Is AI Verification, Really?

A traditional, manual search can drag on for days, sometimes even weeks. In contrast, an AI-powered platform can rip through public records, pulling together an initial ownership and lien report in just minutes.

This isn't about cutting corners; it's about accelerating the initial due diligence. You can vet more properties and make decisions much faster. The final, insurable title report from your title company will still follow its normal timeline, but getting that first look is now dramatically faster.

Are Online Property Records Legally Binding?

This is a big one. The short answer is no. Information pulled from online public record databases is an absolutely essential starting point for your research, but it isn't legally binding on its own.

Think of it as the first, crucial step. The data must be formally verified through a proper title search handled by a title company or an attorney. The legally binding document at the end of the day is the title policy. AI tools simply make sure a deal looks solid before you commit to the more expensive, formal process.

The real edge with AI is its sheer scale. It scans vast, disconnected datasets far more thoroughly than any human possibly could, giving you a much deeper risk assessment right from the get-go.

These advanced platforms can cross-reference names, addresses, and parcel numbers across countless county and state databases. This is how they spot potential red flags—things like undisclosed liens, hidden judgments, or gaps in the chain of title that a standard manual search might easily miss. For a deeper dive into common questions, feel free to explore our comprehensive FAQ page.

How Does This Fit Into an Existing Workflow?

Great question. This kind of technology is built to enhance what you already do, not force you to start over. It’s a powerful tool for the front end of your process.

Your acquisitions, legal, or due diligence teams can use it to quickly screen hundreds of potential properties. They identify the most promising ones and then send that pre-verified data package over to your trusted title company or legal counsel to handle the final steps.

It saves a ton of time and, frankly, a lot of money. You end up spending your professional services budget only on properties that are actually viable. The best way to see how it works is to see it in action.

Ready to see how AI can genuinely change your property verification process? At TitleTrackr, we help you get faster, more accurate results.

Request a demo with TitleTrackr and see for yourself how our platform can fit right into your operations.

Article created using Outrank